Highlights:

Broadwind Energy, Inc. (NASDAQ:BWEN) reported sales of $48.2

million in Q4 2016, up 28% compared to $37.6 million in Q4 2015 as

a result of significantly improved production at the Company’s

Abilene, Texas tower facility.

The Company reported income from continuing operations of $.4

million, or $.03 per share, in Q4 2016, compared to a net loss from

continuing operations of $10.7 million, or $.73 per share, in Q4

2015. The $.76 per share improvement was due to significant

operational improvements in the Towers and Weldments segment and

successful cost management actions across the Company, notably in

the Gearing segment.

The Company reported a net loss from discontinued operations of

$.1 million, or $.01 per share, in Q4 2016, unchanged from the

prior year quarter. The Company reported non-GAAP adjusted EBITDA

(earnings before interest, taxes, depreciation, amortization,

share-based payments and restructuring costs) of $2.5 million in Q4

2016, compared to a non-GAAP adjusted EBITDA loss of $8.1 million

in Q4 2015 (please refer to the reconciliation of GAAP measures to

non-GAAP measures at the end of this release). The $10.6 million

improvement was mainly attributable to the factors described

above.

Broadwind CEO Stephanie Kushner stated, “Broadwind had a solid

fourth quarter, culminating in our first profitable year. We

exceeded our targets for every metric that we set at the beginning

of the year. Orders in 2016 totaled $275 million, nearly triple the

orders in 2015. We removed $9 million from manufacturing overhead

and operating expenses in 2016, which was $1 million more than our

target. Our tower production was on schedule in both plants, and

productivity in our Abilene plant improved dramatically during

2016, ending the year at a record level with record low overtime.

This is a reflection of the process improvements we made throughout

the year and the strong team we have in place. Our Gearing segment

managed well through a challenging year. On 30% lower sales, we

were able to cut the segment’s operating loss by $5 million and

generate positive net cash flow.”

Ms. Kushner continued, “Late last year, our Board approved a

strategy whereby we plan to double our sales over the next three

years by growing our existing businesses and expanding our presence

in clean tech. We plan to accomplish this by a combination of

organic growth and bolt-on acquisitions including the recently

announced Red Wolf transaction. The Abilene tower plant expansion

will be complete by mid-2017 and will offer us important operating

flexibility and a 30% increase in capacity at this plant. For FY

2017, we expect revenue of $210-220 million and EBITDA of

approximately $14-16 million. For Q1 2017, we expect revenue of

$54-56 million and EBITDA of approximately of $3 million. Income

guidance is highly uncertain pending a third-party determination of

purchase accounting for Red Wolf. We will update income guidance

following Q1 17.”

For FY 2016, revenue totaled $180.8 million, compared to $199.2

million for FY 2015. The 9% reduction was due primarily to lower

Towers and Weldments revenue, attributable to lower steel and other

material costs, which are generally passed through to the customer,

and lower Gearing revenue related to reduced demand from oil &

gas and mining customers.

Net income from continuing operations for the twelve months

ended December 31, 2016 was $1.3 million, or $.09 per share,

compared with a net loss from continuing operations of $12.2

million, or $.83 per share, for the twelve months ended December

31, 2015. The increase was due to significantly improved operating

efficiencies in the Towers and Weldments segment and successful

cost containment efforts Company-wide. The net loss from

discontinued operations for FY 2016 totaled $1.0 million, or $.07

per share, compared to net loss from discontinued operations of

$9.6 million, or $.65 per share, for FY 2015 due to the sale and

wind-down of the unprofitable Services segment. The Company

reported non-GAAP adjusted EBITDA of $9.6 million for FY 2016,

compared to a non-GAAP adjusted EBITDA loss of $.4 million for FY

2015 (please refer to the reconciliation of GAAP measures to

non-GAAP measures at the end of this release).

Orders and Backlog

The Company booked $32.3 million of net new orders in Q4 2016,

up significantly from $5.0 million of net new orders booked in Q4

2015. Towers and Weldments orders, which vary considerably from

quarter to quarter, totaled $29.4 million in Q4 2016, up

substantially from $2.8 million in Q4 2015. Gearing orders totaled

$2.9 million in Q4 2016, compared to $2.1 million in Q4 2015.

FY 2016 net new orders totaled $275.0 million, up sharply from

$94.0 million for FY 2015. 2016 orders included a $137 million

multi-year tower order booked in Q2.

At December 31, 2016, total backlog was $188.7 million, more

than doubling backlog of $93.9 million at December 31, 2015.

Segment Results

Towers and Weldments Broadwind Energy produces

fabrications for wind, oil and gas, mining and other industrial

applications, specializing in the production of wind turbine

towers.

Towers and Weldments segment sales totaled $42.3 million in Q4

2016, compared to $31.9 million in Q4 2015. The 32% improvement was

due to significantly improved production at the Abilene facility

compared to the prior year when the plant experienced severe

production issues associated with a challenging contract with a

long-term customer. The Towers and Weldments segment operating

income totaled $2.8 million in Q4 2016, compared to an operating

loss of $5.8 million in Q4 2015. The substantial improvement was

due to significantly improved operations compared to the prior year

when the segment experienced low throughput and losses related to

labor overruns and increased logistics and contractor fees

associated with the contract referenced above. Net income for the

segment totaled $1.8 million in Q4 2016, compared to a net loss of

$3.8 million in Q4 2015. Non-GAAP adjusted EBITDA totaled $3.9

million in Q4 2016, compared to a non-GAAP adjusted EBITDA loss of

$4.2 million in Q4 2015 as a result of the factors described above

(please refer to the reconciliation of GAAP measures to non-GAAP

measures at the end of this release).

Towers and Weldments segment sales for FY 2016 totaled $160.2

million compared to $170.5 million for FY 2015. The decrease is due

to lower steel and other material costs of $16 million, which are

generally passed through to customers, partially offset by a 6%

increase in volume in the current year attributable to consistent

production flow. FY 2016 operating income totaled $12.8 million

compared to FY 2015 operating income of $4.7 million. The $8.1

million improvement was due to significantly improved operating

efficiencies, including higher labor productivity and better cost

management. Net income for the segment totaled $8.5 million in 2016

compared to net income of $3.1 million in 2015. Non-GAAP adjusted

EBITDA for FY 2016 totaled $17.2 million, compared to $9.5 million

for FY 2015, as a result of the factors described above (please

refer to the reconciliation of GAAP measures to non-GAAP measures

at the end of this release).

GearingBroadwind Energy engineers, builds and

remanufactures precision gears and gearboxes for oil and gas,

mining, steel and wind applications.

Gearing segment sales totaled $5.9 million in Q4 2016, up

slightly from $5.8 million in Q4 2015. On essentially flat revenue,

the Q4 2016 operating loss narrowed to $.2 million compared to an

operating loss of $2.9 million in Q4 2015. The significant

improvement was due to a higher-margin mix, better operating

performance including improved productivity, lower scrap and

successful cost management that led to an overall $.7 million

decrease in cash manufacturing overhead and operating expenses, and

also due to a $.6 million reduction in depreciation expense. The

net loss for the Gearing segment totaled $.2 million in Q4 2016,

compared to a net loss of $2.8 million in Q4 2015. Non-GAAP

adjusted EBITDA for Q4 2016 totaled $.5 million compared to

Non-GAAP adjusted EBITDA loss of $1.5 million in Q4 2015. (please

refer to the reconciliation of GAAP measures to non-GAAP measures

at the end of this release). The sharp improvement was due mainly

to the factors described above.

FY 2016 Gearing segment sales totaled $20.6 million compared to

FY 2015 sales of $29.6 million. The 30% decrease was due to weaker

demand from oil & gas and mining customers. Despite lower

revenue, the operating loss for FY 2016 narrowed to $3.2 million

compared to an operating loss of $8.2 million for FY 2015. The

improvement was due to successful cost management which led to a

$3.3 million overall decrease in cash manufacturing overhead and

operating expenses, a $2.5 million reduction in depreciation

expense and the absence of a $.9 million environmental remediation

expense that was recognized in Q3 2015. FY 2016 Gearing segment net

loss totaled $3.3 million compared to a net loss of $8.2 million in

2015. The Non-GAAP adjusted EBITDA loss totaled $.6 million in 2016

compared to a non-GAAP adjusted EBITDA loss of $2.1 million in 2015

due mainly to the factors described above (please refer to the

reconciliation of GAAP measures to non-GAAP measures at the end of

this release).

Corporate

Corporate and other expenses totaled $1.9 million in Q4 2016,

compared to $2.4 million in Q4 2015. The decrease was due mainly to

the absence of a $1.2 million cost incurred in 2015 related to the

separation of the Company’s former CEO, and the favorable impact of

cost management efforts, partially offset by higher incentive

compensation and medical expense.

Cash and Liquidity

During Q4 2016, operating working capital (accounts receivable

and inventory, net of accounts payable and customer deposits)

increased $.6 million due to lower accounts payable at year

end.

Capital expenditures, net of disposals, in Q4 2016 totaled $2.7

million, bringing FY 2016 expenditures to $6.2 million.

Expenditures included investments to upgrade the coatings systems

in the tower plants, and outlays associated with the expansion of

the Abilene tower plant which will be operational in mid-2017.

Cash assets (cash and short-term investments) totaled $21.9

million at December 31, 2016, compared to $24.3 million at

September 30, 2016.

Subsequent to year end, on February 1, 2017, the Company

announced the acquisition of Red Wolf Company, LLC for a closing

cash payment of $16.5 million, subject to adjustment and additional

earn-out payments.

Debt and capital leases totaled $4.1 million at December 31,

2016, including the $2.6 million New Markets Tax Credit loan which

is expected to be substantially forgiven when it matures in

2018.

The Company’s credit line with The Private Bank was undrawn at

December 31, 2016.

About Broadwind Energy, Inc.Broadwind Energy

(NASDAQ:BWEN) is a precision manufacturer of structures, equipment

and components for clean tech and other specialized applications.

From gears and gearing systems for wind, oil and gas and mining

applications, to wind towers and industrial weldments, we have

solutions for the clean tech, energy and infrastructure needs of

the future. With facilities throughout the U.S., Broadwind Energy's

talented team is committed to helping customers maximize

performance of their investments—quicker, easier and smarter. Find

out more at www.bwen.com

Forward-Looking StatementsThis release contains

“forward looking statements”—that is, statements related to future,

not past, events—as defined in Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), that reflect

our current expectations regarding our future growth, results of

operations, financial condition, cash flows, performance, business

prospects and opportunities, as well as assumptions made by, and

information currently available to, our management. Forward looking

statements include any statement that does not directly relate to a

current or historical fact. We have tried to identify forward

looking statements by using words such as “anticipate,” “believe,”

“expect,” “intend,” “will,” “should,” “may,” “plan” and similar

expressions, but these words are not the exclusive means of

identifying forward looking statements. Forward looking statements

include any statement that does not directly relate to a current or

historical fact. Our forward-looking statements may include or

relate to our beliefs, expectations, plans and/or assumptions with

respect to the following: (i) state, local and federal regulatory

frameworks affecting the industries in which we compete, including

the wind energy industry, and the related extension, continuation

or renewal of federal tax incentives and grants and state renewable

portfolio standards; (ii) our customer relationships and efforts to

diversify our customer base and sector focus and leverage customer

relationships across business units; (iii) our ability to continue

to grow our business organically and through acquisitions; (iv) the

sufficiency of our liquidity and alternate sources of funding, if

necessary; (v) our ability to realize revenue from customer orders

and backlog; (vi) our ability to operate our business efficiently,

manage capital expenditures and costs effectively, and generate

cash flow; (vii) the economy and the potential impact it may have

on our business, including our customers; (viii) the state of the

wind energy market and other energy and industrial markets

generally and the impact of competition and economic volatility in

those markets; (ix) the effects of market disruptions and regular

market volatility, including fluctuations in the price of oil, gas

and other commodities; (x) the effects of the recent change of

administrations in the U.S. federal government; (xi) our ability to

successfully integrate and operate the business of Red Wolf

Company, LLC and to identify, negotiate and execute future

acquisitions; and (xii) the potential loss of tax benefits if we

experience an “ownership change” under Section 382 of the Internal

Revenue Code of 1986, as amended (the “IRC”). These statements are

based on information currently available to us and are subject to

various risks, uncertainties and other factors that could cause our

actual growth, results of operations, financial condition, cash

flows, performance, business prospects and opportunities to differ

materially from those expressed in, or implied by, these

statements. We are under no duty to update any of these statements.

You should not consider any list of such factors to be an

exhaustive statement of all of the risks, uncertainties or other

factors that could cause our current beliefs, expectations, plans

and/or assumptions to change.

| |

| BROADWIND ENERGY, INC. AND SUBSIDIARIESCONSOLIDATED

BALANCE SHEETS(IN THOUSANDS) |

| |

| |

|

|

|

|

|

|

|

As of December 31, |

| |

|

|

|

|

|

|

|

|

2016 |

|

|

|

2015 |

|

| |

ASSETS |

|

|

|

|

|

|

| |

CURRENT ASSETS: |

|

|

|

|

|

|

| |

|

Cash and

cash equivalents |

|

|

|

$ |

18,699 |

|

|

$ |

6,436 |

|

| |

|

Short-term

investments |

|

|

|

|

3,171 |

|

|

|

6,179 |

|

| |

|

Restricted

cash |

|

|

|

|

39 |

|

|

|

83 |

|

| |

|

Accounts

receivable, net |

|

|

|

|

11,865 |

|

|

|

9,784 |

|

| |

|

Inventories, net |

|

|

|

|

21,159 |

|

|

|

24,219 |

|

| |

|

Prepaid

expenses and other current assets |

|

|

|

|

2,449 |

|

|

|

1,530 |

|

| |

|

Current

assets held for sale |

|

|

|

|

808 |

|

|

|

4,403 |

|

| |

|

|

Total

current assets |

|

|

|

|

58,190 |

|

|

|

52,634 |

|

| |

LONG-TERM ASSETS: |

|

|

|

|

|

|

| |

|

Property

and equipment, net |

|

|

|

|

54,606 |

|

|

|

51,906 |

|

| |

|

Intangible

assets, net |

|

|

|

|

4,572 |

|

|

|

5,016 |

|

| |

|

Other

assets |

|

|

|

|

294 |

|

|

|

351 |

|

| |

TOTAL ASSETS |

|

|

|

$ |

117,662 |

|

|

$ |

109,907 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

| |

CURRENT LIABILITIES: |

|

|

|

|

|

|

| |

|

Current

maturities of long-term debt |

|

|

|

$ |

- |

|

|

$ |

2,799 |

|

| |

|

Current

portions of capital lease obligations |

|

|

|

|

465 |

|

|

|

447 |

|

| |

|

Accounts

payable |

|

|

|

|

15,852 |

|

|

|

13,822 |

|

| |

|

Accrued

liabilities |

|

|

|

|

8,430 |

|

|

|

8,134 |

|

| |

|

Customer

deposits |

|

|

|

|

18,011 |

|

|

|

9,940 |

|

| |

|

Current

liabilities held for sale |

|

|

|

|

493 |

|

|

|

1,613 |

|

| |

|

|

Total

current liabilities |

|

|

|

|

43,251 |

|

|

|

36,755 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

| |

|

Long-term

debt, net of current maturities |

|

|

|

|

2,600 |

|

|

|

2,600 |

|

| |

|

Long-term

capital lease obligations, net of current portions |

|

|

|

|

1,038 |

|

|

|

- |

|

| |

|

Other |

|

|

|

|

2,190 |

|

|

|

3,060 |

|

| |

|

|

Total

long-term liabilities |

|

|

|

|

5,828 |

|

|

|

5,660 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

| |

|

Preferred

stock, $0.001 par value; 10,000,000 shares authorized; no shares

issued |

|

|

|

|

|

|

| |

|

or

outstanding |

|

|

|

|

- |

|

|

|

- |

|

| |

|

Common

stock, $0.001 par value; 30,000,000 shares authorized; 15,175,767

and |

|

|

|

|

|

|

| |

|

15,012,789

shares issued as of December 31, 2016 and 2015, respectively |

|

|

|

|

15 |

|

|

|

15 |

|

| |

|

Treasury

stock, at cost, 273,937 shares at December 31, 2016 |

|

|

|

|

|

|

| |

|

and

2015 |

|

|

|

|

(1,842 |

) |

|

|

(1,842 |

) |

| |

|

Additional

paid-in capital |

|

|

|

|

378,876 |

|

|

|

378,104 |

|

| |

|

Accumulated

deficit |

|

|

|

|

(308,466 |

) |

|

|

(308,785 |

) |

| |

|

|

Total

stockholders' equity |

|

|

|

|

68,583 |

|

|

|

67,492 |

|

| |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

$ |

117,662 |

|

|

$ |

109,907 |

|

| BROADWIND ENERGY, INC. AND SUBSIDIARIESCONSOLIDATED

STATEMENTS OF OPERATIONS(IN THOUSANDS, EXCEPT PER SHARE

DATA)(UNAUDITED) |

| |

| |

|

|

|

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Revenues |

|

$ |

48,151 |

|

|

$ |

37,573 |

|

|

$ |

180,840 |

|

|

$ |

199,156 |

|

| |

Cost of

sales |

|

|

43,447 |

|

|

|

43,781 |

|

|

|

162,701 |

|

|

|

191,289 |

|

| |

Gross

profit |

|

|

4,704 |

|

|

|

(6,208 |

) |

|

|

18,139 |

|

|

|

7,867 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

| |

|

Selling,

general and administrative |

|

|

4,001 |

|

|

|

4,519 |

|

|

|

15,786 |

|

|

|

18,271 |

|

| |

|

Intangible

amortization |

|

111 |

|

|

|

111 |

|

|

|

444 |

|

|

|

444 |

|

| |

|

Restructuring |

|

|

- |

|

|

|

186 |

|

|

|

- |

|

|

|

1,060 |

|

| |

|

|

Total operating

expenses |

|

|

4,112 |

|

|

|

4,816 |

|

|

|

16,230 |

|

|

|

19,775 |

|

| |

Operating

income (loss) |

|

|

592 |

|

|

|

(11,024 |

) |

|

|

1,909 |

|

|

|

(11,908 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

OTHER (EXPENSE) INCOME, net: |

|

|

|

|

|

|

|

|

| |

|

Interest

expense, net |

|

|

(193 |

) |

|

|

(188 |

) |

|

|

(625 |

) |

|

|

(799 |

) |

| |

|

Other,

net |

|

|

21 |

|

|

|

461 |

|

|

|

49 |

|

|

|

425 |

|

| |

|

|

Total other expense,

net |

|

|

(172 |

) |

|

|

273 |

|

|

|

(576 |

) |

|

|

(374 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net income

(loss) before benefit for income taxes |

|

|

420 |

|

|

|

(10,751 |

) |

|

|

1,333 |

|

|

|

(12,282 |

) |

| |

Provision/(benefit) for income taxes |

|

|

14 |

|

|

|

(25 |

) |

|

|

(2 |

) |

|

|

(36 |

) |

| |

INCOME (LOSS) FROM CONTINUING OPERATIONS |

|

|

405 |

|

|

|

(10,726 |

) |

|

|

1,335 |

|

|

|

(12,246 |

) |

| |

LOSS FROM DISCONTINUED OPERATIONS, NET OF TAX |

|

|

(108 |

) |

|

|

(66 |

) |

|

|

(1,016 |

) |

|

|

(9,561 |

) |

| |

NET

INCOME (LOSS) |

|

$ |

298 |

|

|

$ |

(10,792 |

) |

|

$ |

319 |

|

|

$ |

(21,807 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

NET

INCOME (LOSS) PER COMMON SHARE - BASIC: |

|

|

|

|

|

|

|

|

| |

Income

(loss) from continuing operations |

|

$ |

0.03 |

|

|

$ |

(0.73 |

) |

|

$ |

0.09 |

|

|

$ |

(0.83 |

) |

| |

Loss from

discontinued operations |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.07 |

) |

|

|

(0.65 |

) |

| |

Net income

(loss) |

|

$ |

0.02 |

|

|

$ |

(0.73 |

) |

|

$ |

0.02 |

|

|

$ |

(1.48 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING -

Basic |

|

|

14,876 |

|

|

|

14,738 |

|

|

|

14,843 |

|

|

|

14,677 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

NET

INCOME (LOSS) PER COMMON SHARE - DILUTED: |

|

|

|

|

|

|

|

|

| |

Income

(loss) from continuing operations |

$ |

0.03 |

|

|

$ |

(0.73 |

) |

|

$ |

0.09 |

|

|

$ |

(0.83 |

) |

| |

Loss from

discontinued operations |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.07 |

) |

|

|

(0.65 |

) |

| |

Net income

(loss) |

|

$ |

0.02 |

|

|

$ |

(0.73 |

) |

|

$ |

0.02 |

|

|

$ |

(1.48 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

WEIGHTED AVERAGE COMMON SHARES OUTSTANDING -

Diluted |

|

|

15,096 |

|

|

|

14,738 |

|

|

|

15,081 |

|

|

|

14,677 |

|

| BROADWIND ENERGY, INC. AND SUBSIDIARIESCONSOLIDATED

STATEMENTS OF CASH FLOWS(IN THOUSANDS)(UNAUDITED) |

|

|

| |

|

|

|

|

Twelve Months Ended December 31, |

| |

|

|

|

|

|

2016 |

|

|

2015 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| |

Net income

(loss) |

|

$ |

319 |

|

$ |

(21,807 |

) |

| |

Loss from

discontinued operations |

|

|

(1,016 |

) |

|

(9,561 |

) |

| |

Income

(loss) from continuing operations |

|

|

1,335 |

|

|

(12,246 |

) |

| |

|

|

|

|

|

|

|

Adjustments to reconcile net cash used in operating

activities: |

|

|

| |

|

Depreciation and amortization expense |

|

|

6,914 |

|

|

9,179 |

|

| |

|

Impairment

charges |

|

|

- |

|

|

183 |

|

| |

|

Stock-based

compensation |

|

|

753 |

|

|

919 |

|

| |

|

Allowance

for doubtful accounts |

|

|

61 |

|

|

35 |

|

| |

|

Gain on

disposal of assets |

|

|

(217 |

) |

|

(98 |

) |

| |

|

Changes in

operating assets and liabilities: |

|

|

|

| |

|

|

Accounts

receivable |

|

|

(2,141 |

) |

|

7,223 |

|

| |

|

|

Inventories |

|

|

3,060 |

|

|

6,925 |

|

| |

|

|

Prepaid expenses and

other current assets |

|

|

(933 |

) |

|

(25 |

) |

| |

|

|

Accounts

payable |

|

|

989 |

|

|

(3,625 |

) |

| |

|

|

Accrued

liabilities |

|

|

297 |

|

|

(1,126 |

) |

| |

|

|

Customer deposits |

|

|

8,057 |

|

|

(12,457 |

) |

| |

|

|

Other non-current

assets and liabilities |

|

|

(875 |

) |

|

(399 |

) |

| Net cash

provided by (used in) operating activities of continued

operations |

|

|

17,300 |

|

|

(5,512 |

) |

| |

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| |

Purchases

of available for sale securities |

|

|

(19,223 |

) |

|

(8,062 |

) |

| |

Sales of

available for sale securities |

|

|

13,061 |

|

|

5,082 |

|

| |

Maturities

of available for sale securities |

|

|

9,170 |

|

|

4,825 |

|

| |

Purchases

of property and equipment |

|

|

(6,624 |

) |

|

(2,789 |

) |

| |

Proceeds

from disposals of property and equipment |

|

|

452 |

|

|

1,156 |

|

| Net cash

(used in) provided by investing activities of continued

operations |

|

|

(3,164 |

) |

|

212 |

|

| |

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

| |

Net

proceeds from issuance of stock |

|

|

19 |

|

|

- |

|

| |

Payments on

lines of credit and notes payable |

|

|

- |

|

|

(118,212 |

) |

| |

Proceeds

from lines of credit and notes payable |

|

|

- |

|

|

118,212 |

|

| |

Proceeds

from long-term debt |

|

|

- |

|

|

5,000 |

|

| |

Payments on

long-term debt |

|

|

(2,799 |

) |

|

(2,201 |

) |

| |

Principal

payments on capital leases |

|

|

(539 |

) |

|

(747 |

) |

| Net cash

(used in) provided by financing activities of continued

operations |

|

|

(3,319 |

) |

|

2,052 |

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

DISCONTINUED OPERATIONS: |

|

|

|

| |

Operating

cash flows |

|

|

731 |

|

|

(5,327 |

) |

| |

Investing

cash flows |

|

|

615 |

|

|

2,864 |

|

| |

Financing

cash flows |

|

|

58 |

|

|

(3 |

) |

| Net cash

provided by (used in) discontinued operations (1) |

|

|

1,404 |

|

|

(2,466 |

) |

| |

|

|

|

|

|

|

| Add: Cash

balance of discontinued operations, beginning of period |

|

|

- |

|

|

93 |

|

| Less: Cash

balance of discontinued operations, end of period |

|

|

2 |

|

|

- |

|

| |

|

|

|

|

|

|

| NET

INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED

CASH |

|

|

12,219 |

|

|

(5,621 |

) |

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH beginning of

the period |

|

|

6,519 |

|

|

12,140 |

|

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH end of the

period |

|

$ |

18,738 |

|

$ |

6,519 |

|

| |

|

|

|

|

|

|

|

Supplemental cash flow information: |

|

|

|

| |

Interest

paid |

|

$ |

494 |

|

$ |

652 |

|

| |

Income

taxes paid |

|

$ |

23 |

|

$ |

48 |

|

|

Non-cash investing and financing activities: |

|

|

|

| |

Issuance of

restricted stock grants |

|

$ |

753 |

|

$ |

919 |

|

| |

Equipment

additions via capital lease |

|

$ |

1,616 |

|

$ |

- |

|

| |

BROADWIND ENERGY, INC. AND SUBSIDIARIESSELECTED

SEGMENT FINANCIAL INFORMATION(IN THOUSANDS)(UNAUDITED) |

| |

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| |

|

|

|

December 31, |

|

December 31, |

| |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

ORDERS: |

|

|

|

|

|

| |

Towers and

Weldments |

$ |

29,389 |

|

|

$ |

2,816 |

|

|

$ |

260,790 |

|

|

$ |

69,146 |

|

| |

Gearing |

|

2,913 |

|

|

|

2,088 |

|

|

|

14,220 |

|

|

|

24,881 |

|

| |

Total orders |

$ |

32,302 |

|

|

$ |

4,904 |

|

|

$ |

275,010 |

|

|

$ |

94,027 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

REVENUES: |

|

|

|

|

|

| |

Towers and

Weldments |

|

|

$ |

42,262 |

|

|

$ |

31,916 |

|

|

$ |

160,210 |

|

|

$ |

170,919 |

|

| |

Gearing |

|

|

|

5,889 |

|

|

|

5,830 |

|

|

|

20,648 |

|

|

|

29,588 |

|

| |

Corporate and

Other |

|

|

|

- |

|

|

|

(173 |

) |

|

|

(18 |

) |

|

|

(1,351 |

) |

| |

Total

revenues |

|

|

$ |

48,151 |

|

|

$ |

37,573 |

|

|

$ |

180,840 |

|

|

$ |

199,156 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

OPERATING PROFIT/(LOSS): |

|

|

|

|

|

| |

Towers and

Weldments |

|

|

$ |

2,772 |

|

|

$ |

(5,823 |

) |

|

$ |

12,788 |

|

|

$ |

4,702 |

|

| |

Gearing |

|

|

|

(162 |

) |

|

|

(2,855 |

) |

|

|

(3,244 |

) |

|

|

(8,235 |

) |

| |

Corporate and

Other |

|

|

|

(2,018 |

) |

|

|

(2,347 |

) |

|

|

(7,635 |

) |

|

|

(8,375 |

) |

| |

Total operating

profit/(loss) |

|

|

$ |

592 |

|

|

$ |

(11,025 |

) |

|

$ |

1,909 |

|

|

$ |

(11,908 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measure The Company

provides non-GAAP adjusted EBITDA (earnings before interest, income

taxes, depreciation, amortization, and stock compensation) as

supplemental information regarding the Company’s business

performance. The Company’s management uses adjusted EBITDA when it

internally evaluates the performance of the Company’s business,

reviews financial trends and makes operating and strategic

decisions. The Company believes that this non-GAAP financial

measure is useful to investors because it provides investors with a

better understanding of the Company’s past financial performance

and future results allows investors to evaluate the Company’s

performance using the same methodology and information as used by

the Company’s management. The Company's definition of adjusted

EBITDA may be different from similar non-GAAP financial measures

used by other companies and/or analysts.

| |

BROADWIND ENERGY, INC. AND SUBSIDIARIESRECONCILIATION

OF NON-GAAP FINANCIAL MEASURES (IN THOUSANDS)(UNAUDITED) |

| |

|

| |

Consolidated |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

|

|

|

|

2016 |

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

Net

Income/(Loss) from continuing operations |

|

$ |

405 |

|

$ |

(10,726 |

) |

|

$ |

1,335 |

|

|

$ |

(12,246 |

) |

| |

Interest

Expense |

|

|

193 |

|

|

188 |

|

|

|

625 |

|

|

|

799 |

|

| |

Income Tax

Provision/(Benefit) |

|

|

14 |

|

|

(25 |

) |

|

|

(2 |

) |

|

|

(36 |

) |

| |

Depreciation and Amortization |

|

1,776 |

|

|

2,319 |

|

|

|

6,914 |

|

|

|

9,180 |

|

| |

Share-based

Compensation and Other Stock Payments |

|

126 |

|

|

(4 |

) |

|

|

753 |

|

|

|

893 |

|

| |

Restructuring Expense |

|

- |

|

|

186 |

|

|

|

- |

|

|

|

1,060 |

|

| |

|

Adjusted

EBITDA (Non-GAAP) |

|

$ |

2,514 |

|

$ |

(8,062 |

) |

|

$ |

9,625 |

|

|

$ |

(350 |

) |

| |

Towers and

Weldments Segment |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

|

|

2016 |

|

|

2015 |

|

|

|

2016 |

|

|

2015 |

| |

Net Income/(Loss) |

$ |

1,772 |

|

$ |

(3,780 |

) |

|

$ |

8,510 |

|

$ |

3,096 |

| |

Interest Expense |

|

5 |

|

|

- |

|

|

|

26 |

|

|

4 |

| |

Income Tax

Provision/(Benefit) |

|

1,001 |

|

|

(1,598 |

) |

|

|

4,286 |

|

|

2,161 |

| |

Depreciation and

Amortization |

|

1,100 |

|

|

992 |

|

|

|

4,166 |

|

|

3,954 |

| |

Share-based

Compensation and Other Stock Payments |

|

11 |

|

|

6 |

|

|

|

165 |

|

|

112 |

| |

Restructuring

Expense |

|

- |

|

|

186 |

|

|

|

- |

|

|

186 |

| |

Adjusted

EBITDA (Non-GAAP) |

$ |

3,889 |

|

$ |

(4,194 |

) |

|

$ |

17,153 |

|

$ |

9,513 |

| |

Gearing

Segment |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

Net Loss |

|

$ |

(159 |

) |

|

$ |

(2,841 |

) |

|

$ |

(3,258 |

) |

|

$ |

(8,243 |

) |

| |

Interest Expense |

|

|

- |

|

|

|

6 |

|

|

|

9 |

|

|

|

35 |

|

| |

Income Tax

Provision/(Benefit) |

|

|

(3 |

) |

|

|

(4 |

) |

|

|

4 |

|

|

|

(9 |

) |

| |

Depreciation and

Amortization |

|

|

627 |

|

|

|

1,275 |

|

|

|

2,546 |

|

|

|

5,032 |

|

| |

Share-based

Compensation and Other Stock Payments |

|

|

17 |

|

|

|

45 |

|

|

|

106 |

|

|

|

228 |

|

| |

Restructuring

Expense |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

874 |

|

| |

Adjusted

EBITDA (Non-GAAP) |

|

$ |

482 |

|

|

$ |

(1,519 |

) |

|

$ |

(593 |

) |

|

$ |

(2,083 |

) |

| |

Corporate and

Other |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

Net Loss |

$ |

(1,208 |

) |

|

$ |

(4,105 |

) |

|

$ |

(3,917 |

) |

|

$ |

(7,099 |

) |

| |

Interest Expense |

|

188 |

|

|

|

181 |

|

|

|

590 |

|

|

|

760 |

|

| |

Income Tax

Provision/(Benefit) |

|

(984 |

) |

|

|

1,578 |

|

|

|

(4,292 |

) |

|

|

(2,188 |

) |

| |

Depreciation and

Amortization |

|

49 |

|

|

|

52 |

|

|

|

202 |

|

|

|

194 |

|

| |

Share-based

Compensation and Other Stock Payments |

|

98 |

|

|

|

(55 |

) |

|

|

482 |

|

|

|

553 |

|

| |

Adjusted

EBITDA (Non-GAAP) |

$ |

(1,857 |

) |

|

$ |

(2,349 |

) |

|

$ |

(6,935 |

) |

|

$ |

(7,780 |

) |

BWEN INVESTOR CONTACT:

Joni Konstantelos, 708.780.4819

joni.konstantelos@bwen.com

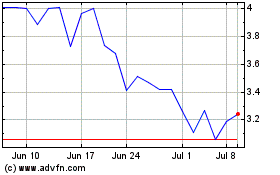

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Aug 2024 to Sep 2024

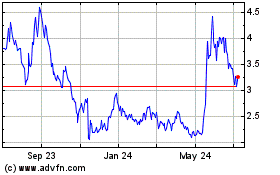

Broadwind (NASDAQ:BWEN)

Historical Stock Chart

From Sep 2023 to Sep 2024