Card Member Spending

and Revenue Performance Accelerate

New Card Acquisitions

and Credit Quality Remain Strong

American Express Company (NYSE:AXP) today reported

first-quarter net income of $1.2 billion, down 13 percent from $1.4

billion in the year-ago quarter, which included certain

subsequently discontinued cobrand partnerships. Diluted earnings

per share was $1.34, down 8 percent from $1.45 a year ago.

First-quarter consolidated total revenues net of interest

expense were $7.9 billion, down 2 percent from $8.1 billion a year

ago. That compared to a year-over-year decline of 4 percent in the

prior quarter. Excluding last year’s Costco-related business and

the impact of foreign exchange rates, adjusted revenues net of

interest expense grew 7 percent.1 That is up from a year-over-year

increase of 6 percent in the prior quarter.1 Those increases

primarily reflected higher adjusted Card Member spending and

adjusted net interest income.

Consolidated provisions for losses were $573 million, up 32

percent from $434 million a year ago. The increase primarily

reflected higher loans, receivables and write-offs.

Consolidated expenses were $5.5 billion, up 1 percent from a

year ago. The current quarter reflected higher rewards expenses

related to recent product enhancements. The prior year included a

benefit of $127 million ($79 million after-tax) from a gain on the

sale of the JetBlue cobrand portfolio and an $84 million ($55

million after-tax) restructuring charge.

The effective tax rate for the quarter was 32 percent, down from

35 percent a year ago, due largely to the geographic mix of

earnings and certain discrete tax items in the current quarter.

The company’s return on average equity (ROE) was 25.1 percent,

up from 23.6 percent a year ago.

“Our first quarter performance marks a good start to the

year with momentum in the consumer and commercial businesses in the

U.S. and in key markets internationally,” said Kenneth I. Chenault,

chairman and chief executive officer. “The results reflect many of

the investments we’ve been making to grow the business, plus

continued progress in reducing operating expenses.

“Card Member spending grew 8 percent, adjusted for changes in

foreign exchange rates and Costco-related business that was

included in the prior year. Loans were up 11 percent and credit

indicators remained best in class.

“We acquired 2.6 million new cards across our global issuing

businesses during the quarter and continued to broaden our reach

among millennials with an expanded merchant network and enhanced

benefits and services to earn a greater share of their wallet.

“The last couple of years have been an important transition

period, and we’ve entered 2017 stronger, more focused and more

resilient. There is still work to do, but our underlying

performance this quarter gives me added confidence in our ability

to deliver our 2017 EPS outlook of $5.60 -$5.80 and position

American Express for sustainable growth in the years ahead.”

Segment Results

U.S. Consumer Services reported first-quarter net income

of $469 million, down 32 percent from $694 million a year ago. The

year-ago period included Costco-related revenues and expenses.

Total revenues net of interest expense decreased 8 percent to

$3.0 billion, from $3.3 billion a year ago.

Provisions for losses totaled $294 million, up 55 percent from

$190 million a year ago. The increase primarily reflected higher

loans and write-offs.

Total expenses were $2.0 billion, up 1 percent from a year ago.

The year-ago quarter included Costco-related rewards, offset in

part by the above-mentioned JetBlue gain. Rewards expenses in the

current quarter included costs related to recent product

enhancements.

The effective tax rate was 33 percent compared to 36 percent a

year ago.

International Consumer and Network Services reported

first-quarter net income of $218 million, up 16 percent from $188

million a year ago.

Total revenues net of interest expense were $1.4 billion, up 5

percent (up 6 percent FX-adjusted2) from a year ago. The increase

primarily reflected higher Card Member spending, net card fees and

loans.

Provisions for losses totaled $66 million, down 7 percent from

$71 million a year ago.

Total expenses were $1.0 billion, up 3 percent (up 4 percent

FX-adjusted2) from a year ago. The increase primarily reflected

rewards costs, driven by higher Card Member spending.

The effective tax rate was 25 percent, compared to 26 percent a

year ago.

Global Commercial Services reported first-quarter net

income of $418 million, down 14 percent from $485 million a year

ago. The year-ago period included Costco-related revenues and

expenses.

Total revenues net of interest expense were $2.5 billion, up 3

percent from $2.4 billion a year ago, primarily reflecting higher

Card Member spending.

Provisions for losses totaled $208 million, up 30 percent from

$160 million a year ago. The increase primarily reflected higher

receivables, loans and write-offs, as well as a slight increase in

delinquencies.

Total expenses were $1.6 billion, up 10 percent from $1.5

billion a year ago. The increase primarily reflected higher rewards

expenses, largely driven by recent product enhancements and higher

Card Member spending.

The effective tax rate was 34 percent, down from 36 percent a

year ago.

Global Merchant Services reported first-quarter net

income of $363 million, up 2 percent from $357 million a year

ago.

Total revenues net of interest expense were $1.1 billion, down 2

percent from a year ago. The year-ago period included

Costco-related revenues.

Total expenses were $505 million, down 3 percent from $521

million a year ago. The decrease reflected lower marketing

spending.

The effective tax rate was 36 percent, down from 38 percent from

a year ago.

Corporate and Other reported first-quarter net loss of

$231 million compared with net loss of $298 million a year ago.

About American Express

American Express is a global services company, providing

customers with access to products, insights and experiences that

enrich lives and build business success. Learn more at

americanexpress.com, and connect with us on

facebook.com/americanexpress, instagram.com/americanexpress,

linkedin.com/company/american-express, twitter.com/americanexpress,

and youtube.com/americanexpress.

Key links to products, services and corporate responsibility

information: charge and credit cards, business credit cards, Plenti

rewards program, travel services, gift cards, prepaid cards,

merchant services, Accertify, corporate card, business travel, and

corporate responsibility.

This earnings release should be read in conjunction with the

Company’s statistical tables for the first-quarter 2017, available

on the American Express website at

http://ir.americanexpress.com and in a Form 8-K filed

today with the Securities and Exchange Commission.

An investor conference call will be held at 5:00 p.m. (ET) today

to discuss first-quarter earnings results. Live audio and

presentation slides for the investor conference call will be

available to the general public on the above-mentioned American

Express Investor Relations website. A replay of the conference call

will be available later today at the same website address.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This release includes forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

which are subject to risks and uncertainties. The forward-looking

statements, which address the Company’s expected business and

financial performance and which include management’s outlook for

2017, among other matters, contain words such as “believe,”

“expect,” “estimate,” “anticipate,” “intend,” “plan,” “aim,”

“will,” “may,” “should,” “could,” “would,” “likely” and similar

expressions. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

on which they are made. The Company undertakes no obligation to

update or revise any forward-looking statements. Factors that could

cause actual results to differ materially from these

forward-looking statements, include, but are not limited to, the

following:

- the Company’s ability to achieve its

2017 earnings per common share outlook as well as the earnings

trajectory for 2017, which will depend in part on the following:

revenues growing consistently with current expectations, which

could be impacted by, among other things, weakening economic

conditions in the United States or internationally, a decline in

consumer confidence impacting the willingness and ability of Card

Members to sustain and grow spending, the strengthening of the U.S.

dollar, a greater erosion of the average discount rate than

expected, a greater impact on discount revenue from cash back and

cobrand partner and client incentive payments, more cautious

spending by large and global corporate Card Members and lower

spending on new cards acquired than estimated; the Company’s

success in addressing competitive pressures and implementing its

strategies and business initiatives, including growing profitable

spending from new and existing Card Members, increasing penetration

among middle market and small business clients, expanding the

Company’s international footprint and increasing merchant

acceptance; the level of spend in bonus categories on rewards-based

and/or cash-back cards and redemptions of Card Member rewards and

offers; the impact of any future contingencies, including, but not

limited to, litigation-related settlements, judgments or expenses,

impairments, the imposition of fines or civil money penalties, an

increase in Card Member reimbursements and changes in reserves;

write-downs of deferred tax assets as a result of tax law or other

changes; credit performance remaining consistent with current

expectations; continued growth of Card Member loans; the ability to

continue to realize benefits from restructuring actions and

operating leverage at levels consistent with current expectations;

the amount the Company spends on Card Member engagement and the

Company’s ability to drive growth from such investments; changes in

interest rates beyond current expectations (including the impact of

hedge ineffectiveness and potential deposit rate increases); the

impact of regulation and litigation, which could affect the

profitability of the Company’s business activities, limit the

Company’s ability to pursue business opportunities, require changes

to business practices or alter the Company’s relationships with

partners, merchants and Card Members; the Company’s tax rate being

in the 33-34% range, which could be impacted by, among other

things, the Company’s geographic mix of income being weighted more

to higher tax jurisdictions than expected, changes in tax laws and

regulation and unfavorable tax audits and other unanticipated tax

items; the impact of accounting changes and reclassifications; and

the Company’s ability to continue executing its share repurchase

program;

- changes in the substantial and

increasing worldwide competition in the payments industry,

including competitive pressure that may impact the prices charged

to merchants that accept American Express cards, competition for

cobrand relationships and the success of marketing, promotion or

rewards programs;

- the actual amount to be spent on

marketing and promotion, as well as the timing of any such

spending, which will be based in part on management’s assessment of

competitive opportunities; overall business performance;

contractual obligations with business partners and other fixed

costs and prior commitments; management’s ability to identify

attractive investment opportunities and make such investments,

which could be impacted by business, regulatory or legal

complexities; and the Company’s ability to realize efficiencies,

optimize investment spending and control expenses to fund such

spending;

- the Company’s rewards expense and cost

of Card Member services growing inconsistently from expectations,

which will depend in part on Card Member behavior as it relates to

their spending patterns and actual usage and redemption of rewards,

as well as the degree of interest of Card Members in the value

proposition offered by the Company; increasing competition, which

could result in greater rewards offerings; the Company’s ability to

enhance card products and services to make them attractive to Card

Members and to continue to expand the Company’s global lounge

collection; and the amount the Company spends on the promotion of

enhanced services and rewards categories and the success of such

promotion;

- the ability of the Company to reduce

its overall cost base by $1 billion on a run rate basis by the end

of 2017, which will depend in part on the timing and financial

impact of reengineering plans, which could be impacted by factors

such as the Company’s inability to mitigate the operational and

other risks posed by potential staff reductions, the Company’s

inability to develop and implement technology resources to realize

cost savings and underestimating hiring and other employee needs;

the ability of the Company to reduce annual operating expenses,

which could be impacted by, among other things, the factors

identified below; the ability of the Company to optimize marketing

and promotion expenses, which could be impacted by higher

advertising and Card Member acquisition costs, competitive

pressures that may require additional expenditures or limit the

Company’s ability to reduce costs and an inability to continue to

shift Card Member acquisition to digital channels; and the

availability of opportunities to invest at a higher level due to

favorable business results and changes in macroeconomic

conditions;

- the ability to reduce annual operating

expenses in 2017 as well as the trajectory for 2017, which could be

impacted by the need to increase significant categories of

operating expenses, such as consulting or professional fees,

including as a result of increased litigation, compliance or

regulatory-related costs or fraud costs; the ability of the Company

to develop, implement and achieve substantial benefits from

reengineering plans; higher than expected employee levels; the

impact of changes in foreign currency exchange rates on costs; the

payment of civil money penalties, disgorgement, restitution,

non-income tax assessments and litigation-related settlements;

impairments of goodwill or other assets; management’s decision to

increase or decrease spending in such areas as technology, business

and product development and sales forces depending on overall

business performance; greater than expected inflation; the

Company’s ability to balance expense control and investments in the

business; the impact of accounting changes and reclassifications;

and the level of M&A activity and related expenses;

- the Company’s delinquency and write-off

rates and growth of provision expense being higher than current

expectations, which will depend in part on changes in the level of

loan balances and delinquencies, mix of loan balances, loans and

receivables related to new Card Members and other borrowers

performing as expected, unemployment rates, the volume of

bankruptcies and recoveries of previously written-off loans;

- the Company’s ability to execute

against its lending strategy to grow loans, which may be affected

by increasing competition, brand perceptions and reputation, the

Company’s ability to manage risk in a growing Card Member loan

portfolio, and the behavior of Card Members and their actual

spending and borrowing patterns, which in turn may be driven by the

Company’s ability to issue new and enhanced card products, offer

attractive non-card lending products, capture a greater share of

existing Card Members’ spending and borrowings, reduce Card Member

attrition and attract new customers;

- the possibility that the Company will

not execute on its plans to significantly increase merchant

coverage, which will depend in part on the success of OptBlue

merchant acquirers in signing merchants to accept American Express,

which could be impacted by the pricing set by the merchant

acquirers, the value proposition offered to small merchants and the

efforts of OptBlue merchant acquirers to sign merchants for

American Express acceptance, as well as the awareness and

willingness of Card Members to use American Express cards at small

merchants and of those merchants to accept American Express

cards;

- the ability of the Company to capture

small business and middle market spending, which will depend in

part on the willingness and ability of companies to use credit and

charge cards for procurement and other business expenditures,

perceived or actual difficulties and costs related to setting up

card-based B2B payment platforms, the ability of the Company to

offer attractive value propositions and card products to potential

customers, competition, the Company’s ability to enhance and expand

its payment solutions, and the effectiveness of the Company’s

marketing and promotion of its corporate payment solutions and

small business card products to potential customers;

- the ability of the Company to grow

internationally, which could be impacted by regulation and business

practices, such as those favoring local competitors or prohibiting

or limiting foreign ownership of certain businesses, the Company’s

ability to partner with additional GNS issuers and the success of

GNS partners in acquiring Card Members and/or merchants, political

or economic instability, which could affect lending and other

commercial activities, the Company’s ability to tailor products and

services to make them attractive to local customers, and

competitors with more scale and experience and more established

relationships with relevant customers, regulators and industry

participants;

- the Company’s ability to attract and

retain Card Members as well as capture the spending and borrowings

of its customers, which will be impacted in part by competition,

brand perceptions (including perceptions related to merchant

coverage) and reputation and the ability of the Company to develop

and market value propositions that appeal to Card Members and new

customers and offer attractive services and rewards programs, which

will depend in part on ongoing investment in marketing and

promotion expenses, new product innovation and development, Card

Member acquisition efforts and enrollment processes, including

through digital channels, and infrastructure to support new

products, services and benefits;

- the erosion of the average discount

rate by a greater amount than anticipated, including as a result of

a greater shift of existing merchants into the OptBlue program,

changes in the mix of spending by location and industry, merchant

negotiations (including merchant incentives, concessions and

volume-related pricing discounts), competition, pricing regulation

(including regulation of competitors’ interchange rates in the

European Union and elsewhere) and other factors;

- changes affecting the ability or desire

of the Company to return capital to shareholders through dividends

and share repurchases, which will depend on factors such as

approval of the Company’s capital plans by its primary regulators,

the amount the Company spends on acquisitions of companies and the

Company’s results of operations and capital needs in any given

period;

- the Company’s deposit rates increasing

faster or slower than current expectations due to market pressures,

regulatory constraints or changes in interest rates, which could

affect the Company’s net interest yield;

- legal and regulatory developments,

including with regard to broad payment system regulatory regimes,

actions by the CFPB and other regulators and the stricter

regulation of financial institutions, which could require the

Company to make fundamental changes to many of its business

practices; exert further pressure on the average discount rate and

GNS volumes; result in increased costs related to regulatory

oversight, litigation-related settlements, judgments or expenses,

restitution to Card Members or the imposition of fines or civil

money penalties; materially affect capital or liquidity

requirements, results of operations, or ability to pay dividends or

repurchase of stock; or result in harm to the American Express

brand; and

- factors beyond the Company’s control

such as changes in global economic and business conditions,

consumer and business spending, the availability and cost of

capital, unemployment rates, geopolitical conditions (including

potential impacts resulting from the proposed exit of the U.K. from

the European Union), foreign currency rates and interest rates, as

well as fire, power loss, disruptions in telecommunications, severe

weather conditions, natural disasters, health pandemics, terrorism,

cyber attacks or fraud, all of which could significantly affect

spending on American Express cards, delinquency rates, loan

balances and results of operation or disrupt the Company’s global

network systems and ability to process transactions.

A further description of these uncertainties and other risks can

be found in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2016 and the Company’s other reports filed with

the Securities and Exchange Commission.

1Adjusted revenues net of interest expense on an FX-adjusted

basis, a non-GAAP measure, excludes from prior-year results

estimated revenues from Costco in the United States, Costco U.S.

cobrand Card Members and other merchants for out-of-store spend on

the Costco cobrand card. Management believes adjusted revenues net

of interest expense is useful in evaluating the ongoing operating

performance of the company following the end of the Costco U.S.

relationship. See footnote 2 for an explanation of FX-adjusted

information and Appendix I for a reconciliation to total revenues

net of interest expense on a GAAP basis.

2 As reported in this release, FX-adjusted information assumes a

constant exchange rate between the periods being compared for

purposes of currency translations into U.S. dollars (i.e., assumes

the foreign exchange rates used to determine results for the three

months ended March 31, 2017 apply to the period(s) against which

such results are being compared). FX-adjusted revenues and expenses

constitute non-GAAP measures. Management believes the presentation

of information on an FX-adjusted basis is helpful to investors by

making it easier to compare the company’s performance in one period

to that of another period without the variability caused by

fluctuations in currency exchange rates.

American Express Company

(Preliminary) Appendix I

Reconciliations of Adjustments (Millions, except

percentages)

YOY % Change

YOY % Change

Q1'17 Q1'16 Q4'16 Q4'15

Adjusted Total Revenues Net of Interest Expense

Total revenues net of interest expense $ 7,889

$ 8,088 (2) $ 8,022 $

8,391 (4) Estimated Costco-related revenues

(A) - 662 -

757 Adjusted Total revenues net of interest expense

$ 7,889 $ 7,426 6 $

8,022 $ 7,634 5 FX-adjusted adjusted

Total revenues net of

interest expense (B)

$ 7,889 $ 7,401 7 $

8,022 $ 7,535 6

(A)

Represents estimated Discount revenue from

Costco in the U.S. for spend on American Express cards and from

other merchants for spend on the Costco cobrand card as well as

Other fees and commissions and Interest income from Costco cobrand

Card Members.

(B)

FX-adjusted information assumes a constant

exchange rate between the periods being compared for purposes of

currency translation into U.S. dollars (i.e. assumes the foreign

exchange rates used to determine results for Q1'17 apply to the

period(s) against which such results are being compared). The

Company believes the presentation of information on an FX-adjusted

basis is helpful to investors by making it easier to compare the

Company's performance in one period to that of another period

without the variability caused by fluctuations in currency exchange

rates.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170419006418/en/

Media:Marina H. Norville,

+1-212-640-2832marina.h.norville@aexp.comorInvestors/Analysts:Ken

Paukowits, +1-212-640-6348ken.f.paukowits@aexp.comorToby Willard,

+1-212-640-5574sherwood.s.willardjr@aexp.com

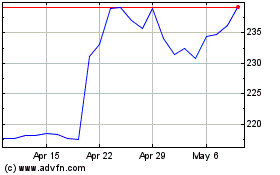

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

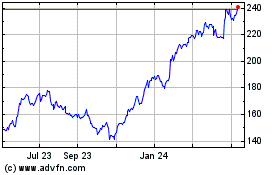

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024