Forward Reports Fiscal 2017 Second Quarter Results

May 12 2017 - 4:01PM

Forward Industries, Inc. (NASDAQ:FORD), a designer and distributor

of custom carry and protective solutions, today announced financial

results for its second fiscal quarter ended March 31, 2017.

Second Quarter 2017 Financial

Highlights

- Loss from Operations was $237 thousand compared to income of

$145 thousand from the second quarter of 2016.

- Revenues were $4.5 million compared to $7 million from the

second quarter of 2016.

- Gross profit percentage declined to 15.8% compared to 17.1% in

the second quarter of 2016.

- Net loss was $238 thousand compared to net income of $144

thousand in the second quarter of 2016.

- Loss per share was $.03 per share compared to income of $.02

per share for the second quarter of 2016.

- Cash and cash equivalents totaled $3.6 million at March 31,

2017.

Terry Wise, Chief Executive Officer of Forward Industries,

stated, “This was a difficult quarter for the company as we work to

expand and transition our business from predominantly diabetic

products which are undergoing market pricing pressures. We

will continue our efforts to safeguard and grow our existing

business with our top tier Medical customers. Concurrently, we are

firmly focused and making promising progress on aggressively

seeking new business within other growing market sectors.”

The tables below are derived from the Company’s

unaudited, condensed consolidated financial statements included in

its Quarterly Report on Form 10-Q filed today with the Securities

and Exchange Commission. Please refer to the Form 10-K for complete

financial statements and further information regarding the

Company’s results of operations and financial condition relating to

the fiscal years ended September 30, 2016 and 2015. Please also

refer to the Form 10-K for a discussion of risk factors applicable

to the Company and its business.

Note Regarding Forward-Looking

StatementsThis press release contains certain

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 including statements regarding expansion of

our existing customer base and diversifying our product

portfolio. Forward has tried to identify these

forward-looking statements by using words such as “may”, “should,”

“expect,” “hope,” “anticipate,” “believe,” “intend,” “plan,”

“estimate” and similar expressions. These forward-looking

statements are based on information currently available to the

Company and are subject to a number of risks, uncertainties and

other factors that could cause its actual results, performance,

prospects or opportunities to differ materially from those

expressed in, or implied by, these forward-looking statements.

These risks include the inability to expand our customer

base, pricing pressures, lack of success of new sales people and

unanticipated issues with our affiliated sourcing agent. No

assurance can be given that the actual results will be consistent

with the forward-looking statements. Investors should read

carefully the factors described in the “Risk Factors” section of

the Company’s filings with the SEC, including the Company’s Form

10-K for the year ended September 30, 2016 for information

regarding risk factors that could affect the Company’s

results. Except as otherwise required by Federal securities

laws, Forward undertakes no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events, changed circumstances or any other

reason.

About Forward

IndustriesIncorporated in 1962, and headquartered West

Palm Beach, Florida, Forward Industries is a designer and

distributor of custom carry and protective solutions. Forward’s

products can be viewed online at www.forwardindustries.com.

| |

|

| FORWARD INDUSTRIES, INC. AND

SUBSIDIARIES |

|

| CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME (LOSS) |

|

| (UNAUDITED) |

|

|

|

|

|

|

|

|

|

For the Three Months

Ended March 31, |

|

For the Six Months Ended

March 31, |

|

| |

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

| Net

revenues |

$ |

4,532,876 |

|

|

$ |

7,025,453 |

|

|

$ |

11,124,124 |

|

|

$ |

14,163,336 |

|

|

| Cost of goods sold |

|

3,816,790 |

|

|

|

5,824,917 |

|

|

|

9,249,209 |

|

|

|

11,440,435 |

|

|

| Gross

profit |

|

716,086 |

|

|

|

1,200,536 |

|

|

|

1,874,915 |

|

|

|

2,722,901 |

|

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Sales and

marketing |

|

389,694 |

|

|

|

432,146 |

|

|

|

807,221 |

|

|

|

865,034 |

|

|

| General

and administrative |

|

563,479 |

|

|

|

623,180 |

|

|

|

1,156,659 |

|

|

|

1,464,846 |

|

|

| Total

operating expenses |

|

953,173 |

|

|

|

1,055,326 |

|

|

|

1,963,880 |

|

|

|

2,329,880 |

|

|

| |

|

|

|

|

|

|

|

|

| Income (loss)

from operations |

|

(237,087 |

) |

|

|

145,210 |

|

|

|

(88,965 |

) |

|

|

393,021 |

|

|

| |

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

| Other

income (expense), net |

|

(443 |

) |

|

|

(907 |

) |

|

|

2,927 |

|

|

|

(4,638 |

) |

|

| Total

other income (expense), net |

|

(443 |

) |

|

|

(907 |

) |

|

|

2,927 |

|

|

|

(4,638 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(237,530 |

) |

|

$ |

144,303 |

|

|

$ |

(86,038 |

) |

|

$ |

388,383 |

|

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

(237,530 |

) |

|

$ |

144,303 |

|

|

$ |

(86,038 |

) |

|

$ |

388,383 |

|

|

| Other

comprehensive loss: |

|

|

|

|

|

|

|

|

|

Translation adjustments |

|

- |

|

|

|

(480 |

) |

|

|

- |

|

|

|

(916 |

) |

|

| Comprehensive

income (loss) |

$ |

(237,530 |

) |

|

$ |

143,823 |

|

|

$ |

(86,038 |

) |

|

$ |

387,467 |

|

|

| |

|

|

|

|

|

|

|

|

| Net income

(loss) per basic common share |

$ |

(0.03 |

) |

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

$ |

0.05 |

|

|

| Net income

(loss) per diluted common share |

$ |

(0.03 |

) |

|

$ |

0.02 |

|

|

$ |

(0.01 |

) |

|

$ |

0.04 |

|

|

| |

|

|

|

|

|

|

|

|

| Weighted

average number of common and |

|

|

|

|

|

|

|

|

|

common equivalent shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

8,671,240 |

|

|

|

8,503,436 |

|

|

|

8,646,103 |

|

|

|

8,445,152 |

|

|

|

Diluted |

|

8,671,240 |

|

|

|

8,660,114 |

|

|

|

8,646,103 |

|

|

|

8,645,395 |

|

|

|

|

|

|

|

|

|

|

|

|

| FORWARD INDUSTRIES, INC. AND

SUBSIDIARIES |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

|

|

|

|

| |

March

31, |

|

September

30, |

| |

|

2017 |

|

|

|

2016 |

|

| |

(Unaudited) |

|

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

| Cash |

$ |

3,649,284 |

|

|

$ |

4,760,620 |

|

| Accounts

receivable |

|

4,424,939 |

|

|

|

4,864,423 |

|

|

Inventories |

|

2,729,219 |

|

|

|

2,572,980 |

|

| Prepaid

expenses and other current assets |

|

155,847 |

|

|

|

141,421 |

|

| Total

current assets |

|

10,959,289 |

|

|

|

12,339,444 |

|

| |

|

|

|

| Property and equipment,

net |

|

31,576 |

|

|

|

43,030 |

|

| Other assets |

|

12,843 |

|

|

|

12,843 |

|

| Total

assets |

$ |

11,003,708 |

|

|

$ |

12,395,317 |

|

| |

|

|

|

| Liabilities and

shareholders' equity |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

40,640 |

|

|

$ |

62,136 |

|

| Due to

Forward China |

|

2,457,896 |

|

|

|

3,519,676 |

|

| Accrued

expenses and other current liabilities |

|

292,602 |

|

|

|

587,741 |

|

| Total

current liabilities |

|

2,791,138 |

|

|

|

4,169,553 |

|

| |

|

|

|

| Other liabilities |

|

44,872 |

|

|

|

51,486 |

|

| Total

liabilities |

|

2,836,010 |

|

|

|

4,221,039 |

|

| |

|

|

|

| Commitments and

contingencies |

|

|

|

| Shareholders'

equity: |

|

|

|

| Common

stock, par value $0.01 per share; 40,000,000 shares

authorized; |

|

|

|

| 8,780,830

shares issued and outstanding |

|

87,808 |

|

|

|

87,808 |

|

|

Additional paid-in capital |

|

17,862,518 |

|

|

|

17,783,060 |

|

|

Accumulated deficit |

|

(9,760,843 |

) |

|

|

(9,674,805 |

) |

|

Accumulated other comprehensive loss |

|

(21,785 |

) |

|

|

(21,785 |

) |

| |

|

|

|

| Total

shareholders' equity |

|

8,167,698 |

|

|

|

8,174,278 |

|

| Total

liabilities and shareholders' equity |

$ |

11,003,708 |

|

|

$ |

12,395,317 |

|

| |

|

|

|

Contact:

Forward Industries, Inc.

Michael Matte, CFO

(561) 465-0031

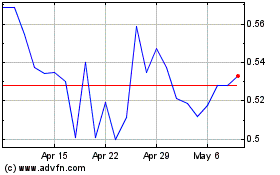

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Mar 2024 to Apr 2024

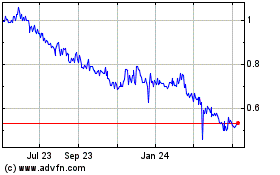

Forward Industries (NASDAQ:FORD)

Historical Stock Chart

From Apr 2023 to Apr 2024