- Full-Year Net Income Increased 32.7% to

$36.8 million

-Full-Year Adjusted Net Income Increased

31.5% to $98.3 million

-Full-Year Operating Income Increased 14.4%

to $154.0 million

- Full-Year Adjusted EBITDA Increased 29.2%

to $371.3 million

- Introducing Full-Year 2017 Adjusted EBITDA

Guidance of $410.0 million to $425.0 million

Summit Materials, Inc. (NYSE: SUM, “Summit” or the

“Company”), a leading vertically integrated construction materials

company, today announced results for the fourth quarter and

full-year 2016.

For the twelve months ended December 31, 2016, the Company

reported basic and diluted earnings per share of $0.53 on net

income of $36.8 million. For the same twelve month period, Summit

reported adjusted diluted earnings per share of $0.97 on adjusted

net income of $98.3 million. For the three months ended December

31, 2016, the Company reported a basic loss per share of ($0.00) on

a net loss of ($0.3) million. For the same three month period,

Summit reported adjusted diluted earnings per share of $0.21 on

adjusted net income of $21.0 million. The Company’s adjusted net

income for the fourth quarter and full-year 2016 excludes an $14.9

million charge for estimated future payments to certain current and

former limited partners under the tax receivable agreement entered

into at the time of the Company’s initial public offering, $13.8

million of which is expected to be paid beginning in 2019 or

thereafter.

“Our strong full-year performance further validates the unique

competitive advantages afforded by our integrated, materials-based

model,” stated Tom Hill, CEO of Summit Materials. “Our leading

positions in well-structured, early-cycle markets drove sustained

margin expansion throughout all lines of business in 2016, as both

gross margin and Adjusted EBITDA margin increased to record levels.

Adjusted EBITDA exceeded the high-end of our guided range for the

full-year, given sustained growth in materials pricing,

contributions from completed acquisitions and improved cost

efficiencies.”

“Gross profit generated from our materials lines of business

increased by more than 35% year-over-year in 2016, despite

temporary softness in organic sales volumes of aggregates in our

Texas and Vancouver markets,” continued Hill. “Excluding Texas and

Vancouver, organic sales volumes of aggregates and ready-mix

increased 1.2% and 5.1%, respectively, in the full-year 2016,

versus the prior year. Looking ahead to 2017, we anticipate

positive growth in materials pricing and volumes across all of our

reporting segments.”

“In January 2017, we entered into definitive agreements to

acquire Colorado-based Everist Materials and Arkansas-based

Razorback Concrete Company for a combined $110 million in cash,”

stated Hill. “Collectively, these acquisitions bring aggregates

operations with ~100 million tons of permitted reserves and an

extensive network of vertically integrated ready-mix concrete and

asphalt plants in close proximity to our existing portfolio of

materials-based assets. In addition to Everist, which closed in

January 2017, and Razorback, which is expected to close during the

first quarter 2017, our acquisition pipeline remains robust, with

more than 20 additional transactions currently under review.”

“Our cement business represents a clear catalyst for growth

heading into 2017,” continued Hill. “Limited domestic production

capacity and continued growth in U.S. demand have combined to

create opportunities for sustained growth in industry cement

pricing. During the fourth quarter, our cement segment generated

organic price and volume growth of 6.8% and nearly 1%,

respectively. Looking ahead to the remainder of 2017, we anticipate

continued Adjusted EBITDA growth in our cement business, as

supported by sustained growth in organic cement prices and sales

volumes along the Mississippi River corridor.”

“Following the recent election cycle, we have entered a new era

of bipartisan support for funding that will help to properly

maintain and modernize our nation’s aging transportation

infrastructure,” continued Hill. “In the markets we serve, nearly

60 cents of every dollar spent by states on transportation

infrastructure is federally funded. Given that nearly 40% of our

net revenue is derived from public infrastructure work, Summit is

well positioned to benefit from this opportunity. With the support

of appropriations from the FAST Act, we anticipate an acceleration

in state-level infrastructure spending beginning in mid-to-late

2017. Further, given ongoing advocacy by Congress and the current

Administration for increased investment in state transportation

infrastructure, we see numerous opportunities for multi-year growth

in our public-facing businesses.”

“We generated significant growth in cash flows from operations

last year, resulting in a material improvement in our credit

metrics,” stated Brian Harris, CFO of Summit Materials. “We had

outstanding debt of $1.5 billion as of December 31, 2016. Net

leverage was 3.9x at year-end 2016, ahead of our full-year guidance

of 4.0x. Including net proceeds from the 10 million share equity

offering we completed in January 2017, net leverage declined to

3.5x at year-end 2016. Looking ahead, we currently anticipate a

further reduction in net leverage to approximately 3.0x by year-end

2017, assuming the mid-point of our 2017 Adjusted EBITDA

guidance.”

“We had $143.4 million in cash and $209.4 million of available

liquidity under our revolving credit facility at year-end,” stated

Harris. “Including proceeds from the equity offering we completed

in January 2017, net of $110 million used to fund the acquisition

of Everist and Razorback, we had pro-forma cash and liquidity of

approximately $480 million exiting 2016,” continued Harris. “Our

current liquidity position provides sufficient flexibility with

which to fund the working capital and strategic growth requirements

of our business at this time. Looking forward, disciplined capital

allocation remains a high priority for us, particularly as we seek

to reduce our net leverage ratio and improve our credit metrics. We

are pleased with our full-year performance and remain focused on

creating additional value for our investors in the year ahead.”

Full-Year 2016 | Financial

Performance

Net revenue increased 15.4% year-over-year to $1.5 billion,

versus $1.3 billion in 2015. The year-over-year improvement in net

revenue was primarily attributable to higher acquisition-related

sales volumes across all lines of business, coupled with improved

organic and acquisition-related pricing on aggregates, cement and

ready-mix concrete.

Gross profit increased 25.4% year-over-year to $554.0 million,

versus $441.7 million in 2015. Gross profit generated from the

Company’s aggregates and cement assets represented 52.5% of total

gross profit in 2016, versus 48.4% of gross profit in 2015. Gross

margin increased 300 basis points to a record 37.2% for the

full-year 2016, versus 34.2% in 2015. Adjusted EBITDA increased

29.2% year-over-year to $371.3 million, versus $287.5 million in

2015. Adjusted EBITDA margin increased 270 basis points to a record

25.0% for the full-year 2016, versus 22.3% in 2015.

Adjusted net income increased 31.5% year-over-year to $98.3

million, versus $74.7 million in 2015. On an adjusted basis, the

Company reported full-year 2016 earnings per share of $0.97 per

adjusted diluted share, using 101.2 million weighted-average total

shares. The shares of Class A common stock are issued by

Summit Materials, Inc., and as such the earnings and equity

interests of non-controlling interests, including LP units that are

issued by its subsidiary Summit Materials Holdings L.P., are not

included in basic earnings per share. Summit believes adjusted net

income and Adjusted EPS are more representative of earnings

performance, as these measures exclude the non-operating impact to

earnings per share of any potential exchange of LP units for Class

A common stock in any given quarter.

- West Segment: Adjusted EBITDA

increased 11.1% year-over-year to $167.4 million, versus $150.8

million in 2015. Adjusted EBITDA margin increased to 22.7% in 2016,

up from 21.0% in 2015. A year-over-year decline in organic Adjusted

EBITDA growth was more than offset by acquisition-related EBITDA

contributions. The organic decline was attributable to severe

weather and flooding in Houston and tough prior-year comparisons in

the Vancouver, B.C. market related to the timing of customer

projects.

- East Segment: Adjusted EBITDA

increased 36.5% year-over-year to $126.0 million, versus $92.3

million in 2015. Adjusted EBITDA margin increased to 26.8% in 2016,

up from 24.6% in 2015. A year-over-year decline in organic Adjusted

EBITDA growth was more than offset by acquisition-related EBITDA

contributions. The organic decline was attributable to transitory

softness in public infrastructure spending in the Kansas and

Kentucky markets.

- Cement Segment: Adjusted EBITDA

increased 51.0% to $113.0 million, versus $74.8 million in 2015.

Adjusted EBITDA margin increased to 40.2% in 2016, up from 38.3% in

2015. A year-over-year increase in average selling prices,

increased sales volumes due to the acquisition of the Davenport

cement assets in July 2015, improved production efficiencies and

continued cost reductions all contributed to improved full-year

results.

Full-Year 2016 | Results by Line of

Business

- Aggregates Business: Aggregates

net revenues increased 20.8% to $264.6 million in 2016, when

compared to the prior year period. Aggregates gross profit as a

percentage of aggregates net revenues increased nearly 260 basis

points to 62.0% in 2016, when compared to the prior year period.

Including acquisitions, sales volumes increased 11.8% and average

sales price increased 7.2%, when compared to the prior year period.

Excluding acquisitions, organic sales volume declined 5.5% and

organic average sales price increased 4.8%, when compared to the

prior year period. In the full-year 2016, organic sales volumes

were affected by severe weather conditions throughout Texas and

lower year-over-year contributions from the Vancouver, B.C. market,

given the completion of a large sand river project in 2015.

- Cement Business: Cement net

revenues increased 49.3% to $250.3 million in 2016, when compared

to the prior year period. Cement gross profit as a percentage of

cement segment net revenues was 45.1% in 2016, more than 220 basis

points higher than in the prior year period. Sales volumes and the

average sales price increased 37.0% and 7.5%, respectively, when

compared to the prior year period. Cement volumes increased on a

year-over-year basis as a result of the Davenport acquisition in

July 2015, while cement prices improved as a result of favorable

overall market conditions.

- Products Business: Net revenues

from ready-mix concrete, asphalt and other products increased 7.8%

to $708.1 million in 2016, when compared to the prior year.

Products gross margin as a percentage of product net revenues

increased 190 basis points to 26.6% in 2016, when compared to the

prior year period. Including acquisitions, sales volumes and the

average selling price of ready-mix concrete increased 12.2% and

0.8%, respectively, versus the prior year. Including acquisitions,

sales volumes of asphalt were flat, versus the prior year, while

the average selling price declined by 5.1%, versus the prior year.

Excluding acquisitions, organic sales volumes of ready-mix concrete

and asphalt declined 3.4% and 13.0%, respectively, while average

selling prices increased 2.0% and declined 3.6%, respectively.

Fourth Quarter 2016 | Financial

Performance

Net revenue increased by 7.7% year-over-year to $387.4 million

in the fourth quarter 2016, versus $359.5 in the prior year period.

The year-over-year improvement in net revenue was primarily

attributable to higher acquisition-related sales volumes across all

lines of business, improved organic pricing on cement and ready-mix

concrete, in addition to improved acquisition related pricing on

aggregates.

Gross profit increased 13.9% year-over-year to $148.9 million in

the fourth quarter 2016, versus $130.7 million in the prior year

period. Gross profit generated from the Company’s aggregates and

cement assets represented 52.2% of total gross profit in the fourth

quarter 2016, versus 52.9% of gross profit in the prior year

period. Gross margin increased 210 basis points to 38.4% in the

fourth quarter 2016, versus 36.3% in the prior year period.

Adjusted EBITDA increased 12.9% year-over-year to $102.0 million,

versus $90.3 million in the prior year period. Adjusted EBITDA

margin increased 120 basis points to a record 26.3% in the fourth

quarter 2016, versus 25.1% in the prior year period.

Adjusted net income declined 38.9% year-over-year to $21.0

million in the fourth quarter 2016, versus $34.4 million in the

prior year period. On an adjusted basis, the Company reported

fourth quarter 2016 earnings per share of $0.21 per adjusted

diluted share, using 101.2 million weighted-average total shares.

The shares of Class A common stock are issued by Summit

Materials, Inc., and as such the earnings and equity interests of

non-controlling interests, including LP units, are not included in

basic earnings per share. Summit believes adjusted net income and

Adjusted EPS are more representative of earnings performance, as

these measures exclude the non-operating impact to earnings per

share of any potential exchange of LP units for Class A common

stock in any given quarter.

- West Segment: Adjusted EBITDA

was relatively flat at $39.9 million in the fourth quarter 2016,

versus the prior year period. Adjusted EBITDA margin increased to

22.4% in the fourth quarter 2016, versus 21.5% in the prior year

period. A year-over-year decline in Adjusted EBITDA in certain of

the Company’s Texas operations was more than offset by

acquisition-related EBITDA contributions.

- East Segment: Adjusted EBITDA

increased 20.5% year-over-year to $35.6 million in the fourth

quarter 2016, versus $29.5 million in the prior year period.

Adjusted EBITDA margin declined to 27.1% in the fourth quarter

2016, down from 29.0% in the prior year period. A year-over-year

decline in Adjusted EBITDA growth primarily related to the delayed

public funding in Kentucky was more than offset by

acquisition-related EBITDA contributions.

- Cement Segment: Adjusted EBITDA

increased 10.4% to $34.2 million in the fourth quarter 2016, versus

$30.9 million in the prior year period. Adjusted EBITDA margin

increased to 43.8% in the fourth quarter 2016, up from 41.3% in the

prior year period. A year-over-year increase in average selling

prices, organic sales volumes, improved production efficiencies and

cost reductions all contributed to improved results.

Fourth Quarter 2016 | Results by Line

of Business

- Aggregates Business: Aggregates

net revenues increased 10.9% to $63.4 million in the fourth quarter

2016, when compared to the prior year period. Aggregates gross

profit as a percentage of aggregates net revenues declined 140

basis points to 63.7% in the fourth quarter 2016, versus 65.1% in

the prior year period. Including acquisitions, sales volumes and

average selling prices increased 5.3% and 2.7%, respectively, in

the fourth quarter 2016, when compared to the prior year period.

Excluding acquisitions, organic sales volumes declined 11.8% and

average selling prices were flat in the fourth quarter 2016, versus

the prior year period. Organic sales volumes in the fourth quarter

2016 were impacted by a combination of transitory softness in

Houston’s residential market, lower contributions from continued

delays in public spending within the Kentucky market and tough

prior-year comparisons in the Vancouver, B.C. market.

- Cement Business: Cement net

revenues increased by 12.7% to $70.7 million in the fourth quarter

2016, when compared to the prior year period. Cement gross profit

as a percentage of cement segment net revenues was 47.9% in the

fourth quarter 2016, 530 basis points higher than in the prior year

period. On an organic basis, cement sales volumes and average

selling prices increased 0.6% and 6.8% in the fourth quarter 2016,

respectively, when compared to the prior year period. A combination

of steady organic demand along the Company’s core markets along the

Mississippi River, coupled with continued organic growth in average

selling prices, contributed to strong fourth quarter results in the

Cement segment.

- Products Business: Net revenues

increased by 3.1% to $181.2 million in the fourth quarter 2016,

when compared to the prior year period. Products gross margin as a

percentage of products net revenues. Products gross margin as a

percentage of product net revenues increased 170 basis points to

26.1% in the fourth quarter 2016, when compared to the prior year

period. Including acquisitions, sales volumes and the average

selling price of ready-mix concrete increased 12.3% and declined

1%, respectively, compared to the prior year period. Including

acquisitions, sales volumes and the average selling price of

asphalt increased 1.7% and declined 10.5%, respectively, compared

to the prior year period. Excluding acquisitions, organic sales

volumes of ready-mix concrete and asphalt declined 9.5% and 9.2%,

respectively, while average selling prices increased 1.5% and

declined 9.0%, respectively.

Liquidity and Capital

Resources

At December 31, 2016, the Company had cash on hand of $143.4

million and borrowing capacity under its revolving credit facility

of $209.4 million. Including net proceeds from the equity offering

completed in January 2017, the Company held pro-forma cash of

$271.5 million at year-end 2016. The borrowing capacity on the

revolving credit facility is net of $25.6 million of

outstanding letters of credit, and is fully available to the

Company within the terms and covenant requirements of its credit

agreement. At year-end 2016, the Company had $1.5 billion in debt

outstanding, versus $1.3 billion in debt outstanding at year-end

2015.

2017 Financial Guidance &

Outlook

Based on current market conditions, the Company anticipates

Adjusted EBITDA in the range of $410.0 million to $425.0 million

for the full-year 2017. The Adjusted EBITDA outlook assumes organic

improvement, coupled with the residual impact of acquisitions

announced since the beginning of 2017, including the acquisitions

of Everist Materials and Razorback Concrete. No additional

potential acquisitions are included within the Company’s full-year

2017 Adjusted EBITDA guidance.

For the full year 2017, the Company anticipates gross capital

expenditures to be in the range $135.0 million to $155.0 million,

which includes several maintenance and profit-improvement projects.

Longer-term, the Company expects gross capital expenditures to

approximate 7-8% of net revenue per annum.

Webcast and Conference Call

Information

Summit Materials will conduct a conference call today at 11:00

a.m. eastern time (9:00 a.m. mountain time) to review the Company’s

fourth quarter and full-year 2016 financial results. A webcast of

the conference call and accompanying presentation materials will be

available in the Investors section of Summit’s website

at investors.summit-materials.com. To listen to a live

broadcast, go to the site at least 15 minutes prior to the

scheduled start time in order to register, download, and install

any necessary audio software.

To participate in the live teleconference:

Domestic Live: 1-877-407-0784International Live:

1-201-689-8560Conference ID: 86972581

To listen to a replay of the teleconference, which will be

available through March 22, 2017:

Domestic Replay: 1-844-512-2921International Replay:

1-412-317-6671Conference ID: 13652776

About Summit Materials

Summit Materials is a leading vertically integrated

materials-based company that supplies aggregates, cement, ready-mix

concrete and asphalt in the United States and British Columbia,

Canada. Summit is a geographically diverse, materials-based

business of scale that offers customers a single-source provider of

construction materials and related downstream products in the

public infrastructure, residential and nonresidential, and end

markets. Summit has a strong track record of successful

acquisitions since its founding and continues to pursue growth

opportunities in new and existing markets. For more information

about Summit Materials, please visit www.summit-materials.com.

Non-GAAP Financial

Measures

The Securities and Exchange Commission (“SEC”) regulates the use

of “non-GAAP financial measures,” such as adjusted net income

(loss), Adjusted EPS, Adjusted EBITDA, Adjusted EBITDA margin,

gross profit and free cash flow, which are derived on the basis of

methodologies other than in accordance with U.S. generally accepted

accounting principles (“U.S. GAAP”). We have provided these

measures because, among other things, we believe that they provide

investors with additional information to measure our performance,

evaluate our ability to service our debt and evaluate certain

flexibility under our restrictive covenants. Our adjusted net

income, Adjusted EPS, Adjusted EBITDA, Adjusted EBITDA margin,

gross profit and net leverage may vary from the use of such terms

by others and should not be considered as alternatives to or more

important than net income (loss), operating income (loss), revenue

or any other performance measures derived in accordance with U.S.

GAAP as measures of operating performance or to cash flows as

measures of liquidity.

Adjusted EBITDA, Adjusted EBITDA margin and other non-GAAP

measures have important limitations as analytical tools, and you

should not consider them in isolation or as substitutes for

analysis of our results as reported under U.S. GAAP. Some of the

limitations of Adjusted EBITDA are that these measures do not

reflect: (i) our cash expenditures or future requirements for

capital expenditures or contractual commitments; (ii) changes

in, or cash requirements for, our working capital needs;

(iii) interest expense or cash requirements necessary to

service interest and principal payments on our debt; and

(iv) income tax payments we are required to make. Because of

these limitations, we rely primarily on our U.S. GAAP results and

use Adjusted EBITDA, Adjusted EBITDA margin and other non-GAAP

measures on a supplemental basis.

Adjusted EBITDA, Adjusted EBITDA margin, gross profit, adjusted

net income, Adjusted EPS and free cash flow reflect additional ways

of viewing aspects of our business that, when viewed with our GAAP

results and the accompanying reconciliations to U.S. GAAP financial

measures included in the tables attached to this press release, may

provide a more complete understanding of factors and trends

affecting our business. We strongly encourage investors to review

our consolidated financial statements in their entirety and not

rely on any single financial measure.

Reconciliations of the non-GAAP measures used in this press

release are included in the attached tables, to the extent

available without unreasonable effort. Because GAAP financial

measures on a forward-looking basis are not accessible, and

reconciling information is not available without unreasonable

effort, we have not provided reconciliations for forward-looking

non-GAAP measures. For the same reasons, we are unable to address

the probable significance of the unavailable information, which

could be material to future results.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the federal securities laws, which involve risks and

uncertainties. Forward-looking statements include all statements

that do not relate solely to historical or current facts, and you

can identify forward-looking statements because they contain words

such as “believes,” “expects,” “may,” “will,” “should,” “seeks,”

“intends,” “trends,” “plans,” “estimates,” “projects” or

“anticipates” or similar expressions that concern our strategy,

plans, expectations or intentions. Any and all statements made

relating to the expectations for our anticipated benefits from

recent acquisitions, the macroeconomic outlook for our markets,

potential acquisition activity, our estimated and projected

earnings, margins, costs, expenditures, cash flows, sales volumes

and financial results are forward-looking statements. These

forward-looking statements are subject to risks and uncertainties

that may change at any time, and, therefore, our actual results may

differ materially from those expected. We derive many of our

forward-looking statements from our operating budgets and

forecasts, which are based upon many detailed assumptions. While we

believe that our assumptions are reasonable, it is very difficult

to predict the impact of known factors, and, of course, it is

impossible to anticipate all factors that could affect our actual

results.

In light of the significant uncertainties inherent in the

forward-looking statements included herein, the inclusion of such

information should not be regarded as a representation by us or any

other person that the results or conditions described in such

statements or our objectives and plans will be achieved. Important

factors could affect our results and could cause results to differ

materially from those expressed in our forward-looking statements,

including but not limited to the factors discussed in the section

entitled “Risk Factors” in our Annual Report on Form 10-K for the

fiscal year ended January 2, 2016. Such factors may be updated from

time to time in our periodic filings with the SEC, which are

accessible on the SEC’s website at www.sec.gov.

We undertake no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

SUMMIT MATERIALS, INC. AND

SUBSIDIARIES

Consolidated Statements of Operations

($ in thousands, except share and per

share amounts)

Three months ended

Year ended December 31, January 2,

December 31,

January 2,

2016 2016 2016 2016 (unaudited)

(unaudited) (audited) (audited) Revenue: Product $ 315,329 $

295,633 $ 1,223,008 $ 1,043,843 Service 72,060

63,899 265,266 246,123 Net

revenue 387,389 359,532 1,488,274 1,289,966 Delivery and

subcontract revenue 35,584 41,930

137,789 142,331 Total revenue

422,973 401,462 1,626,063

1,432,297 Cost of revenue (excluding items shown separately

below): Product 192,185 185,534 751,697 676,457 Service

46,334 43,343 182,584

171,857 Net cost of revenue 238,519 228,877 934,281 848,314

Delivery and subcontract cost 35,584 41,930

137,789 142,331 Total cost of

revenue 274,103 270,807

1,072,070 990,645 General and administrative

expenses 58,654 28,285 243,862 177,769 Depreciation, depletion,

amortization and accretion 40,105 32,905 149,300 119,723

Transaction costs 1,507 1,475

6,797 9,519 Operating income 48,604 67,990

154,034 134,641 Interest expense 25,069 22,398 97,536 84,629 Loss

on debt financings — 7,318 — 71,631 Tax receivable agreement

expense 14,938 — 14,938 — Other (income) expense, net (66 )

(1,747 ) 733 (2,425 ) Income (loss)

from operations before taxes 8,663 40,021 40,827 (19,194 ) Income

tax expense (benefit) 2,614 (5,795 )

(5,299 ) (18,263 ) Income (loss) from continuing operations

6,049 45,816 46,126 (931 ) Income from discontinued operations

— (1,600 ) — (2,415 ) Net

income 6,049 47,416 46,126 1,484 Net income (loss) attributable to

noncontrolling interest in subsidiaries (41 ) 91 16 (1,826 ) Net

income (loss) attributable to Summit Holdings (1) 6,380

23,962 9,327 (24,408 )

Net income attributable to Summit Inc. $ (290 ) $ 23,363 $

36,783 $ 27,718 Net income per share of Class A

common stock: Basic $ (0.00 ) $ 0.46 $ 0.53 $ 0.70 Diluted $ (0.00

) $ 0.46 $ 0.53 $ 0.51 Weighted average shares of Class A common

stock: Basic 87,276,645 50,881,602 68,833,986 39,367,381

Diluted

87,276,645 50,908,151 69,317,452 89,472,266

_________________________

(1) Represents portion of business owned

by private interests

SUMMIT MATERIALS, INC. AND

SUBSIDIARIES

Consolidated Balance Sheets

($ in thousands, except share and per

share amounts)

2016 2015

Assets Current assets:

Cash and cash equivalents

$ 143,392 $ 186,405 Accounts receivable, net 162,377 145,544 Costs

and estimated earnings in excess of billings 7,450 5,690

Inventories 157,679 130,082 Other current assets 12,800

4,807 Total current assets 483,698 472,528

Property, plant and equipment, net 1,444,367 1,269,006 Goodwill

781,824 596,397 Intangible assets, net 24,576 15,005 Other assets

47,001 43,243 Total assets $ 2,781,466

$ 2,396,179

Liabilities and Stockholders’

Equity Current liabilities: Current portion of debt $ 6,500 $

6,500 Current portion of acquisition-related liabilities 24,162

20,584 Accounts payable 81,565 81,397 Accrued expenses 111,605

92,942 Billings in excess of costs and estimated earnings

15,456 13,081 Total current liabilities

239,288 214,504 Long-term debt 1,514,456 1,273,652

Acquisition-related liabilities 32,664 39,977 Other noncurrent

liabilities 135,019 100,186 Total

liabilities 1,921,427 1,628,319

Stockholders’ equity: Class A common stock, par value $0.01 per

share; 1,000,000,000 shares authorized, 96,033,222 and 49,745,944

shares issued and outstanding as of December 31, 2016 and January

2, 2016, respectively 961 497 Class B common stock, par value $0.01

per share; 250,000,000 shares authorized, 100 and 69,007,297 shares

issued and outstanding as of December 31, 2016 and January 2, 2016,

respectively — 690 Additional paid-in capital 824,304 619,003

Accumulated earnings 19,028 10,870 Accumulated other comprehensive

loss (2,249 ) (2,795 ) Stockholders’ equity 842,044

628,265 Noncontrolling interest in consolidated subsidiaries 1,378

1,362 Noncontrolling interest in Summit Holdings 16,617

138,233 Total stockholders’ equity

860,039 767,860 Total liabilities and

stockholders’ equity $ 2,781,466 $ 2,396,179

SUMMIT MATERIALS, INC. AND

SUBSIDIARIES

Consolidated Statements of Cash Flows

($ in thousands)

2016 2015

Cash flow from operating activities: Net income (loss) $

46,126 $ 1,484 Adjustments to reconcile net income (loss) to net

cash provided by operating activities: Depreciation, depletion,

amortization and accretion 160,633 125,019 Share-based compensation

expense 49,940 19,899 Deferred income tax benefit (8,589 ) (19,838

) Net (gain) loss on asset disposals (3,102 ) (23,087 ) Net gain on

debt financings — (9,877 ) Other (1,282 ) (1,629 ) Decrease

(increase) in operating assets, net of acquisitions: Accounts

receivable, net 2,511 3,852 Inventories (10,297 ) 4,275 Costs and

estimated earnings in excess of billings (2,684 ) 6,604 Other

current assets (5,518 ) 11,438 Other assets 1,976 (1,369 )

(Decrease) increase in operating liabilities, net of acquisitions:

Accounts payable (5,751 ) (4,241 ) Accrued expenses 13,196 (14,354

) Billings in excess of costs and estimated earnings 700 1,313

Other liabilities 7,004 (1,286 ) Net cash

provided by operating activities 244,863

98,203 Cash flow from investing activities: Acquisitions,

net of cash acquired (336,958 ) (510,017 ) Purchases of property,

plant and equipment (153,483 ) (88,950 ) Proceeds from the sale of

property, plant and equipment 16,868 13,110 Other 2,921

1,510 Net cash used for investing activities

(470,652 ) (584,347 ) Cash flow from financing

activities: Proceeds from equity offerings — 1,037,444 Capital

issuance costs (136 ) (61,609 ) Capital contributions by partners —

— Proceeds from debt issuances 354,000 1,748,875 Debt issuance

costs (5,801 ) (14,246 ) Payments on debt (120,702 ) (1,505,486 )

Purchase of noncontrolling interests — (497,848 ) Payments on

acquisition-related liabilities (32,040 ) (18,056 ) Distributions

from partnership (13,034 ) (28,736 ) Other 420

(1 ) Net cash provided by financing activities 182,707

660,337 Impact of foreign currency on cash 69

(1,003 ) Net (decrease) increase in cash (43,013 )

173,190 Cash and cash equivalents—beginning of period

186,405 13,215 Cash and cash equivalents—end

of period $ 143,392 $ 186,405

SUMMIT MATERIALS, INC. AND

SUBSIDIARIES

Unaudited Revenue Data by Segment and Line

of Business

($ in thousands)

Three months ended

Year ended December 31, January 2,

December 31, January 2, 2016

2016 2016 2016 Net Revenue by Segment

West $ 178,085 $ 182,763 $ 736,573 $ 719,485 East 131,385 101,902

470,614 374,997 Cement 77,919 74,867 281,087

195,484 Net Revenue $ 387,389 $ 359,532 $ 1,488,274 $

1,289,966 Net Revenue by Line of Business Materials

Aggregates $ 63,392 $ 57,144 $ 264,609 $ 219,040 Cement (1) 70,691

62,710 250,349 167,696 Products 181,246 175,779

708,050 657,107 Total Materials and Products

315,329 295,633 1,223,008 1,043,843 Services

72,060 63,899 265,266 246,123 Net

Revenue $ 387,389 $ 359,532 $ 1,488,274 $ 1,289,966 Gross

Profit Materials Aggregates $ 40,356 $ 37,228 $ 164,129 $ 130,163

Cement (1) 37,299 31,913 126,907 83,804 Products 47,351 42,812

188,611 162,466 Services 23,864 18,702 74,346

65,219 Gross Profit $ 148,870 $ 130,655 $ 553,993 $ 441,652

_______________________

(1) Net revenue for the cement line of business

excludes revenue associated with the processing of hazardous and

non-hazardous waste, which is processed into fuel and used in the

cement plants and is included in services net revenue.

Additionally, net revenue from cement swaps and other

cement-related products are included in products net revenue. The

cement segment gross profit includes the earnings from the waste

processing operations, cement swaps and other products.

SUMMIT MATERIALS, INC. AND

SUBSIDIARIES

Unaudited Volume and Price Statistics

(Units in thousands)

Three months ended Year

ended Total Volume December 31, 2016

January 2, 2016 December 31, 2016 January

2, 2016 Aggregates (tons) 8,790 8,349 36,092 32,297 Cement

(tons) 658 628 2,357 1,720 Ready-mix concrete (cubic yards) 1,025

913 3,823 3,406 Asphalt (tons) 1,090 1,072 4,359 4,359

Three months ended Year ended Pricing

December 31, 2016 January 2, 2016 December 31,

2016 January 2, 2016 Aggregates (per ton) $ 9.67 $ 9.42

$ 9.85 $ 9.19 Cement (per ton) 109.57 102.25 108.63 101.05

Ready-mix concrete (per cubic yards) 104.44 104.82 103.74 102.92

Asphalt (per ton) 52.06 58.15 54.74 57.67

Year over Year

Comparison Volume Pricing Volume

Pricing Aggregates (per ton) 5.3 % 2.7 % 11.8 % 7.2 % Cement

(per ton) 4.8 % 7.2 % 37.0 % 7.5 % Ready-mix concrete (per cubic

yards) 12.3 % (0.4 ) % 12.2 % 0.8 % Asphalt (per ton) 1.7 % (10.5 )

% - % (5.1 ) %

Year over Year Comparison (Excluding

acquisitions) Volume Pricing Volume

Pricing Aggregates (per ton) (11.8 ) % 0.0 % (5.5 ) % 4.8 %

Cement (per ton) 0.6 % 6.8 % * * Ready-mix concrete (per cubic

yards) (9.5 ) % 1.5 % (3.4 ) % 2.0 % Asphalt (per ton) (9.2 ) %

(9.0 ) % (13.0 ) % (3.6 ) %

_________________________

* The Davenport Assets were immediately integrated

with our existing cement operations such that it is impracticable

to bifurcate the growth attributable to the Davenport Assets from

organic growth.

SUMMIT MATERIALS, INC. AND

SUBSIDIARIES

Unaudited Reconciliations of Gross Revenue

to Net Revenue by Line of Business

($ and Units in thousands)

Three months ended December 31, 2016

Gross Revenue Intercompany

Net Volumes Pricing by Product

Elimination/Delivery Revenue Aggregates 8,790 $ 9.67

$ 84,989 $ (21,597 ) $ 63,392 Cement 658 109.57

72,078 (1,387 ) 70,691 Materials $ 157,067 $ (22,984

) $ 134,083 Ready-mix concrete 1,025 104.44 107,035 274 107,309

Asphalt 1,090 52.06 56,766 154 56,920 Other Products 79,732

(62,715 ) 17,017 Products $ 243,533 $ (62,287 ) $

181,246

Year ended December 31, 2016

Gross Revenue Intercompany Net Volumes

Pricing by Product Elimination/Delivery

Revenue Aggregates 36,092 $ 9.85 $ 355,617 $ (91,008 ) $

264,609 Cement 2,357 108.63 256,046 (5,697 )

250,349 Materials $ 611,663 $ (96,705 ) $ 514,958 Ready-mix

concrete 3,823 103.74 396,597 (681 ) 395,916 Asphalt 4,359 54.74

238,588 (230 ) 238,358 Other Products 327,778

(254,002 ) 73,776 Products $ 962,963 $ (254,913 ) $ 708,050

SUMMIT MATERIALS, INC. AND

SUBSIDIARIESUnaudited Reconciliations of Non-GAAP Financial

Measures($ in thousands, except share and per share amounts)

The tables below reconcile our net income to Adjusted EBITDA and

present Adjusted EBITDA by segment for the three months and year

ended December 31, 2016 and January 2, 2016.

Three months ended

Year ended December 31, January

2, December 31, January 2,

Reconciliation of Net Income to Adjusted EBITDA 2016

2016 2016 2016 Net

income $ 6,049 $ 47,416 $ 46,126 $ 1,484 Interest expense 25,069

22,398 97,536 84,629 Income tax expense (benefit) 2,614 (5,795 )

(5,299 ) (18,263 ) Depreciation, depletion and amortization

39,743 32,632 147,736

118,321 EBITDA $ 73,475 $ 96,651 $

286,099 $ 186,171 Accretion 362 273 1,564 1,402 IPO/

Legacy equity modification costs — — 37,257 28,296 Loss on debt

financings — 7,318 — 71,631 Tax receivable agreement expense 14,938

— 14,938 — Income from discontinued operations — (1,600 ) — (2,415

) Transaction costs 1,507 1,475 6,797 9,519 Management fees and

expenses (1,379 ) — (1,379 ) 1,046 Non-cash compensation 3,817

1,310 12,683 5,448 Loss (gain) on disposal and impairment of assets

3,805 (16,561 ) 3,805 (16,561 ) Other 5,490

1,463 9,583 2,991 Adjusted

EBITDA $ 102,015 $ 90,329 $ 371,347 $ 287,528

Adjusted EBITDA by Segment West 39,887 39,314

167,434 150,764 East 35,602 29,545 126,007 92,303 Cement 34,163

30,948 112,991 74,845 Corporate (7,637 ) (9,478 )

(35,085 ) (30,384 ) Adjusted EBITDA $ 102,015

$ 90,329 $ 371,347 $ 287,528 Adjusted EBITDA

Margin (1) 26.3 % 25.1 % 25.0 % 22.3 %

(1) Adjusted EBITDA margin is defined as

Adjusted EBITDA as a percentage of net revenue.

The table below reconciles our net (loss) income per share

attributable to Summit Materials, Inc. to adjusted income per share

for the three months and year ended December 31, 2016 and January

2, 2016. The per share amount of the net income attributable to

Summit Materials, Inc. presented in the table is calculated using

the total equity interests for the purpose of reconciling to

adjusted net income per share.

Three months ended

Twelve months ended December 31, 2016

January 2, 2016 December 31, 2016 January

2, 2016 Reconciliation of Net (Loss) Income Per Share to

Adjusted Diluted EPS Net Income Per Share

Net Income Per Share Net Income

Per Share Net Income Per Share Net

(loss) income attributable to Summit Materials, Inc. $ (290 ) $ — $

23,363 $ 0.23 $ 36,783 $ 0.36 $ 27,718 $ 0.28 Adjustments: Net

income (loss) attributable to noncontrolling interest 6,380 0.06

23,962 0.24 9,327 0.09 (24,408 ) (0.25 ) IPO/ Legacy equity

modification costs — — — — 37,257 0.37 28,296 0.29 Tax receivable

agreement expense 14,938 0.15 — — 14,938 0.15 — — Loss on debt

financings, net of tax — — 3,671 0.04 — — 59,696 0.60 Gain on

transfer of Bettendorf assets — —

(16,561 ) (0.16 ) — — (16,561 )

(0.17 ) Adjusted diluted net income $ 21,028 $ 0.21 $ 34,435

$ 0.35 $ 98,305 $ 0.97 $ 74,741 $ 0.75

Weighted-average shares: Class A common stock 87,276,645 50,881,602

68,833,986 39,367,381 LP Units outstanding 13,900,060

50,306,370 32,327,907 59,911,631

Total equity interest 101,176,705 101,187,972

101,161,893 99,279,012

The following table reconciles operating income to gross profit

and gross margin for the three months and year ended December 31,

2016 and January 2, 2016.

Three months ended Year

ended December 31, January 2, December 31,

January 2, Reconciliation of Operating Income to Gross

Profit 2016 2016 2016 2016 (in

thousands) Operating income $ 48,604 $ 67,990 $ 154,034 $ 134,641

General and administrative expenses 58,654 28,285 243,862 177,769

Depreciation, depletion, amortization and accretion 40,105 32,905

149,300 119,723 Transaction costs 1,507 1,475

6,797 9,519 Gross Profit $ 148,870 $ 130,655 $ 553,993 $

441,652 Gross Margin (1) 38.4 % 36.3 % 37.2 % 34.2 %

_______________________

(1) Gross margin is defined as gross

profit as a percentage of net revenue.

The following table reconciles net cash used for operating

activities to free cash flow for the three months and year ended

December 31, 2016 and January 2, 2016.

Three months ended

Year ended December 31, January 2,

December 31, January 2, 2016

2016 2016 2016 Net income

$ 6,049 $ 47,416 $ 46,126 $ 1,484 Non-cash items 49,260

(9,467 ) 197,600 90,487

Net income adjusted for non-cash items 55,309 37,949 243,726 91,971

Change in working capital accounts 105,031

78,484 1,137 6,232 Net cash

provided by operating activities 160,340 116,433 244,863 98,203

Capital expenditures, net of asset sales (30,892 )

(15,051 ) (136,615 ) (75,840 ) Free cash flow $

129,448 $ 101,382 $ 108,248 $ 22,363

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170222005577/en/

Summit Materials, Inc.Investor & Media Relations:Noel Ryan,

303-515-5155noel.ryan@summit-materials.com

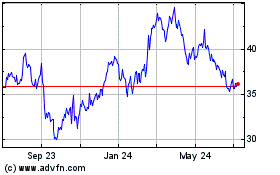

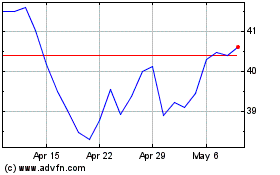

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Summit Materials (NYSE:SUM)

Historical Stock Chart

From Apr 2023 to Apr 2024