Report of Foreign Issuer (6-k)

April 12 2017 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE

13a-16 OR 15b-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

April,

2017

Commission File Number 001-14370

COMPANIA DE MINAS BUENAVENTURA S.A.A.

(Exact name of

registrant as specified in its charter)

BUENAVENTURA MINING COMPANY INC.

(Translation of registrant’s

name into English)

Republic of Peru

(Jurisdiction of incorporation or

organization)

CARLOS VILLARAN 790

SANTA CATALINA, LIMA 13, PERU

(

Address

of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ____

X

___ Form 40-F _______

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes _______ No ___

X

____

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): Not applicable.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

COMPAÑÍA DE MINAS BUENAVENTURA S.A.A.

By: /s/ CARLOS E. GALVEZ PINILLOS

Name: Carlos E. Galvez Pinillos

Title: Chief Financial Officer

Date: April 11, 2017

Buenaventura

Announces First Quarter and 2017 Estimated Production per Metal Results

LIMA, Peru--(BUSINESS WIRE)--April 11, 2017--

Compañia de Minas

Buenaventura S.A.A.

(“Buenaventura” or “the Company”) (NYSE:BVN;

Lima Stock Exchange: BUE.LM), Peru’s largest publicly-traded precious

metals mining company, today announced preliminary 1Q17 production

results and 2017 operating guidance (100% basis).

|

1Q17 Production per Metal and

2017 Operating

Guidance (100% basis)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q17 (Actual)

|

|

|

2017 (Estimated)

|

|

|

|

|

|

|

|

|

|

Gold (Oz.)

|

|

|

|

|

|

|

|

Orcopampa

|

|

|

42,332

|

|

|

180K - 190K

|

|

Tambomayo

|

|

|

-

|

|

|

60K - 90K

|

|

La Zanja

|

|

|

32,255

|

|

|

115K - 125K

|

|

Tantahuatay

|

|

|

31,245

|

|

|

145K - 155K

|

|

Yanacocha

|

|

|

137,622

|

|

|

530K - 560K

|

|

|

|

|

|

|

|

|

|

Silver (Oz.)

|

|

|

|

|

|

|

|

Uchucchacua

|

|

|

4,021,722

|

|

|

16.0M - 17.0M

|

|

Julcani

|

|

|

666,236

|

|

|

3.0M - 3.4M

|

|

Mallay

|

|

|

320,372

|

|

|

1.5M - 1.7M

|

|

Tambomayo

|

|

|

-

|

|

|

1.6M - 1.9M

|

|

El Brocal

|

|

|

1,044,908

|

|

|

3.5M - 4.5M

|

|

|

|

|

|

|

|

|

|

Zinc (MT)

|

|

|

|

|

|

|

|

El Brocal

|

|

|

16,903

|

|

|

60K - 70K

|

|

Uchucchacua

|

|

|

1,882

|

|

|

6.5K - 7.5K

|

|

Mallay

|

|

|

2,174

|

|

|

11.5K - 12.5K

|

|

Tambomayo

|

|

|

-

|

|

|

2K - 5K

|

|

|

|

|

|

|

|

|

|

Copper (MT)

|

|

|

|

|

|

|

|

El Brocal

|

|

|

11,155

|

|

|

55K - 65K

|

|

Cerro Verde

|

|

|

TBA

|

|

|

500K - 550K

|

|

|

|

|

|

|

|

|

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest, publicly traded

precious metals Company and a major holder of mining rights in Peru. The

Company is engaged in the mining, processing, development and

exploration of gold and silver and other metals via wholly owned mines

and through its participation in joint exploration projects.

Buenaventura currently operates several mines in Peru (Orcopampa*,

Uchucchacua*, Mallay*, Julcani*, Tambomayo*, El Brocal, La Zanja and

Coimolache) and is developing the San Gabriel Project.

The Company owns 43.65% of Minera Yanacocha S.R.L (a partnership with

Newmont Mining Corporation), an important precious metal producer and

19.58% of Sociedad Minera Cerro Verde, an important Peruvian copper

producer.

For a printed version of the Company’s 2015 Form 20-F,

please contact the persons indicated above, or download a PDF format

file from the Company’s web site.

(*) Operations wholly owned by Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as defined

in the U.S. Private Securities Litigation Reform Act of 1995) that

involve risks and uncertainties, including those concerning the

Company’s, Yanacocha’s and Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals mined,

the success of joint ventures, estimates of future explorations,

development and production, subsidiaries’ plans for capital

expenditures, estimates of reserves and Peruvian political, economic,

social and legal developments. These forward-looking statements reflect

the Company’s view with respect to the Company’s, Yanacocha’s and Cerro

Verde’s future financial performance. Actual results could differ

materially from those projected in the forward-looking statements as a

result of a variety of factors discussed elsewhere in this Press Release.

CONTACT:

Compañia de Minas Buenaventura S.A.A.

Lima:

Carlos

Galvez, 511-419-2540

Chief Financial Officer

or

Rodrigo

Echecopar, 511-419-2609

Investor Relations Coordinator

rodrigo.echecopar@buenaventura.pe

or

NY:

Barbara

Cano, 646-452-2334

barbara.cano@mbsvalue.com

Company

Website:

www.buenaventura.pe/ir

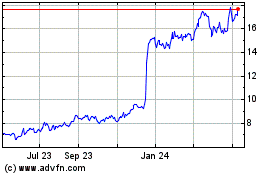

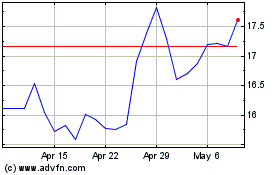

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Sep 2023 to Sep 2024