As filed with the Securities and Exchange

Commission on April 7, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVINE Live Inc.

(Exact name of registrant as specified

in its charter)

|

Minnesota

|

41-1673770

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

6740 Shady Oak Road

Eden Prairie, MN 55344-3433

(952)943-6000

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Damon E. Schramm

Senior Vice President, General Counsel

and Secretary

EVINE Live Inc.

6740 Shady Oak Road

Eden Prairie, MN 55344-3433

(Address, including zip code, and telephone number, including area code, of agent for service)

Copies to

:

J.C. Anderson, Esq.

Gray, Plant, Mooty, Mooty & Bennett,

P.A.

500 IDS Center

80 South Eighth Street

Minneapolis, MN 55402

(612) 632-3002

APPROXIMATE DATE OF COMMENCEMENT

OF PROPOSED SALE TO THE PUBLIC:

From time to time after the effective date of this registration statement.

If the only securities

being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

¨

If any of the securities being registered on this Form are

to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box.

x

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective on filing with the Commission pursuant to Rule

462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

|

Large

accelerated filer

¨

|

Accelerated

filer

x

|

Non-accelerated filer

¨

|

Smaller

reporting company

¨

|

|

|

(Do not check if

a smaller

reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of each class of securities to be registered

|

Amount to be

Registered (1) (2)

|

Proposed

Maximum offering price

per unit (3)

|

Proposed

maximum aggregate

offering price (3)

|

Amount of

registration fee

|

|

Common Stock, par value $0.01 per share

|

873,175

|

$1.21

|

$1,056,541.75

|

$122.45

|

|

(1)

|

The number of securities being registered consists of common stock issuable pursuant to outstanding Option Warrants, as further described in the sections titled “Description of Securities” and “Use of Proceeds.”

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended, this registration statement registers such indeterminate number of additional shares of common stock as may be issued in connection with stock splits, stock dividends or similar transactions.

|

|

(3)

|

Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c), based on the average of the high and low prices for shares of the registrant’s common stock as reported on The NASDAQ Global Market on April 6, 2017. No separate consideration will be received for shares of common stock that are sold hereunder.

|

The registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that

this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a),

may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it

seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to Completion, dated April 7, 2017.

PROSPECTUS

EVINE

Live Inc.

873,175

Shares of Common Stock

This

prospectus relates to the sale by the selling shareholders identified in this prospectus, including their transferees, pledgees,

donees, transferees or successors-in-interest, of up to an aggregate of 873,175 shares of our common stock, par value $0.01 per

share, which are issuable upon the exercise of outstanding warrants (“Option Warrants”). The Option Warrants were

issued pursuant to the exercise of options which were issued in a private placement (the “Private Placement”) completed

on September 19, 2016. See the section titled “Description of Securities” beginning on page 8 of this prospectus

for more information.

We

are registering these securities on behalf of the selling shareholders, to be offered and sold by them from time to time. We are

not selling any shares of common stock under this prospectus and any proceeds we receive from the exercise of the Option Warrants

will be used for general corporate purposes and debt repayment. It is anticipated that the selling shareholders will sell their

shares of common stock from time to time in one or more transactions, in negotiated transactions or otherwise, at prevailing market

prices or at prices otherwise negotiated (see the section titled “Plan of Distribution” beginning on page 13

of this prospectus). All expenses of registration incurred in connection with this resale offering are being borne by us,

but all selling and other expenses incurred by the selling shareholders will be borne by the selling shareholders.

We

may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the

entire prospectus and any amendments or supplements carefully before you make your investment decision.

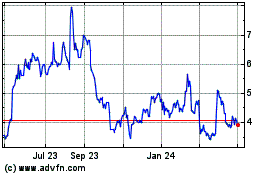

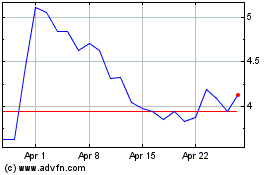

Our common

stock trades on the Nasdaq Global Market under the ticker symbol “EVLV.” On April 6, 2017, the closing price of our

common stock was $1.20 per share.

Investing

in these securities involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus,

any prospectus supplement relating to an offer of securities and any document incorporated by reference herein or therein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date

of this prospectus is April 7, 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

When we refer to “we,” “us”

or the “Company,” we mean EVINE Live Inc. and its subsidiaries unless the context indicates otherwise.

You should rely only on the information

provided in this prospectus, any prospectus supplement and any free writing prospectus, including the information incorporated

herein or therein by reference. Neither we nor the selling shareholders have authorized anyone to provide you with different information.

You should not assume that the information in this prospectus, any prospectus supplement and any free writing prospectus is accurate

at any date other than the date indicated on the cover page of such documents.

The distribution of this prospectus, any

prospectus supplement and any free writing prospectus and the offering of the securities in certain jurisdictions may be restricted

by law. Persons into whose possession this prospectus, any prospectus supplement and any free writing prospectus come should inform

themselves about and observe any such restrictions. This prospectus, any prospectus supplement and any free writing prospectus

does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such

offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to

any person to whom it is unlawful to make such offer or solicitation.

This prospectus, any prospectus supplement

and any free writing prospectus may include trademarks, service marks and trade names owned by us or other companies. All trademarks,

service marks and trade names included in this prospectus, any prospectus supplement and any free writing prospectus are the property

of their respective owners.

WHERE YOU CAN FIND MORE INFORMATION;

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available over the Internet at the SEC’s web site

at www.sec.gov. You may also read and copy any document we file with the SEC at its Public Reference Room located at 100 F Street,

N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

We maintain a web site at www.evine.com. The information on our web site is not incorporated by reference in this prospectus, any

prospectus supplement and any free writing prospectus, and you should not consider it a part of this prospectus, any prospectus

supplement or any free writing prospectus.

The SEC allows us to “incorporate

by reference” the information we file with them, which means that we can disclose important information to you by referring

you to separate documents. The information incorporated by reference is considered to be part of this prospectus, any prospectus

supplement and any free writing prospectus, and later information filed with the SEC will update and supersede this information.

We incorporate by reference the documents listed below (other than information deemed furnished and not filed in accordance with

SEC rules):

|

|

·

|

Annual Report on Form 10-K for the fiscal year ended January 28, 2017;

|

|

|

·

|

Current Reports on Form 8-K filed with the SEC on January 31, 2017, March 21, 2017, March 23, 2017, March 27, 2017, and March

29, 2017;

|

|

|

·

|

The description of our common stock contained in the Registration Statement on Form 8-A filed with the SEC on May 22,

1992, as the same may be amended from time to time;

|

|

|

·

|

The description of our Series A Junior Participating Cumulative Preferred Stock and the Shareholder Rights Agreement contained

in our Registration Statement on Form 8-A, filed with the SEC on July 13, 2015, as the same may be amended from time to time;

|

|

|

·

|

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act

of 1934, or the “Exchange Act,” after the date of the initial registration statement and prior to effectiveness of

the registration statement shall be deemed to be incorporated by reference into the prospectus (except for information filed pursuant

to Items 2.02 and 7.01 unless specifically deemed filed and not furnished in accordance with SEC rules); and

|

|

|

·

|

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act subsequent

to the date of this prospectus and prior to the termination of this offering (except for information deemed furnished and not filed

in accordance with SEC rules).

|

Copies of these filings are available

at no cost on our website, www.evine.com. You may request a copy of these filings (other than an exhibit to a filing unless that

exhibit is specifically incorporated by reference into that filing) at no cost, by writing to or telephoning us at the following

address:

Corporate Secretary

EVINE Live Inc.

6740 Shady Oak Road

Eden Prairie, Minnesota 55344

(952) 943-6000

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, any prospectus supplement

delivered with this prospectus and the documents incorporated by reference herein and therein, may contain statements that constitute

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E

of the Securities Exchange Act of 1934. All statements other than statements of historical fact, including statements regarding

guidance, industry prospects or future results of operations or financial position made in this prospectus are forward-looking.

We often use words such as anticipates,

believes, expects, estimates, intends, predicts, hopes, should, plans, will and similar expressions to identify forward-looking

statements. These statements are based on management’s current expectations and accordingly are subject to uncertainty and

changes in circumstances. Actual results may vary materially from the expectations contained herein due to various important factors,

including (but not limited to): consumer preferences, spending and debt levels; the general economic and credit environment; interest

rates; seasonal variations in consumer purchasing activities; the ability to achieve the most effective product category mixes

to maximize sales and margin objectives; competitive pressures on sales; pricing and gross sales margins; the level of cable and

satellite distribution for our programming and the associated fees or estimated cost savings from contract renegotiations; our

ability to establish and maintain acceptable commercial terms with third-party vendors and other third parties with whom we have

contractual relationships, and to successfully manage key vendor relationships and develop key partnerships and proprietary and

exclusive brands; our ability to manage our operating expenses successfully and our working capital levels; our ability to remain

compliant with our credit facilities covenants; customer acceptance of our branding strategy and our repositioning as a video commerce

company; the market demand for television station sales; changes to our management and information systems infrastructure; challenges

to our data and information security; changes in governmental or regulatory requirements, including without limitation, regulations

of the Federal Communications Commission and Federal Trade Commission, and adverse outcomes from regulatory proceedings; litigation

or governmental proceedings affecting our operations; significant public events that are difficult to predict, or other significant

television-covering events causing an interruption of television coverage or that directly compete with the viewership of our programming;

our ability to obtain and retain key executives and employees; our ability to attract new customers and retain existing customers;

changes in shipping costs; our ability to offer new or innovative products and customer acceptance of the same; changes in customer

viewing habits of television programming; and those risk factors identified under Item 1A in our annual report on Form 10-K for

the year ended January 28, 2017.

You are cautioned not

to place undue reliance on forward-looking statements, which speak only as of the date of this filing. We are under no obligation

(and expressly disclaim any such obligation) to update or alter our forward-looking statements whether as a result of new information,

future events or otherwise.

SUMMARY

The following summary contains basic

information about us and this offering. It does not contain all of the information that you should consider in making your investment

decision. You should read and consider carefully all of the information in this prospectus, including the information set forth

under “Risk Factors,” any applicable prospectus supplement, as well as the more detailed financial information, including

the consolidated financial statements and related notes thereto, appearing elsewhere or incorporated by reference in this prospectus,

before making an investment decision. Unless the context indicates otherwise, all references in this prospectus to “EVINE,”

“our,” “us” and “we” refer to EVINE Live Inc. and its subsidiaries as a combined entity.

Our Company

We are a multiplatform video commerce company

that offers a mix of proprietary, exclusive and name brands directly to consumers in an engaging and informative shopping experience

through TV, online and mobile devices. We operate a 24-hour television shopping network, Evine, which is distributed primarily

on cable and satellite systems, through which we offer proprietary, exclusive and name brand merchandise in the categories of jewelry

& watches; home & consumer electronics; beauty; and fashion & accessories. We also operate evine.com, a comprehensive

digital commerce platform that sells products which appear on our television shopping network as well as an extended assortment

of online-only merchandise. Our programming and products are also marketed via mobile devices, including smartphones and tablets,

and through the leading social media channels.

Our investor relations website address is

evine.com/ir. Our goal is to maintain the investor relations website as a way for investors to easily find information about us,

including press releases, announcements of investor conferences, investor and analyst presentations and corporate governance. We

also make available free of charge our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on

Form 8-K, proxy statements and all amendments to these filings as soon as practicable after that material is electronically

filed with or furnished to the SEC. The information found on our website is not part of this or any other report we file with,

or furnish to, the SEC.

On November 18, 2014,

we announced that we had changed our corporate name to Evine Live Inc. from ValueVision Media, Inc. Effective November 20, 2014,

our NASDAQ trading symbol also changed to EVLV from VVTV. We transitioned from doing business as "ShopHQ" and rebranded

to "Evine Live", "Evine" and evine.com on February 14, 2015.

In May 2013, we previously

announced a rebranding of our 24-hour television shopping network and digital commerce internet website from ShopNBC and ShopNBC.com

to ShopHQ and ShopHQ.com, respectively.

EVINE Live Inc. is

a Minnesota corporation with principal and executive offices located at 6740 Shady Oak Road, Eden Prairie, Minnesota 55344-3433.

Our telephone number is (952) 943-6000.

The Offering

|

Common stock

outstanding as of April 7, 2017

|

|

60,968,092

|

|

Common

stock offered by selling shareholders, reflecting shares issuable upon exercise of Option

Warrants

|

|

873,175

|

|

Common stock outstanding assuming all Option Warrants

are exercised

|

|

61,841,267

|

|

Use of Proceeds

|

|

We will not receive any proceeds from the sale of the common stock by the selling shareholders. To the extent proceeds are received upon the exercise of the Option Warrants, we intend to use such proceeds for general

working capital and debt repayment purposes.

|

|

NASDAQ Symbol

|

|

Shares of our common stock are listed on the NASDAQ Global Market under the symbol “EVLV”.

|

|

Risk Factors

|

|

See the section of this prospectus titled “Risk Factors” and the risk factors set forth in our most recent quarterly report on Form 10-Q and annual report on Form 10-K. You should carefully read and consider these risk factors together with all of the other information included in or incorporated by reference into this prospectus before you decide to purchase shares of our common stock.

|

RISK FACTORS

An investment

in our common stock involves risks. Before purchasing any shares of our common stock, consider carefully the risks together with

all of the other information contained or incorporated by reference in this prospectus, including the risks described under the

caption “Risk Factors” included in each of Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended

January 28, 2017, and any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K

we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus,

as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, and the risk factors and other information

contained in any applicable prospectus supplements before acquiring any of our common stock.

We

caution you that the risks and uncertainties we have described, among others, could cause our actual results to differ materially

from those expressed in forward-looking statements made by us or on our behalf in filings with the SEC, press releases, communications

with investors and oral statements. We undertake no obligation to update any forward-looking statements, whether as a result of

new information, future events or otherwise.

USE OF PROCEEDS

We

will receive none of the proceeds from any sale or other disposition of the common stock covered by this prospectus. We would receive

proceeds upon the cash exercise of the Option Warrants for which the underlying shares of common stock are being registered hereunder,

although we cannot predict when or if such securities will be exercised. Assuming full cash exercise of the Option Warrants at

the exercise price per share of common stock of, respectively,

$3.00 per share for 333,873 shares, $1.76 for 489,302 shares

and $1.92 for 50,000 shares

, we will receive proceeds of approximately $1,958,791. We currently

intend to use the cash proceeds from any Option Warrant exercises for general working capital and debt repayment purposes.

The

amount and timing of our actual use of proceeds may vary significantly depending on the actual amount of proceeds we receive and

the timing of when we receive such proceeds. In addition, the terms of the Option Warrants provide that following June 17, 2017,

they may be exercised on a cashless basis if at the time of exercise, the shares of common stock underlying the Option Warrants

are not subject to a registration statement or there has been a failure to maintain the effective registration of such shares.

We will receive no cash proceeds from Option Warrants that are exercised on a cashless basis under such terms of the Option Warrants.

SELLING SHAREHOLDERS

The common stock

being offered by each selling shareholder, upon satisfaction of applicable exercise provisions, will become issuable pursuant

to the Option Warrants issued to the selling shareholders at various times pursuant to the exercise of their Options issued

on September 19, 2016, when we completed the Private Placement pursuant to separate securities purchase agreements with each

selling shareholder dated as of September 14, 2016 (the “Purchase Agreements”). As set forth in the Purchase

Agreements, we sold shares of our common stock, Warrants and Options to each of five “accredited investors” as

defined in Rule 501(a) under the Securities Act pursuant to an exemption from registration under the Securities Act. Such

shares of common stock, and shares of common stock underlying the Warrants and Options, were registered pursuant to the

Registration Statement on Form S-3 (No. 333-214061) declared effective by the SEC on December 15, 2016 (the “Prior

Registration Statement”).

The Options reflected

rights to purchase both shares of common stock (registered pursuant to the Prior Registration Statement) and warrants to purchase

shares of common stock (the “Option Warrants,” the underlying shares of which are the subject of this registration

statement). The number of shares of common stock issuable upon exercise of the outstanding Option Warrants, and the exercise price

thereof, were determined in accordance with the terms of the Option at the time of its exercise. Four of the five “accredited

investors” (the “selling shareholders”) exercised their Options in whole or in part prior to their expiration

dates, resulting in the issuance of (a) 1,746,350 shares of common stock which were previously registered pursuant to the Prior

Registration Statement, and (b) four Option Warrants pursuant to which an aggregate of 873,175 shares of common stock may be purchased

at an exercise price of, respectively, (i) $3.00 per share for 333,873 shares, (ii) $1.76 for 489,302 shares and (iii) $1.92 for

50,000 shares.

For details on the

terms and conditions of the Option Warrants, please refer to the subsection of this prospectus titled “Description of Option

Warrants to Purchase Common Stock Pursuant to Which Common Stock May Be Issued,” under the section titled “DESCRIPTION

OF SECURITIES.”

Upon closing of the

Private Placement, Tommy Hilfiger (who is affiliated with TH Media Partners, LLC) and Thomas D. Mottola became members of the Company’s

new Brand Building Advisory Committee, which is a non-board committee that will advise the Board of Directors, including on matters

related to brand strategy. Except for such service, and the ownership of the shares of common stock, Warrants, Options and Option

Warrants, the selling shareholders have not, within the past three years, had any other position, office or other material relationship

with us.

The information in the table below with respect to the selling shareholders has

been obtained from the selling shareholders. When we refer to the “selling shareholders” in this prospectus, we mean

the selling shareholders listed in the table below as offering securities, as well as their respective pledgees, donees, transferees

or other successors-in-interest.

We

do not know if, when or in what amounts the selling shareholders may offer their shares of common stock issuable upon the exercise

of the Option Warrants for sale. The selling shareholders may sell some, all or none of the shares offered by this prospectus.

Because the number of shares the selling shareholders may offer and sell is not presently known, we cannot estimate the number

of securities that will be held by each selling shareholder after completion of this offering. This table, however, presents the

maximum number of shares of common stock that the selling stockholders may offer pursuant to this prospectus and the number of

shares of common stock that would be beneficially owned after the sale of the maximum number of shares of common stock by each

selling stockholder.

Beneficial ownership

is determined under the rules of the SEC

, and includes voting or investment power with respect

to shares. In calculating the number of shares beneficially owned by an individual or entity and the percentage ownership of that

individual or entity, shares underlying options or warrants that are either currently exercisable or exercisable within 60 days

from the date of this prospectus are deemed outstanding. These shares, however, are not deemed outstanding for the purpose of

computing the percentage ownership of any other individual or entity. In addition, unless otherwise indicated below, to our knowledge,

each selling shareholder named in the table has sole voting and investment power with respect to the shares of common stock beneficially

owned by it. The inclusion of any shares in this table does not constitute an admission of beneficial ownership for any selling

shareholder named below. For purposes of the chart below, the “offering” refers to the resale of the securities purchased

through the Private Placement and registered under this prospectus.

|

|

|

Number of Shares of Common Stock Owned Prior to Offering

|

|

|

Maximum Number of Shares of Common Stock to be Sold Pursuant to this Prospectus

|

|

|

Shares of Common Stock Owned After Offering

|

|

|

Name of Selling Shareholder

|

|

Number

|

|

|

Percent (1)

|

|

|

Number

|

|

|

Percent (2)

|

|

|

Number (3)

|

|

|

Percent (3)

|

|

|

Thomas D. Mottola

|

|

|

4,444,096

|

(4)

|

|

|

7.29

|

%

|

|

|

489,302

|

(5)

|

|

|

*

|

%

|

|

|

3,954,794

|

|

|

|

6.49

|

%

|

|

TH Media Partners, LLC

|

|

|

3,842,153

|

(6)

|

|

|

6.30

|

%

|

|

|

50,000

|

(7)

|

|

|

*

|

%

|

|

|

3,792,153

|

|

|

|

6.22

|

%

|

|

Morris Goldfarb

|

|

|

2,631,473

|

(8)

|

|

|

4.32

|

%

|

|

|

203,547

|

(9)

|

|

|

*

|

%

|

|

|

2,427,926

|

|

|

|

3.98

|

%

|

|

Tower View LLC

|

|

|

1,283,835

|

(10)

|

|

|

2.11

|

%

|

|

|

130,326

|

(11)

|

|

|

*

|

%

|

|

|

1,153,509

|

|

|

|

1.89

|

%

|

*Less than 1%

|

(1)

|

Based on 60,968,092 shares of our common stock outstanding on April 7, 2017.

|

|

(2)

|

Calculated per selling shareholder on a post-exercise basis, based on 60,968,092 shares of our common stock outstanding on April 7, 2017.

|

|

(3)

|

This number assumes the resale by the selling shareholders of all of the shares underlying the Option Warrants being registered pursuant to this prospectus. The selling shareholders are also entitled to sell other shares of our common stock under the Prior Registration Statement.

|

|

(4)

|

Includes 1,984,127 shares purchased through the Private Placement, 992,063 shares underlying a Warrant, 978,604 shares purchased pursuant to the exercise of the selling shareholder’s Option on January 23, 2017, and 489,302 shares issuable upon the exercise of the selling shareholder’s Option Warrant issued on January 23, 2017.

|

|

(5)

|

Includes 489,302 shares that are issuable upon exercise of the selling shareholder’s Option Warrant.

|

|

(6)

|

Includes 1,984,127 shares purchased through the Private Placement, 992,063 shares underlying a Warrant, 100,000 shares purchased pursuant to the exercise of the first tranche of the Amended Option on March 16, 2017, 715,963 shares issuable upon the exercise of the second tranche of the Amended Option, and 50,000 shares issuable upon the exercise of the selling shareholder’s Option Warrant issued on March 16, 2017.

|

|

(7)

|

Includes 50,000 shares that are issuable upon exercise of the selling shareholder’s outstanding Option Warrant.

|

|

(8)

|

Includes 1,210,318 shares purchased through the Private Placement, 605,159 shares underlying a Warrant, 407,094 shares purchased upon exercise of the selling shareholder’s Option on November 10, 2016, 203,547 shares issuable upon the exercise of the selling shareholder’s Option Warrant issued on November 10, 2016, and 205,355 shares purchased by the selling shareholder on the public market.

|

|

(9)

|

Includes 203,547 shares that are issuable upon exercise of the selling shareholder’s Option Warrant.

|

|

(10)

|

Includes 595,238 shares purchased through the Private Placement, 297,619 shares underlying a Warrant, 260,652 shares purchased upon exercise of the selling shareholder’s Option on November 10, 2016, and 130,326 shares issuable upon the exercise of the selling shareholder’s Option Warrant issued on November 10, 2016.

|

|

(11)

|

Includes 130,326 shares that are issuable upon exercise of the selling shareholder’s Option Warrant.

|

DESCRIPTION OF SECURITIES

Our articles of incorporation provide that

we may issue up to 100,000,000 shares of capital stock, par value $0.01 per share in the case of common stock, and having a par

value as determined by the board of directors in the case of preferred stock. As of April 7, 2017, there were outstanding (i) 60,968,092

shares of common stock and (ii) Option Warrants to purchase 873,175 shares of common stock. In addition, as of April 7, there were

6,598,729 shares of common stock that may be issued upon the exercise of outstanding stock options (number includes both vested

and unvested stock options and unvested restricted stock grants) issued pursuant to the Company’s 2011, 2004 and 2001 Incentive

Stock Option Plans, and rights to purchase up to 400,000 shares of Series A Junior Participating Cumulative Preferred Stock.

Pursuant to the Purchase Agreement, we were

required to register the shares of common stock sold in the Private Placement, as well as the shares of common stock issuable upon

exercise of the Warrants, Options and Option Warrants (collectively, the “registrable securities”) for resale or other

disposition. Pursuant to the Prior Registration Statement, the registrable securities, other than the Option Warrants, were registered

with the SEC.

With respect to the shares issuable upon

exercise of the Option Warrants, we are required to (i) file a registration statement covering such shares within 30 days following

the earlier of the exercise of all five of the Options or the expiration of the exercise period for the Options; (ii) cause the

shelf registration statement to be declared effective by the SEC as soon as possible after the initial filing, and in any event

no later than 90 days after the closing date (or 120 days in the event of a full review of the shelf registration statement by

the SEC); and (iii) keep the shelf registration statement effective until the earlier of the second anniversary of the closing,

such time as all registrable securities may be sold pursuant to Rule 144 under the Securities Act of 1933 during any three-month

period without the need for the Company to be in compliance with the current public information requirement of Rule 144 or such

time as all registrable securities have been sold pursuant to an effective registration statement or Rule 144. If we are unable

to comply with any of the above covenants, we will be required to pay liquidated damages to the selling shareholders in the amount

of 1% of the average of closing stock prices of the unregistered securities for every 30 days until such non-compliance is cured

(subject to a 12% cap), with such liquidated damages payable in cash.

A description of the material terms and

provisions of our capital stock is set forth below. The description is intended as a summary and is qualified in its entirety by

reference to our articles of incorporation and bylaws incorporated herein by reference. We have filed our articles of incorporation

and bylaws as exhibits to the registration statement of which this prospectus is a part. You should read our articles of incorporation

and bylaws for additional information before you buy any capital stock.

The following is a summary of the material

features of our capital stock:

Common Stock

Holders of our common stock are entitled

to one vote per share in the election of directors and on all other matters on which shareholders are entitled or permitted to

vote. Holders of common stock are not entitled to cumulative voting rights. Subject to the terms of any outstanding series of preferred

stock, the holders of common stock are entitled to dividends in amounts and at times as may be declared by the board of directors

out of funds legally available therefor. Upon our liquidation or dissolution, holders of common stock are entitled to share ratably

in all net assets available for distribution to shareholders after payment of any liquidation preferences to holders of preferred

stock. Holders of common stock have no redemption, conversion or preemptive rights.

Pursuant to standstill agreements entered

into by each selling shareholder as required by the Purchase Agreement, each of the selling shareholders agreed that for a period

of 1 year from the closing date, such selling shareholder would not, individually or in concert with any group, purchase or otherwise

acquire securities of the Company which would cause such selling shareholder, or the group with which such selling shareholder

became associated, to beneficially own greater than 19.999% of the Company’s outstanding common stock.

Preferred Stock

Our articles

of incorporation permit us to issue shares of preferred stock, from time to time, in one or more series and with such designation

and preferences for each series as are stated in the resolutions providing for the designation and issue of each such series adopted

by our board of directors. Our articles of incorporation authorize our board of directors to determine the number of shares, voting,

dividend, redemption and liquidation preferences and limitations pertaining to such series. The board of directors, without shareholder

approval, may issue preferred stock with voting rights and other rights that could adversely affect the voting power of the holders

of our common stock and outstanding preferred stock could have certain anti-takeover effects. The ability of the board of directors

to issue preferred stock without shareholder approval could have the effect of delaying, deferring or preventing a change in control

of our company or the removal of existing management. We currently do not have shares of preferred stock outstanding; however,

we have authorized up to 400,000

Series A Junior Participating Cumulative

Preferred Stock,

$0.01

par

value, in connection with

the Shareholder Rights Plan described below, and pursuant

to which we granted rights to purchase shares of the

Series A Junior Participating

Cumulative Preferred Stock

. A description of the

Series A Junior

Participating Cumulative Preferred Stock can be found in our registration statement on Form 8-A filed on July 13, 2015.

Description of Option Warrants to Purchase Common

Stock Pursuant to Which Common Stock May Be Issued

Through the Private Placement, we issued

common stock, five Warrants and five Options, which are further described in the Prior Registration Statement. Prior to their expiration,

four of the five Options were exercised in whole or in part, resulting in the issuance of four Option Warrants which are outstanding

as of the date of this prospectus. Shares underlying the outstanding Option Warrants are being registered for resale under the

shelf registration statement of which this prospectus forms a part.

The exercise price for the Option Warrants

was calculated as the price per share equal to a 50% premium to the Company’s closing stock price on the Nasdaq Global Market

on the trading day most recently ended prior to the announcement of the exercise of the corresponding Option pursuant to which

such Option Warrant was issued, subject to adjustment for stock splits, stock dividends, combinations or similar events. The term

of each Option Warrant is five years from the date of issuance and an Option Warrant may not be exercised for the first six months

after issuance.

The selling shareholders exercised their

Options in whole or in part prior to the Options’ expiration and were accordingly issued four Option Warrants. Two selling

shareholders exercised their Options in full on November 10, 2016, and were issued Option Warrants to purchase an aggregate of

333,873 shares of common stock with an exercise price of $3.00 per share and an expiration date of November 10, 2021. One selling

shareholder exercised his entire Option on January 23, 2017 and was issued an Option Warrant to purchase 489,302 shares of common

stock with an exercise price of $1.76 per share and an expiration date of January 23, 2022.

One selling shareholder, TH Media Partners,

LLC (“TH Media”), entered into a First Amended and Restated Option (the “Amended Option”) with the Company

on March 16, 2017. Pursuant to the Amended Option, TH Media was granted the right to exercise its Option in two tranches. The first

tranche was required to be exercised on March 16, 2017 and reflected rights to purchase 150,000 shares of common stock, issuable

in the form of 100,000 shares of common stock, and an Option Warrant to purchase 50,000 shares of common stock. The Option Warrant

has an exercise price of $1.92 per share and an expiration date of March 16, 2022. Its exercise price was calculated as the price

per share equal to a 50% premium to the closing price of the Company’s common stock on the Company’s principal trading

market on the trading day immediately preceding the exercise of the first tranche of the Amended Option.

The second tranche reflects rights to purchase

up to 1,073,945 shares of common stock, which are issuable in the form of 715,963 common shares and a warrant to purchase an additional

357,982 common shares. The second tranche must be exercised on or before September 16, 2017. The shares issuable upon the exercise

of the warrants issuable pursuant to the second tranche of the Amended Option are not required to be registered.

Provisions Regarding Aliens

Except as otherwise provided by law, not

more than 20% of the aggregate voting power of all shares outstanding entitled to vote on any matter shall be at any time voted

by or for the account of aliens as defined in the Communications Act of 1934, or their representatives, or by or for the account

of a foreign government or representative thereof, or by or for the account of any corporation organized under the laws of a foreign

country.

Except as otherwise provided by law, aliens,

foreign governments, or corporations organized under the laws of a foreign country, or the representatives of such aliens, foreign

governments, or corporations organized under the laws of a foreign country, shall not own, directly or through a third party who

holds the stock for the account of such alien, foreign government, or corporation organized under the laws of a foreign country:

(1) more than 20% of the number of shares of our outstanding stock, or (2) shares representing more than 20% of the aggregate

voting power of all of our outstanding shares of voting stock.

Shares of stock

shall not be transferable on our books to aliens, foreign governments, or corporations organized under the laws of foreign

countries, or to the representatives of, or persons holding for the account of, such aliens, foreign governments, or

corporations organized under the laws of foreign countries, unless, after giving effect to such transfer, the aggregate

number of shares of stock owned by or for the account of aliens, foreign governments, and corporations organized under the

laws of foreign countries, and any representatives thereof, will not exceed 20% of the number of shares of outstanding stock,

and the aggregate voting power of such shares will not exceed twenty percent 20% of the aggregate voting power of all

outstanding shares of our voting stock.

If, notwithstanding these restrictions on

transfer, the aggregate number of shares of stock owned by or for the account of aliens, foreign governments, and corporations

organized under the laws of foreign countries, exceed 20% of our shares of outstanding stock, or if the aggregate voting power

of such shares exceed 20% of the aggregate voting power of all outstanding shares of our voting stock, we have the right to redeem

shares of all classes of capital stock, at their then fair market value, on a pro rata basis, owned by or for the account of all

aliens, foreign governments, and corporations organized under the laws of foreign countries, in order to reduce the number of shares

and/or percentage of voting power held by or for the account of aliens, foreign governments, and corporations organized under the

laws of foreign countries, and their representatives to the maximum number or percentage allowed under our articles of incorporation

or as otherwise required by applicable federal law.

The board of directors shall make such rules and regulations

as it deems necessary or appropriate to enforce the provisions of this section.

Anti-Takeover Provisions Contained in Our Articles of Incorporation,

Shareholder Rights Plan and the Minnesota Business Corporation Act

Our shareholder rights plan, as well as

certain provisions of our articles of incorporation and of Minnesota law described below could have an anti-takeover effect. These

provisions are intended to provide management flexibility, to enhance the likelihood of continuity and stability in the composition

of our board of directors and in the policies formulated by our board of directors and to discourage an unsolicited takeover of

our company, if our board of directors determines that such a takeover is not in our best interests or the best interests of our

shareholders. However, these provisions could have the effect of discouraging certain attempts to acquire us that could deprive

our shareholders of opportunities to sell their shares of our stock at higher values.

Shareholder Rights Plan

During the second quarter of fiscal 2015,

we adopted a shareholder rights plan to preserve the value of certain deferred tax benefits, including those generated by net operating

losses. On July 10, 2015, we declared a dividend distribution of one purchase right (a “Right”) for each outstanding

share of our common stock to shareholders of record as of the close of business on July 23, 2015 and issuable as of that date,

and on July 13, 2015, we entered into a shareholder rights plan (the “Rights Plan”) with Wells Fargo Bank, N.A., a

national banking association, with respect to the Rights. Except in certain circumstances set forth in the Rights Plan, each Right

entitles the holder to purchase from us one one-thousandth of a share of Series A Junior Participating Cumulative Preferred Stock,

$0.01 par value, of the Company (“Preferred Stock” and each one one-thousandth of a share of Preferred Stock, a “Unit”)

at a price of $9.00 per Unit.

The Rights initially trade together with

the common stock and are not exercisable. Subject to certain exceptions specified in the Rights Plan, the Rights will separate

from the common stock and become exercisable following (i) the tenth calendar day after a public announcement or filing that a

person or group has become an “Acquiring Person,” which is defined as a person who has acquired, or obtained the right

to acquire, beneficial ownership of 4.99% or more of the common stock then outstanding, subject to certain exceptions, or (ii)

the tenth calendar day (or such later date as may be determined by the board of directors) after any person or group commences

a tender or exchange offer, the consummation of which would result in a person or group becoming an Acquiring Person. If a person

or group becomes an Acquiring Person, each Right will entitle its holders (other than such Acquiring Person) to purchase one Unit

at a price of $9.00 per Unit. A Unit is intended to give the shareholder approximately the same dividend, voting and liquidation

rights as would one share of common stock, and should approximate the value of one share of common stock. At any time after a

person becomes an Acquiring Person, the board of directors may exchange all or part of the outstanding Rights (other than those

held by an Acquiring Person) for shares of common stock at an exchange rate of one share of common stock (and, in certain circumstances,

a Unit) for each Right. We will promptly give public notice of any exchange (although failure to give notice will not affect the

validity of the exchange).

The Rights will expire upon certain events

described in the Rights Plan, including the close of business on the date of the third annual meeting of shareholders following

the last annual meeting of our shareholders at which the Rights Plan was most recently approved by shareholders, unless the Rights

Plan is re-approved by shareholders at that third annual meeting of shareholders. However, in no event will the Rights Plan expire

later than the close of business on July 13, 2025. Until the close of business on the tenth calendar day after the day a public

announcement or a filing is made indicating that a person or group has become an Acquiring Person, we may in our sole and absolute

discretion amend the Rights or the Rights Plan agreement without the approval of any holders of the Rights or shares of common

stock in any manner, including without limitation, amendments that increase or decrease the purchase price or redemption price

or accelerate or extend the final expiration date or the period in which the Rights may be redeemed. We may also amend the Rights

Plan after the close of business on the tenth calendar day after the day such public announcement or filing is made to cure ambiguities,

to correct defective or inconsistent provisions, to shorten or lengthen time periods under the Rights Plan or in any other manner

that does not adversely affect the interests of holders of the Rights. No amendment of the Rights Plan may extend its expiration

date.

Statutory Provisions

Section 302A.671 of the Minnesota Business

Corporation Act applies, with certain exceptions, to any acquisitions of our voting stock from a person other than us, and other

than in connection with certain mergers and exchanges to which we are a party and certain tender offers or exchange offers approved

in advance by a disinterested board committee, resulting in the beneficial ownership of 20% or more of the voting power of our

then outstanding stock. Section 302A.671 requires approval of the granting of voting rights for the shares received pursuant

to any such acquisitions by a vote of our shareholders holding a majority of the voting power of our outstanding shares and a majority

of the voting power of our outstanding shares that are not held by the acquiring person, our officers or those non-officer employees,

if any, who are also our directors. Similar voting requirements are imposed for acquisitions resulting in beneficial ownership

of 33-1/3% or more or a majority of the voting power of our then outstanding stock. In general, shares acquired without this approval

are denied voting rights in excess of the 20%, 33-1/3% or 50% thresholds and, to that extent, can be called for redemption at their

then fair market value by us within 30 days after the acquiring person has failed to deliver a timely information statement to

us or the date our shareholders voted not to grant voting rights to the acquiring person’s shares.

Section 302A.673 of the Minnesota Business

Corporation Act generally prohibits any business combination by us, or any subsidiary of ours, with any shareholder that beneficially

owns 10% or more of the voting power of our outstanding shares (an “interested shareholder”) within four years following

the time the interested shareholder crosses the 10% stock ownership threshold, unless the business combination is approved by a

committee of disinterested members of our board of directors before the time the interested shareholder crosses the 10% stock ownership

threshold.

Section 302A.675 of the Minnesota Business

Corporation Act generally prohibits an offeror from acquiring our shares within two years following the offeror’s last purchase

of our shares pursuant to a takeover offer with respect to that class, unless our shareholders are able to sell their shares to

the offeror upon substantially equivalent terms as those provided in the earlier takeover offer. This statute will not apply if

the acquisition of shares is approved by a committee of disinterested members of our board of directors before the purchase of

any shares by the offeror pursuant to the earlier takeover offer.

Authorized But Unissued Shares of Common Stock and Preferred

Stock

Our authorized but unissued shares of

common stock and preferred stock are available for our board of directors to issue without shareholder approval. We may use

these additional shares for a variety of corporate purposes, including future public offerings to raise additional capital,

corporate acquisitions and employee benefit plans. In addition, our articles of incorporation permit us to issue shares of

preferred stock, from time to time, in one or more series and with such designation and preferences for each series as are

stated in the resolutions providing for the designation and issue of each such series adopted by our board of directors. Our

articles of incorporation authorize our board of directors to determine the number of shares, voting, dividend, redemption

and liquidation preferences and limitations pertaining to such series. The board of directors, without shareholder approval,

may issue common stock or preferred stock with voting rights and other rights that could adversely affect the voting power of

the holders of our common stock could have certain anti-takeover effects. We currently do not have any shares of preferred

stock outstanding and have no present plans to issue any shares of preferred stock. The ability of the board of directors to

issue common stock or preferred stock without shareholder approval could have the effect of delaying, deferring or preventing

a change in control of our company or the removal of existing management.

Transfer Agent and Registrar

Wells Fargo Shareowner Services has been

appointed as the transfer agent and registrar for our common stock.

Listing

Our common stock is quoted on the Nasdaq

Global Market under the symbol “EVLV.”

Limitation of Liability and Indemnification Matters

We are subject to Minnesota Section 302A.521,

which provides that a corporation shall indemnify any person made or threatened to be made a party to a proceeding by reason of

the former or present official capacity (as defined in Section 302A.521 of the Minnesota Statutes) of that person against

judgments, penalties, fines, including, without limitation, excise taxes assessed against such person with respect to an employee

benefit plan, settlements and reasonable expenses, including attorneys’ fees and disbursements, incurred by such person in

connection with the proceeding, if, with respect to the acts or omissions of that person complained of in the proceeding, that

person:

|

|

·

|

has not been indemnified therefor by another organization or employee benefit plan;

|

|

|

·

|

received no improper personal benefit and Section 302A.255 (with respect to director conflicts of interest), if applicable,

has been satisfied;

|

|

|

·

|

in the case of a criminal proceeding, had no reasonable cause to believe the conduct was unlawful; and

|

|

|

·

|

in the case of acts or omissions occurring in such person’s performance in an official capacity, such person must have

acted in a manner such person reasonably believed was in the best interests of the corporation or, in certain limited circumstances,

not opposed to the best interests of the corporation.

|

In addition, Section 302A.521, subdiv. 3

requires payment by the registrant, upon written request, of reasonable expenses in advance of final disposition in certain instances.

A decision as to required indemnification is made by a majority of the disinterested board of directors present at a meeting at

which a disinterested quorum is present, or by a designated committee of disinterested directors, by special legal counsel, by

the disinterested shareholders, or by a court.

Our bylaws provide that we will indemnify

any of our officers, directors, employees, and agents to the fullest extent permitted by Minnesota law and we have indemnification

agreements with our directors and officers.

We have a director and officer liability

insurance policy to cover us, our directors and our officers against certain liabilities.

PLAN OF DISTRIBUTION

We

are registering for resale the shares of common stock issuable upon the exercise of the Option Warrants issued to the selling

shareholders and certain transferees. We will not receive any of the proceeds from the sale by the selling shareholders of the

shares of common stock, although we may receive proceeds upon the exercise of the Option Warrants by the selling shareholders.

We will bear all fees and expenses incident to our obligation to register the shares of common stock. If the shares of common

stock are sold through broker-dealers or agents, the selling shareholder will be responsible for any compensation to such broker-dealers

or agents.

The

selling shareholders may pledge or grant a security interest in some or all of the shares of common stock owned by them and, if

they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of

common stock from time to time pursuant to this prospectus.

The

selling shareholders also may transfer and donate the shares of common stock in other circumstances in which case the transferees,

donees, pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

The

selling shareholders will sell their shares of common stock subject to the following:

|

|

·

|

all

of a portion of the shares of common stock beneficially owned by the selling shareholders

or their perspective pledgees, donees, transferees or successors in interest, may be

sold on the OTC Bulletin Board Market, any national securities exchange or quotation

service on which the shares of our common stock may be listed or quoted at the time of

sale, in the over-the counter market, in privately negotiated transactions, through the

writing of options, whether such options are listed on an options exchange or otherwise,

short sales or in a combination of such transactions;

|

|

|

·

|

each

sale may be made at market price prevailing at the time of such sale, at negotiated prices,

at fixed prices or at carrying prices determined at the time of sale;

|

|

|

·

|

some

or all of the shares of common stock may be sold through one or more broker-dealers or

agents and may involve crosses, block transactions or hedging transactions. The selling

shareholders may enter into hedging transactions with broker-dealers or agents, which

may in turn engage in short sales of the common stock in the course of hedging in positions

they assume. The selling shareholders may also sell shares of common stock short and

deliver shares of common stock to close out short positions or loan or pledge shares

of common stock to broker-dealers or agents that in turn may sell such shares;

|

|

|

·

|

in

connection with such sales through one or more broker-dealers or agents, such broker-dealers

or agents may receive compensation in the form of discounts, concessions or commissions

from the selling shareholders and may receive commissions from the purchasers of the

shares of common stock for whom they act as broker-dealer or agent or to whom they sell

as principal (which discounts, concessions or commissions as to particular broker-dealers

or agents may be in excess of those customary in the types of transaction involved).

Any broker-dealer or agent participating in any such sale may be deemed to be an “underwriter”

within the meaning of the Securities Act and will be required to deliver a copy of this

prospectus to any person who purchases any share of common stock from or through such

broker-dealer or agent. We have been advised that, as of the date hereof, none of the

selling shareholders have made any arrangements with any broker-dealer or agent for the

sale of their shares of common stock; and

|

|

|

·

|

in

connection with any other sales or transfers of common stock not prohibited by law.

|

The

selling shareholders and any broker-dealer participating in the distribution of the shares of common stock may be deemed to be

“underwriters” within the meaning of the Securities Act, and any profits realized by the selling shareholders and

any commissions paid, or any discounts or concessions allowed to any such broker-dealer may be deemed to be underwriting commissions

or discounts under the Securities Act. In addition, any shares of common stock covered by this prospectus which qualify for sale

pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus. A selling shareholder may also transfer,

devise or gift the shares of common stock by other means not covered in this prospectus in which case the transferee, devisee

or giftee will be the selling shareholder under this prospectus.

If

required at the time a particular offering of the shares of common stock is made, a prospectus supplement or, if appropriate, a

post-effective amendment to the shelf registration statement of which this prospectus is a part, will be distributed which will

set forth the aggregate amount of shares of common stock being offered and the terms of the offering, including the name or names

of any broker-dealers or agents, any discounts, commissions or concessions allowed or reallowed or paid to broker-dealers.

Under

the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed brokers

or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered or qualified

for sale in such state or an exemption from registration or qualification is available and is complied with. There can be no assurance

that any selling shareholder will sell any or all of the shares of common stock registered pursuant to the shelf registration statement,

of which this prospectus forms a part.

The

selling shareholders and any other person participating in such distribution will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including, without limitation, Regulation M of the Exchange Act, which may limit

the timing of purchases and sales of any of the shares of common stock by the selling shareholders and any other participating

person. Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage

in market-making activities with respect to the shares of common stock. All of the foregoing may affect the marketability of the

shares of common stock and the ability of any person or entity to engage in market-making activities with respect to the shares

of common stock.

We will bear all expenses of the registration

of the shares of common stock including, without limitation, Securities and Exchange Commission filing fees and expenses of compliance

with the state securities of “blue sky” laws. The selling shareholders will pay all underwriting discounts and selling

commissions and expenses, brokerage fees and transfer taxes, as well as the fees and disbursements of counsel to and experts for

the selling shareholders, if any. We will indemnify the selling shareholders against liabilities, including some liabilities under

the Securities Act, in accordance with the registration rights agreement or the selling shareholder will be entitled to contribution.

We will be indemnified by the selling shareholders against civil liabilities, including liabilities under the Securities Act that

may arise from any written information furnished to us by the selling shareholders for use in this prospectus, in accordance with

the related securities purchase agreement or will be entitled to contribution. Once sold under this shelf registration statement,

of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our

affiliates.

LEGAL MATTERS

Gray, Plant, Mooty, Mooty & Bennett,

P.A, Minneapolis, Minnesota, will issue an opinion about the legality of the securities offered under this prospectus. Any underwriters

will be represented by their own legal counsel.

EXPERTS

The consolidated financial statements,

and the related consolidated financial statement schedule, incorporated in this prospectus by reference from the EVINE Live Inc.

Annual Report on Form 10-K for the year ended January 28, 2017, and the effectiveness of EVINE Live Inc. and subsidiaries’

internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public

accounting firm, as stated in their reports, which are incorporated herein by reference. Such consolidated financial statements

and consolidated financial statement schedule have been so incorporated in reliance upon the reports of such firm given upon their

authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

|

Item 14.

|

Other Expenses of

Issuance and Distribution

|

The

following table sets forth the various expenses to be incurred in connection with the sale and distribution of the securities

being registered hereby, all of which will be borne by the Company (except any underwriting discounts and commissions and expenses

incurred by the selling shareholders for brokerage or legal services or any other expenses incurred by the selling stockholders

in disposing of the shares). All amounts shown are estimates except the SEC registration fee.

|

SEC registration fee

|

|

$

|

122.45

|

|

|

Legal fees and expenses

|

|

$

|

10,000

|

|

|

Accounting fees and expenses

|

|

$

|

5,000

|

|

|

Miscellaneous

|

|

$

|

1,000

|

|

|

Total

|

|

$

|

16,122.45

|

|

|

|

Item 15.

|

Indemnification of

Directors and Officers

|

We are subject to

the Minnesota Business Corporation Act (the “MBCA”). Section 302A.521 of the MBCA provides that we shall indemnify

a person made or threatened to be made a party to a proceeding by reason of the former or present official capacity of such person

against judgments, penalties, fines, including, without limitation, excise taxes assessed against such person with respect to any

employee benefit plan, settlements and reasonable expenses, including attorneys’ fees and disbursements, incurred by such

person in connection with the proceeding, if, with respect to the acts or omissions of such person complained of in the proceeding,

such person:

|

|

·

|

has not been indemnified by another organization or employee benefit plan for the same judgments,

penalties, fines, including, without limitation, excise taxes assessed against the person with respect to an employee benefit plan,

settlements, and reasonable expenses, including attorneys’ fees and disbursements, incurred by the person in connection with

the proceeding with respect to the same acts or omissions;

|

|

|

·

|

received no improper personal benefit and Section 302A.255 of the MBCA, if applicable, has been

satisfied;

|

|

|

·

|

in the case of a criminal proceeding, had no reasonable cause to believe the conduct was unlawful;

and

|

|

|

·

|

in the case of acts or omissions occurring in such person’s performance in an official capacity,

such person must have acted in a manner such person reasonably believed was in our best interests, or, in certain limited circumstances,

not opposed to our best interests.

|

In addition, Section 302A.521,

subdivision 3 requires payment by the registrant, upon written request, of reasonable expenses in advance of final disposition

in certain instances. A decision as to required indemnification is made by a majority of the disinterested board of directors

present at a meeting at which a disinterested quorum is present, or by a designated committee of disinterested directors, by special

legal counsel, by the disinterested shareholders, or by a court.

Our bylaws provide

that we will indemnify any of our officers, directors, employees, and agents to the fullest extent permitted by Minnesota law and

we have indemnification agreements with our directors and officers.

We have a director

and officer liability insurance policy to cover us, our directors and our officers against certain liabilities.

A list of exhibits

filed with this registration statement on Form S-3 is set forth on the Exhibit Index and is incorporated herein by reference.

|

|

(a)

|

The undersigned registrant hereby undertakes:

|

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to

include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if

the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high

end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule

424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement ; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement;

provided

,

however

,

that paragraphs (a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to

Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) that is a part of the registration statement.

(2) That,

for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(4) That,

for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement

relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof.

Provided

,

however

, that no statement made

in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to

a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such effective date.

(b) The undersigned