Consolidated Communications Holdings, Inc. (Nasdaq:CNSL) (the

“Company”) reported results for the first quarter 2017. As

previously announced, the Company will hold a conference call and

simultaneous webcast to discuss its results today at 11 a.m. (ET).

First Quarter 2017:

- Revenue was $169.9 million

- Net cash from operating activities was $51.7 million

- Adjusted EBITDA was $71.1 million

- Dividend payout ratio was 80.5 percent

“It’s been a productive start to the year,” said Bob Udell,

president and chief executive officer of Consolidated

Communications. “Our consolidated revenues, adjusted earnings

and free cash flow are stable. We continue to make progress

enhancing our commercial and broadband services to offset the known

USF and legacy revenue step downs. We realized solid growth in data

and Internet connections this quarter while working through some

continued bandwidth price compression.”

“Overall, we are executing well on our strategy and positioning

Consolidated Communications for future growth,” Udell added.

“We are expanding our fiber centric reach and maintaining strong

and steady cash flows. We are on track to close on our

FairPoint acquisition mid-year. We secured shareholder

approval in March and we’re making good progress with the

regularity approvals having 11 of the 17 required states

completed. We declared our 48th consecutive quarterly

dividend this week and remain confident in our ability to continue

delivering value for our shareholders.”

Financial Results for the First Quarter

- Revenue in the first quarter totaled $169.9 million, compared

to $188.8 million in the first quarter 2016 which included $11.4

million of revenue from businesses which the Company divested in

2016, the equipment sales business and the Iowa ILEC property.

Excluding the impact of the Iowa ILEC divestiture, consumer

revenue was down $3.9 million in first quarter due to voice and

video declines. Commercial revenue was essentially flat due

to continued price compression despite strong growth in Metro

Ethernet circuits. Subsidies were down $1.9 million due to

scheduled step downs in CAF II and Texas USF, and access revenue

was down $2.0 million due to continued declines in voice

services.

- Income from operations was $18.6 million, compared to $24.3

million in the year-ago quarter, down primarily due to lower

revenue, as described above, and partially offset by a decrease in

operating expenses.

- Interest expense, net was $29.7 million compared to $18.6

million for the same period last year. The increase in

interest expense is primarily due to $3.5 million in amortization

of the commitment fees for the financing secured in December for

the FairPoint acquisition and the onset of ticking fees related to

the financing, which began January 15 at the rate of approximately

4 percent per month, and totaled $7.9 million in the first

quarter. The increased fees were partially offset by the

Company’s October refinancing which will result in $2 million in

annual interest savings.

- Cash distributions from the Company’s wireless partnerships

were $5.6 million compared to $6.8 million the prior year

period.

- Other income, net was $5.2 million, compared to $7.2 million in

the first quarter of 2016.

- On a GAAP basis, net income was a loss of $3.7 million.

Adjusted diluted net income per share excludes certain items

in the manner described in the table provided in this

release. Adjusted diluted net income per share was $0.11 in

the first quarter, compared to $0.19 the same period last

year.

- Adjusted EBITDA was $71.1 million compared to $78.6 million a

year ago. The year over year decline was primarily due to

lower revenue and wireless distributions.

- The total net debt to last 12-month adjusted EBITDA ratio was

4.58.

Cash Available to Pay Dividends, Capex

For the first quarter, cash available to pay dividends was $24.3

million, and the dividend payout ratio was 80.5 percent. At

March 31, 2017, cash and cash equivalents were $26.6 million.

Capital expenditures were $29 million for the first

quarter.

Financial Guidance

The Company affirmed its 2017 guidance as follows.

| |

2017

Guidance |

2016 Results |

| Cash Interest Expense*

|

$70 million to $72

million |

$70.7

million |

| Cash Income Taxes |

$1 million to $3

million |

($183,000) |

| Capital

Expenditures |

$115 million to $120

million |

$125.2

million |

*Cash interest expense does not include ticking fees associated

with the FairPoint financing.

Dividend Payments

The Company’s board of directors declared a quarterly dividend

of $0.38738 per common share, which is payable on Aug. 1, 2017 to

stockholders of record at the close of business on July 15,

2017. This will represent the 48th consecutive quarterly

dividend paid by the Company.

Conference Call Information

The Company will host a conference call today at 11 a.m. ET / 10

a.m. CT to discuss first quarter earnings and developments with

respect to the Company. The live webcast and replay can be

accessed from the Investor Relations section of the Company’s

website at http://ir.consolidated.com. The live conference

call dial-in number is 1-877-374-3981 with conference ID

10058144. A telephonic replay of the conference call will be

available through May 11, 2017 and can be accessed by calling

1-855-859-2056. About Consolidated

Communications

Consolidated Communications provides business and broadband

communications services across its 11-state service area to

carrier, commercial and consumer customers. For more than a

century, the Company has consistently provided innovative,

reliable, high-quality products and services. The Company offers a

wide range of communications solutions including: High-Speed

Internet, Data, Digital TV, Phone, managed and cloud services and

wireless backhaul over an extensive fiber optic network.

Use of Non-GAAP Financial Measures

This press release, as well as the conference call, includes

disclosures regarding “EBITDA,” “adjusted EBITDA,” “cash available

to pay dividends” and the related “dividend payout ratio,” “total

net debt to last twelve month adjusted EBITDA coverage ratio,”

“adjusted diluted net income per share” and “adjusted net income

attributable to common stockholders,” all of which are non-GAAP

financial measures and described in this section as not being in

compliance with Regulation S-X. Accordingly, they should not

be construed as alternatives to net cash from operating or

investing activities, cash and cash equivalents, cash flows from

operations, net income or net income per share as defined by GAAP

and are not, on their own, necessarily indicative of cash available

to fund cash needs as determined in accordance with GAAP. In

addition, not all companies use identical calculations, and the

non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies. A

reconciliation of the differences between these non-GAAP financial

measures and the most directly comparable financial measures

presented in accordance with GAAP is included in the tables that

follow.

Adjusted EBITDA is comprised of EBITDA, adjusted for certain

items as permitted or required by the lenders under our credit

agreement in place at the end of each quarter in the periods

presented. The tables that follow include an explanation of

how adjusted EBITDA is calculated for each of the periods presented

with the reconciliation to net income. EBITDA is defined as

net earnings before interest expense, income taxes, depreciation

and amortization on a historical basis.

Cash available to pay dividends represents adjusted EBITDA plus

cash interest income less (1) cash interest expense, (2) capital

expenditures and (3) cash income taxes; this calculation differs in

certain respects from the similar calculation used in our credit

agreement.

We present adjusted EBITDA, cash available to pay dividends and

the related dividend payout ratio for several reasons.

Management believes adjusted EBITDA, cash available to pay

dividends and the dividend payout ratio are useful as a means to

evaluate our ability to fund our estimated uses of cash (including

interest on our debt) and pay dividends. In addition, we have

presented adjusted EBITDA, cash available to pay dividends and the

dividend payout ratio to investors in the past because they are

frequently used by investors, securities analysts and other

interested parties in the evaluation of companies in our industry,

and management believes presenting them here provides a measure of

consistency in our financial reporting. Adjusted EBITDA and cash

available to pay dividends, referred to as Available Cash in our

credit agreement, are also components of the restrictive covenants

and financial ratios contained in our credit agreement that

requires us to maintain compliance with these covenants and limit

certain activities, such as our ability to incur debt and to pay

dividends. The definitions in these covenants and ratios are

based on adjusted EBITDA and cash available to pay dividends after

giving effect to specified charges. In addition, adjusted

EBITDA, cash available to pay dividends and the dividend payout

ratio provide our board of directors with meaningful information to

determine, with other data, assumptions and considerations, our

dividend policy and our ability to pay dividends under the

restrictive covenants in our credit agreement and to measure our

ability to service and repay debt. We present the related

“total net debt to last twelve month adjusted EBITDA coverage

ratio” principally to put other non-GAAP measures in context and

facilitate comparisons by investors, security analysts and others;

this ratio differs in certain respects from the similar ratio used

in our credit agreement. These measures differ in certain

respects from the ratios used in our senior notes

indenture.

These non-GAAP financial measures have certain

shortcomings. In particular, adjusted EBITDA does not

represent the residual cash flows available for discretionary

expenditures, since items such as debt repayment and interest

payments are not deducted from such measure. Similarly, while

we may generate cash available to pay dividends, we are not

required to use any such cash to pay dividends, and the payment of

any dividends is subject to declaration by our board of directors,

compliance with applicable law and the terms of our credit

agreement. Because adjusted EBITDA is a component of the

dividend payout ratio and the ratio of total net debt to last

twelve month adjusted EBITDA, these measures are also subject to

the material limitations discussed above. In addition, the

ratio of total net debt to last twelve month adjusted EBITDA is

subject to the risk that we may not be able to use the cash on the

balance sheet to reduce our debt on a dollar-for-dollar basis.

Management believes these ratios are useful as a means to evaluate

our ability to incur additional indebtedness in the

future.

We present the non-GAAP measures adjusted diluted net income per

share and adjusted diluted net income attributable to common

stockholders because our net income and net income per share are

regularly affected by items that occur at irregular intervals or

are non-cash items. We believe that disclosing these measures

assists investors, securities analysts and other interested parties

in evaluating both our company over time and the relative

performance of the companies in our industry.

Safe Harbor

The Securities and Exchange Commission (“SEC”) encourages

companies to disclose forward-looking information so that investors

can better understand a company’s future prospects and make

informed investment decisions. Certain statements in this

communication are forward-looking statements and are made pursuant

to the safe harbor provisions of the Securities Litigation Reform

Act of 1995. These forward-looking statements reflect, among

other things, current expectations, plans, strategies, and

anticipated financial results of Consolidated Communications

Holdings, Inc. (the “Company”) and FairPoint Communications, Inc.

(“FairPoint”), both separately and as a combined entity.

There are a number of risks, uncertainties, and conditions that may

cause the actual results of the Company and FairPoint, both

separately and as a combined entity, to differ materially from

those expressed or implied by these forward-looking

statements. These risks and uncertainties include the timing

and ability to complete the proposed acquisition of FairPoint by

the Company, the expected benefits of the integration of the two

companies and successful integration of FairPoint’s operations with

those of the Company and realization of the synergies from the

integration, as well as a number of factors related to the

respective businesses of the Company and FairPoint, including

economic and financial market conditions generally and economic

conditions in the Company’s and FairPoint’s service areas; various

risks to stockholders of not receiving dividends and risks to the

Company’s ability to pursue growth opportunities if the Company

continues to pay dividends according to the current dividend

policy; various risks to the price and volatility of the Company’s

common stock; changes in the valuation of pension plan assets; the

substantial amount of debt and the Company’s ability to repay or

refinance it or incur additional debt in the future; the Company’s

need for a significant amount of cash to service and repay the debt

and to pay dividends on its common stock; restrictions contained in

the Company’s debt agreements that limit the discretion of

management in operating the business; legal or regulatory

proceedings or other matters that impact the timing or ability to

complete the acquisition as contemplated, regulatory changes,

including changes to subsidies, rapid development and introduction

of new technologies and intense competition in the

telecommunications industry; risks associated with the Company’s

possible pursuit of acquisitions; system failures; cyber-attacks,

information or security breaches, or technology failure of the

Company or of a third party; losses of large customers or

government contracts; risks associated with the rights-of-way for

the network; disruptions in the relationship with third party

vendors; losses of key management personnel and the inability to

attract and retain highly qualified management and personnel in the

future; changes in the extensive governmental legislation and

regulations governing telecommunications providers and the

provision of telecommunications services; new or changing tax laws

or regulations; telecommunications carriers disputing and/or

avoiding their obligations to pay network access charges for use of

the Company’s and FairPoint’s network; high costs of regulatory

compliance; the competitive impact of legislation and regulatory

changes in the telecommunications industry; liability and

compliance costs regarding environmental regulations; the

possibility of disruption from the integration of the two companies

making it more difficult to maintain business and operational

relationships; the possibility that the acquisition is not

consummated, including, but not limited to, due to the failure to

satisfy the closing conditions; the possibility that the merger or

the acquisition may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; and

diversion of management’s attention from ongoing business

operations and opportunities. A detailed discussion of risks

and uncertainties that could cause actual results and events to

differ materially from such forward-looking statements are

discussed in more detail in the Company’s and FairPoint’s

respective filings with the SEC, including the Annual Report on

Form 10-K of the Company for the year ended December 31, 2016,

which was filed with the SEC on March 1, 2017, under the heading

“Item 1A—Risk Factors,” and the Annual Report on Form 10-K of

FairPoint for the year ended December 31, 2016, which was filed

with the SEC on March 6, 2017, under the heading “Item 1A—Risk

Factors,” and in subsequent reports on Forms 10-Q and 8-K and other

filings made with the SEC by each of the Company and FairPoint.

Many of these circumstances are beyond the ability of the Company

and FairPoint to control or predict. Moreover,

forward-looking statements necessarily involve assumptions on the

part of the Company and FairPoint. These forward-looking

statements generally are identified by the words “believe,”

“expect,” “anticipate,” “estimate,” “project,” “intend,” “plan,”

“should,” “may,” “will,” “would,” “will be,” “will continue” or

similar expressions. Such forward-looking statements involve

known and unknown risks, uncertainties and other factors that may

cause actual results, performance or achievements of the Company

and FairPoint, and their respective subsidiaries, both separately

and as a combined entity to be different from those expressed or

implied in the forward-looking statements. All

forward-looking statements attributable to us or persons acting on

the respective behalf of the Company or FairPoint are expressly

qualified in their entirety by the cautionary statements that

appear throughout this communication. Furthermore,

forward-looking statements speak only as of the date they are

made. Except as required under the federal securities laws or

the rules and regulations of the SEC, each of the Company and

FairPoint disclaim any intention or obligation to update or revise

publicly any forward-looking statements. You should not place

undue reliance on forward-looking statements.

- Tables to follow -

| |

|

| Consolidated Communications Holdings,

Inc. |

|

| Condensed Consolidated Balance

Sheets |

|

| (Dollars in thousands, except par value) |

|

| (Unaudited) |

|

|

|

March

31, |

|

December

31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

$ |

26,629 |

|

|

$ |

27,077 |

|

|

| Accounts

receivable, net |

|

49,770 |

|

|

|

56,216 |

|

|

| Income

tax receivable |

|

24,058 |

|

|

|

21,616 |

|

|

| Prepaid

expenses and other current assets |

|

29,014 |

|

|

|

28,292 |

|

|

| Total current

assets |

|

129,471 |

|

|

|

133,201 |

|

|

| |

|

|

|

|

| Property, plant and

equipment, net |

|

1,047,796 |

|

|

|

1,055,186 |

|

|

| Investments |

|

106,035 |

|

|

|

106,221 |

|

|

| Goodwill |

|

756,877 |

|

|

|

756,877 |

|

|

| Other intangible

assets |

|

28,521 |

|

|

|

31,612 |

|

|

| Other assets |

|

9,540 |

|

|

|

9,661 |

|

|

| Total assets |

$ |

2,078,240 |

|

|

$ |

2,092,758 |

|

|

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS'

EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

$ |

6,436 |

|

|

$ |

6,766 |

|

|

| Advance

billings and customer deposits |

|

26,544 |

|

|

|

26,438 |

|

|

| Dividends

payable |

|

19,653 |

|

|

|

19,605 |

|

|

| Accrued

compensation |

|

16,638 |

|

|

|

16,971 |

|

|

| Accrued

interest |

|

24,726 |

|

|

|

11,260 |

|

|

| Accrued

expense |

|

50,564 |

|

|

|

54,123 |

|

|

| Current

portion of long-term debt and capital lease obligations |

|

15,830 |

|

|

|

14,922 |

|

|

| Total current

liabilities |

|

160,391 |

|

|

|

150,085 |

|

|

| |

|

|

|

|

| Long-term debt and

capital lease obligations |

|

1,375,271 |

|

|

|

1,376,754 |

|

|

| Deferred income

taxes |

|

242,725 |

|

|

|

244,298 |

|

|

| Pension and other

post-retirement obligations |

|

128,978 |

|

|

|

130,793 |

|

|

| Other long-term

liabilities |

|

14,121 |

|

|

|

14,573 |

|

|

| Total liabilities |

|

1,921,486 |

|

|

|

1,916,503 |

|

|

| |

|

|

|

|

| Shareholders'

equity: |

|

|

|

|

| Common

stock, par value $0.01 per share; 100,000,000 shares

|

|

|

|

|

|

authorized, 50,734,486 and 50,612,362, shares outstanding |

|

|

|

|

| as of

March 31, 2017 and December 31, 2016, respectively |

|

507 |

|

|

|

506 |

|

|

|

Additional paid-in capital |

|

200,917 |

|

|

|

217,725 |

|

|

| Retained

earnings (deficit) |

|

(3,685 |

) |

|

|

- |

|

|

|

Accumulated other comprehensive loss, net |

|

(46,266 |

) |

|

|

(47,277 |

) |

|

|

Noncontrolling interest |

|

5,281 |

|

|

|

5,301 |

|

|

| Total

shareholders' equity |

|

156,754 |

|

|

|

176,255 |

|

|

| Total

liabilities and shareholders' equity |

$ |

2,078,240 |

|

|

$ |

2,092,758 |

|

|

| |

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Condensed Consolidated Statements of

Operations |

| (Dollars in thousands, except per share amounts) |

| (Unaudited) |

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

|

March

31, |

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net revenues |

$ |

169,935 |

|

|

$ |

188,846 |

|

|

| Operating

expenses: |

|

|

|

|

| Cost of

services and products |

|

71,391 |

|

|

|

79,720 |

|

|

| Selling,

general and administrative |

|

|

|

|

|

expenses |

|

36,433 |

|

|

|

40,676 |

|

|

|

Acquisition and other transaction costs |

|

1,329 |

|

|

|

- |

|

|

|

Depreciation and amortization |

|

42,195 |

|

|

|

44,140 |

|

|

| Income from

operations |

|

18,587 |

|

|

|

24,310 |

|

|

| Other income

(expense): |

|

|

|

|

| Interest

expense, net of interest income |

|

(29,671 |

) |

|

|

(18,646 |

) |

|

| Other

income, net |

|

5,205 |

|

|

|

7,211 |

|

|

| Income (loss) before

income taxes |

|

(5,879 |

) |

|

|

12,875 |

|

|

| Income tax expense

(benefit) |

|

(2,174 |

) |

|

|

4,973 |

|

|

| Net income (loss) |

|

(3,705 |

) |

|

|

7,902 |

|

|

| |

|

|

|

|

| Less: net income (loss)

attributable to noncontrolling interest |

|

(20 |

) |

|

|

53 |

|

|

| |

|

|

|

|

| Net

income (loss) attributable to common shareholders |

$ |

(3,685 |

) |

|

$ |

7,849 |

|

|

| |

|

|

|

|

| Net

income (loss) per basic and diluted common shares |

|

|

|

|

|

attributable to common shareholders |

$ |

(0.07 |

) |

|

$ |

0.15 |

|

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

|

|

|

| Condensed Consolidated Statements of Cash

Flows |

|

|

|

| (Dollars in thousands) |

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

|

|

|

|

|

|

|

March

31, |

|

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

| OPERATING

ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

Net income (loss) |

|

$ |

(3,705 |

) |

|

$ |

7,902 |

|

|

|

|

|

|

|

|

Adjustments to

reconcile net income (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

|

|

|

Depreciation and

amortization |

|

|

42,195 |

|

|

|

44,140 |

|

|

|

|

|

|

|

|

Deferred income

taxes |

|

|

22 |

|

|

|

- |

|

|

|

|

|

|

|

|

Cash distributions from

wireless partnerships in excess of/(less than) earnings |

|

|

523 |

|

|

|

(233 |

) |

|

|

|

|

|

|

|

Non-cash stock-based

compensation |

|

|

538 |

|

|

|

892 |

|

|

|

|

|

|

|

|

Amortization of

deferred financing |

|

|

4,400 |

|

|

|

794 |

|

|

|

|

|

|

|

|

Other adjustments,

net |

|

|

(4 |

) |

|

|

(116 |

) |

|

|

|

|

|

|

|

Changes in operating

assets and liabilities, net |

|

|

7,749 |

|

|

|

6,162 |

|

|

|

|

|

| |

|

Net cash

provided by operating activities |

|

|

51,718 |

|

|

|

59,541 |

|

|

|

|

|

| INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

Purchase of property,

plant and equipment, net |

|

|

(29,025 |

) |

|

|

(28,688 |

) |

|

|

|

|

| |

|

Proceeds from sale of

assets |

|

|

43 |

|

|

|

14 |

|

|

|

|

|

| |

|

Net cash

used in investing activities |

|

|

(28,982 |

) |

|

|

(28,674 |

) |

|

|

|

|

| FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

| |

|

Proceeds from issuance

of long-term debt |

|

|

7,000 |

|

|

|

- |

|

|

|

|

|

| |

|

Payment of capital

lease obligations |

|

|

(1,289 |

) |

|

|

(387 |

) |

|

|

|

|

| |

|

Payment on long-term

debt |

|

|

(9,250 |

) |

|

|

(2,275 |

) |

|

|

|

|

| |

|

Share repurchases for

minimum tax withholding |

|

|

(41 |

) |

|

|

(71 |

) |

|

|

|

|

| |

|

Dividends on common

stock |

|

|

(19,604 |

) |

|

|

(19,551 |

) |

|

|

|

|

| |

|

Net cash used for

financing activities |

|

|

(23,184 |

) |

|

|

(22,284 |

) |

|

|

|

|

| Net change

in cash and cash equivalents |

|

|

(448 |

) |

|

|

8,583 |

|

|

|

|

|

| Cash and

cash equivalents at beginning of period |

|

|

27,077 |

|

|

|

15,878 |

|

|

|

|

|

| Cash and

cash equivalents at end of period |

|

$ |

26,629 |

|

|

$ |

24,461 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

| Consolidated Revenue by Category |

| (Dollars in thousands) |

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

|

|

|

|

March

31, |

|

|

|

|

|

|

|

2017 |

|

|

2016 |

|

|

|

Commercial and carrier: |

|

|

|

|

|

|

|

| Data and

transport services (includes VoIP) |

|

|

$ |

49,414 |

|

$ |

49,112 |

|

|

| Voice

services |

|

|

|

23,516 |

|

|

25,025 |

|

|

|

Other |

|

|

|

3,902 |

|

|

2,624 |

|

|

| |

|

|

|

76,832 |

|

|

76,761 |

|

|

|

Consumer: |

|

|

|

|

|

|

|

| Broadband

(VoIP, Data and Video) |

|

|

|

51,684 |

|

|

54,559 |

|

|

| Voice

services |

|

|

|

12,855 |

|

|

14,491 |

|

|

|

|

|

|

|

64,539 |

|

|

69,050 |

|

|

|

|

|

|

|

|

|

|

|

| Equipment

sales and service |

|

|

|

- |

|

|

9,640 |

|

|

|

Subsidies |

|

|

|

10,572 |

|

|

13,074 |

|

|

| Network

access |

|

|

|

14,553 |

|

|

16,813 |

|

|

| Other

products and services |

|

|

|

3,439 |

|

|

3,508 |

|

|

| Total operating

revenue |

|

|

$ |

169,935 |

|

$ |

188,846 |

|

|

| |

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

|

|

|

|

|

| Schedule of Adjusted EBITDA

Calculation |

|

|

|

|

|

| (Dollars in thousands) |

|

|

|

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

|

|

|

|

|

March

31, |

|

|

|

|

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

(3,705 |

) |

|

$ |

7,902 |

|

|

|

|

|

|

|

| Add (subtract): |

|

|

|

|

|

|

|

|

|

| Income

tax expense (benefit) |

|

(2,174 |

) |

|

|

4,973 |

|

|

|

|

|

|

|

| Interest

expense, net |

|

29,671 |

|

|

|

18,646 |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

42,195 |

|

|

|

44,140 |

|

|

|

|

|

|

|

| EBITDA |

|

65,987 |

|

|

|

75,661 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Adjustments to EBITDA

(1): |

|

|

|

|

|

|

|

|

|

| Other,

net (2) |

|

4,233 |

|

|

|

2,472 |

|

|

|

|

|

|

|

|

Investment income (accrual basis) |

|

(5,278 |

) |

|

|

(7,197 |

) |

|

|

|

|

|

|

|

Investment distributions (cash basis) |

|

5,644 |

|

|

|

6,796 |

|

|

|

|

|

|

|

| Non-cash

compensation (3) |

|

538 |

|

|

|

892 |

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

71,124 |

|

|

$ |

78,624 |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

| (1) These adjustments reflect those required or permitted

by the lenders under our credit agreement. |

|

|

|

|

|

| (2) Other, net includes income attributable to

noncontrolling interests, acquisition and non-recurring related

costs, and certain miscellaneous items. |

|

|

|

|

|

| (3) Represents compensation expenses in connection with

our Restricted Share Plan, which because of the non-cash nature of

the expenses are excluded from adjusted EBITDA. |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

|

|

|

| Cash Available to Pay Dividends |

|

|

|

| (Dollars in thousands) |

|

|

|

| (Unaudited) |

|

|

|

| |

|

|

|

|

|

Three Months

Ended |

|

|

|

|

|

March 31,

2017 |

|

|

|

| |

|

|

|

|

| Adjusted EBITDA |

$ |

71,124 |

|

|

|

|

| |

|

|

|

|

| - Cash interest

expense |

|

(17,444 |

) |

|

|

|

| - Capital

expenditures |

|

(29,025 |

) |

|

|

|

| - Cash income

(taxes)/refund |

|

(309 |

) |

|

|

|

| Cash available to pay

dividends |

$ |

24,346 |

|

|

|

|

| |

|

|

|

|

| Dividends Paid |

$ |

19,604 |

|

|

|

|

| Payout Ratio |

|

80.5 |

% |

|

|

|

| |

|

|

|

|

| Note:

The above calculation excludes the principal payments on our

debt. |

|

|

|

| |

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

|

|

| Total Net Debt to LTM Adjusted EBITDA

Ratio |

|

|

| (Dollars in thousands) |

|

|

| (Unaudited) |

|

|

|

|

|

|

|

| Summary of Outstanding

Debt: |

March 31,

2017 |

|

|

| Term loan, net of

discount $4,505 |

$ |

890,995 |

|

|

|

| Revolving loan |

|

- |

|

|

|

| Senior unsecured notes

due 2022, net of discount $4,147 |

|

495,853 |

|

|

|

| Capital leases |

|

17,638 |

|

|

|

| Total debt as of March

31, 2017 |

$ |

1,404,486 |

|

|

|

| Less deferred debt

issuance costs |

|

(13,385 |

) |

|

|

| Less cash on hand |

|

(26,629 |

) |

|

|

| Total net debt as of

March 31, 2017 |

$ |

1,364,472 |

|

|

|

| |

|

|

|

| Adjusted EBITDA for the

last |

|

|

|

| twelve

months ended March 31, 2017 |

$ |

298,259 |

|

|

|

| |

|

|

|

|

|

| Total Net Debt to last

twelve months |

|

|

|

|

|

| Adjusted

EBITDA |

|

4.58x |

|

|

|

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

|

|

| Adjusted Net Income and Net Income Per

Share |

|

|

| Dollars in thousands, except per share amounts) |

|

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months

Ended |

|

|

|

|

March

31, |

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

| Net income (loss) |

$ |

(3,705 |

) |

|

$ |

7,902 |

|

|

| Transaction and

severance related costs, net of tax |

|

2,063 |

|

|

|

1,019 |

|

|

| Amortization of

commitment fee, net of tax |

|

2,160 |

|

|

|

- |

|

|

| Ticking fees on

committed financing, net of tax |

|

4,892 |

|

|

|

- |

|

|

| Non-cash stock

compensation, net of tax |

|

331 |

|

|

|

548 |

|

|

| Adjusted net

income |

$ |

5,741 |

|

|

$ |

9,468 |

|

|

| |

|

|

|

|

|

| Weighted average number

of shares outstanding |

|

50,410 |

|

|

|

50,289 |

|

|

| |

|

|

|

|

|

| Adjusted diluted net

income per share |

$ |

0.11 |

|

|

$ |

0.19 |

|

|

| |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

Calculations above assume a 38.4% and 38.6% effective tax rate for

the three months ended March 31, 2017 and 2016, respectively. |

|

|

| |

|

|

|

|

|

| Consolidated Communications Holdings,

Inc. |

|

| Key Operating Statistics |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March

31, |

|

December 31, |

|

% Change |

|

March

31, |

|

% Change |

|

|

|

|

|

|

2017 |

|

|

|

2016 |

|

|

in Qtr |

|

|

2016 |

|

|

YOY |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Voice

Connections (1) |

|

|

453,332 |

|

|

|

457,315 |

|

|

(0.9 |

%) |

|

|

478,035 |

|

|

(5.2 |

%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Data and

Internet Connections (1) |

|

|

477,180 |

|

|

|

473,403 |

|

|

0.8 |

% |

|

|

459,597 |

|

|

3.8 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Video

Connections |

|

|

102,906 |

|

|

|

106,343 |

|

|

(3.2 |

%) |

|

|

114,485 |

|

|

(10.1 |

%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Business

and Broadband as % of total revenue (2) |

|

82.1 |

% |

|

|

82.3 |

% |

|

(0.2 |

%) |

|

|

80.7 |

% |

|

1.7 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Fiber route

network miles (long-haul and metro) |

|

14,172 |

|

|

|

14,157 |

|

|

0.1 |

% |

|

|

13,812 |

|

|

2.6 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| On-net

buildings |

|

|

5,766 |

|

|

|

5,618 |

|

|

2.6 |

% |

|

|

5,224 |

|

|

10.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer

Customers |

|

|

248,796 |

|

|

|

253,203 |

|

|

(1.7 |

%) |

|

|

265,428 |

|

|

(6.3 |

%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Consumer

ARPU |

|

$ |

86.47 |

|

|

$ |

84.15 |

|

|

2.8 |

% |

|

$ |

86.72 |

|

|

(0.3 |

%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

| 1) The acquisition of Champaign Telephone Co. and

the sale of the Iowa ILEC resulted in a net increase of 4,905 data

connections and a net reduction of 4,290 voice connections in the

third quarter 2016. |

|

| |

| 2) Business and Broadband revenue % includes:

commercial/carrier, equipment sales and service, directory,

consumer broadband and special access. |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Company Contact:

Jennifer Spaude, Consolidated Communications

507-386-3765

Jennifer.spaude@consolidated.com

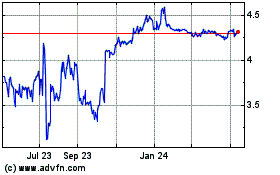

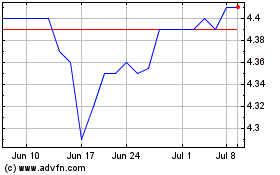

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Sep 2023 to Sep 2024