The LGL Group, Inc. (NYSE MKT:LGL) (the “Company” or “LGL”),

announced results for the full year and quarter ended December 31,

2016.

Summary of 2016 Full-Year Financial Results:

- Revenues of $20.9 million, up 0.9%

compared to 2015

- Net income of $0.06 per share compared

to a net loss of ($0.27) per share in 2015

- Order backlog improved 19.9% to $10.5

million at December 31, 2016 from $8.8 million at December 31,

2015

- Adjusted EBITDA was $0.27 per share,

compared to $0.19 per share for 2015

Summary of Q4 2016 Financial Results:

- Revenues of $5.8 million, up 14.6%

compared to Q4 2015

- Net income of $0.08 per share compared

to a net loss of ($0.05) per share in Q4 2015

- Adjusted EBITDA was $0.12 per share,

compared to $0.05 per share for Q4 2015

Commenting on the Company’s 2016 results, Chairman and CEO,

Michael J. Ferrantino, Sr. stated, “All of the arrows in our

statement of operations and, for the first time in several years,

our balance sheet as well, are pointed north. In addition, our

share price from the start of the year to the end of the year moved

from $3.70 per share to $5.02 per share, an increase of 35.7%.”

Mr. Ferrantino continued, “Although I am pleased with the

increase in our share price I am still not satisfied, so our work

continues. Our strategy is clear and consistent. We are about

growth, both as it relates to our organic strategy of introducing

new market driven products, as well as our initiative to add on

synergistic pieces to LGL like the purchase of Precise Time and

Frequency, Inc. (“PTF”) in September. PTF added a small amount to

our revenue in 2016 and incurred a small loss due to one-time costs

related to moving the business over to our systems. I do expect

that in Q1 2017 PTF will be accretive.”

In closing, Mr. Ferrantino added, “To our shareholders who have

stood by us, thank you for your patience. All of us at LGL and our

subsidiaries are doing our best to see you are properly rewarded.

And to our new shareholders and potential shareholders, I believe

our future is only limited by our bandwidth which continues to

broaden every year.”

About The LGL Group, Inc.

The LGL Group, Inc., through its two principal subsidiaries

MtronPTI and PTF, designs, manufactures and markets

highly-engineered electronic components used to control the

frequency or timing of signals in electronic circuits, and designs

high performance Frequency and Time reference standards that form

the basis for timing and synchronization in various

applications.

Headquartered in Orlando, Florida, the Company has additional

design and manufacturing facilities in Yankton, South Dakota,

Wakefield, Massachusetts and Noida, India, with local sales offices

in Hong Kong, Sacramento, California and Austin, Texas.

For more information on the Company and its products and

services, contact Patti Smith at The LGL Group, Inc., 2525 Shader

Rd., Orlando, Florida 32804, (407) 298-2000, or visit

www.lglgroup.com and www.mtronpti.com.

Caution Concerning Forward-Looking Statements

This press release may contain forward-looking statements made

in reliance upon the safe harbor provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21 E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include all statements that do not relate solely to

historical or current facts, and can be identified by the use of

words such as “may,” “will,” “expect,” “project,” “estimate,”

“anticipate,” “plan,” “believe,” “potential,” “should,” “continue”

or the negative versions of those words or other comparable words.

These forward-looking statements are not guarantees of future

actions or performance. These forward-looking statements are based

on information currently available to us and our current plans or

expectations, and are subject to a number of uncertainties and

risks that could significantly affect current plans, anticipated

actions and our future financial condition and results. Certain of

these risks and uncertainties are described in greater detail in

our filings with the Securities and Exchange Commission. We are

under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a

result of new information, future events or otherwise.

THE LGL GROUP, INC. Condensed Consolidated Statements of

Operations (Dollars in Thousands, Except Shares and Per

Share Amounts) For the year ended December

31, 2016 2015

(Unaudited)

REVENUES $ 20,891 $ 20,713 Costs and expenses:

Manufacturing cost of sales 13,858 13,863 Engineering, selling and

administrative 7,194 7,638 OPERATING

LOSS (161 ) (788 ) Total other income 144 85

LOSS BEFORE INCOME TAXES (17 ) (703 ) Income tax benefit

(provision) 165 (8 ) NET INCOME (LOSS)

$ 148 $ (711 ) Weighted average number of shares used

in basic EPS calculation 2,665,043 2,640,803

Weighted average number of shares used in diluted EPS

calculation 2,665,730 2,640,803 BASIC

AND DILUTED NET INCOME (LOSS) PER COMMON SHARE $ 0.06 $

(0.27 )

For the quarter ended December

31,

2016 2015

REVENUES $ 5,776 $ 5,042 Costs and expenses: Manufacturing

cost of sales 3,789 3,366 Engineering, selling and administrative

1,984 1,816 OPERATING INCOME (LOSS) 3 (140 )

Total other income (expense) 59 (2 ) INCOME (LOSS)

BEFORE INCOME TAXES 62 (142 ) Income tax benefit (provision)

164 5 NET INCOME (LOSS) $ 226 $ (137 )

Weighted average number of shares used in basic EPS calculation

2,664,123 2,655,668 Weighted average number of

shares used in diluted EPS calculation 2,672,549

2,655,668 BASIC AND DILUTED NET INCOME (LOSS) PER COMMON

SHARE $ 0.08 $ (0.05 )

THE LGL GROUP, INC.

Condensed Consolidated Balance Sheets

(Dollars in Thousands)

December 31,

2016

December 31,

2015

(Unaudited) ASSETS Cash and cash equivalents $ 2,778 $ 5,553

Marketable securities 2,770 56 Accounts receivable, net of

allowances of $31 and $34, respectively 3,504 2,606 Inventories,

net 3,638 3,546 Prepaid expenses and other current assets

200 191 Total Current Assets 12,890 11,952 Property, plant

and equipment, net 2,711 3,165 Intangible assets, net 628 475

Deferred income taxes, net 214 — Other assets, net 203

211 Total Assets $ 16,646 $ 15,803 LIABILITIES AND

STOCKHOLDERS’ EQUITY Total Liabilities 2,755 2,076 Stockholders’

Equity 13,891 13,727 Total Liabilities and

Stockholders’ Equity $ 16,646 $ 15,803

Reconciliations of GAAP to Non-GAAP Measures

To supplement our consolidated condensed financial statements

presented on a GAAP(generally accepted accounting principles)

basis, the Company uses certain non-GAAP measures, including

Adjusted EBITDA, which we define as net income (loss) adjusted to

exclude depreciation and amortization expense, interest income

(expense), provision (benefit) for income taxes, stock-based

compensation expense and other items we believe are discrete events

which have a significant impact on comparable GAAP measures and

could distort an evaluation of our normal operating performance.

These adjustments to our GAAP results are made with the intent of

providing both management and investors a more complete

understanding of the underlying operational results and trends and

our marketplace performance. The presentation of this additional

information is not meant to be considered in isolation or as a

substitute for net earnings or diluted earnings per share prepared

in accordance with generally accepted accounting principles in the

United States.

Reconciliation of GAAP Income (Loss)

Before Income Taxes to Non-GAAP Adjusted EBITDA:

For the period ended December 31, 2016 (000’s, except shares and

per share amounts) Three months Twelve

months Net income (loss) before income taxes $ 62 $ (17

) Interest expense 2 22 Depreciation and amortization 185 772

Non-cash stock compensation 71 67 Gain on disposal of assets — (110

) Bargain purchase gain — (4 ) Adjusted EBITDA $ 320

$ 730

Basic per share information:

Weighted average shares outstanding. 2,664,123

2,665,043 Adjusted EBITDA. $ 0.12 $ 0.27

Diluted per share information:

Weighted average shares outstanding. 2,672,549

2,665,730 Adjusted EBITDA. $ 0.12 $ 0.27

For the period ended December 31, 2015 (000’s, except shares

and per share amounts)

Three months Twelve months Net

loss before income taxes $ (142 ) $ (703 ) Interest expense 7 32

Depreciation and amortization 212 870 Non-cash stock compensation

64 265 Impairment of note receivable — 38

Adjusted EBITDA $ 141 $ 502 Weighted

average number of shares used in basic and diluted EPS calculation

2,655,668 2,640,803 Adjusted EBITDA per

share $ 0.05 $ 0.19

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170321005347/en/

The LGL Group, Inc.Patti Smith,

407-298-2000pasmith@lglgroup.com

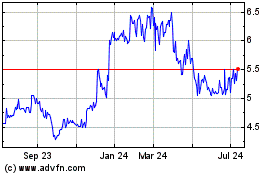

LGL (AMEX:LGL)

Historical Stock Chart

From Aug 2024 to Sep 2024

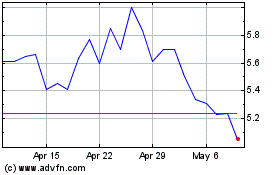

LGL (AMEX:LGL)

Historical Stock Chart

From Sep 2023 to Sep 2024