American Express Posts Lower Earnings, Revenue

January 19 2017 - 5:14PM

Dow Jones News

By Anne Steele

American Express Co. posted lower top- and bottom-line results

in the final quarter of the year, but the credit card company said

it has made progress in turning around its business.

Shares edged down 0.3% after hours to $76.50.

American Express has suffered from issues ranging from the loss

of its 16-year exclusive relationship with warehouse-club retailer

Costco Wholesale Corp., to heavy competition, to declines in

corporate travel budgets.

"At the start of 2016 we said we would move with a strong sense

of urgency to change the trajectory of our business," said Chief

Executive Kenneth Chenault. "The results we're reporting today

reflect substantial progress on that commitment."

Mr. Chenault said the company is ahead of plans to reset its

cost base and improve operating efficiency. American Express last

year said it would cut $1 billion in costs. On Thursday it said its

fourth-quarter expenses were 2% lower.

Mr. Chenault, who acknowledged "we continue to operate in a very

challenging environment," said card member spending grew 7% during

the quarter, excluding the impact of Costco in the year

earlier-period and the effect of the stronger U.S. dollar.

The company attributed the gains to continued strength in

international markets, accelerated growth among small and midsize

companies and strong long-term relationships with higher spending

consumers.

For 2017, the company forecast earnings of $5.60 to $5.80 a

share, bracketing analysts' estimates for $5.75 a share, according

to Thomson Reuters.

In all for the fourth quarter, American Express reported a

profit of $825 million, or 88 cents a share, down from $899

million, or 89 cents a share, a year earlier. Excluding

restructuring charges, earnings were 91 cents a share, below

analyst estimates for 98 cents.

Revenue slipped 4.4% to $8.02 billion. Excluding the impacts of

the Costco loss and the stronger dollar, the company said the top

line increased 6%.

Revenue at American Express has been in focus lately because it

has fallen short of internal growth targets. Analysts were looking

for $7.95 billion.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

January 19, 2017 16:59 ET (21:59 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

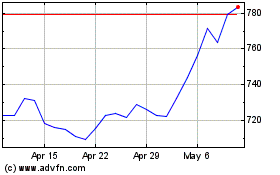

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Mar 2024 to Apr 2024

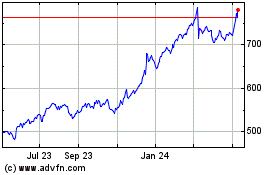

Costco Wholesale (NASDAQ:COST)

Historical Stock Chart

From Apr 2023 to Apr 2024