UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant

x

|

|

|

|

Filed by a Party other than the Registrant

o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

o

|

Definitive Additional Materials

|

|

x

|

Soliciting Material under §240.14a-12

|

|

|

|

ANGIE’S LIST, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

Employee Q&A

(May 8, 2017)

As part of our commitment to be as open and transparent with our communications throughout this process as possible, we are providing additional information in response to questions we have received from our employees in response to the announcement of our proposed combination with IAC’s HomeAdvisor business into a new company, which will be called ANGI Homeservices Inc.

As expected, many of the questions that we have received are related to individual roles, compensation, benefits and other terms of employment after completion of the transaction when we make the transition to ANGI Homeservices Inc. In most cases, it is too early in the process to answer those questions but we remain committed to sharing information with you if we are able as soon as it becomes available. Employees should continue to submit questions to Human Resources at: IntegrationQuestions@angielist.com.

1)

What did you announce?

·

We announced

that we have

entered into an agreement with IAC to combine our company with IAC’s HomeAdvisor business, into a new, publicly traded company to be called ANGI Homeservices Inc.

2)

What does it mean to employees? Will we have jobs? How significant will layoffs be? When will they happen?

·

It is important to keep in mind that the new combined company is expected to be a larger, stronger company than Angie’s List is today, with significant growth potential.

·

That said, whenever you combine two companies, it is inevitable that there will be redundancies in resources, functions and/or vendors. At the same time, there may be new opportunities as the combined company looks to leverage assets and grow.

·

So what does that mean for you? It is important that each of us continues to go the extra mile because our performance matters. The leadership team will be working with HomeAdvisor management during the transition to understand what resources will be needed in the combined company.

·

Keep in mind that the transaction is not expected to close until Q4 2017.

3)

Where will the combined company be headquartered? Will they keep our campus in Indianapolis?

·

The combined company’s headquarters will be based out of HomeAdvisor’s current Golden, Colorado location.

·

As you know, HomeAdvisor has a significant presence in Indianapolis today.

·

This is a growth company and, as we understand it, HomeAdvisor is hiring already as part of its growth plan.

·

There will be a retention plan; however, we do not have any specific details to provide at this time.

4)

Will the combined company leverage both the Angie’s List and HomeAdvisor brands?

·

Yes. We expect the combined company to maintain both Angie’s List and HomeAdvisor’s brands for the foreseeable future.

5)

What will the combined company sell — annual contracts or leads?

·

We expect that by combining with HomeAdvisor, the combined company will offer a broader array of products.

·

Service Providers will have even greater options in how they do business with the combined company in the future. The potential value add to our customers was part of our rationale for pursuing the combination.

·

Angie’s List has both an advertising and lead generation model today. HomeAdvisor also has a listing model, so we see more opportunity to benefit our customers as a result of the combination.

6)

Was a merger necessary? Why wouldn’t we continue to operate on our own?

You’ll recall that we previously announced that Angie’s List was evaluating strategic alternatives with the objective of achieving the full potential of our assets and pursuing a path to maximizing value creation for our shareholders. We believe that this combination will allow us to do that. The board of directors of Angie’s List unanimously approved the proposed transaction and believes that the transaction is in the best interests of Angie’s List and its shareholders.

7)

Who will run the combined company?

·

HomeAdvisor’s CEO Chris Terrill will assume the role of CEO of ANGI Homeservices Inc.

8)

What is happening to the executive team?

·

We expect the executive team to be here through the closing of the transaction.

·

IAC values the innovation and marketing vision that Angie has brought to Angie’s List. She will serve on the board of directors of the combined company and may also serve in an additional role.

·

Further operational and organizational detail will be shared at closing.

9)

When is the transaction expected to close?

·

The transaction is expected to close in the fourth quarter of 2017, assuming satisfaction of all conditions to closing, including approval of the merger by Angie’s List stockholders.

10)

What happens to my current compensation and benefits?

·

Until the transaction is completed, Angie’s List and HomeAdvisor remain independent companies and your salary and benefits will remain unchanged.

11)

What benefits will the combined company offer?

·

All benefits and benefit providers are expected to remain the same through the date of closing, which is expected to be in the fourth quarter of 2017. The Angie’s List health and welfare benefits generally will remain in place until IAC replaces them with IAC plans. Employees will receive updates and detailed guidance in advance of any changes to their benefits and compensation.

12)

Can I still use my PTO?

·

Yes! While you are an employee of Angie’s List, PTO should be scheduled in accordance with our normal practices via Ceridian.

13)

Will the charitable contribution matching program continue after the integration?

·

The charitable contribution matching program will continue through the closing of the transaction.

·

Decisions have not been made for 2018 and beyond. If any future changes are made, you will receive updates and detailed guidance in advance.

14)

Upon closing, will there be an Employee Stock Purchase Plan (ESPP) for the new company? What happens to my current ESPP election?

·

Decisions have not been made regarding whether the combined company will offer an Employee Stock Purchase Plan.

·

The Angie’s List ESPP is expected to continue with the current offering period (May 1, 2017 — October 31, 2017). Note, however, that certain limitations will apply and, if the closing occurs prior to the end of the current offering period, the current offering period will be truncated so it ends prior to the closing.

·

If you choose to not continue participation in the ESPP during the current offering period, you may elect to terminate such participation at any time prior to mid-October and your prior payroll deductions will be returned to you. To terminate participation or for more information, please contact email Cory Craig at coryc@angieslist.com.

15)

How does this proposed transaction impact my equity?

·

Your ANGI shares owned on the Closing Date will be converted into Class A common stock of the combined company on a one-for-one basis, or, if you so elect, $8.50 per share in cash, with the total amount of cash available in the transaction capped at $130 million. If Angie’s List shareholders make elections for cash that in total exceed the cap, the number of Angie’s List shares held by the electing shareholders to be converted into cash will be subject to the proration provisions in the merger agreement.

16)

I was previously granted stock options by Angie’s List, how does the proposed transaction impact my stock options?

·

Your Angie’s List stock options will be converted into stock options to acquire the same number of shares of Class A Common Stock of the combined company at the same per share exercise price. The stock options of the combined company that you receive will be subject to the same material terms and conditions (including vesting) as applied immediately prior to the conversion. Any performance goals applicable to your stock options will be adjusted to account for the proposed transaction.

·

For example, assume you were granted 100 stock options on April 27, 2015, and 50 options are currently vested and 50 options remain unvested. After closing, your options will be converted into an equivalent number of options of ANGI Homeservices Inc. and you will be 50% vested, and the remaining 50% would vest pro rata on each April 2018 and 2019, respectively.

17)

I was previously granted RSU’s by Angie’s List, how does the proposed transaction impact my stock?

·

All RSUs that vest prior to the closing date will be converted into shares of ANGI common stock and thereafter will be converted, on a 1-to-1 basis, into shares of Class A common stock of ANGI Homeservices Inc. (or $8.50 in cash, if you make a cash election with respect to such shares, subject to proration).

·

Angie’s List RSUs that are unvested at the closing date will be converted on a one-for-one basis into restricted stock units of the combined company, subject to the same terms and conditions (including vesting) as immediately prior to the conversion.

·

With respect to performance-based restricted stock units granted in June 2016, applicable performance criteria will be deemed to be satisfied at target levels, and the restricted stock units will vest solely based on continued service following the closing of the proposed transaction.

18)

How does this affect my 401(k) contribution?

·

Following the closing, employees of the combined company are expected to be eligible to participate in a 401(k) plan sponsored by the combined company. No changes to the Angie’s List 401(k) plan are anticipated prior to closing of the transaction, so all employee contributions will remain the same as currently designated and Angie’s List will continue its 3% employer contribution for those who are eligible. Any changes made will be communicated to employees in advance.

19)

Are we still moving from Landmark to campus?

·

We expect to move out of Landmark next year and are working through the logistics of moving employees to campus. More information to come as it develops.

20)

Will there still be promotions? Are we able to fill open positions?

·

We just recently completed our annual merit and promotion cycle so there won’t be any impending promotions at this time.

·

We are able to fill open positions, but there are certain limitations, so please work very closely with your Human Resources partner.

IMPORTANT ADDITIONAL INFORMATION

This communication is being made in respect of the proposed merger transaction involving IAC/InterActiveCorp, a Delaware corporation, Halo TopCo, Inc., a Delaware corporation and wholly owned subsidiary of IAC (“NewCo”), Casa Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of NewCo, and Angie’s List, lnc., a Delaware corporation (the “Company”‘). This communication does not constitute an offer to sell or the solicitation of an offer to buy the Company’s securities or the solicitation of any vote or approval. The proposed merger will be submitted to the stockholders of the Company for their consideration. In connection therewith, the Company intends to file relevant materials with the Securities and Exchange Commission (the “SEC”), including a definitive proxy statement/prospectus, to be included in the registration statement on Form S-4 to be filed by NewCo in connection with the proposed merger. However, such documents are not currently available. The definitive proxy statement/prospectus will be mailed to the stockholders of the Company. BEFORE MAKING ANY VOTING OR ANY INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/ PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of the definitive proxy statement/prospectus, any amendments or supplements thereto and other documents containing important information about NewCo and the Company, once such documents are filed with the SEC, at the SEC’s Internet site at www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s website at www.angieslist.com under the heading “Investor Relations.” Stockholders of the Company may also obtain a free copy of the definitive proxy statement/ prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/ prospectus by contacting the Company’s Investor Relations Department at 1030 East Washington St, Indianapolis, IN 46202, (866)843-5478

The Company and certain of its directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of the Company is set forth in its proxy statement for its 2017 annual meeting of stockholders, which was filed with the SEC on April 28, 2017, its annual report on Form 10-K for the fiscal year ended December 31, 2016, which was filed with the SEC on February 21, 2017, and in subsequent documents filed with the SEC, each of which can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation of the stockholders of the Company and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the preliminary and definitive proxy statements/ prospectuses and other relevant materials to be filed with the SEC when they become available.

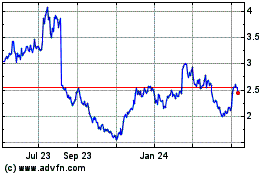

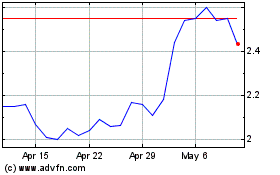

Angi (NASDAQ:ANGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Angi (NASDAQ:ANGI)

Historical Stock Chart

From Apr 2023 to Apr 2024