4G chipmaker Sequans Communications S.A. (NYSE: SQNS) today

announced financial results for the first quarter ended March 31,

2017.

First Quarter 2017 Highlights:

Revenue: Revenue of $12.4 million decreased 10.9%

compared to the fourth quarter of 2016 primarily as a result of the

typical pattern of seasonality. Revenue increased 33.9% compared to

the first quarter of 2016, due to higher product sales partly

offset by lower license and service revenues.

Gross margin: Gross margin was 47.1% compared to gross

margin of 38.2% in the fourth quarter of 2016 due to a more

favorable product mix, and compared to 47.5% in the first quarter

of 2016, due to a less favorable revenue mix in the first quarter

of 2017 as a result of lower license and service revenues.

Operating loss: Operating loss was $4.2 million compared

to an operating loss of $4.9 million in the fourth quarter of 2016

and an operating loss of $5.2 million in the first quarter of

2016.

Net loss: Net loss was $5.6 million, or ($0.07) per

diluted share/ADS, compared to a net loss $5.4 million, or ($0.07)

per diluted share/ADS, in the fourth quarter of 2016 and a net loss

of $9.2 million, or ($0.16) per diluted share/ADS, in the first

quarter of 2016.

Non-IFRS Net loss: Excluding the non-cash items of

stock-based compensation and the fair-value (in 2016) and effective

interest adjustments related to the convertible debt and other

financings, non-IFRS net loss was $4.7 million, or ($0.06) per

diluted share/ADS, compared to a non-IFRS net loss of $4.2 million,

or ($0.06) per diluted share/ADS in the fourth quarter of 2016, and

a non-IFRS net loss of $5.5 million, or ($0.09) per diluted

share/ADS, in the first quarter of 2016.

Cash: Cash, cash equivalents and short-term deposit at

March 31, 2017 totaled $14.5 million compared to $20.5 million at

December 31, 2016.

In millions of US$ except percentages, shares and per share amounts

Key Metrics Q1 2017

%* Q4 2016 %* Q1 2016 %* Revenue

$12.4 $14.0 $9.3 Gross

profit

5.9 47.1% 5.3 38.2% 4.4 47.5% Operating loss

(4.2) (34.2%) (4.9) (34.9%) (5.2) (56.0%) Net loss

(5.6) (45.1%) (5.4) (38.5%) (9.2) (99.4%) Diluted EPS

($0.07) ($0.07) ($0.16) Weighted average number of diluted

shares/ADS

75,043,865 74,501,387 59,196,482 Cash flow from

(used in) operations

(9.9) (5.7) 3.9 Cash, cash equivalents

and short-term deposit at quarter-end

14.5 20.5 6.5

Additional information on non-cash items: - Stock-based

compensation included in operating result

0.3 0.5 0.3 -

Change in the fair value of convertible debt embedded derivative

- - 3.1 - Non-cash interest on convertible debt and other

financing

0.6 0.7 0.4 Non-IFRS diluted EPS (excludes

stock-based compensation, fair value and effective interest

adjustments related to the convertible and other debt and embedded

derivative)

($0.06) ($0.06) ($0.09)

* Percentage of revenue

“We are off to a good start in 2017, with key metrics

meeting or exceeding expectations,” said Georges Karam, Sequans’

CEO. “Demand for our broadband solutions continues to increase; we

have a backlog of IoT-related orders supporting the ramp of Cat 1

devices during the year, and we remain on track to grow at least

40% in 2017. Meanwhile, our design win momentum across our entire

product line, with particularly strong interest in our Monarch Cat

M1/NB1 platform for IoT, continues to position us to achieve even

higher growth next year.”

Q2 2017 Outlook

The following statements are based on management’s current

assumptions and expectations. These statements are forward-looking

and actual results may differ materially. Sequans undertakes no

obligation to update these statements.

Sequans expects revenue for the second quarter of 2017 to be in

the range of $13.5 to $15.5 million with non-IFRS gross margin

above 40%. Based on this revenue range and expected gross margin,

non-IFRS net loss per diluted share/ADS is expected to be between

($0.05) and ($0.07) for the second quarter of 2017, based on

approximately 75.1 million weighted average number of diluted

shares/ADSs. Non-IFRS EPS guidance excludes the impact of stock

based compensation, the non-cash fair-value and effective interest

adjustments related to the convertible debt and other financings,

and any other relevant non-cash or non-recurring expenses.

Conference Call and Webcast

Sequans plans to conduct a teleconference and live webcast to

discuss the financial results for the first quarter of 2017 today,

May 2, 2017 at 8:00 a.m. EDT /14:00 CEST. To participate in the

live call, analysts and investors should dial 800-230-1074 (or +1

651-291-5254 if outside the U.S.). A live and archived webcast of

the call will be available from the Investors section of the

Sequans website at www.sequans.com/investors/. A replay of the

conference call will be available until June 2, 2017 by dialing

toll free 800-475-6701 in the U.S., or +1 320-365-3844 from outside

the U.S., using the following access code: 421729.

Forward Looking Statements

This press release contains projections and other

forward-looking statements regarding future events or our future

financial performance. All statements other than present and

historical facts and conditions contained in this release,

including any statements regarding our future results of operations

and financial positions, business strategy, plans and our

objectives for future operations and potential strategic

partnerships, are forward-looking statements (within the meaning of

the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as

amended). These statements are only predictions and reflect our

current beliefs and expectations with respect to future events and

are based on assumptions and subject to risk and uncertainties and

subject to change at any time. We operate in a very competitive and

rapidly changing environment. New risks emerge from time to time.

Given these risks and uncertainties, you should not place undue

reliance on these forward-looking statements. Actual events or

results may differ materially from those contained in the

projections or forward-looking statements. Some of the factors that

could cause actual results to differ materially from the

forward-looking statements contained herein include, without

limitation: (i) the contraction or lack of growth of markets in

which we compete and in which our products are sold, (ii)

unexpected increases in our expenses, including manufacturing

expenses, (iii) our inability to adjust spending quickly enough to

offset any unexpected revenue shortfall, (iv) delays or

cancellations in spending by our customers, (v) unexpected average

selling price reductions, (vi) the significant fluctuation to which

our quarterly revenue and operating results are subject due to

cyclicality in the wireless communications industry and transitions

to new process technologies, (vii) our inability to anticipate the

future market demands and future needs of our customers, (viii) our

inability to achieve new design wins or for design wins to result

in shipments of our products at levels and in the timeframes we

currently expect, (ix) our inability to enter into and execute on

strategic alliances, (x) the impact of natural disasters on our

sourcing operations and supply chain, and (xi) other factors

detailed in documents we file from time to time with the Securities

and Exchange Commission. Forward-looking statements in this release

are made pursuant to the safe harbor provisions contained in the

Private Securities Litigation Reform Act of 1995.

Use of Non-IFRS/non-GAAP Financial Measures

To supplement our unaudited consolidated financial statements

prepared in accordance with IFRS, we disclose certain non-IFRS, or

non-GAAP, financial measures. These measures exclude non-cash

charges relating to stock-based compensation and the non-cash

financial expense related to the convertible debt and its embedded

derivative issued in April 2015 and April 2016. We believe that

these measures can be useful to facilitate comparisons among

different companies. These non-GAAP measures have limitations in

that the non-GAAP measures we use may not be directly comparable to

those reported by other companies. We seek to compensate for this

limitation by providing a reconciliation of the non-GAAP financial

measures to the most directly comparable IFRS measures in the table

attached to this press release. We are not able to provide a

non-GAAP reconciliation for forward-looking IFRS estimates for

gross margin and net loss per diluted share without unreasonable

efforts, because certain adjustments are not known until the end of

the period. The impact of these adjustments could be significant to

our actual IFRS results.

About Sequans Communications

Sequans Communications S.A. (NYSE: SQNS) is a leading provider

of single-mode 4G LTE wireless semiconductor solutions for Internet

of Things (IoT) and a wide range of broadband data devices. Founded

in 2003, Sequans has developed and delivered seven generations of

4G technology and its chips are certified and shipping in 4G

networks around the world. Today, Sequans offers two LTE product

lines: StreamliteLTE™, optimized for IoT and M2M devices and

StreamrichLTE™, optimized for feature-rich mobile computing and

home and portable router devices. The company is based in Paris,

France with additional offices in the United States, United

Kingdom, Sweden, Israel, Hong Kong, Singapore, Taiwan, South Korea,

and China.

Visit Sequans online

at www.sequans.com; www.facebook.com/sequans; www.twitter.com/sequans

Condensed financial tables follow

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Three months

ended (in thousands of US$, except share and per share

amounts) March 31, Dec 31, March 31,

2017 2016 2016

Revenue : Product revenue $ 9,640 $ 11,947 $ 5,412

Other revenue 2,790 2,006 3,873

Total

revenue 12,430 13,953

9,285 Cost of revenue Cost of product revenue 5,989

7,879 4,128 Cost of other revenue 589 740 747

Total cost of revenue 6,578

8,619 4,875 Gross profit

5,852 5,334 4,410 Operating

expenses : Research and development 6,194 6,327 6,727 Sales and

marketing 2,496 2,204 1,501 General and administrative 1,411 1,669

1,378

Total

operating expenses 10,101 10,200

9,606 Operating loss (4,249)

(4,866) (5,196) Financial income

(expense): Interest income (expense), net (1,038) (1,080) (628)

Change in the fair value of convertible debt embedded derivative -

- (3,127) Foreign exchange gain (loss) (246) 670

(212)

Loss before income taxes (5,533)

(5,276) (9,163) Income tax expense

(benefit) 71 95 66

Loss $

(5,604) (5,371) $ (9,229) Attributable to

: Shareholders of the parent (5,604) (5,371) (9,229) Minority

interests - - - Basic loss per share

($0.07) ($0.07) ($0.16) Diluted loss per share

($0.07) ($0.07) ($0.16) Weighted average number of

shares used for computing: — Basic 75,043,865 74,501,387 59,196,482

— Diluted 75,043,865 74,501,387 59,196,482

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION At March 31,

At December 31, (in thousands of US$)

2017 2016

ASSETS Non-current assets Property, plant and

equipment $ 6,302 $ 6,659 Intangible assets 7,450 7,707 Deposits

and other receivables 338 332 Available for sale assets

315 310

Total non-current

assets 14,405 15,008

Current assets Inventories 8,184 8,693 Trade receivables

17,189 15,285 Prepaid expenses and other receivables 2,923 3,172

Recoverable value added tax 434 470 Research tax credit receivable

2,980 1,902 Short term deposit 345 345 Cash and cash equivalents

14,162 20,202

Total

current assets 46,217 50,069

Total assets $ 60,622 $

65,077 EQUITY AND LIABILITIES Equity

Issued capital, euro 0.02 nominal value, 75,122,137 shares

authorized, issued and outstanding at March 31, 2017 (75,030,078 at

December 31, 2016) $ 1,925 $ 1,923 Share premium 189,233 189,029

Other capital reserves 28,598 28,257 Accumulated deficit (215,157 )

(209,553 ) Other components of equity (602 )

(796 )

Total equity (deficit) 3,997

8,860

Non-current liabilities

Government grant advances, loans and other liabilities 5,001 5,144

Convertible debt and accrued interest 17,199 16,338 Provisions

1,332 1,306 Other Liabilities 22 22 Deferred revenue

1,940 1,940

Total non-current

liabilities 25,494 24,750

Current liabilities Trade payables 12,585 18,358

Interest-bearing receivables financing 11,882 7,712 Government

grant advances 560 601 Other current liabilities 5,633 4,415

Deferred revenue 424 335 Provisions 47

46

Total current liabilities

31,131 31,467

Total equity and

liabilities $ 60,622 $ 65,077

SEQUANS COMMUNICATIONS S.A.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

Three months ended March 31, (in thousands of

US$) 2017 2016

Operating activities Loss before income taxes

$ (5,533 ) $ (9,163 )

Non-cash adjustment to reconcile income before tax to net cash from

(used in) operating activities Depreciation and impairment of

property, plant and equipment 691 796 Amortization and impairment

of intangible assets 569 489 Share-based payment expense 341 253

Increase in provisions 16 75 Financial expense (income) 1,061 631

Change in the fair value of convertible debt embedded derivative -

3,127 Foreign exchange loss (gain) 69 243 Working capital

adjustments Decrease (Increase) in trade receivables and other

receivables (1,671 ) 7,041 Decrease (Increase) in inventories 509

482 Decrease (Increase) in research tax credit receivable (1,078 )

(787 ) Increase (Decrease) in trade payables and other liabilities

(4,726 ) 1,367 Increase (Decrease) in deferred revenue 89 (267 )

Increase (Decrease) in government grant advances (250 ) (382 )

Income tax paid 2 (41 )

Net cash flow from (used in) operating

activities (9,911 ) 3,864

Investing activities Purchase of intangible assets and

property, plant and equipment (419 ) (1,234 ) Sale (purchase) of

financial assets (11 ) (31 ) Sale of short-term deposit - (3 )

Interest received 23 3

Net cash flow used in investments

activities (407 ) (1,265 )

Financing activities Proceeds from issue of warrants,

exercise of stock options/warrants 206 129 Proceeds from

Interest-bearing receivables financing 4,170 (4,916 ) Repayment of

borrowings and finance lease liabilities - (12 ) Interest paid (101

) (30 )

Net cash flows from (used in) financing activities

4,275 (4,829 ) Net increase (decrease)

in cash and cash equivalents (6,043 ) (2,230 ) Net foreign exchange

difference 3 1 Cash and cash equivalent at January 1 20,202 8,288

Cash and cash equivalents at end of the period $

14,162 $ 6,059 SEQUANS

COMMUNICATIONS S.A. UNAUDITED

RECONCILIATION OF NON-IFRS FINANCIAL RESULTS

Three months ended (in

thousands of US$, except share and per share amounts) March

31, Dec 31, March 31, 2017

2016 2016 Net IFRS loss as

reported $ (5,604) $ (5,371) $ (9,229)

Add back Stock-based compensation expense according to IFRS

2 (1) 341 459 254 Change in the fair value of convertible debt

embedded derivative - - 3,127 Non-cash interest on Convertible debt

and other financing (2) 610 671 365

Non-IFRS loss adjusted

$ (4,653) $ (4,241) $

(5,483) IFRS basic loss per share as reported ($0.07)

($0.07) ($0.16) Add back Stock-based compensation expense

according to IFRS 2 (1) $0.00 ($0.00) $0.01 Change in the fair

value of convertible debt embedded derivative $0.00 $0.00 $0.05

Non-cash interest on Convertible debt and other financing (2)

$0.01 $0.01 $0.01 Non-IFRS basic loss per

share ($0.06) ($0.06) ($0.09) IFRS diluted

loss per share ($0.07) ($0.07) ($0.16) Add back Stock-based

compensation expense according to IFRS 2 (1) $0.00 ($0.00) $0.01

Change in the fair value of convertible debt embedded derivative

$0.00 $0.00 $0.05 Non-cash interest on Convertible debt and other

financing (2) $0.01 $0.01 $0.01 Non-IFRS

diluted loss per share ($0.06) ($0.06) ($0.09)

(1) Included in the IFRS loss as follows: Cost of product

revenue $ 3 $ - $ 4 Research and development 109 192 108 Sales and

marketing 79 131 39 General and administrative 150 136 103

(2) Related to the difference between contractual and effective

interests

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170502005744/en/

Sequans Communications S.A.Media Relations:Kimberly Tassin,

+1-425-736-0569Kimberly@sequans.comorInvestor Relations:Claudia

Gatlin, +1-212-830-9080Claudia@sequans.com

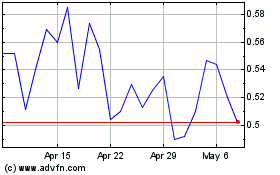

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Aug 2024 to Sep 2024

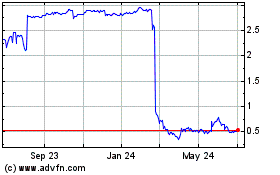

Sequans Communications (NYSE:SQNS)

Historical Stock Chart

From Sep 2023 to Sep 2024