USD Partners LP (NYSE: USDP) (the “Partnership”) announced today

its operating and financial results for the three months ended

March 31, 2017. Highlights with respect to the first quarter of

2017 include the following:

- Generated Net cash provided by

operating activities of $12.8 million, Adjusted EBITDA of $15.4

million and Distributable cash flow of $12.3 million

- Reported Net income of $5.2

million

- Increased quarterly cash distribution

for eighth consecutive quarter to $0.335 per unit ($1.34 per unit

on an annualized basis)

- Ended quarter with $192.2 million of

available liquidity

“The Partnership’s results continue to benefit from stable and

predictable cash flows from high-quality customers,” said Dan

Borgen, the Partnership’s Chief Executive Officer. “This enabled us

to deliver another quarter of distribution growth, with

approximately 1.6x coverage, while remaining well-positioned to

execute on accretive growth opportunities.”

First Quarter 2017 Operational and Financial Results

Substantially all of the Partnership’s cash flows are generated

from multi-year, take-or-pay terminal service agreements related to

the Hardisty and Casper terminals, which include minimum monthly

commitment fees. The Partnership’s customers include major

integrated oil companies, refiners and marketers, the majority of

which are investment grade rated.

For the first quarter of 2017 relative to the first quarter of

2016, Net cash provided by operating activities increased by 39%,

while Adjusted EBITDA and Distributable cash flow increased by 7%

and 12%, respectively. These increases were primarily driven by a

reduction in operating expenses due to one-time costs associated

with the integration of the Casper terminal during the first

quarter of 2016 and were partially offset by higher interest

expense associated with the Partnership’s revolving credit

facility.

Distributable cash flow for the first quarter of 2017 also

benefited from an approximate $1.1 million decrease in Cash paid

for income taxes, primarily due to the receipt of the remaining

C$0.9 million tax refund, as well as lower Canadian income taxes

paid during the quarter.

Net income, which increased 142% for the first quarter of 2017

relative to 2016, also benefited from additional Terminalling

services revenue due to the recognition of greater amounts of

previously deferred revenues in the current period as compared to

the prior year. Additionally, the value of the Canadian dollar

relative to the U.S. dollar strengthened to a lesser extent during

the first quarter of 2017 relative to 2016, which resulted in

smaller non-cash losses from changes in the fair value of the

Partnership’s derivative instruments.

On April 27, 2017, the Partnership declared a quarterly cash

distribution of $0.335 per unit ($1.34 per unit on an annualized

basis), which represents growth of 1.5% relative to the fourth

quarter of 2016 and 8.9% relative to the first quarter of 2016. The

distribution is payable on May 12, 2017, to unitholders of record

as of the close of business on May 8, 2017.

During March 2017, the Partnership repaid all amounts previously

outstanding on its term loan facility. As a result, the

Partnership’s revolving credit facility comprises the full $400.0

million of capacity under its credit agreement, subject to limits

set forth therein.

As of March 31, 2017, the Partnership had total available

liquidity of $192.2 million, including $4.2 million of unrestricted

cash and cash equivalents and undrawn borrowing capacity of $188.0

million on its $400.0 million senior secured credit facility,

subject to continued compliance with financial covenants. The

Partnership is in compliance with its financial covenants and has

no maturities under its senior secured credit facility until

October 2019.

First Quarter 2017 Conference Call Information

The Partnership will host a conference call and webcast

regarding first quarter 2017 results at 11:00 a.m. Eastern Time

(10:00 a.m. Central Time) on Thursday, May 4, 2017.

To listen live over the Internet, participants are advised to

log on to the Partnership’s website at www.usdpartners.com and

select the “Events & Presentations” sub-tab under the

“Investors” tab. To join via telephone, participants may dial (877)

266-7551 domestically or +1 (339) 368-5209 internationally,

conference ID 14385750. Participants are advised to dial in at

least five minutes prior to the call.

An audio replay of the conference call will be available for

thirty days by dialing (800) 585-8367 domestically or +1 (404)

537-3406 internationally, conference ID 14385750. In addition, a

replay of the audio webcast will be available by accessing the

Partnership's website after the call is concluded.

About USD Partners LP

USD Partners LP is a fee-based, growth-oriented master limited

partnership formed in 2014 by US Development Group LLC to acquire,

develop and operate energy-related logistics assets, including rail

terminals and other high-quality and complementary midstream

infrastructure. The Partnership’s assets consist primarily of: (i)

a crude oil origination terminal in Hardisty, Alberta, Canada, with

capacity to load up to two 120-railcar unit trains per day, (ii) a

crude oil terminal in Casper, Wyoming, with unit train-capable

railcar loading capacity in excess of 100,000 barrels per day and

six customer-dedicated storage tanks with 900,000 barrels of total

capacity and (iii) a unit train-capable ethanol destination rail

terminal in West Colton, California. In addition, the Partnership

provides railcar services through the management of a railcar fleet

that is committed to customers on a long-term basis.

Non-GAAP Financial Measures

The Partnership defines Adjusted EBITDA as Net cash provided by

operating activities adjusted for changes in working capital items,

changes in restricted cash, interest, income taxes, foreign

currency transaction gains and losses, adjustments related to

deferred revenue associated with minimum monthly commitment fees

and other items which do not affect the underlying cash flows

produced by the Partnership’s businesses. Adjusted EBITDA is a

non-GAAP, supplemental financial measure used by management and

external users of the Partnership’s financial statements, such as

investors and commercial banks, to assess:

- the Partnership’s liquidity and the

ability of the Partnership’s businesses to produce sufficient cash

flows to make distributions to the Partnership’s unitholders;

and

- the Partnership’s ability to incur and

service debt and fund capital expenditures.

The Partnership defines Distributable cash flow, or DCF, as

Adjusted EBITDA less net cash paid for interest, income taxes and

maintenance capital expenditures. DCF does not reflect changes in

working capital balances. DCF is a non-GAAP, supplemental financial

measure used by management and by external users of the

Partnership’s financial statements, such as investors and

commercial banks, to assess:

- the amount of cash available for making

distributions to the Partnership’s unitholders;

- the excess cash being retained for use

in enhancing the Partnership’s existing businesses; and

- the sustainability of the Partnership’s

current distribution rate per unit.

The Partnership believes that the presentation of Adjusted

EBITDA and DCF in this press release provides information that

enhances an investor's understanding of the Partnership’s ability

to generate cash for payment of distributions and other purposes.

The GAAP measure most directly comparable to Adjusted EBITDA and

DCF is Net cash provided by operating activities. Adjusted EBITDA

and DCF should not be considered alternatives to Net cash provided

by operating activities or any other measure of liquidity or

performance presented in accordance with GAAP. Adjusted EBITDA and

DCF exclude some, but not all, items that affect cash from

operations and these measures may vary among other companies. As a

result, Adjusted EBITDA and DCF may not be comparable to similarly

titled measures of other companies.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of U.S. federal securities laws, including statements

with respect to the Partnership’s liquidity, the ability of the

Partnership to grow and opportunities to grow, and the amount and

timing of future distribution payments. Words and phrases such as

“is expected,” “is planned,” “believes,” “projects,” and similar

expressions are used to identify such forward-looking statements.

However, the absence of these words does not mean that a statement

is not forward-looking. Forward-looking statements relating to the

Partnership are based on management’s expectations, estimates and

projections about the Partnership, its interests and the energy

industry in general on the date this press release was issued.

These statements are not guarantees of future performance and

involve certain risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may

differ materially from what is expressed or forecast in such

forward-looking statements. Factors that could cause actual results

or events to differ materially from those described in the

forward-looking statements include those as set forth under the

heading “Risk Factors” in the Partnership’s most recent Annual

Report on Form 10-K and in our subsequent filings with the

Securities and Exchange Commission. The Partnership is under no

obligation (and expressly disclaims any such obligation) to update

or alter its forward-looking statements, whether as a result of new

information, future events or otherwise.

USD Partners LP Consolidated

Statements of Income For the Three Months Ended March 31,

2017 and 2016 (unaudited) For the Three Months

Ended March 31, 2017 2016

(in thousands)

Revenues Terminalling services $ 23,559 $ 22,023

Terminalling services — related party 1,740 1,650 Railroad

incentives 15 15

Fleet leases

643 643 Fleet leases — related party 890 890 Fleet services 468 69

Fleet services — related party 279 684 Freight and other

reimbursables 157 383 Freight and other reimbursables — related

party 1 -

Total revenues

27,752 26,357 Operating costs

Subcontracted rail services 2,013 2,043 Pipeline fees 5,417 4,714

Fleet leases 1,533 1,533 Freight and other reimbursables 158 383

Operating and maintenance 707 870 Selling, general and

administrative 2,315 2,894 Selling, general and administrative —

related party 1,432 1,492 Depreciation and amortization

4,941 4,905

Total operating costs

18,516 18,834 Operating income

9,236 7,523 Interest expense 2,607 2,183 Loss

associated with derivative instruments 211 1,523 Foreign currency

transaction loss (gain) 30 (130 ) Other expense, net 5

-

Income before provision for income taxes

6,383 3,947 Provision for income taxes 1,185

1,797

Net income $ 5,198

$ 2,150 USD Partners

LP Consolidated Statements of Cash Flows For the

Three Months Ended March 31, 2017 and 2016 (unaudited)

For the Three Months Ended March 31,

2017 2016 Cash flows from operating

activities:

(in thousands)

Net income $ 5,198 $ 2,150 Adjustments to reconcile net income to

net cash provided by operating activities: Depreciation and

amortization 4,941 4,905 Loss associated with derivative

instruments 211 1,523 Settlement of derivative contracts 299 490

Unit based compensation expense 798 728 Other 282 169 Changes in

operating assets and liabilities: Accounts receivable 35 (62 )

Accounts receivable – related party 213 1,706 Prepaid expenses and

other current assets 1,579 330 Accounts payable and accrued

expenses 93 (737 ) Accounts payable and accrued expenses – related

party 307 (95 ) Deferred revenue and other liabilities (1,120 ) 872

Deferred revenue – related party

-

(329 ) Change in restricted cash (21 ) (2,426 ) Net

cash provided by operating activities

12,815

9,224 Cash flows from investing

activities: Additions of property and equipment (126 )

(273 ) Net cash used in investing activities

(126 ) (273 ) Cash flows from

financing activities: Distributions (7,903 ) (7,030 ) Vested

phantom units used for payment of participant taxes (1,070 ) (77 )

Proceeds from long-term debt 5,000 5,000 Repayment of long-term

debt (16,342 ) (9,077 ) Net cash used in financing

activities

(20,315 ) (11,184

) Effect of exchange rates on cash 105

325 Net change in cash and cash equivalents (7,521 ) (1,908

) Cash and cash equivalents – beginning of period 11,705

10,500 Cash and cash equivalents – end of

period

$ 4,184 $ 8,592

USD Partners LP Consolidated Balance

Sheets (unaudited) March 31, December

31, 2017 2016 ASSETS (in thousands)

Current assets Cash and cash equivalents $ 4,184 $ 11,705

Restricted cash 5,498 5,433 Accounts receivable, net 4,295 4,321

Accounts receivable — related party - 219 Prepaid expenses 9,737

10,325 Other current assets 1,130 2,562

Total current assets 24,844 34,565 Property and equipment, net

124,728 125,702 Intangible assets, net 108,767 111,919 Goodwill

33,589 33,589 Other non-current assets 186 192

Total assets $ 292,114 $

305,967 LIABILITIES AND PARTNERS’

CAPITAL Current liabilities Accounts payable and accrued

expenses $ 2,498 $ 2,221 Accounts payable and accrued expenses —

related party 517 214 Deferred revenue, current portion 26,461

26,928 Deferred revenue, current portion — related party 4,324

4,292 Other current liabilities 3,351 3,513

Total current liabilities 37,151 37,168 Long-term debt, net

209,981 220,894 Deferred revenue, net of current portion - 264

Deferred income tax liability, net 886 823

Total liabilities 248,018

259,149 Commitments and contingencies Partners’

capital Common units 101,902 122,802 Class A units 1,300 1,811

Subordinated units (58,306 ) (76,749 ) General partner units 72 111

Accumulated other comprehensive income (loss) (872 )

(1,157 )

Total partners' capital 44,096

46,818 Total liabilities and partners'

capital $ 292,114 $ 305,967

USD Partners LP GAAP to

Non-GAAP Reconciliations For the Three Months Ended March

31, 2017 and 2016 (unaudited) For the Three

Months Ended March 31, 2017 2016

(in thousands)

Net cash provided by operating activities $

12,815 $ 9,224 Add (deduct): Amortization of

deferred financing costs (215 ) (215 ) Deferred income taxes (58 )

46 Changes in accounts receivable and other assets (1,827 ) (1,974

) Changes in accounts payable and accrued expenses (400 ) 832

Changes in deferred revenue and other liabilities 1,120 (543 )

Change in restricted cash 21 2,426 Interest expense, net 2,603

2,183 Provision for income taxes 1,185 1,797 Foreign currency

transaction loss (gain) (1) 30 (130 ) Deferred revenue associated

with minimum monthly commitment fees (2) 80

763

Adjusted EBITDA 15,354 14,409 Add

(deduct): Cash paid for income taxes (3) (616 ) (1,710 ) Cash paid

for interest (2,362 ) (1,807 ) Maintenance capital expenditures

(126 ) -

Distributable cash flow

$ 12,250 $ 10,892

(1) Represents foreign exchange transaction gains and losses

associated with activities between the Partnership's U.S. and

Canadian subsidiaries. (2) Represents deferred revenue

associated with minimum monthly commitment fees in excess of

throughput utilized, which fees are not refundable to the

Partnership's customers. Amounts presented are net of: (a) the

corresponding prepaid Gibson pipeline fee that will be recognized

as expense concurrently with the recognition of revenue; (b)

revenue recognized in the current period that was previously

deferred; and (c) expense recognized for previously prepaid Gibson

pipeline fees, which correspond with the revenue recognized that

was previously deferred. (3)

Includes a partial refund of approximately

$0.7 million (representing C$0.9 million) received in the three

months ended March 31, 2017, for our 2015 foreign income taxes.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170503006660/en/

USD Partners LPAdam Altsuler, (281) 291-3995Vice President,

Chief Financial Officeraaltsuler@usdg.comorAshley Means Zavala,

(281) 291-3965Director, Finance & Investor

Relationsameans@usdg.com

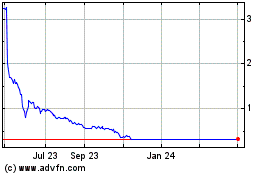

USD Partners (NYSE:USDP)

Historical Stock Chart

From Aug 2024 to Sep 2024

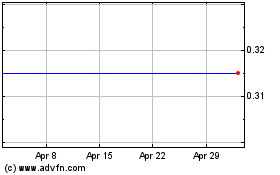

USD Partners (NYSE:USDP)

Historical Stock Chart

From Sep 2023 to Sep 2024