Suez Posts 2.9% Gain in Net Profit, Has Eyes of GE's Water Business

March 01 2017 - 3:07AM

Dow Jones News

By Inti Landauro

PARIS--French water and waste-management services supplier Suez

SA (SEV.FR) posted a 2.9% rise in net profit on growth at its

international businesses outside of Europe, where demand remained

sluggish, and signaled interest in buying the water assets of

General Electric Co. (GE).

Suez Chief Executive Jean-Louis Chaussade said buying the GE

business, which the U.S. company said was up for sale last

December, fitted well with the French company's plans to grow its

provision of water services to industry. Mr. Chaussade declined to

mention a price or any detail on how Suez, primarily a provider of

water services to municipalities, would finance the possibly

multibillion-dollar acquisition.

Suez's net profit rose to 420 million euros ($445 million) in

the year to end-December, up from EUR408 million in 2015, on a 1.2%

rise in revenue to EUR15.32 billion revenue and

better-than-expected cost control, the company said. Analysts

polled by FactSet expected an average net profit of EUR432 million

and revenue of EUR15.30 billion.

The company, whose major shareholder is energy company Engie SA,

said it managed to cut costs by EUR180 million last year up from a

EUR150 million target.

Faced with slow business in France and the rest of the European

Union in recent years, Suez had expanded in international markets

to benefit from stronger demand there. The company generated 33% of

its revenue from outside Europe in 2016, up from 26% a year

earlier. Revenue from its international unit rose 7% in the year

while revenue fell 1.9% in France and 0.7% in Europe outside

France, the company said.

Suez expects revenue and earnings before taxes and interest to

rise slightly this year.

The company kept its dividend unchanged at EUR0.65 a share and

said it intends to keep the dividend at the same level or raise it

next year.

-Write to Inti Landauro at inti.landauro@wsj.com

(END) Dow Jones Newswires

March 01, 2017 02:52 ET (07:52 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

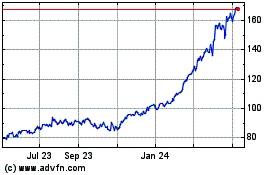

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

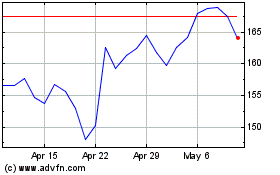

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024