UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

CERULEAN

PHARMA INC.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

15708Q105

(CUSIP Number)

Sabrina Martucci Johnson

Chief Executive Officer

Daré Bioscience, Inc.

10210 Campus Point Drive, Suite 150

San Diego, CA 92121

(858) 769-9145

Copies

to:

Sebastian E. Lucier, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C.

3580 Carmel Mountain Road, Suite 300

San Diego, CA 92130

(858) 314-1501

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

March 19, 2017

(Date of Event Which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box ☐

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF

REPORTING PERSON

I.R.S. IDENTIFICATION NO. OF ABOVE PERSON (ENTITIES ONLY)

Daré Bioscience, Inc.

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP (See Instructions)

(a) ☐ (b) ☒

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS (See Instructions)

OO

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Delaware

|

|

|

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON

WITH

|

|

7

|

|

SOLE VOTING POWER

0

|

|

|

8

|

|

SHARED VOTING POWER

6,029,782(1)

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

0

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,029,782(1)

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW

(11) EXCLUDES CERTAIN SHARES (See Instructions) ☐

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW (11)

20.70%(2)

|

|

14

|

|

TYPE OF REPORTING PERSON (See

Instructions)

CO

|

|

(1)

|

Beneficial ownership of the common stock, par value $.0001 per share, of Cerulean Pharma Inc., a Delaware corporation (“

Cerulean

”), is being reported hereunder solely because the Reporting Person

may be deemed to

|

|

|

have beneficial ownership of Cerulean common stock by virtue of the Support Agreement described in Item 4 of this Schedule 13D (the “

Support Agreement

”). Neither the

filing of this Schedule 13D nor any of its contents shall be deemed to constitute an admission by the Reporting Person that it is the beneficial owner of any Cerulean common stock for purposes of Section 13(d) of the Securities and Exchange

Act, as amended (the “

Exchange Act

”), or for any other purpose, and such beneficial ownership thereof is expressly disclaimed. In accordance with the terms of the Support Agreement, the number reported includes 5,219,990

shares of Cerulean common stock, warrants to purchase up to 30,809 shares of Cerulean common stock (the “

Warrants

”) and 1,375,209 shares subject to options to acquire shares of Cerulean common stock (the

“

Options

”) that are subject to the Support Agreement. In accordance with materials provided by Cerulean, the Designated Equityholders (as defined in Item 4) collectively hold 778,983 shares subject to options to acquire

shares of Cerulean common stock exercisable within 60 days of March 20, 2017 and warrants to purchase up to 30,809 shares of common stock of Cerulean exercisable within 60 days of March 20, 2017.

|

|

(2)

|

Based on 29,021,455 shares of Common Stock issued and outstanding as of the close of business on March 17, 2017, as disclosed by Cerulean in the Stock Purchase Agreement (as defined in Item 4 below).

|

|

Item 1.

|

Security and Issuer.

|

This statement on Schedule 13D relates to the common stock, $0.0001 par value per

share, of Cerulean Pharma Inc., a Delaware corporation (the “

Issuer

” or “

Cerulean

”). The principal place executive office of Cerulean is 35 Gatehouse Drive, Waltham,

MA 02451.

|

Item 2.

|

Identity and Background.

|

(a) – (b) – (c) – (f)

This Schedule 13D is being filed on behalf of Daré Bioscience, Inc., a Delaware corporation (the “

Reporting Company

” or

“

Daré

”). The address of the principal business office of Daré is 10210 Campus Point Drive, Suite 150, San Diego, CA 92121. The principal business occupation of Daré is the development and

commercialization of products for women’s reproductive health.

As a result of entering into the Support Agreement described in Items 3 and 4 below,

Daré may be deemed to have formed a “group” with each of the Designated Equityholders (as defined in Item 4 below) for purposes of Section 13(d)(3) of the Exchange Act and Rule 13d-5(b)(1) thereunder. Daré expressly

declares that the filing of this Schedule 13D shall not be construed as an admission by it that it has formed any such group.

To the best of

Daré’s knowledge as of the date hereof, the name, business address, present principal occupation or employment and citizenship of each executive officer and director of Daré is set forth in

Schedule A

hereto, and the

business address of each person set forth in

Schedule A

is 10210 Campus Point Drive, Suite 150, San Diego, CA 92121. The information contained in

Schedule A

is incorporated herein by reference.

(d) – (e)

During the last five years, Daré

has not, and to the best of Daré‘s knowledge, none of the persons listed on

Schedule A

has (i) been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) been a party to a

civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violations with respect to such laws.

|

Item 3.

|

Source and Amount of Funds or Other Consideration.

|

As an inducement for Daré to enter into the

Stock Purchase Agreement described in Item 4 below and in consideration thereof, certain equity holders of Cerulean entered into the Support Agreement with Daré relating to the Daré Transaction (as defined in Item 4). In

addition, these equity holders of Cerulean granted Daré an irrevocable proxy with respect to the Cerulean securities covered by the Support Agreement. Daré did not pay additional consideration to the equity holders of Cerulean in

connection with the execution and delivery of the Support Agreement, and thus no funds were used for such purpose.

References to, and descriptions of, the Daré Transaction, the Stock Purchase Agreement, and the Support

Agreement, as set forth herein, are qualified in their entirety by reference to the Stock Purchase Agreement and the Support Agreement included as Exhibits 1 and 2, respectively, to this Statement, which are incorporated by reference herein in their

entirety.

|

Item 4.

|

Purpose of Transaction.

|

(a) and (b)

On March 19, 2017, Cerulean, Daré and the holders of capital stock and securities convertible into capital stock of Daré named therein (the

“

Selling Stockholders

”) entered into a Stock Purchase Agreement (the “

Stock Purchase Agreement

”), pursuant to which, among other things, subject to the satisfaction or waiver of the conditions set

forth in the Stock Purchase Agreement, each Selling Stockholder agreed to sell to Cerulean, and Cerulean agreed to purchase from each Selling Stockholder, all of the outstanding shares of capital stock, including those issuable upon conversion of

convertible securities, of Daré (the “

Daré Shares

”) owned by such Selling Stockholder (the “

Daré Transaction

”).

The Selling Stockholders own (and will own upon conversion of all outstanding convertible securities of Daré) 100% of the outstanding Daré

Shares and, following the consummation of the Daré Transaction, Daré will become a wholly owned subsidiary of Cerulean.

Subject to the

terms and conditions of the Stock Purchase Agreement, at the closing of the Daré Transaction, the Selling Stockholders will collectively receive a number of shares of Cerulean common stock equal to the product of the number of shares of

Daré stock held by such Selling Stockholder multiplied by an exchange ratio calculated based on the relative valuations of each of Daré and Cerulean at the closing of the Daré Transaction. Also, in connection with the

Daré Transaction, Cerulean will assume the (i) outstanding stock option awards of Daré, and (ii) outstanding warrants of Daré, each of which will be adjusted to reflect the exchange ratio for the Daré

Transaction. Immediately following the closing of the Daré Transaction, the shares issued to the Selling Stockholders in the Daré Transaction are expected to represent between approximately 51% and 70% (depending on the net cash

positions of Cerulean and Daré at closing) of the outstanding equity securities of Cerulean as of immediately following the consummation of the Daré Transaction.

Each of Cerulean, Daré and the Selling Stockholders has agreed to customary representations, warranties and covenants in the Stock Purchase Agreement

including, among others, covenants relating to (1) using commercially reasonable efforts to obtain the requisite approvals of the stockholders of Cerulean to the Daré Voting Proposal described below, (2) non-solicitation of

competing acquisition proposals by each of Cerulean and Daré, (3) Cerulean using commercially reasonable efforts to maintain the existing listing of the Company’s common stock on The NASDAQ Stock Market, Inc.

(“

NASDAQ

”), and (4) Cerulean’s and Daré’s conduct of their respective businesses during the period between the date of signing the Stock Purchase Agreement and the closing of the Daré Transaction.

Consummation of the Daré Transaction is subject to certain closing conditions, including, among other things, (1) approval of the issuance of

the shares of the Company’s common stock in the Daré Transaction by the stockholders of Cerulean in accordance with applicable NASDAQ rules (the “

Daré Voting Proposal

”), (2) the absence of any order,

executive order, stay, decree, judgment or injunction or statute, rule or regulation that makes the consummation of the Daré Transaction illegal, or otherwise prohibits the consummation of the Daré Transaction, and (3) the

approval of the NASDAQ Initial Listing Application—For Companies Conducting a Business Combination that Results in a Change of Control with respect to the shares of Cerulean common stock to be issued in connection with the Daré

Transaction. Each party’s obligation to consummate the Daré Transaction is also subject to other specified customary conditions, including (1) the representations and warranties of the other party being true and correct as of the

date of the Stock Purchase Agreement and as of the closing date of the Daré Transaction, generally subject to an overall material adverse effect qualification, and (2) the performance in all material respects by the other party of its

obligations under the Stock Purchase Agreement. The Stock Purchase Agreement contains certain termination rights for both Cerulean and Daré, and further provides that, upon termination of the Stock Purchase Agreement under specified

circumstances, Cerulean may be required to pay Daré a termination fee of $300,000, or Daré may be required to pay Cerulean a termination fee of $450,000.

Also in connection with the Stock Purchase Agreement, certain stockholders holding outstanding common stock of

Cerulean as of the date of the Stock Purchase Agreement (the “

Designated Equityholders

”) have each entered into a support agreement in favor of Daré (the “

Support Agreement

”), pursuant to which

such stockholders agree, among other things, to vote all of their shares of Cerulean capital stock in favor of the Daré Transaction and against any competing proposal.

The foregoing descriptions of the Stock Purchase Agreement, the Daré Transaction and the Support Agreement, and the transactions contemplated thereby,

in each case, do not purport to be complete and are qualified in their entirety by reference to the Stock Purchase Agreement, which is filed as Exhibit 1 hereto and which is incorporated herein by reference, and to the Support Agreement, which is

filed as Exhibit 2 hereto and which is incorporated herein by reference. The Stock Purchase Agreement and the Support Agreement have been included to provide investors and security holders with information regarding their terms. They are not

intended to provide any other factual information about Cerulean, Daré, the Selling Stockholders or their respective subsidiaries and affiliates. The Stock Purchase Agreement contains representations and warranties by Daré and the

Selling Stockholders, on the one hand, and by Cerulean, on the other hand, made solely for the benefit of the other. The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules

delivered by each party in connection with the signing of the Stock Purchase Agreement, and certain representations and warranties in the Stock Purchase Agreement were made as of a specified date, may be subject to a contractual standard of

materiality different from what might be viewed as material to investors, or may have been used for the purpose of allocating risk between the Selling Stockholders and Daré. Accordingly, the representations and warranties in the Stock

Purchase Agreement should not be relied on by any persons as characterizations of the actual state of facts about Cerulean at the time they were made or otherwise. In addition, information concerning the subject matter of the representations and

warranties may change after the date of the Stock Purchase Agreement, which subsequent information may or may not be fully reflected in Cerulean’s public disclosures.

(c)

Not Applicable.

(d)

Under the Stock Purchase Agreement, the Company has

agreed that promptly following the closing of the Daré Transaction, it will take all action necessary to fix the number of members of the board of directors of Cerulean at five (5); to cause to be elected to the board of directors the three

(3) such directors to be identified by Daré; and to obtain the resignations of certain of the Company’s existing directors and officers. In addition, the Company has agreed to take all action necessary to cause certain persons to be

appointed as executive officers of the Company.

(e)

In addition to any changes that may result from the Transaction described in Item 4(a) and (b) above, which are hereby incorporated by reference,

Cerulean may, if necessary, seek stockholder approval to effect a reverse split of Cerulean common stock at a ratio to be determined by Cerulean, which is intended to ensure that the listing requirements of NASDAQ are satisfied.

(f)

Not Applicable.

(g)

In

connection with the Daré Transaction, Cerulean will request that its stockholders approve resolutions authorizing Cerulean to amend its certificate of incorporation, by-laws and corporate governance documents to change the name of Cerulean

from “Cerulean Pharma, Inc.” to “Daré Bioscience, Inc.”, subject to the consummation of the Daré Transaction.

(h)

Not Applicable.

(i)

Not Applicable.

(j)

Other than as described above, Daré currently has no plans or proposals that relate to, or may result in, any of the matters listed in 4(a) –

(i) of Schedule 13D (although Daré reserves the right to develop such plans).

|

Item 5.

|

Interest in Securities of the Issuer.

|

(a) and (b)

As of the date hereof, the Reporting Person owns no shares of Cerulean common stock. For purposes of Rule 13d-3 under the Act (“

Rule

13d-3

”); however, as a result of entering into the Support Agreement, the Reporting Person may be deemed to possess shared voting power over, and therefore beneficially own for purposes of Rule 13d-3, the 6,029,782 shares of Cerulean

common stock that are beneficially owned by the Designated Equityholders. The 6,029,782 shares of Cerulean common stock, including 778,983 shares subject to options to acquire shares of Cerulean common stock exercisable within 60 days of

March 20, 2017 and warrants to purchase up to 30,809 shares of common stock of Cerulean exercisable within 60 days of March 20, 2017, over which the Reporting Person may be deemed to have shared voting power represent approximately 20.70%

of the issued and outstanding shares of common stock of Cerulean, based on the number of shares issued and outstanding on March 17, 2017 as represented by Cerulean in the Stock Purchase Agreement. Notwithstanding the preceding, the Reporting

Person hereby disclaims beneficial ownership of such shares of Cerulean common stock, and this Schedule 13D shall not be construed as an admission that the Reporting Person is, for any or all purposes, the beneficial owner of the securities covered

by this Schedule 13D.

(c)

Except as described in

this Schedule 13D, there have been no transactions in the shares of common stock of Cerulean effected by the Reporting Person or, to the best of the Reporting Person’s knowledge, any person or entity identified on

Schedule A

hereto,

during the last 60 days.

(d)

Other than the

Designated Equityholders identified in Item 4 who are party to the Support Agreement, to the best of the Reporting Person’s knowledge, neither the Reporting Person nor any of its respective directors and executive officers named in

Schedule A

hereto has or knows any other person who has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, any Cerulean common stock beneficially owned by the Reporting Person.

(e)

Not Applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

The

information set forth under Items 3, 4, and 5 and the agreements set forth in the Exhibits attached hereto are incorporated by reference. Other than the Stock Purchase Agreement and the Support Agreement described above, to the best of the Reporting

Person’s knowledge, there are no contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting Person, or any person listed on

Schedule A

hereto, and any person with respect to the securities of

Cerulean, including, but not limited to, transfer or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or loss, or the giving or withholding of

proxies, including any securities pledged or otherwise subject to a contingency the occurrence of which would give another person voting power or investment power over such securities.

|

Item 7.

|

Material to be Filed as Exhibits.

|

|

|

|

|

|

Exhibit

|

|

Title

|

|

|

|

|

1

|

|

Stock Purchase Agreement dated as of March 19, 2017, entered into by and among Cerulean Pharma Inc., Daré Bioscience, Inc. and equityholders of Daré Bioscience, Inc. named therein.

|

|

|

|

|

2

|

|

Support Agreement dated as of March 19, 2017, entered into by and among Cerulean Pharma Inc., Daré Bioscience, Inc. and shareholders of Cerulean Pharma Inc. named therein.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

Dated: March 28, 2017

|

|

|

|

DARÉ BIOSCIENCE, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Sabrina Martucci Johnson

|

|

|

|

|

|

Name:

|

|

Sabrina Martucci Johnson

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

SCHEDULE A

DIRECTORS AND EXECUTIVE OFFICERS OF DARÉ BIOSCIENCE, INC.

The following is a list of the directors and executive officers of Daré Bioscience, Inc. (“

Daré

”), setting forth the

name, residence or business address, present position with Daré and present principal occupation or employment (along with the name of any corporation or other organization in which such employment is conducted). All directors and officers

listed below are citizens of the United States and employed by Daré. The principal address of Daré and the current business address for each individual listed below is 10210 Campus Point Drive, Suite 150, San Diego, CA 92121.

|

|

|

|

|

|

|

Name of Directors

|

|

Citizenship

|

|

Present Principal Occupation

|

|

|

|

|

|

Sabrina Martucci Johnson

|

|

US

|

|

Sabrina Martucci Johnson serves as the Chief Executive Officer and a member of the board of directors of Daré. Ms. Johnson is also currently

part-time

Chief Financial Officer at the

California Institute for Biomedical Research, a non-profit research institution.

|

|

|

|

|

|

Roger Hawley

|

|

US

|

|

Roger Hawley serves as a member of the board of directors of Daré. Mr. Hawley also serves as a director of Zogenix, Inc. and provides consulting services to Alveo Technologies, Inc.

|

|

|

|

|

|

Executive Officers Who Are Not Directors

|

|

Citizenship

|

|

Present Principal Occupation

|

|

Lisa Walters-Hoffert

|

|

US

|

|

Lisa Walters-Hoffert serves as the Chief Financial Officer of Daré.

|

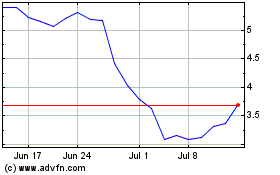

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Mar 2024 to Apr 2024

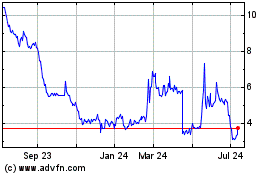

Dare Bioscience (NASDAQ:DARE)

Historical Stock Chart

From Apr 2023 to Apr 2024