U.S. Factory Activity Accelerated to Fastest Pace in More Than Two Years -- 2nd Update

February 01 2017 - 1:35PM

Dow Jones News

By Jeffrey Sparshott

U.S. manufacturing activity rose to the highest level in more

than two years in January amid rising demand and expectations for a

friendlier business environment during the Trump

administration.

The Institute for Supply Management on Wednesday said its

purchasing managers index rose to 56.0 in January from 54.5 in

December, the highest since November 2014. A reading over 50

indicates expansion in the sector; below 50 suggests

contraction.

The closely watched gauge has now climbed for five straight

months, partly reflecting stabilization of the dollar and oil

prices, alongside some improvement demand at home and abroad.

November's election of Donald Trump -- and his promises of lower

taxes, fewer regulations, more infrastructure spending and a focus

on domestic production -- also appears to have raised corporate

expectations.

"I think they've come out with guns blazing and following up on

the some of their campaign promises," Mark Millett, president and

chief executive of Steel Dynamics Inc., told investors last week.

"And I think tax reform...and sensible regulation will certainly

help the country have a more positive business climate and boost

the economy."

The U.S. steel industry had been battered by low commodity

prices, which damped demand for heavy equipment, and a flood of

imports.

The Fort Wayne, Ind.-based company said the outlook has

brightened. Mr. Millett anticipates steady demand from the auto

sector, a strong improvement in the energy sector and pickup in

construction from government infrastructure spending.

More broadly, 12 of the 18 industries in Wednesday's reported

growth in January.

Underlying details also were upbeat. The ISM new-orders index

inched up to 60.4 in January from 60.3 the prior month, and the

production index was 61.4 last month, up from 59.4 in December.

The employment index increased to 56.1 compared with 52.8 a

month earlier, suggesting the sector is hiring at a healthy

clip.

"It's a continuation of the momentum that was built in the

latter part of last year and hopes and expectations for the new

economy, the new administration, which is settling into starting

its work," said Bradley Holcomb, who oversees the survey.

Raw material prices are also up for 11 straight months, a

development that could suggesting rising inflation pressures. The

subindex registered 69 in January, an increase from 65.5.

The overall ISM gauge signaled contraction in late 2015 and

early 2016 as manufacturers were squeezed by the energy sector's

slump and a strong dollar, which curtailed foreign demand for

U.S.-made products.

Other measures of manufacturing, meanwhile, have been mixed.

Demand for long-lasting goods stabilized toward the end of the

year, according to separate Commerce Department data. A Federal

Reserve report on industrial output showed that factory activity

ended 2016 little changed from the beginning of the year.

"We suspect some of the current strength [in ISM] reflects a

temporary postelection rise in confidence rather than any

significant change yet in underlying trends," said Jim O'Sullivan,

chief U.S. economist at High Frequency Economics.

Write to Jeffrey Sparshott at jeffrey.sparshott@wsj.com

(END) Dow Jones Newswires

February 01, 2017 13:20 ET (18:20 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

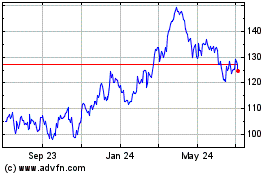

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

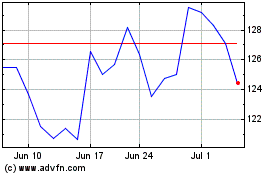

Steel Dynamics (NASDAQ:STLD)

Historical Stock Chart

From Apr 2023 to Apr 2024