Pre-tax income from continuing operations of

$0.3 million for the fourth quarter of 2016 versus pre-tax loss

from continuing operations of $(0.9) million for the fourth quarter

of 2015

Adjusted EBITDA of $1.6 million for the fourth

quarter of 2016 versus $0.4 million for the fourth quarter of

2015

Pre-tax loss from continuing operations of

$(2.3) million for the full year 2016 versus $(6.5) million for

2015

Adjusted EBITDA of $2.6 million for the full

year 2016 versus $1.0 million for 2015

Luna Innovations Incorporated (NASDAQ: LUNA) today announced its

financial results for the fourth quarter and year ended December

31, 2016.

For the three months ended December 31, 2016, the company

recognized pre-tax income from continuing operations of $0.3

million compared to a pre-tax loss from continuing operations of

$(0.9) million for the three months ended December 31, 2015.

Adjusted earnings before interest, taxes, depreciation and

amortization ("adjusted EBITDA") improved to $1.6 million for the

three months ended December 31, 2016, compared to adjusted

EBITDA of $0.4 million for the three months ended December 31,

2015. Adjusted EBITDA is reconciled to pre-tax income (loss) from

continuing operations for the respective periods within the tables

included in this release. Net income attributable to common

stockholders was $0.3 million for the three months ended

December 31, 2016, compared to net income attributable to

common stockholders of $7.9 million for the three months ended

December 31, 2015. Net income for the three months ended

December 31, 2015, included the realization of an $8.3 million

gain associated with the receipt in December 2015 of the final

payments earned with respect to the company's sale of its medical

shape sensing technology in 2014.

“Following our merger with API in 2015, we have remained focused

on the successful execution of our key strategic initiatives and

the realization of operational synergies from the merger to drive

the company to profitability,” said My Chung, president and chief

executive officer of Luna. “We are extremely pleased with the

progress we demonstrated throughout 2016 in increasing our revenues

from our high speed optical receiver products and our ODiSI

products to fuel our growth and improve our profitability. As a

result of this success, for the fourth quarter of 2016 we are able

to report positive quarterly earnings from continuing operations

for the first time since 2011."

Fourth Quarter Financial

Highlights

Total revenues for the three months ended December 31,

2016, were $16.0 million, compared to $15.5 million for the three

months ended December 31, 2015. Technology development

revenues grew to $4.7 million for the three months ended

December 31, 2016, from $3.7 million for the three months

ended December 31, 2015. Product and licensing revenue were

$11.3 million for the three months ended December 31, 2016,

compared to $11.7 million for the three months ended

December 31, 2015.

Gross profit increased to $6.1 million, or 38% of total revenue,

for the three months ended December 31, 2016, compared to

gross profit of $5.0 million, or 33% of total revenue, for the

three months ended December 31, 2015. The improvement in gross

margin percentage resulted from a change in product mix in the

fourth quarter of 2016, principally due to a larger volume of sales

of test and measurement equipment, including ODiSI products, which

typically carry a higher gross margin than do sales of integrated

coherent receivers, which were a proportionately larger component

of revenues for the three months ended December 31, 2015.

Selling, general and administrative expenses increased slightly

to $4.3 million for the three months ended December 31, 2016,

compared to $4.2 million for the three months ended

December 31, 2015. Research, development and engineering

expenses decreased to $1.3 million for the three months ended

December 31, 2016, compared to $1.6 million for the three

months ended December 31, 2015.

Before taxes, the company recognized income from continuing

operations of $0.3 million for the three months ended

December 31, 2016, compared to a pre-tax loss from continuing

operations of $(0.9) million for the three months ended

December 31, 2015.

The company had no income from discontinued operations for the

three months ended December 31, 2016. Income from discontinued

operations was $8.3 million for the three months ended December 31,

2015, representing the payment received by the company in December

2015 to settle all remaining obligations associated with future

technical milestone payments and royalties related to the sale of

the company's medical shape sensing business sold to Intuitive

Surgical in 2014.

Net income attributable to common stockholders was $0.3 million

for the three months ended December 31, 2016, compared to net

income attributable to common stockholders of $7.9 million for the

three months ended December 31, 2015. The decrease in net

income attributable to common stockholders was due to the income

from discontinued operations recognized in December 2015. Adjusted

EBITDA improved to $1.6 million for the three months ended

December 31, 2016, compared to adjusted EBITDA of $0.4 million

for the three months ended December 31, 2015.

Cash and cash equivalents were $12.8 million as of

December 31, 2016, compared to $13.2 million as of September

30, 2016, and $17.5 million as of December 31, 2015. The

decrease in cash and cash equivalents during the three months ended

December 31, 2016 was primarily attributable to $0.4 million

of long term debt repayment during the quarter. The decrease in

cash and cash equivalents for the year ended December 31, 2016

included $1.9 million of long term debt repayment, $1.5 million of

capital expenditures, and $0.3 million of common stock repurchase

activity.

Full Year 2016 Financial

Highlights

Total revenues were $59.2 million for the year ended

December 31, 2016, compared to $44.0 million for the year

ended December 31, 2015. Revenues for 2015 included the

operations of Advanced Photonix, Inc. ("API") for the period from

the closing of the company's merger with API on May 8, 2015 through

December 31, 2015. Products and licensing revenues increased to

$42.4 million for the year ended December 31, 2016, compared

to $30.4 million for the year ended December 31, 2015.

Technology development revenues increased to $16.8 million for the

year ended December 31, 2016 compared to $13.6 million for the

year ended December 31, 2015.

Gross profit for the year ended December 31, 2016, grew to

$21.7 million compared to $16.5 million for the year ended

December 31, 2015. The gross margin was 37% of total revenues

for both 2016 and 2015.

Selling, general and administrative expenses decreased to $18.1

million for the year ended December 31, 2016, compared to

$18.5 million for the year ended December 31, 2015.

Research, development and engineering expenses increased to $5.5

million for the year ended December 31, 2016, compared to $4.3

million for the year ended December 31, 2015. Research,

development and engineering expenses in 2015 included expenses

associated with the operations of API for the period from the

closing of the merger with API on May 8, 2015 through December 31,

2015.

The company's resulting pre-tax loss from continuing operations

improved to $(2.3) million for the year ended December 31,

2016, compared to a pre-tax loss from continuing operations of

$(6.5) million for the year ended December 31, 2015.

For the year ended December 31, 2015, the company

recognized income from discontinued operations of $8.3 million

related to the after-tax gain associated with the sale of the

company's medical shape sensing business.

The company recognized a net loss attributable to common

stockholders of $(2.5) million for the year ended December 31,

2016, compared to net income attributable to common stockholders of

$2.2 million for the year ended December 31, 2015. The net income

for 2015 resulted from the income from discontinued operations

discussed above. Adjusted EBITDA improved $1.6 million, to $2.6

million for the year ended December 31, 2016, compared to $1.0

million for the year ended December 31, 2015.

Non-GAAP Measures

In evaluating the operating performance of its business, the

company's management considers adjusted EBITDA, which excludes

certain charges and credits that are required by generally accepted

accounting principles (“GAAP”). Adjusted EBITDA provides useful

information to both management and investors by excluding the

effect of certain non-cash expenses and items that the company

believes may not be indicative of its operating performance,

because either they are unusual and the company does not expect

them to recur in the ordinary course of its business or they are

unrelated to the ongoing operation of the business in the ordinary

course. Adjusted EBITDA should be considered in addition to results

prepared in accordance with GAAP, but should not be considered a

substitute for, or superior to, GAAP results. Adjusted EBITDA has

been reconciled to the nearest GAAP measure in the table following

the financial statements attached to this press release.

Conference Call

Information

As previously announced, the company will conduct an investor

conference call at 5:00 p.m. (EDT) today to discuss its financial

results and business developments for the fourth quarter of 2016

and the full year ended December 31, 2016. The call can be

accessed by dialing 855.236.2056 domestically or

267.753.2162 internationally prior to the start of the call. The

participant access code is 84325923. Investors are advised

to dial in at least five minutes prior to the call to register. The

conference call will also be webcast live over the Internet. The

webcast can be accessed by logging on to the “Investor Relations”

section of the company's website, www.lunainc.com, prior to the event. The webcast

will be archived under the “Webcasts and Presentations” section of

the Luna website for at least 30 days following the conference

call.

About Luna:

Luna Innovations Incorporated (www.lunainc.com) is a leader in

optical technology, providing unique capabilities in high speed

optoelectronics and high performance fiber optic test products for

the telecommunications industry and distributed fiber optic sensing

for the aerospace and automotive industries. Luna is organized into

two business segments, which work closely together to turn ideas

into products: a Technology Development segment and a Products and

Licensing segment. Luna's business model is designed to accelerate

the process of bringing new and innovative technologies to

market.

Forward-Looking Statements:

The statements in this release that are not historical facts

constitute “forward-looking statements” made pursuant to the safe

harbor provision of the Private Securities Litigation Reform Act of

1995 that involve risks and uncertainties. These statements include

the company's expectations regarding the company’s future financial

performance. Management cautions the reader that these

forward-looking statements are only predictions and are subject to

a number of both known and unknown risks and uncertainties, and

actual results, performance, and/or achievements of the company may

differ materially from the future results, performance, and/or

achievements expressed or implied by these forward-looking

statements as a result of a number of factors. These factors

include, without limitation, failure of demand for the company’s

products and services to meet expectations, integration or other

operational issues related to the merger, technological challenges

and those risks and uncertainties set forth in the company’s

periodic reports and other filings with the Securities and Exchange

Commission ("SEC"). Such filings are available on the SEC’s website

at www.sec.gov and on the company’s website at www.lunainc.com. The

statements made in this release are based on information available

to the company as of the date of this release and the company

undertakes no obligation to update any of the forward-looking

statements after the date of this release.

Luna Innovations Incorporated Consolidated

Statements of Operations Three months ended December

31, Years ended December 31, 2016

2015 2016 2015 (unaudited) (unaudited)

Revenues: Technology development revenues $ 4,653,141 $ 3,717,820 $

16,825,157 $ 13,599,048 Products and licensing revenues 11,305,018

11,732,459 42,385,839 30,421,310 Total

revenues 15,958,159 15,450,279 59,210,996

44,020,358 Cost of revenues: Technology development costs

3,544,065 3,159,858 12,711,447 10,378,616 Products and licensing

costs 6,303,086 7,254,523 24,764,788

17,141,079 Total cost of revenues 9,847,151

10,414,381 37,476,235 27,519,695 Gross profit

6,111,008 5,035,898 21,734,761 16,500,663

Operating expense: Selling, general and administrative

4,346,919 4,209,480 18,139,966 18,481,270 Research, development,

and engineering 1,337,306 1,641,783 5,532,130

4,268,988 Total operating expense 5,684,225 5,851,263

23,672,096 22,750,258 Operating income/(loss)

426,783 (815,365 ) (1,937,335 ) (6,249,595 ) Other expense:

Other income/(expense), net 1,118 (4,769 ) (35,849 ) (9,967 )

Interest expense, net (82,253 ) (83,882 ) (320,942 ) (220,403 )

Total other expense (81,135 ) (88,651 ) (356,791 ) (230,370 )

Income/(loss) from continuing operations before income taxes

345,648 (904,016 ) (2,294,126 ) (6,479,965 ) Income tax

expense/(benefit) 39,488 (489,709 ) 75,366 (470,605 )

Income/(loss) from continuing operations 306,160 (414,307 )

(2,369,492 ) (6,009,360 ) Income from discontinued operations, net

of income taxes — 8,328,790 — 8,326,386

Net income/(loss) 306,160 7,914,483 (2,369,492 ) 2,317,026

Preferred stock dividend 30,527 21,012 105,258

85,830 Net income/(loss) attributable to common stockholders

$ 275,633 $ 7,893,471 $ (2,474,750 ) $ 2,231,196

Net income/(loss) per share from continuing operations:

Basic and diluted $ 0.01 $ (0.02 ) $ (0.09 ) $ (0.26 ) Net income

per share from discontinued operations: Basic and diluted $ — $

0.30 $ — $ 0.36 Net income/(loss) per share attributable to common

stockholders: Basic and diluted $ 0.01 $ 0.29 $ (0.09 ) $ 0.10

Weighted average shares: Basic 27,538,606 27,464,993 27,547,217

23,026,494 Diluted 32,563,013 27,464,993 27,547,217 23,026,494

Luna Innovations Incorporated Consolidated

Balance Sheets

December 31,2016

December 31,2015

(unaudited)

Assets Current assets: Cash and cash equivalents

$ 12,802,458 $ 17,464,040 Accounts receivable, net 14,297,725

11,034,557 Inventory, net 8,370,235 8,863,167 Prepaid expenses

1,627,175 1,388,439 Total current assets 37,097,593

38,750,203 Property and equipment, net 6,780,838 6,614,238

Intangible assets, net 8,681,263 10,404,312 Goodwill 2,348,331

2,274,112 Other assets 88,948 88,948

Total

assets $ 54,996,973 $

58,131,813 Liabilities and stockholders’

equity Current Liabilities: Current portion of long term debt

obligation 1,833,333 1,833,333 Current portion of capital lease

obligation 52,128 31,459 Accounts payable 4,466,192 4,054,425

Accrued liabilities 8,667,100 8,304,686 Deferred revenue 949,603

1,109,759 Total current liabilities 15,968,356

15,333,662 Long-term deferred rent 1,403,957 1,564,229 Long-term

debt obligation 2,420,032 4,291,667 Long-term capital lease

obligation 114,940 35,237

Total liabilities

19,907,285 21,224,795 Commitments and

contingencies Stockholders’ equity: Preferred stock, par value

$0.001, 1,321,514 shares authorized, issued and outstanding at

December 31, 2016 and 2015 1,322 1,322 Common stock, par value

$0.001, 100,000,000 shares authorized, 27,988,104 and 27,644,833

shares issued, 27,541,277 and 27,477,181 shares outstanding at

December 31, 2016 and 2015, respectively 28,600 28,178 Treasury

stock at cost, 167,652 shares at December 31, 2016 and 22,725

shares at December 31, 2015 (517,987 ) (184,934 ) Additional

paid-in capital 82,451,958 81,461,907 Accumulated deficit

(46,874,205 ) (44,399,455 )

Total stockholders’ equity

35,089,688 36,907,018 Total

liabilities and stockholders’ equity $ 54,996,973

$ 58,131,813 Luna Innovations

Incorporated Consolidated Statements of Cash Flows

Years ended December 31, 2016

2015 (unaudited)

Cash flows used in operating

activities: Net income $ (2,369,492 ) $ 2,317,026 Adjustments

to reconcile net income to net cash used in operating activities:

Depreciation and amortization 3,713,879 2,457,032 Stock-based

compensation 860,215 1,124,379 Gain on sale of discontinued

operations, net of income taxes — (8,326,386 ) Allowance for

doubtful accounts 305,593 10,375 Tax benefit from utilization of

loss from current year operations — (510,772 ) Changes in operating

assets and liabilities: Accounts receivable (3,568,761 ) (2,040,323

) Inventory 492,932 (252,934 ) Other assets (238,736 ) (131,411 )

Accounts payable and accrued expenses 564,689 16,429 Deferred

credits (160,156 ) 248,678 Net cash used in operating

activities (399,837 ) (5,087,907 )

Cash flows (used in)/provided

by investing activities: Acquisition of property and equipment

(1,509,984 ) (710,348 ) Intangible property costs (490,200 )

(367,050 ) Cash acquired in business combination — 374,517 Proceeds

from sale of discontinued operations, net — 8,997,595

Net cash (used in)/provided by investing activities (2,000,184 )

8,294,714

Cash flows (used in)/ provided by/ financing

activities: Payments on debt obligations (1,871,635 )

(6,712,355 ) Payments on capital lease obligation (56,873 ) (77,184

) Purchase of treasury stock (333,053 ) (152,713 ) Borrowings under

term loans — 7,000,000 Proceeds from the exercise of options and

warrants — 82,516 Net cash (used in)/provided by

financing activities (2,261,561 ) 140,264

Net change in

cash and cash equivalents (4,661,582 ) 3,347,071 Cash and cash

equivalents—beginning of period 17,464,040 14,116,969

Cash and cash equivalents—end of period $ 12,802,458 $

17,464,040

Supplemental disclosure of cash flow

information Cash paid for interest $ 308,116 $ 187,017 Dividend

on preferred stock, 79,292 shares of common stock issuable for each

of the years ended December 31, 2016 and 2015 $ 105,258 $ 85,830

Cash paid for income taxes $ 233,732 $ 40,167 Cash received for

income tax refunds $ 67,127 $ —

Luna Innovations

Incorporated Reconciliation of Income/(Loss) from Continuing

Operations Before Income Taxes to EBITDA and Adjusted EBITDA

Three months ended December 31, Year

endedDecember 31, 2016 2015

2016 2015 (unaudited)

(unaudited) Income/(loss) from continuing operations before

income taxes $ 345,648 $ (904,016 ) $ (2,294,126 ) $

(6,479,965 ) Interest expense 82,253 83,882 320,942 220,403

Depreciation and amortization 954,002 908,224

3,713,879 2,457,032 EBITDA 1,381,903 88,090 1,740,695

(3,802,530 ) Share-based compensation 194,861 277,714 860,215

1,124,379 Transaction costs — 54,840 —

3,704,019 Adjusted EBITDA $ 1,576,764 $ 420,644

$ 2,600,910 $ 1,025,868

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170316006261/en/

Luna Innovations IncorporatedInvestor Contact:Dale

Messick, CFO1 540-769-8400IR@lunainc.com

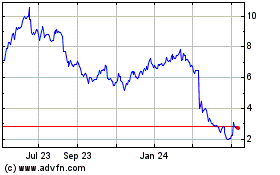

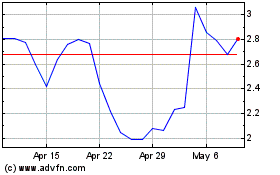

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2023 to Apr 2024