UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the

Registrant ☒ Filed by a Party other than the

Registrant ☐

CHECK THE APPROPRIATE BOX:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

|

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☐

|

|

Definitive Proxy Statement

|

|

|

|

|

☒

|

|

Definitive Additional Materials

|

|

|

|

|

☐

|

|

Soliciting Material Under Rule 14a-12

|

CVS Health Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX):

|

|

|

|

|

|

|

|

|

|

☒

|

|

No fee required.

|

|

|

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials:

|

|

|

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the form or schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount previously paid:

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

4)

|

|

Date Filed:

|

Shareholder Outreach 2017 Annual Meeting

May 10, 2017

Forward-looking Statements This

presentation contains forward-looking statements within the meaning of the federal securities laws. By their nature, all forward-looking statements involve risks and uncertainties. Actual results may differ materially from those contemplated by the

forward-looking statements for a number of reasons as described in our SEC filings, including the risk factors section and cautionary statement disclosure in those filings.

Cost Quality Access …enabling us to

deliver superior outcomes at a lower cost A F F O R D A B L E A C C E S S I B L E E F F E C T I V E OUR INTEGRATED ASSETS The Most Extensive Suite of Leading Assets… Patients Payors Providers Retail Mail Long-Term Care Infusion Medical Claims

Editing Digital Retail Clinics Specialty Clinical Programs Cost Management Tools 3

Our Integrated Model Drives More

Affordable, Accessible and Effective Care Premier company with the ability to impact patients, payors and providers with innovative, channel-agnostic solutions Deep clinical expertise and insights enable us to help deliver superior outcomes at a

lower cost Unmatched CVS Pharmacy value proposition for all payors Broadest specialty capabilities to holistically manage patients in growing market Leading pharmacy provider in long-term care, enabling broader patient reach across the care

continuum Site-of-care management capabilities to move patients to more cost-effective sites Largest retail clinic operator, providing convenient, cost-effective care Unparalleled scale in the U.S., making us a low-cost provider We remain

well-positioned to be successful and achieve long-term growth because of our ability to pivot as health care changes and deliver needed solutions that will enhance patient access, improve health outcomes and lower overall health care costs Our

Competitive Advantage

2016 Performance Highlights + 9.3% YoY +

15.8% YoY Exceeded target by 22% + 6.2% YoY 2016 was another successful year for CVS Health as we continued to benefit from our focus on delivering affordable, accessible and effective health care In 2016 we delivered strong results across the

enterprise, enabling us to generate substantial free cash and return more than $6 billion to shareholders through dividends and repurchases Our substantial cash generation continues to provide us opportunities to bolster growth across the business

The strong performance of Return on Net Assets (“RoNA”) closely links to the Company’s strong cash flow and demonstrates a disciplined approach to optimizing capital allocation

Total Shareholder Return Industry Headwinds

and Uncertainty Stemming from Political Environment Despite a decline in CVS Health’s stock price in 2016, we outperformed the S&P 500 Index and the S&P 500 Food & Staples Retail Index on a five-year basis The rapidly changing

health care landscape includes uncertainties concerning health care policy and the exclusion of CVS Pharmacy from certain health plan retail networks, resulting in the loss of prescription volume beginning in late 2016 Due in part to the rhetoric

surrounding last year’s presidential election, our stock, as well as that of others in our space, was affected by the public discussion regarding the rising costs of prescription drugs and the possible repeal and replacement of the Affordable

Care Act Note: Figures represent year-end numbers as of December 31, 2016. For more information please see our Annual Report at: http://investors.cvshealth.com/~/media/Files/C/CVS-IR-v3/reports/annual-report-2016.pdf CVS Health TSR CAGR

2015-16 -17.8% 2013-16 4.9% 2011-16 15.9%

CEO Compensation Plan Design 2016 Reported

CEO Pay Mix 89% Performance Aligned 79% Long-Term Element Metrics Annual (21%) Base Salary – Annual Cash Incentive Adjusted Operating Profit Retail Customer Service / PBM Client Satisfaction Long-Term (79%) Long-Term Incentive Plan Return on

Net Assets (RoNA) Total Shareholder Return (TSR) Stock Options Prior year Company and individual performance Restricted Stock Units (RSUs) Prior year Company and individual performance RoNA and TSR are the metrics for all outstanding LTIP award

cycles: 2014-2016 2015-2017 2016-2018 2017-2019 7

Performance Metrics Support Corporate

Strategy and Long-Term Growth MIP Adjusted Operating Profit Annual Cash Incentive Retail Customer Service / PBM Client Satisfaction Return on Net Assets (RoNA) TSR performance modifier based on percentile ranking of CVS Health versus the S&P 500

index Long-Term Incentive Plan Adjusted based on performance ranking: At or above 66th percentile: +25% At or above 33rd percentile and below 66th percentile: 0% Below the 33rd percentile: -25% Adjusted net operating profit after tax (Adjusted

NOPAT) divided by the most recent years’ Adjusted Average Net Assets NOPAT portion consistent with long-term steady state goals Assets portion supports free cash flow guidance and long-term estimates Enterprise focus and accountability on

satisfying customers, clients and patients Acts as a negative modifier only to 20% of the pool funding Earnings before interest and taxes adjusted for certain items MIP goals are grounded in our annual budget and external guidance How Metrics

Support Strategy and Growth Links compensation outcomes directly to relative performance of peer companies with whom CVS competes for talent and capital Measures profitability and efficient management of cash, inventory and accounts receivable Key

measure of profitability that is followed closely by investors and is linked to long-term growth Measures client and customer satisfaction, an important driver of recurring revenue and long-term strategic and operational goals Committee changed the

modifier for 2017-2019 LTIP awards in response to shareholder feedback so it is applied in quartiles on a pro-rata basis to provide for reduced payout for below median performance Beginning with 2017-2019 TSR Modifier: Top Quartile: +25% Third

Quartile: 0% to +25% (prorated) Second Quartile: 0% to -25% (prorated) Bottom Quartile: -25%

Actual Award $2,382,000 The Committee

exercised negative discretion in determining the final award by reducing the formulaic results by an additional 10% based on its evaluation of the CEO’s performance Annual Program Sets Challenging Targets for our Executives Under the Executive

Incentive Plan (EIP), a maximum pool is created for tax-deductibility purposes to pay annual cash incentives to named executive officers 2016 CEO Performance Assessment Considered by the Committee Strong overall financial results, including PBM

sales, cash flow from operations and earnings growth However, performance was shy of mid-year guidance, TSR decreased, and the retail network exclusions resulted in a headwind for 2017 Implemented a four part plan to return the Company to profitable

growth in 2018 Base Salary $1,630,000 Target % of Base Salary 200% MIP Funding 81.2% As a starting point for evaluating annual EIP awards, the Committee considered performance results under our Management Incentive Plan (MIP), a program maintained

for a broad portion of the employee population Target Actual Funding MIP Adjusted Operating Profit $10,711.0M $10,592.0M 81.5% Retail Customer Service / PBM Client Satisfaction (Potential Downward Modifier to 20% of the Pool) 100% 98.2% 81.2% CEO

EIP Award for 2016 Formulaic Award $2,647,120 Committee adopted guardrails in 2016 to limit positive discretion to no more than 25% of formulaic funding result; there is no limit on negative discretion Given our strong earnings growth, below target

MIP achievement reflects the clear challenging nature of our performance targets

Substantial Portion of Long-Term

Incentives are Performance-Based Target Long-Term Incentive Components Stock Options 7 year term Vest annually over 4 years Restricted Stock Units 5 year vesting period; 50% vests after Year 3, 50% at Year 5 Long-Term Incentive Plan RoNA and TSR

modifier apply to 2016-2018 performance cycle as well as all outstanding award cycles Awards settled 100% in common stock Minimum performance threshold (below which no payment will be made) and capped maximum payouts Executive prohibited from

selling or trading shares for 2 years following payment date 2016 aggregate equity award value of $8M for CEO reported in the Summary Compensation Table reflects grants made in April 2016 for strong company and individual results in 2015 50% 25% 25%

Based on strong performance against the RoNA metric throughout the three year cycle, actual RoNA exceeded the goal by 730 basis points and earned a maximum payout RoNA Result for LTIP Performance Cycle Threshold Target Maximum Actual 31.98% 33.26%

35.41% 40.56% 2014-2016 Award

Compensation Program Informed by

Shareholder Outreach Proactive Changes to Our Compensation Plan Based on Shareholder Feedback Reduced award cap on our Executive Incentive Plan (EIP) and implemented guardrails for limited use of positive discretion Revised the TSR modifier for the

2017-2019 LTIP by applying it in pro-rated quartiles to reduce payouts for performance below the 50th percentile Commencing with grants made in 2017, dividend equivalents on RSUs will be paid only when and if awards vest Improved disclosure to

clarify shareholders’ understanding of why we use certain incentive plan metrics In the Fall of 2016, we contacted our top institutional shareholders who collectively own more than 50 percent of our shares and spoke with representatives of

many large institutional shareholders to get their views on our compensation program Based on these discussions, we made a number of enhancements to further link the Company’s compensation programs with the Company’s business and talent

strategies and the long-term interests of our shareholders Our compensation program continues to evolve in response to meaningful dialogue with our shareholders

Diverse, Highly Qualified and

Independent Board Balance of Skills and Experience Business Development and Corporate Transactions Corporate Governance Health Care and Regulated Industries Legal and Regulatory Compliance Risk Management International Business Operations Consumer

Products and Services Finance Leadership Public Policy and Government Affairs Technology and Innovation 92% Independent Richard Bracken David Brown Alecia DeCoudreaux Nancy-Ann DeParle David Dorman Anne Finucane* Larry Merlo William Weldon Tony

White Jean-Pierre Millon Richard Swift Mary Schapiro Retired Chairman and CEO, HCA Holdings, Inc. Chairman, Broad and Cassel Former President, Mills College President and CEO, CVS Health Corporation Co-Founding Partner, Consonance Capital Partners,

LLC Founding Partner, Centerview Capital Technology Fund Vice Chairman, Bank of America Corporation Retired President and CEO, PCS Health Systems, Inc. Retired Chairman, President and CEO, Foster Wheeler Ltd. Retired Chairman & CEO, Johnson

& Johnson Former Chairman, President and CEO, Applied Biosystems, Inc. Independent Chairman Vice Chair, Advisory Board Promontory Financial Group Our director nominees possess relevant experience, skills and qualifications that contribute to a

well-functioning Board to effectively oversee the Company’s strategy and management 33% Female For the past 6 years, Ms. Finucane has successfully balanced her obligations as a C-Suite executive at a major financial institution with her Board

obligations; prior to 2016, her attendance was over 90% In 2016, due to an urgent family medical emergency and a single, unavoidable work conflict her attendance fell below 75% We see this as a one-off, non-recurring work situation that has been

resolved and an understandable family obligation that impacted her board attendance and have confidence in Ms. Finucane’s commitment for the future *Anne Finucane Board Attendance New Nominee

We apply leading executive compensation

practices and our program motivates executive officers to take personal responsibility for the performance of CVS Health Governance Practices Enhance Effective Oversight Best in Class Governance and Compensation Governance Practices We recommend

shareholders vote AGAINST proposal number 6 to reduce the ownership threshold to call special meetings of shareholders We have a preexisting special meeting right with a 25% ownership threshold Of the 63% of S&P 500 companies that provide for

special meeting rights: 40% have a 25% ownership threshold like CVS, the most common of companies with the right Only 33% have an ownership threshold below 25% We also provide shareholders the ability to act by written consent Maintaining both of

these rights is in line with our best in class governance profile Only 22% of S&P 500 companies provide shareholders with both rights 16% of S&P 500 companies provide for written consent and have a special meeting right at 25% or less 13

Note: All statistics for S&P 500 are based on Shark Repellent’s universe of coverage, which includes 470 US public companies. Independent Chair Annual election of all directors Majority voting standard in uncontested director elections

Proxy access by-law at 3%/3 years Shareholder right to call special meetings Shareholder right to act by written consent No supermajority vote provisions Strong disclosure of political contributions and lobbying expenditures (First Tier of the

CPA-Zicklin Report) Corporate Social Responsibility reports issued every year since 2008 (winner of Best CSR Disclosure award from Corporate Secretary magazine) Robust “clawback” policy No excise tax gross-ups or recycling of shares in

equity plan Broad anti-pledging and hedging policies Double trigger vesting of equity awards

We Ask for Your Vote at the 2017 Annual

Meeting FOR the election of the 12 director nominees to serve on the Board FOR the ratification of appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal 2017 FOR the Say on Pay advisory

vote on the approval of executive compensation FOR 1-year frequency of the Say on Pay advisory vote FOR the approval of the 2017 Incentive Compensation Plan (ICP) AGAINST the shareholder proposal regarding the ownership threshold for calling special

meetings of shareholders AGAINST the shareholder proposal regarding a report on executive pay AGAINST the shareholder proposal regarding a report on renewable energy targets ü ü ü ü ü û û û Our Board values

your support for Management’s recommendations on the following ballot items:

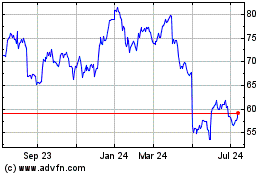

CVS Health (NYSE:CVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

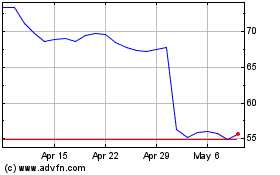

CVS Health (NYSE:CVS)

Historical Stock Chart

From Apr 2023 to Apr 2024