- Earnings per diluted share increased

to $0.21 for the quarter ended March 31, 2017 compared to $0.18 for

same quarter in 2016

- Exceeded $2 billion in total assets

at March 31, 2017

- 137 consecutive quarters of

profitability

- Annualized return on average assets

was 1.17% and annualized return on average equity 10.87% for the

quarter ended March 31, 2017

- Noninterest income increased 19%

compared to same quarter in 2016

- Non-performing assets to total

assets remain at low levels, 0.34% at March 31, 2017

Farmers National Banc Corp. (Farmers) (NASDAQ: FMNB) today

reported financial results for the three months ended March 31,

2017.

Net income for the three months ended March 31, 2017 was $5.8

million, or $0.21 per diluted share, which compares to $4.8

million, or $0.18 per diluted share, for the three months ended

March 31, 2016 and $5.4 million or $0.20 per diluted share for the

linked quarter. Annualized return on average assets and return on

average equity were 1.17% and 10.87%, respectively, for the three

month period ending March 31, 2017, compared to 1.03% and 9.41% for

the same three month period in 2016, and 1.08% and 9.74% for the

linked quarter. Farmers’ return on average tangible equity

(Non-GAAP) also improved to 13.54% for the quarter ended March 31,

2017 compared to 11.83% for the same quarter in 2016 and 12.34% for

the linked quarter.

On March 13, 2017, Farmers entered into an agreement and plan of

merger with Monitor Bancorp, Inc. (Monitor), the holding company

for The Monitor Bank, located in Holmes County in Ohio. This

transaction is expected to close during the third quarter of 2017.

This transaction will serve as an entrance into the attractive

Holmes County market for Farmers. Monitor has an excellent core

deposit base and has been a solid earner with strong asset quality.

This transaction will help Farmers continue to grow its market

share, balance sheet and earnings. As of December 31, 2016, Monitor

had total assets of $43.3 million, which included net loans of

$22.3 million and deposits of $37.2 million. For the year ended

December 31, 2016, Monitor’s return on average assets and return on

average equity were 0.74% and 5.44%, respectively.

Kevin J. Helmick, President and CEO, stated, “We are excited to

announce our fourth acquisition in the past two years, which

further enhances Farmers’ brand and delivers long-term value for

our shareholders. We have stayed focused on our strategic growth

plan which has paved the way for the company to reach over $2

billion in assets at the end of the first quarter. This growth

enhances profitability by creating significant economies of scale

and improved operational efficiencies. We are also pleased to

report that our earnings have increased through the successful

integration of our previous mergers and we continue to be

encouraged by our organic loan growth, which has increased 11%

during the past twelve months, and improvements in our level of

noninterest income.”

2017 First Quarter Financial Highlights

- Loan growthTotal loans were

$1.46 billion at March 31, 2017, compared to $1.32 billion at March

31, 2016, representing an increase of 11.1%. The increase in loans

is a direct result of Farmers’ focus on loan growth utilizing a

talented lending and credit team, while adhering to a sound

underwriting discipline. The increase in loans has occurred across

each of the major loan categories. Loans now comprise 77.9% of the

Bank's average earning assets for the quarter ended March 31, 2017,

an improvement compared to 75.3% for the same period in 2016. This

improvement, along with the growth in earning assets, has resulted

in an 8% increase in tax equated loan income in the first quarter

of 2017 compared to the same quarter in 2016.

- Loan qualityNon-performing

assets to total assets remain at a low level, currently at 0.34%.

Early stage delinquencies also continue to remain at low levels, at

$8.3 million, or 0.57% of total loans, at March 31, 2017. Net

charge-offs for the current quarter were $583 thousand, compared to

$368 thousand in the same quarter in 2016; however, total net

charge-offs as a percentage of average net loans outstanding is

only 0.16% for the quarter ended March 31, 2017. Lending to the

energy sector is insignificant and less than 1% of the loan

portfolio.

- Net interest marginThe net

interest margin for the three months ended March 31, 2017 was

4.01%, a 6 basis points decrease from the quarter ended March 31,

2016. In comparing the first quarter of 2017 to the same period in

2016, asset yields decreased 1 basis point, while the cost of

interest-bearing liabilities increased 8 basis points. The net

interest margin is impacted by the additional accretion as a result

of the discounted loan portfolios acquired in the NBOH and

Tri-State mergers, which increased the net interest margin by 5 and

9 basis points for the quarters ended March 31, 2017 and 2016,

respectively.

- Noninterest incomeNoninterest

income increased 19% to $5.9 million for the quarter ended March

31, 2017 compared to $4.9 million in 2016. Gains on the sale of

mortgage loans increased $205 thousand, or 51% in the current

year’s quarter compared to the same quarter in 2016. Insurance

agency commissions increased $535 thousand in comparing the same

two quarters due mainly to the acquisition of the Bowers Group.

Trust fees increased $182 thousand or 12.2% in comparing the first

quarter of 2017 to the same quarter in 2016.

- Noninterest expensesFarmers has

remained committed to managing the level of noninterest expenses.

Total noninterest expenses for the first quarter of 2017 increased

slightly to $14.6 million compared to $14.4 million in the same

quarter in 2016, primarily as a result of an increase in salaries

and employee benefits of $733 thousand, offset by a $423 thousand

decrease in other operating expenses. It is important to note that

annualized noninterest expenses measured as a percentage of

quarterly average assets decreased from 3.07% in the first quarter

of 2016 to 2.92% in the first quarter of 2017.

- Efficiency ratioThe efficiency

ratio for the quarter ended March 31, 2017 improved to 58.79%

compared to 62.65% for the same quarter in 2016. The main factors

leading to this improvement were the increase in net interest

income and noninterest income, the decrease in merger related

costs, along with the stabilized level of noninterest expenses

relative to average assets as explained in the preceding

paragraphs.

2017 Outlook

Mr. Helmick added, “We are encouraged by the promising start to

2017 in our financial results. We will focus our energy on the

seamless integration of our newly acquired bank and customers and

we remain committed to the businesses and families we serve and to

our community banking approach and culture.”

Founded in 1887, Farmers National Banc Corp. is a diversified

financial services company headquartered in Canfield, Ohio, with $2

billion in banking assets and $1 billion in trust

assets. Farmers National Banc Corp.’s wholly-owned

subsidiaries are comprised of The Farmers National Bank of

Canfield, a full-service national bank engaged in commercial and

retail banking with 38 banking locations in Mahoning, Trumbull,

Columbiana, Stark, Wayne, Medina and Cuyahoga Counties in Ohio and

Beaver County in Pennsylvania, Farmers Trust Company, which

operates three trust offices and offers services in the same

geographic markets, and National Associates, Inc. Farmers National

Insurance, LLC and Bowers Insurance Agency, Inc., wholly-owned

subsidiaries of The Farmers National Bank of Canfield, offer a

variety of insurance products.

Non-GAAP Disclosure

This press release includes disclosures of Farmers’ tangible

common equity ratio, return on average tangible assets, return on

average tangible equity and net income excluding costs related to

acquisition activities, which are financial measures not prepared

in accordance with generally accepted accounting principles in the

United States (GAAP). A non-GAAP financial measure is a numerical

measure of historical or future financial performance, financial

position or cash flows that excludes or includes amounts that are

required to be disclosed by GAAP. Farmers believes that these

non-GAAP financial measures provide both management and investors a

more complete understanding of the underlying operational results

and trends and Farmers’ marketplace performance. The presentation

of this additional information is not meant to be considered in

isolation or as a substitute for the numbers prepared in accordance

with GAAP. The reconciliations of non-GAAP financial measures are

included in the tables following Consolidated Financial Highlights

below.

Forward-Looking Statements

This earnings release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements about Farmers’ financial condition,

results of operations, asset quality trends and profitability.

Forward-looking statements are not historical facts but instead

represent only management’s current expectations and forecasts

regarding future events, many of which, by their nature, are

inherently uncertain and outside of Farmers’ control.

Forward-looking statements are preceded by terms such as “expects,”

“believes,” “anticipates,” “intends” and similar expressions, as

well as any statements related to future expectations of

performance or conditional verbs, such as “will,” “would,”

“should,” “could” or “may.” Farmers’ actual results and financial

condition may differ, possibly materially, from the anticipated

results and financial condition indicated in these forward-looking

statements. Factors that could cause Farmers’ actual results to

differ materially from those described in the forward-looking

statements can be found in Farmers’ Annual Report on Form 10-K for

the year ended December 31, 2016, which has been filed with the

Securities and Exchange Commission (SEC) and is available on

Farmers’ website (www.farmersbankgroup.com) and on the SEC’s

website (www.sec.gov). Forward-looking statements are not

guarantees of future performance and should not be relied upon as

representing management’s views as of any subsequent date. Farmers

does not undertake any obligation to update the forward-looking

statements to reflect the impact of circumstances or events that

may arise after the date of the forward-looking statements.

Farmers National Banc Corp. and Subsidiaries Consolidated

Financial Highlights (Amounts in thousands, except per share

results) Unaudited

Consolidated

Statements of Income For the Three Months Ended March

31, Dec. 31, Sept. 30, June 30, March

31, 2017 2016 2016 2016 2016

Total interest income $ 18,850 $ 18,469 $ 18,332 $ 17,950 $ 17,747

Total interest expense 1,319 1,178 1,139

1,061 1,000

Net interest income 17,531 17,291

17,193 16,889 16,747 Provision for loan losses 1,050 990 1,110 990

780 Other income 5,887 6,076 6,485 5,737 4,946 Merger related costs

62 19 31 224 289 Other expense 14,551 14,981

15,194 14,559 14,155

Income before income

taxes 7,755 7,377 7,343 6,853 6,469 Income taxes 1,972

2,014 1,967 1,833 1,671

Net

income $ 5,783 $ 5,363 $ 5,376 $ 5,020 $ 4,798 Average

shares outstanding 27,054 27,048 27,048 26,965 26,937 Basic and

diluted earnings per share 0.21 0.20 0.20 0.19 0.18 Cash dividends

1,353 1,082 1,082 1,083 1,077 Cash dividends per share 0.05 0.04

0.04 0.04 0.04

Performance Ratios Net Interest Margin

(Annualized) 4.01 % 3.95 % 3.97 % 4.06 % 4.07 % Efficiency Ratio

(Tax equivalent basis) 58.79 % 60.37 % 60.85 % 62.60 % 62.65 %

Return on Average Assets (Annualized) 1.17 % 1.08 % 1.10 % 1.06 %

1.03 % Return on Average Equity (Annualized) 10.87 % 9.74 % 9.97 %

9.69 % 9.41 % Dividends to Net Income 23.40 % 20.18 % 20.13 % 21.57

% 22.45 %

Other Performance Ratios (Non-GAAP) Return on

Average Tangible Assets 1.18 % 1.11 % 1.13 % 1.08 % 1.04 % Return

on Average Tangible Equity 13.54 % 12.34 % 12.73 % 12.22 % 11.83 %

Consolidated Statements of Financial Condition

March 31, Dec. 31, Sept. 30, June 30,

March 31, 2017 2016 2016 2016

2016 Assets Cash and cash equivalents $ 61,251 $

41,778 $ 67,372 $ 62,184 $ 34,619 Securities available for sale

377,072 369,995 368,729 378,432 387,093 Loans held for sale

1,098 355 2,148 1,737 488 Loans 1,461,461 1,427,635 1,395,620

1,358,484 1,315,501 Less allowance for loan losses 11,319

10,852 10,518 9,720 9,390 Net Loans

1,450,142 1,416,783 1,385,102 1,348,764

1,306,111 Other assets 136,924 137,202

137,657 134,002 131,996

Total Assets $

2,026,487 $ 1,966,113 $ 1,961,008 $ 1,925,119 $ 1,860,307

Liabilities and Stockholders' Equity Deposits

Noninterest-bearing $ 374,399 $ 366,870 $ 352,441 $ 339,364 $

334,391 Interest-bearing 1,165,821 1,157,886

1,139,724 1,108,078 1,111,491 Total deposits

1,540,220 1,524,756 1,492,165 1,447,442 1,445,882 Other

interest-bearing liabilities 245,069 213,496 235,757 247,934

192,078 Other liabilities 23,136 14,645 17,649

17,252 18,365 Total liabilities 1,808,425 1,752,897

1,745,571 1,712,628 1,656,325 Stockholders' Equity 218,062

213,216 215,437 212,491 203,982

Total Liabilities and Stockholders'

Equity

$ 2,026,487 $ 1,966,113 $ 1,961,008 $ 1,925,119 $ 1,860,307

Period-end shares outstanding 27,067 27,048 27,048 27,048 26,924

Book value per share $ 8.06 $ 7.88 $ 7.96 $ 7.86 $ 7.58 Tangible

book value per share (Non-GAAP) * 6.40 6.21 6.29 6.17 5.99 *

Tangible book value per share is calculated by dividing tangible

common equity by average outstanding shares

Capital and

Liquidity Common Equity Tier 1 Capital Ratio (a) 11.79 % 11.69

% 11.67 % 11.61 % 11.82 % Total Risk Based Capital Ratio (a) 12.51

% 12.53 % 12.51 % 12.41 % 12.63 % Tier 1 Risk Based Capital Ratio

(a) 11.79 % 11.83 % 11.81 % 11.75 % 11.97 % Tier 1 Leverage Ratio

(a) 9.37 % 9.41 % 9.35 % 9.37 % 9.34 % Equity to Asset Ratio 10.76

% 10.84 % 10.99 % 11.04 % 10.96 % Tangible Common Equity Ratio 8.74

% 8.75 % 8.88 % 8.87 % 8.88 % Net Loans to Assets 71.56 % 72.06 %

70.63 % 70.06 % 70.21 % Loans to Deposits 94.89 % 93.63 % 93.53 %

93.85 % 90.98 %

Asset Quality Non-performing loans $ 6,553 $

8,170 $ 8,003 $ 8,360 $ 9,710 Other Real Estate Owned 318 482 506

572 555 Non-performing assets 6,871 8,652 8,509 8,932 10,265 Loans

30 - 89 days delinquent 8,258 12,747 10,986 11,371 10,072

Charged-off loans 943 841 562 820 578 Recoveries 360 185 250 160

210 Net Charge-offs 583 656 312 660 368 Annualized Net Charge-offs

to Average Net Loans Outstanding 0.16 % 0.20 % 0.09 % 0.20 % 0.11 %

Allowance for Loan Losses to Total Loans 0.77 % 0.76 % 0.75 % 0.72

% 0.71 % Non-performing Loans to Total Loans 0.45 % 0.57 % 0.57 %

0.62 % 0.74 % Allowance to Non-performing Loans 172.73 % 132.83 %

131.43 % 116.27 % 96.70 % Non-performing Assets to Total Assets

0.34 % 0.44 % 0.43 % 0.46 % 0.55 %

(a) March 31, 2017 ratio is estimated

Reconciliation of Common Stockholders' Equity to Tangible Common

Equity March 31, Dec. 31, Sept. 30,

June 30, March 31, 2017 2016

2016 2016 2016 Stockholders' Equity $ 218,062

$ 213,216 $ 215,437 $ 212,491 $ 203,982 Less Goodwill and Other

Intangibles 44,789 45,154 45,299 45,718

42,574 Tangible Common Equity $ 173,273 $ 168,062 $ 170,138

$ 166,773 $ 161,408 Average Stockholders' Equity 215,819 219,028

214,484 207,776 204,986 Less Average Goodwill and Other Intangibles

45,028 45,173 45,575 43,475

42,796 Average Tangible Common Equity $ 170,791 $ 173,855 $ 168,909

$ 164,301 $ 162,190

Reconciliation of Total Assets to

Tangible Assets March 31, Dec. 31, Sept.

30, June 30, March 31, 2017 2016

2016 2016 2016 Total Assets $ 2,026,487 $

1,966,113 $ 1,961,008 $ 1,925,119 $ 1,860,307 Less Goodwill and

Other Intangibles 44,789 45,154 45,299

45,718 42,574 Tangible Assets $ 1,981,698 $ 1,920,959 $

1,915,709 $ 1,879,401 $ 1,817,733 Average Assets 2,001,084

1,977,589 1,949,204 1,897,068 1,881,458 Less average Goodwill and

Other Intangibles 45,028 45,173 45,575

43,475 42,796 Average Tangible Assets $ 1,956,056 $

1,932,416 $ 1,903,629 $ 1,853,593 $ 1,838,662

Reconciliation of Net Income, Excluding Costs Related to

Acquisition Activities For the Three Months Ended

March 31, Dec. 31, Sept. 30, June 30,

March 31, 2017 2016 2016 2016

2016 Income before income taxes - Reported $ 7,755 $ 7,377 $

7,343 $ 6,853 $ 6,469 Acquisition Costs 62 19

31 224 289 Income before income taxes - Adjusted

7,817 7,396 7,374 7,077 6,758 Income tax expense (b) 1,987

2,018 1,973 1,899 1,746 Net income -

Adjusted $ 5,830 $ 5,378 $ 5,401 $ 5,178 $ 5,012 Average shares

outstanding 27,054 27,048 27,048 26,965 26,937 EPS excluding

acquisition costs $ 0.22 $ 0.20 $ 0.20 $ 0.19 $ 0.19 (b) The

income tax expense change from actual income tax expense relates to

the deductibility of certain acquisition costs.

Reconciliation of Return on Average Assets and Average Equity,

Excluding Acquisition Costs For the Three Months Ended

March 31, Dec. 31, Sept. 30, June 30,

March 31, 2017 2016 2016 2016

2016 ROA excluding acquisition costs (c) 1.17 % 1.09 % 1.11

% 1.09 % 1.07 % ROE excluding acquisition costs (d) 10.81 % 9.82 %

10.07 % 9.97 % 9.78 % (c) Net income -adjusted divided by

average assets (d) Net income - adjusted divided by average equity

For the Three Months Ended March 31, Dec.

31, Sept. 30, June 30, March 31, End of

Period Loan Balances

2,017

2016 2016 2016 2016 Commercial real

estate $ 456,917 $ 446,975 $ 426,657 $ 418,269 $ 414,119 Commercial

208,913 204,771 207,228 201,796 197,708 Residential real estate

441,593 430,674 423,009 418,693 405,560 Consumer 216,648 212,836

205,466 192,232 180,791 Agricultural loans 133,868

128,981 129,959 124,551 114,625 Total,

excluding net deferred loan costs $ 1,457,939 $ 1,424,237 $

1,392,319 $ 1,355,541 $ 1,312,803

For the Three Months

Ended March 31, Dec. 31, Sept. 30, June

30, March 31, Noninterest Income 2017

2016 2016 2016 2016 Service charges on

deposit accounts $ 951 $ 1,031 $ 1,057 $ 987 $ 935 Bank owned life

insurance income 201 208 194 201 212 Trust fees 1,678 1,482 1,693

1,564 1,496 Insurance agency commissions 674 559 569 293 139

Security gains 13 1 31 41 0 Retirement plan consulting fees 513 444

561 496 489 Investment commissions 222 310 308 356 236 Net gains on

sale of loans 607 838 1,063 540 402 Debit card and EFT fees 653 722

656 657 626 Other operating income 375 481 353

602 411 Total Noninterest Income $ 5,887 $ 6,076 $

6,485 $ 5,737 $ 4,946

For the Three Months Ended

March 31, Dec. 31, Sept. 30, June 30,

March 31, Noninterest Expense 2017 2016

2016 2016 2016 Salaries and employee benefits

$ 8,287 $ 8,248 $ 8,366 $ 7,740 $ 7,554 Occupancy and equipment

1,587 1,748 1,587 1,616 1,664 State and local taxes 417 363 394 394

393 Professional fees 747 803 671 754 529 Merger related costs 62

19 31 224 289 Advertising 244 241 383 363 345 FDIC insurance 235

199 287 286 283 Intangible amortization 365 368 421 335 337 Core

processing charges 655 743 738 580 638 Telephone and data 241 275

206 233 216 Other operating expenses 1,773 1,993

2,141 2,258 2,196 Total Noninterest Expense $

14,613 $ 15,000 $ 15,225 $ 14,783 $ 14,444

Average

Balance Sheets and Related Yields and Rates (Dollar Amounts in

Thousands)

Three Months Ended Three Months Ended March 31,

2017 March 31, 2016 AVERAGE AVERAGE BALANCE INTEREST (1)

RATE (1) BALANCE INTEREST (1) RATE (1) EARNING ASSETS Loans (2) $

1,436,494 $ 16,638 4.70 % $ 1,292,415 $ 15,430 4.80 % Taxable

securities 211,711 1,118 2.14 260,677 1,437 2.22 Tax-exempt

securities (2) 152,913 1,639 4.35 128,527 1,356 4.24 Equity

securities 9,924 115 4.70 9,559 113 4.75 Federal funds sold and

other 34,234 63 0.75 24,957 38 0.61 Total earning

assets 1,845,276 19,573 4.30 1,716,135 18,374 4.31 Nonearning

assets 155,808 165,323 Total assets $ 2,001,084 $

1,881,458 INTEREST-BEARING LIABILITIES Time deposits $ 235,153 $

500 0.86 % $ 243,511 $ 409 0.68 % Savings deposits 520,081 170 0.13

529,921 151 0.11 Demand deposits 384,602 244 0.26 317,513 147 0.19

Short term borrowings 249,505 327 0.53 215,477 175 0.33 Long term

borrowings 12,291 78 2.57 22,021 118 2.16 Total

interest-bearing liabilities $ 1,401,632 1,319 0.38 $ 1,328,443

1,000 0.30

NONINTEREST-BEARING LIABILITIES AND

STOCKHOLDERS' EQUITY

Demand deposits 369,477 334,919 Other liabilities 14,156 13,110

Stockholders' equity 215,819 204,986

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$ 2,001,084 $ 1,881,458 Net interest

income and interest rate spread $ 18,254 3.92 % $ 17,374

4.01 % Net interest margin 4.01 % 4.07 %

(1) Interest and yields are calculated on a tax-equivalent

basis where applicable. (2) For 2017, adjustments of $155 thousand

and $568 thousand, respectively, were made to tax equate income on

tax exempt loans and tax exempt securities. For 2016, adjustments

of $160 thousand and $467 thousand, respectively, were made to tax

equate income on tax exempt loans and tax exempt securities. These

adjustments were based on a marginal federal income tax rate of

35%, less disallowances.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170419005996/en/

Farmers National Banc Corp.Kevin J. Helmick, President and CEO,

330-533-3341exec@farmersbankgroup.com

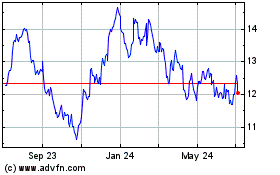

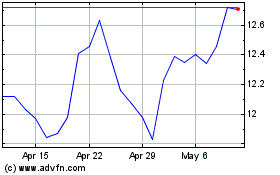

Farmers National Banc (NASDAQ:FMNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Farmers National Banc (NASDAQ:FMNB)

Historical Stock Chart

From Apr 2023 to Apr 2024