Additional Proxy Soliciting Materials (definitive) (defa14a)

May 05 2017 - 4:48PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of

1934

Filed by the Registrant

☑

Filed by a Party other than the Registrant

☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☑

Definitive Additional Materials

☐

Soliciting Material Under Rule 14a-12

GENERAC HOLDINGS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant

)

Payment of Filing Fee (Check the appropriate box):

|

☑

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state

how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the

date of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

AMENDMENT

NO. 1 TO PROXY STATEMENT

FOR

2017 ANNUAL

MEETING OF STOCKHOLDERS

TO BE

HELD ON

JUNE 15, 2017

EXPLANATORY NOTE

This Amendment No. 1 to Schedule 14A (“Amendment No. 1”) is being filed to amend the definitive proxy statement of

Generac Holdings, Inc. (the “Company”) for its 2017 Annual Meeting of Stockholders (“Proxy Statement”), which was filed with the Securities and Exchange Commission on April 28, 2017, in order to add an additional Proposal to the original Proxy Statement.

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act), and the related rules of the SEC, the Company is providing stockholders a non-binding advisory vote to approve the frequency of stockholder advisory votes on the compensation of our named executive officers. At the 2011 Annual Meeting of Stockholders, our stockholders indicated their preference for us to hold advisory votes on executive compensation on an annual basis

, and the Board of Directors subsequently determined that we would hold an annual advisory vote on executive compensation. Accordingly, the current frequency of our advisory votes on executive compensation is once every year. This change affects the Notice of Annual Meeting of Stockholders; amends the Proxy Statement to add the voting requirements for the new Proposal 6; amends the Proxy Statement to add the new Proposal 6; and adds Proposal 6 to the Proxy Card. All other items of the Proxy Statement are unchanged.

CHANGES TO PROXY

STATEMENT

The following sections of the Proxy Statement shall change in accordance with this Amendment No. 1:

|

|

1.

|

|

A

new Proposal 6 shall be added to the Notice of Annual Meeting of Stockholders and current Proposal 6 shall be renumbered Proposal 7. The new Proposal 6 is a

non-binding advisory vote to approve the frequency of stockholder advisory votes on the compensation of our

named

executive

officers.

The

Notice

is

amended

to

read

in

its

entirety

as

follows:

|

generac holdings inc.

S45 W29290 Hwy. 59

Waukesha, Wisconsin 53189

________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held

June

15

,

2017

________________

To our stockholders,

Notice is hereby given that the

2017 annual meeting of stockholders of Generac Holdings Inc. will be held on Thursday, June 15, 2017, at 9:00 a.m. local time, at Generac corporate headquarters at S45 W29290 Hwy. 59, Waukesha, Wisconsin 53189, for the following purposes:

|

|

1.

|

To elect the

three nominees named herein as Class II directors;

|

|

|

2.

|

To approve

the performance measures included in the 2010 Equity Incentive Plan;

|

|

|

3.

|

To approve the Annual Performance Bonus Plan;

|

|

|

4.

|

To ratify the selection of

Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2017;

|

|

|

5.

|

To vote on an advisory, non-binding “

say-on-pay” resolution to approve the compensation of our executive officers;

|

|

|

6.

|

To

vote on an advisory, non-binding “say-on-pay frequency” proposal regarding the frequency of shareholder votes on compensation of our executive officers;

|

|

|

7.

|

To consider any other matters that may properly come before the meeting or any adjournments or postponements of the meeting.

|

Holders of record of our common stock at the close of

business on April 17, 2017 are entitled to notice of, and to vote at, the annual meeting. Stockholders of record may vote their shares via telephone or over the Internet or, if a paper proxy card is requested, by signing, dating and mailing the proxy card in the envelope provided or by delivering any completed proxy card at the annual meeting. Stockholders of record may also vote in person at the annual meeting. Instructions regarding all methods of voting are contained on any Notice of Internet Availability of Proxy Materials or proxy card provided. If your shares are held in the name of a bank, broker, fiduciary or custodian, follow the voting instructions you receive from your record holder.

|

|

By Order of the Board of Directors,

|

|

|

|

|

|

Aaron

Jagdfeld

President and Chief Executive Officer

|

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE MEETING, TO ASSURE THAT YOUR SHARES ARE REPRESENTED AT THE MEETING PLEASE VOTE PROMPTLY BY TELEPHONE OR THE INTERNET, OR REQUEST A PROXY

CARD TO COMPLETE, SIGN AND RETURN. IF YOU ATTEND THE MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO, EVEN IF YOU HAVE PREVIOUSLY SUBMITTED YOUR PROXY.

|

|

2

.

|

|

The Section entitled “Matters to be Considered” shall be amended to read as follows:

|

Matters to be Considered

At the meeting, stockholders will be asked to vote to elect the

three nominees named herein as Class II directors, to approve the material terms of our performance measures under the Company’s 2010 Equity Incentive Plan, as well as approve the Annual Performance Bonus Plan, both in accordance with Internal Revenue Code (“IRC”) §162(m), to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm

, to vote on an advisory, non-binding “say-on-pay” resolution to approve the compensation of our executive officers and to vote on an advisory, non-binding “say-on-pay frequency” proposal

.

See “PROPOSAL 1—ELECTION OF CLASS II DIRECTORS”, “PROPOSAL 2— APPROVAL OF THE PERFORMANCE MEASURES INCLUDED IN THE 2010 EQUITY INCENTIVE PLAN”, “PROPOSAL 3 – APPROVAL OF THE ANNUAL PERFORMANCE BONUS PLAN”, “PROPOSAL 4—RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM”, “PROPOSAL 5 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

” and “PROPOSAL 6—ADVISORY VOTE ON “SAY-ON-PAY FREQUENCY”. The Board of Directors does not know of any matters to be brought before the meeting other than as set forth in the notice of meeting. If any other matters properly come before the meeting, the persons named in the enclosed form of proxy or their substitutes will vote in accordance with their best judgment on such matters.

|

|

3

.

|

|

A new paragraph shall be added in between paragraphs 5 and 6 in the Section entitled “

Required Votes” as follows:

|

Advisory Vote on

“Say-on-Pay

Frequency”

Proposal

.

Proposal 6, relating to a non-binding proposal regarding the frequency of our "say-on-pay" votes, allows stockholders to choose between the options of holding this advisory vote once every three years, once every other year, once every year, or to abstain from voting. The option receiving the highest number of votes will be considered as the stockholders' preferred frequency for the non-binding "say-on-pay" votes. Shares not voted (because of abstention, broker non-vote, or otherwise) will have no effect on the determination of the vote

.

|

|

4

.

|

|

The Section entitled “Matters to be Considered” shall be amended to read as follows:

|

Shares Held by Brokers

If you are the beneficial owner of shares held for you by a broker, your broker must vote those shares in accordance with your instructions. If you do not give voting instructions to your broker, your broker may vote your shares for you on any discretiona

ry items of business to be voted upon at the annual meeting. If you do not provide voting instructions on a non-discretionary item, including the election of the nominees named herein as directors, the shares will be treated as “broker non-votes.” We believe that the ratification of the appointment of Deloitte & Touche LLP (Proposal 4) is a routine matter on which brokers will be permitted to vote any unvoted shares in their discretion. We believe that election of the three nominees named herein as Class II directors (Proposal 1), approval of material terms of officer performance measures included in the 2010 Equity Incentive Plan (Proposal 2), approval of the Annual Performance Bonus Plan (Proposal 3), the advisory, non-binding “say on pay” resolution (Proposal 5) and the advisory, non-binding “say-on-pay frequency” proposal (Proposal 6) are non-routine matters on which brokers will not be permitted to vote any unvoted shares. “Broker non-votes” will be included in determining the presence of a quorum at the annual meeting

.

|

|

5

.

|

|

A new Proposal

6 of the Proxy Statement shall be added to the Proxy Statement after the section entitled “Advisory Vote on Executive Compensation (Proposal 5)”. Proposal 6 is added to read in its entirety as follows:

|

PROPOSAL 6

—

ADVISORY VOTE ON THE FREQUENCY OF THE VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act of 1934, we are offering our stockholders an opportunity to cast an advisory vote on whether the non-binding stockholder advisory vote on the compensation of our named executive officers should occur every one, two or three years. Although the vote is non-binding, we value continuing and constructive feedback from our stockholders on executive compensation and other important matters. The Board and the Compensation Committee will take into consideration the voting results when determining how often a non-binding stockholder advisory vote on the compensation of our named executive officers should occur.

The Board has determined that an advisory vote on executive compensation every year continues to be the best approach for the Company based on a number of considerations, including the vote frequency which the Board believes the majority of our investors prefer.

Stockholders are not voting to approve or disapprove of the Board's recommendation. Instead, the proxy card provides stockholders with four choices with respect to this proposal; (1) one year, (2) two years, (3) three years or (4) abstaining from voting on the proposal. For the reason discussed above, we are asking our stockholders to indicate their support for the non-binding advisory vote on executive compensation to be held every one year.

Generally, approval of any matter presented to stockholders requires the affirmative vote of the holders of a majority of the shares of common stock represented at the annual meeting and entitled to vote on the matter. However, because this vote is advisory and non-binding, if none of the frequency options receive the vote of a majority of shares of common stock represented at the annual meeting and entitled to vote thereon, the option receiving the greatest number of votes will be considered the frequency recommended by the Company's stockholders. Even though this vote will not be binding on the Company or Board, the Board of Directors will take into account the result of the vote when determining the frequency of future say-on-pay votes.

The Board unanimously recommends a vote for “

1 YEAR” on the advisory, non-binding proposal regarding the frequency of shareholder vote on c

ompensation of

o

ur

e

xecutive

o

fficers

.

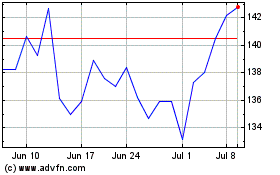

Generac (NYSE:GNRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Generac (NYSE:GNRC)

Historical Stock Chart

From Apr 2023 to Apr 2024