|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

OMB APPROVAL

|

|

|

Washington, D.C. 20549

|

OMB Number: 3235-0381

|

|

|

|

Expires: September 30, 2018

|

|

|

FORM 40-F

|

Estimated average burden

hours per response. . . ...429.93

|

[Check one]

|

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12

OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

OR

|

|

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR

15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended:

December 31, 2016

Commission File Number:

001-34406

|

ADVANTAGE OIL & GAS LTD.

|

|

(Exact name of Registrant as specified in its charter)

|

|

|

|

N/A

|

|

(Translation of Registrant’s name into English (if applicable))

|

|

|

|

ALBERTA

|

|

(Province or other jurisdiction of incorporation or organization):

|

|

|

|

1311

|

|

(Primary Standard Industrial Classification Code Number (if applicable))

|

|

|

|

N/A

|

|

(I.R.S. Employer Identification Number (if applicable))

|

|

|

|

Suite 300, 440 – 2 Avenue SW, Calgary, Alberta T2P 5E9 (403) 718-8000

|

|

(Address and telephone number of Registrant’s principal executive offices)

|

|

|

|

Corporation Service Company

|

|

1133 Avenue of Americas, 31st Floor, New York, NY 10036 1-800-927-9800

|

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

|

Securities registered or to be registered pursuant to Section 12(b)

of the Act.

|

Common Shares

|

|

New York Stock Exchange

|

|

Title of each class

|

|

Name of each exchange on

which registered

|

Securities registered or to be registered pursuant to Section

12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant

to Section 15(d) of the Act.

None

(Title of Class)

|

SEC2285(01-12)

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

For annual reports, indicate by check mark the information filed

with this Form:

Annual

information form

þ

Audited annual financial statements

þ

Indicate the number of outstanding shares of each of the issuer’s

classes of capital or common stock as of the close of the period covered by the annual report.

Common Shares: 184,654,333

Indicate by check mark whether the Registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for

such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements

for the past 90 days.

Yes

þ

No

☐

Indicate by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant

was required to submit and post such files).

Yes

¨

No

¨

DOCUMENTS INCLUDED IN THIS FORM

The following documents are included in the

Form:

|

No.

|

Document

|

|

1.

|

Annual Information Form of the Registrant for the year ended December 31, 2016 (filed herein as Exhibit 99.1)

|

|

|

|

|

2.

|

Consolidated Financial Statements of the Registrant for the fiscal year ended December 31, 2016, prepared under International Financial Reporting Standards as issued by the International Accounting Standards Board (filed herein as Exhibit 99.2)

|

|

|

|

|

3.

|

Consolidated Management’s Discussion and Analysis of the Registrant for the fiscal year ended December 31, 2016 (filed herein as Exhibit 99.3).

|

|

|

|

|

4.

|

Consent of PricewaterhouseCoopers LLP to the inclusion of the Auditors’ Report dated March 2, 2017 on the Registrant’s Audited Consolidated Financial Statements for the fiscal year ended December 31, 2016.

|

|

|

|

|

5.

|

Consent of Sproule Associates Limited to the incorporation by reference herein of its Statement of Reserves Data and other Information in Form 51-101F1, which statement and report is contained in the Registrant’s Annual Information Form for the fiscal year ended December 31, 2016.

|

|

|

|

|

6.

|

CEO Certification pursuant to rule 13a-14(a) of the Exchange Act.

|

|

|

|

|

7.

|

CFO Certification pursuant to rule 13a-14(a) of the Exchange Act.

|

|

|

|

|

8.

|

CEO Certification pursuant to U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

9.

|

CFO Certification pursuant to U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

PRINCIPAL DOCUMENTS

A. Annual

Information Form

For the Registrant’s

Annual Information Form for the fiscal year ended December 31, 2016, see Exhibit 99.1 of this Annual Report on Form 40-F.

B. Audited Annual Financial

Statements

For the Registrant’s

Audited Consolidated Financial Statements for the year ended December 31, 2016, including the report of its Independent Auditor

with respect thereto, see Exhibit 99.2 of this Annual Report on Form 40-F.

C. Consolidated Management’s

Discussion and Analysis

For the Registrant’s

Consolidated Management’s Discussion and Analysis of the operating and financial results for the year ended December 31,

2016, see Exhibit 99.3 of this Annual Report on Form 40-F.

CERTIFICATIONS AND DISCLOSURES REGARDING

CONTROLS AND PROCEDURES

A. CERTIFICATIONS.

See Exhibits 31.1 and 31.2 to this Annual Report on Form 40-F.

B. DISCLOSURE

CONTROLS AND PROCEDURES. As of the end of the Registrant’s fiscal year ended December 31, 2016, an evaluation of the effectiveness

of the Registrant’s “disclosure controls and procedures” (as such term is defined in Rules 13a-15(e) and 15d-15(e)

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) was carried out by the Registrant’s

management with the participation of the principal executive officer and principal financial officer. Based upon that evaluation,

the Registrant’s principal executive officer and principal financial officer have concluded that as of the end of that fiscal

year, the Registrant’s disclosure controls and procedures are effective to ensure that information required to be disclosed

by the Registrant in reports that it files or submits under the Exchange Act is (i) recorded, processed, summarized and reported

within the time periods specified in Securities and Exchange Commission rules and forms and (ii) accumulated and communicated to

the Registrant’s management, including its principal executive officer and principal financial officer, to allow timely decisions

regarding required disclosure.

It should be noted that while

the Registrant’s principal executive officer and principal financial officer believe that the Registrant’s disclosure

controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that the Registrant’s

disclosure controls and procedures or internal control over financial reporting will prevent all errors and fraud. A control system,

no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control

system are met. Reference is made in the “Evaluation of Disclosure Controls and Procedures” and “Evaluation of

Internal Controls over Financial Reporting” sections of Management’s Discussion and Analysis of the Registrant for

the fiscal year ended December 31, 2016, included herein.

C. MANAGEMENT’S

ANNUAL REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING. The required disclosure is included in “Management’s Report

on Internal Control over Financial Reporting” that accompanies the Registrant’s Consolidated Financial Statements for

the fiscal year ended December 31, 2016, filed as part of this Annual Report on Form 40-F.

D. ATTESTATION

REPORT OF THE INDEPENDENT AUDITOR. The required disclosure is included in the “Independent Auditor’s Report”

that accompanies the Registrant’s Consolidated Financial Statements for the fiscal year ended December 31, 2016, filed as

part of this Annual Report on Form 40-F.

E. CHANGES

IN INTERNAL CONTROL OVER FINANCIAL REPORTING. During the fiscal year ended December 31, 2016, there were no significant changes

in the Registrant’s internal control over financial reporting that have materially affected, or are reasonably likely to

materially affect, the Registrant’s internal control over financial reporting. Reference is made in the “Evaluation

of Internal Controls over Financial Reporting” section of Management’s Discussion and Analysis of the Registrant for

the fiscal year ended December 31, 2016, included herein.

NOTICES PURSUANT TO REGULATION BTR

None.

CODE OF ETHICS FOR CHIEF EXECUTIVE OFFICER

AND SENIOR FINANCIAL OFFICERS

The Registrant has adopted

a Code of Ethics for its senior officers, principal financial officer and controller or principal accounting officer, directors

and employees. This code applies to the President and Chief Executive Officer, Vice President Finance and Chief Financial Officer,

Senior Vice President, Directors and employees. It is available on the Registrant’s web site at

www.advantageog.com

and in print to any shareholder who requests it. All amendments to the code, and all waivers of the code with respect to any of

the officers covered by it, will be posted on the Registrant’s web site and provided in print to any shareholder who requests

them.

AUDIT COMMITTEE

Identification of Audit Committee

The following individuals

comprise the entire membership of the Advantage Audit Committee: Paul G. Haggis, Stephen E. Balog, and Jill Angevine.

Audit Committee Financial Experts

Paul G. Haggis has been determined

by the board of the Registrant to meet the “audit committee financial expert” criteria prescribed by the Securities

and Exchange Commission and has been designated as audit committee financial expert for the Audit Committee of the board of the

Registrant.

Each of the directors serving

on the Audit Committee has also been determined by the board of the Registrant to be independent within the criteria established

by the New York Stock Exchange, Inc. for audit committee membership.

PRINCIPAL ACCOUNTING FEES

AND

SERVICES – INDEPENDENT AUDITORS

Fees payable to the Registrant’s

independent auditors for the years ended December 31, 2016 and December 31, 2015, totaled $364,400 and $361,800, respectively,

as detailed in the following tables. All funds are in Canadian dollars.

The following table discloses

fees billed to the Registrant by its current auditors, PricewaterhouseCoopers LLP:

|

|

|

Year ended

December 31,

2016

|

|

|

Year ended

December 31,

2015

|

|

|

Audit Fees

|

|

$

|

263,000

|

|

|

$

|

276,800

|

|

|

Audit Related Fees

|

|

|

45,000

|

|

|

|

60,000

|

|

|

Tax Fees

|

|

|

16,500

|

|

|

|

25,000

|

|

|

All Other Fees

|

|

|

39,900

|

|

|

|

-

|

|

|

TOTAL

|

|

$

|

364,400

|

|

|

$

|

361,800

|

|

The nature of the services provided by the

Registrant’s independent auditors under each of the categories indicated in the table is described below.

Audit Fees

Audit fees were for professional services rendered

by the Registrant’s independent auditors for the audit of the Registrant’s annual financial statements and services

provided in connection with statutory and regulatory filings or engagements. These services include audit or review of financials

forming part of such prospectus.

Audit-Related Fees

Audit-related fees were for assurance and related

services reasonably related to the performance of the audit or review of the annual statements and are not reported under “Audit

Fees” above.

Tax Fees

Tax fees were for tax advice and tax planning

professional services. These services consisted of general tax planning and advisory services relating to common forms of domestic

and international taxation (i.e., income tax, capital tax, goods and services tax, scientific research and experimental development

tax credits).

All Other Fees

Work related to Offering.

PREAPPROVAL POLICIES AND PROCEDURES

In 2016, Advantage’s

Audit Committee pre-approved all audit, audit-related and tax fees. The Audit Committee will be informed routinely as to the non-audit

services actually provided by the auditor pursuant to this pre-approval process. The auditors also present the estimate for the

annual audit related services to the Audit Committee for approval prior to undertaking the annual audit of the financial statements.

OFF-BALANCE SHEET ARRANGEMENTS

None.

CONTRACTUAL OBLIGATIONS

|

|

|

Payments due by period (Cdn$MM)

|

|

|

|

|

Total

|

|

|

Less than 1

year

|

|

|

1-3 years

|

|

|

3-5 years

|

|

|

More

than 5

years

|

|

|

Building Leases

|

|

$

|

3.0

|

|

|

$

|

1.1

|

|

|

$

|

1.9

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Pipeline/Transportation

|

|

$

|

180.2

|

|

|

$

|

24.9

|

|

|

$

|

54.0

|

|

|

$

|

39.8

|

|

|

$

|

61.5

|

|

|

Bank Indebtedness

(1) (2)

|

|

$

|

163.3

|

|

|

$

|

6.9

|

|

|

$

|

156.4

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Total Contractual Obligations

|

|

$

|

346.5

|

|

|

$

|

32.9

|

|

|

$

|

212.3

|

|

|

$

|

39.8

|

|

|

$

|

61.5

|

|

|

|

(1)

|

As at December 31, 2016, the Corporation’s bank indebtedness was governed by a credit facility

agreement with a syndicate of financial institutions. Under the terms of the agreement, the facility is reviewed annually, with

the next review scheduled in June 2017. The facility is revolving and extendible at each annual review for a further 364 day period

at the option of the syndicate. If not extended, the credit facility is converted at that time into a one-year term facility, with

the principal payable at the end of such one-year term. Management fully expects that the facility will be extended at each annual

review.

|

|

|

|

|

|

|

(2)

|

Amounts include estimated amounts of interest.

|

DISCLOSURES PURSUANT TO REQUIREMENTS OF

THE

NEW YORK STOCK EXCHANGE

Presiding Director at Meetings of Non-Management Directors

The Registrant schedules

regular executive sessions in which the Registrant’s “non-management directors” (as that term is defined in the

rules of the New York Stock Exchange) meet without management participation. Ron McIntosh serves as the presiding director (the

“Chair of the Board”) at such sessions. Each of the Registrant’s non-management directors is “independent”

as such term is used in the rules of the Canadian Securities Commissions and the New York Stock Exchange Corporate Governance Standards.

Communication with Non-Management Directors

Shareholders may send communications

to the Registrant’s non-management directors by writing to Investors Relations, EY Tower, Suite 300, 440 - 2 Avenue SW, Calgary,

Alberta T2P 5E9, or calling the toll free number at 1-866-393-0393. Communications will be referred to the Chair of the Board for

appropriate action. The status of all outstanding concerns addressed to the Chair of the Board will be reported to the board of

directors as appropriate.

Corporate Governance Guidelines

According to NYSE Rule 303A.09,

a listed company must adopt and disclose a set of corporate governance guidelines with respect to specified topics and must disclose

any significant ways in which its practices differ from those followed by US domestic companies under the NYSE rules. Such guidelines

and disclosures are required to be posted on the listed company’s website. The Registrant has adopted the required guidelines

and made the required disclosures, all of which are available on the Registrant’s website at

www.advantageog.com

and

in print to any shareholder who requests them.

Board Committee Charters

Advantage’s Audit Committee

Charter, the Terms of Reference of the Human Resources, Compensation and Corporate Governance Committee and the Terms of Reference

for the Independent Reserve Evaluation Committee are available for viewing on the Registrant’s website at

www.advantageog.com

and are available in print to any person who requests them. Requests for copies of these documents should be made by contacting:

Investor Relations, EY Tower, Suite 300, 440 - 2 Avenue SW, Calgary, Alberta T2P 5E9.

UNDERTAKING

The Registrant undertakes

to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish

promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F;

the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously

filed with the Commission a Form F-X in connection with the Common Shares.

Any change to the name or

address of the agent for service of process of the Registrant shall be communicated promptly to the Securities and Exchange Commission

by an amendment to the Form F-X referencing the file number of the relevant registration statement.

EXHIBITS

The following exhibits are

filed as part of this report.

Exhibit

Number

|

|

Description

|

|

|

|

|

|

23.1

|

|

Consent of PricewaterhouseCoopers LLP to the inclusion of the Auditors’ Report dated March 2, 2017 on the Registrant’s Audited Consolidated Financial Statements for the fiscal year ended December 31, 2016.

|

|

|

|

|

|

23.2

|

|

Consent of Sproule Associates Limited to the incorporation by reference herein of its Statement of Reserves Data and other Information in Form 51-101F1, which statement and report is contained in the Registrant’s Annual Information Form for the fiscal year ended December 31, 2016.

|

|

|

|

|

|

31.1

|

|

CEO Certification pursuant to rule 13a-14(a) of the Exchange Act.

|

|

|

|

|

|

31.2

|

|

CFO Certification pursuant to rule 13a-14(a) of the Exchange Act.

|

|

|

|

|

|

32.1

|

|

CEO Certification pursuant to U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

32.2

|

|

CFO Certification pursuant to U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

|

|

|

|

99.1

|

|

Annual Information Form of the Registrant for the year ended December 31, 2016.

|

|

|

|

|

|

99.2

|

|

Consolidated Financial Statements of the Registrant for the fiscal year ended December 31, 2016, prepared under International Financial Reporting Standards as issued by the International Accounting Standards Board.

|

|

|

|

|

|

99.3

|

|

Consolidated Management’s Discussion and Analysis of the Registrant for the fiscal year ended December 31, 2016.

|

SIGN

A

TURE

Pursuant to the requirements

of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused

this Annual Report on Form 40-F to be signed on its behalf by the undersigned, thereto duly authorized, in the City of Calgary,

Province of Alberta, Canada.

Dated: March 2, 2017

|

|

ADVANTAGE OIL & GAS LTD.

|

|

|

|

|

|

|

|

By:

|

/s/ Craig Blackwood

|

|

|

|

|

Name:

Craig

Blackwood

|

|

|

|

|

Title:

Vice President Finance and Chief Financial Officer

|

|

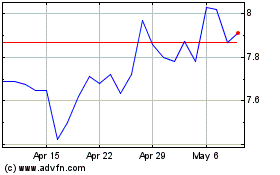

Advantage Energy (PK) (USOTC:AAVVF)

Historical Stock Chart

From Mar 2024 to Apr 2024

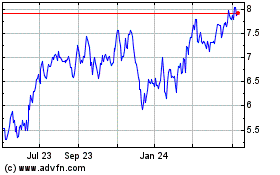

Advantage Energy (PK) (USOTC:AAVVF)

Historical Stock Chart

From Apr 2023 to Apr 2024