Cognizant Technology Shakes Up Board Under Activist Pressure--2nd Update

February 08 2017 - 1:20PM

Dow Jones News

By Imani Moise

Cognizant Technology Solutions Corp., under pressure from

activist investor Elliott Management Corp., said Wednesday it would

replace three members of its board.

The IT operations company also announced plans to expand its

adjusted operating margins to 22% from the previous target range of

19% to 20%, and launch a new capital return program, delivering

$3.4 billion in capital to investors over the next two years

through dividends and share repurchases.

Shares rose 4.1% to $55.99 during afternoon trading, offsetting

a 4% decline in the stock so far this year.

Cognizant's board will also form a financial policy committee to

oversee completion of the plans, advised by Chief Executive

Francisco D'Souza, one of the new board members, and one other

adviser.

In the past, Elliott, which held a 4% stake in the company as of

November, has griped that Cognizant has maintained a margin target

of 19% to 20% for nearly two decades despite the company's growth.

Revenue at Cognizant rose 8.6% to $13.49 billion last year from

$886 million about a decade earlier. Adjusted operating margin for

the year was 19.5%.

Under the terms of the agreement filed with the Securities and

Exchange Commission, Elliott, also in a proxy fight for control

over Arconic Inc., agreed to standstill provisions capping its

stake at below 5%, preventing a hostile takeover.

Moving into the new year, Cognizant said it would accelerate its

shift to digital services and solutions to meet growing demand from

clients. Like other companies that have traditionally relied on

outsourcing, Cognizant has been pressured by businesses' shift

toward the cloud, in which software and IT services are accessed

over the internet from third-party providers.

For the full fiscal year, the company expects adjusted earnings

of at least $3.63 per share on $14.56 billion to $14.84 billion in

revenue. Analysts polled by Thomson Reuters are expecting $3.64 per

share on $14.76 billion in revenue.

Cognizant also reported fourth quarter results Wednesday,

posting a profit of $416 million, or 68 cents a share, down from

$424 million, or 69 cents, a year earlier. On an adjusted basis,

the company earned 87 cents compared with 80 cents in the year-ago

quarter. Revenue grew 7.1% to $3.46 billion.

Analysts polled by Thomson Reuters had forecast earnings of 86

cents on $3.49 billion in revenue.

Write to Imani Moise at imani.moise@wsj.com

(END) Dow Jones Newswires

February 08, 2017 13:05 ET (18:05 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

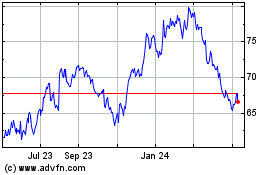

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

From Mar 2024 to Apr 2024

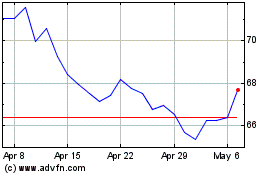

Cognizant Technology Sol... (NASDAQ:CTSH)

Historical Stock Chart

From Apr 2023 to Apr 2024