UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

January 10, 2017

____________________

IMATION CORP.

(Exact name of registrant as specified in

its charter)

___________________

| Delaware |

|

001-14310 |

|

41-1838504 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

1099 Helmo Ave. N., Suite 250, Oakdale,

Minnesota 55128

(Address of principal executive offices,

including zip code)

(651) 704-4000

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 | Regulation FD Disclosure. |

Attached as Exhibit 99.1 hereto is an updated

presentation (the “Presentation”) that representatives of Imation Corp. (the “Company” or “we”)

plan to use with investors relating to, among other things, the transactions contemplated by the Transaction Documents (as defined

below).

Exhibit 99.1 attached hereto shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as expressly set forth

by specific reference in such filing.

Additional Information About the Proposals and Where to Find

It

The Company has filed with the U.S. Securities

and Exchange Commission (“SEC”) a definitive proxy statement in connection with a special meeting of the Company’s

stockholders (the “Special Meeting”) with respect to the following proposals (the “Proposals”): (1) to

approve the issuance of up to 15,000,000 shares of common stock of the Company (the “Capacity Shares”) to Clinton Group,

Inc. (“Clinton Group”); (2) to approve (i) an amendment to Imation’s Restated Certificate of Incorporation to

effect, at the discretion of Imation’s Board of Directors (the “Board”) and at any time prior to January 31,

2018, a reverse stock split using a ratio, to be established by the Board in its sole discretion, within a range of 1:2 to 1:20

and (ii) a reduction of the number of authorized shares of the Company’s common stock in a corresponding proportion; and

(3) to adjourn the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies. The

Company has mailed the definitive proxy statement and other relevant documents to its stockholders in connection with its solicitation

of proxies for the Special Meeting to approve the Proposals. This Current Report on Form 8-K and the Presentation (collectively,

this “Communication”) do not contain all the information that should be considered concerning the Proposals. This Communication

is not intended to provide the basis for any investment decision or any other decision in respect to the Proposals. The Company’s

stockholders and other interested persons are advised to read the definitive proxy statement and other relevant documents delivered

to its stockholders in connection with the Company’s solicitation of proxies for the Special Meeting, as these materials

contain important information about the Company and the Proposals. The definitive proxy statement has been mailed to stockholders

of the Company as of January 6, 2017, the record date established for voting on the Proposals. Stockholders are also able to obtain

copies of the definitive proxy statement and other documents filed with the SEC, without charge, at the SEC’s web site at

(www.sec.gov), or by directing a request to: Imation Corp., 1099 Helmo Ave. N., Suite 250, Oakdale, Minnesota 55128, Attn: Corporate

Secretary, (651) 704-4311.

Participants in Solicitation

The Company and its directors and executive

officers may be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with

the Proposals. Information regarding the special interests of these directors and executive officers in the Proposals is included

in the definitive proxy statement referred to above. Additional information regarding the directors and executive officers of the

Company is also included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2015, which is available

free of charge at the SEC’s web site (www.sec.gov) and at the address described above and is also included in the definitive

proxy statement.

Forward Looking Statements

This Communication includes “forward

looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Forward-looking statements are not historical facts, and involve risks and uncertainties that could

cause actual results to differ materially from those expected and projected. Words such as “expects”, “believes”,

“anticipates”, “intends”, “estimates”, “seeks” and variations and similar words

and expressions are intended to identify such forward-looking statements. Such forward-looking statements with respect to the transactions

contemplated by the Subscription Agreement, the Capacity and Services Agreement and the Registration Rights Agreement relating

to the issuance of the Capacity Shares (collectively, the “Transaction Documents”) are based on current expectations

that are subject to risks and uncertainties. A number of factors could cause actual events, performance or results to differ materially

from the events, performance and results discussed in the forward-looking statements. These factors include, but are not limited

to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction Documents

and the proposed transactions contemplated thereby, (2) the outcome of any legal proceedings that may be instituted against the

Company or others following announcement of the transactions contemplated by the Transaction Documents; (3) the inability to complete

the transactions contemplated by the Transaction Documents due to the failure to obtain approval of the stockholders of the Company

or other conditions to closing in the Transaction Documents, (4) delays in obtaining, adverse conditions contained in, or the inability

to obtain necessary regulatory approvals or complete regulatory reviews required to complete the transactions contemplated by the

Transaction Documents; (5) the risk that the proposed transactions disrupt current plans and operations as a result of the announcement

and consummation of the transactions described in this Communication; (6) the ability to recognize the anticipated benefits of

the Proposals; (7) costs related to the proposed transactions; (8) changes in applicable laws or regulations; (9) the possibility

that the Company or Clinton Group may be adversely affected by other economic, business, and/or competitive factors; and (10) other

risks and uncertainties indicated from time to time in the definitive proxy statement relating to the Proposals and other filings

with the SEC by the Company (including those described under “Risk Factors” in such other filings). Readers are cautioned

not to place undue reliance upon any forward-looking statements, which speak only as of the date made, and the Company undertakes

no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise,

except as required by law.

Disclaimers

This Communication shall not constitute

a solicitation of a proxy, consent or authorization with respect to any securities or the Proposals or an offer to sell or the

solicitation of an offer to buy the Capacity Shares or any other security. The Capacity Shares have not been registered under the

Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration

or an applicable exemption from registration requirements. An investment in the Company is not an investment in Clinton Group.

The historical results of Clinton Group and other data on past performance contained in this Communication are not necessarily

indicative of future performance of the Company or its subsidiaries.

This Communication does not constitute an

offer of any investment fund we may sponsor.

This Communication does not constitute an offer to sell or a solicitation to buy any securities in any private investment

vehicle managed by GlassBridge (collectively, the “GlassBridge-Managed Funds”), and may not be relied upon in

connection with any offer or sale of securities. Any such offer or solicitation may only be made pursuant to the current Confidential

Private Offering Memorandum (or similar document) for any such GlassBridge-Managed Fund, which are provided only to qualified

offerees and which should be carefully reviewed prior to investing. This Communication does not constitute an

offer to sell or a solicitation to buy any securities in any private investment vehicle managed by Clinton Group or its affiliates

(collectively, the “Clinton-Managed Funds”), and may not be relied upon in connection with any offer or sale of securities.

Any such offer or solicitation may only be made pursuant to the current Confidential Private Offering Memorandum (or similar document)

for any such Clinton-Managed Fund, which are provided only to qualified offerees and which should be carefully reviewed prior to

investing.

In addition, GlassBridge Asset Management,

LLC (“GlassBridge”) is a newly formed entity and the GlassBridge funds are currently in a formation stage; therefore,

the information provided in this Communication regarding GlassBridge’s and the funds’ policies, procedures, and processes,

which are based on GlassBridge’s expectation on how operations will be conducted, is preliminary, is subject to change, and

may not conform to actual operational experience. GlassBridge is not currently registered with the SEC as an investment adviser

under the U.S. Investment Advisers Act of 1940, as amended, or under similar state laws, and nothing in this Communication constitutes

investment advice with respect to securities.

GlassBridge and the funds have no

operating history upon which prospective investors can evaluate their performance. The past investment performance of Clinton Group,

or entities with which it has been associated, may not be construed as an indication of the future results of the GlassBridge funds.

The GlassBridge funds’ investment programs should be evaluated on the basis that there can be no assurance that Clinton Group’s

assessment of the short-term or long-term prospects of investments will prove accurate or that any GlassBridge fund will achieve

its investment objective. GlassBridge’s multi-strategy fund is expected to launch with Clinton Group’s quantitative

strategy as the sole initial strategy of the fund, and GlassBridge will seek to add other strategies to the multi-strategy fund

throughout 2017.

Certain clients, principals, affiliates

and officers of Clinton Group are stockholders of the Company which may present certain conflicts of interest. The existence of

potential conflicts of interest between the Company and the clients, principals, affiliates and officers of Clinton Group that

are stockholders of the Company does not mean that there will be actual conflicts of interest. Further, the existence of an actual

or potential conflict of interest does not mean that it will be acted upon to the detriment of any stockholder.

Trademarks

This Communication includes trademarks and

tradenames owned by the Company and its subsidiaries, including “Imation”, “GlassBridge”, “Nexsan”

and “UNITY”. Solely for convenience, these trademarks or tradenames may appear without the ® or ™ symbols,

but such references are not intended to indicate in any way that the Company will not assert, to the fullest extent, the Company’s

rights to use these trademarks and tradenames.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

We incorporate by reference herein the Exhibit

Index following the signature page to this Current Report on Form 8-K.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

IMATION CORP. |

| |

|

|

|

| Dated: January 10, 2017 |

|

|

|

By: |

|

/s/ Danny Zheng |

| |

|

|

|

Name: |

|

Danny Zheng |

| |

|

|

|

Title: |

|

Chief Financial Officer |

Exhibit Index

| Exhibit No. |

|

Description |

| 99.1 |

|

Investor Presentation. |

Exhibit 99.1

Strictly Confidential. Not for Distribution. UPDATED STOCKHOLDER PRESENTATION January 2017 FinTECH ASSET MANAGEMEN T

IMPORTANT DISCLOSURES AND DISCLAIMERS A DDITIONAL I NFORMATION A BOUT THE P ROPOSALS AND W HERE TO F IND I T Imation Corp . (“Imation” or the “Company”) has filed with the U . S . Securities and Exchange Commission (“SEC”) a definitive proxy statement in connection with a special meeting of the Company’s stockholders (the “Special Meeting”) with respect to the following proposals (the “Proposals”) : ( 1 ) to approve the issuance of up to 15 , 000 , 000 shares of common stock of the Company (the “Capacity Shares”) to Clinton Group, Inc . (“Clinton Group”) ; ( 2 ) to approve (i) an amendment to Imation’s Restated Certificate of Incorporation to effect, at the discretion of Imation’s Board of Directors (the “Board”) and at any time prior to January 31 , 2018 , a reverse stock split using a ratio, to be established by the Board in its sole discretion, within a range of 1 : 2 to 1 : 20 and (ii) a reduction of the number of authorized shares of the Company's common stock in a corresponding proportion ; and ( 3 ) to adjourn the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies . The Company has mailed the definitive proxy statement and other relevant documents to its stockholders in connection with its solicitation of proxies for the Special Meeting to approve the Proposals . This presentation does not contain all the information that should be considered concerning the Proposals . It is not intended to provide the basis for any investment decision or any other decision in respect to the Proposals . The Company’s stockholders and other interested persons are advised to read the definitive proxy statement and other relevant documents delivered to its stockholders in connection with the Company’s solicitation of proxies for the Special Meeting, as these materials contain important information about the Company and the Proposals . The definitive proxy statement has been mailed to stockholders of the Company as of January 6 , 2017 , the record date established for voting on the Proposals . Stockholders are also able to obtain copies of the definitive proxy statement and other documents filed with the SEC, without charge, at the SEC’s web site at (www . sec . gov), or by directing a request to : Imation Corp . , 1099 Helmo Ave . N . , Suite 250 , Oakdale, Minnesota 55128 , Attn : Corporate Secretary, ( 651 ) 704 - 4311 . P ARTICIPANTS IN S OLICITATION The Company and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of the Company in connection with the Proposals . Information regarding the special interests of these directors and executive officers in the Proposals is included in the definitive proxy statement referred to above . Additional information regarding the directors and executive officers of the Company is also included in the Company’s Annual Report on Form 10 - K for the year ended December 31 , 2015 , which is available free of charge at the SEC’s web site (www . sec . gov) and at the address described above and is also included in the definitive proxy statement . F ORWARD L OOKING S TATEMENTS This presentation includes “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially from those expected and projected . Words such as “expects”, “believes”, “anticipates”, “intends”, “estimates”, “seeks” and variations and similar words and expressions are intended to identify such forward - looking statements . Such forward - looking statements with respect to the transactions contemplated by the Subscription Agreement, the Capacity and Services Agreement and the Registration Rights Agreement relating to the issuance of the Capacity Shares (collectively, the “Transaction Documents”) are based on current expectations that are subject to risks and uncertainties . A number of factors could cause actual events, performance or results to differ materially from the events, performance and results discussed in the forward - looking statements . These factors include, but are not limited to : ( 1 ) the occurrence of any event, change or other circumstances that could give rise to the termination of the Transaction Documents and the proposed transactions contemplated thereby, ( 2 ) the outcome of any legal proceedings that may be instituted against the Company or others following announcement of the transactions contemplated by the Transaction Documents ; ( 3 ) the inability to complete the transactions contemplated by the Transaction Documents due to the failure to obtain approval of the stockholders of the Company or other conditions to closing in the Transaction Documents, ( 4 ) delays in obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the transactions contemplated by the Transaction Documents ; ( 5 ) the risk that the proposed transactions disrupt current plans and operations as a result of the announcement and consummation of the transactions described herein ; ( 6 ) the ability to recognize the anticipated benefits of the Proposals ; ( 7 ) costs related to the proposed transactions ; ( 8 ) changes in applicable laws or regulations ; ( 9 ) the possibility that the Company or Clinton Group may be adversely affected by other economic, business, and/or competitive factors ; and ( 10 ) other risks and uncertainties indicated from time to time in the definitive proxy statement relating to the Proposals and other filings with the SEC by the Company (including those described under “Risk Factors” in such other filings) . Readers are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made, and the Company undertakes no obligation to update or revise any forward - 1

IMPORTANT DISCLOSURES AND DISCLAIMERS D ISCLAIMERS This presentation shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or the Proposals or an offer to sell or the solicitation of an offer to buy the Capacity Shares or any other security . The Capacity Shares have not been registered under the Securities Act or the securities laws of any other jurisdiction and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements . An investment in the Company is not an investment in Clinton Group . The historical results or past performance of Clinton Group are not necessarily indicative of future performance of the Company or its subsidiaries . This presentation does not constitute an offer of any investment fund we may sponsor . This presentation does not constitute an offer to sell or a solicitation to buy any securities in any private investment vehicle managed by GlassBridge (collectively, the “ GlassBridge - Managed Funds”), and may not be relied upon in connection with any offer or sale of securities . Any such offer or solicitation may only be made pursuant to the current Confidential Private Offering Memorandum (or similar document) for any such GlassBridge - Managed Fund, which are provided only to qualified offerees and which should be carefully reviewed prior to investing . This presentation does not constitute an offer to sell or a solicitation to buy any securities in any private investment vehicle managed by Clinton Group or its affiliates (collectively, the "Clinton - Managed Funds"), and may not be relied upon in connection with any offer or sale of securities . Any such offer or solicitation may only be made pursuant to the current Confidential Private Offering Memorandum (or similar document) for any such Clinton - Managed Fund, which are provided only to qualified offerees and which should be carefully reviewed prior to investing . In addition, GlassBridge is a newly formed entity and the GlassBridge funds are currently in a formation stage ; therefore, the information provided in this Presentation regarding GlassBridge's and the funds' policies, procedures, and processes, which are based on GlassBridge's expectation on how operations will be conducted, is preliminary, is subject to change, and may not conform to actual operational experience . GlassBridge is not currently registered with the SEC as an investment adviser under the U . S . Investment Advisers Act of 1940 , as amended, or under similar state laws, and nothing in this presentation constitutes investment advice with respect to securities . GlassBridge and the funds have no operating history upon which prospective investors can evaluate their performance . The past investment performance of Clinton Group, or entities with which it has been associated, may not be construed as an indication of the future results of the GlassBridge funds . The GlassBridge funds' investment programs should be evaluated on the basis that there can be no assurance that Clinton Group's assessment of the short - term or long - term prospects of investments will prove accurate or that any GlassBridge fund will achieve its investment objective . GlassBridge's multi - strategy fund is expected to launch with Clinton Group's quantitative strategy as the sole initial strategy of the fund, and GlassBridge will seek to add other strategies to the multi - strategy fund throughout 2017 . Certain clients, principals, affiliates and officers of Clinton Group are stockholders of the Company which may present certain conflicts of interest . The existence of potential conflicts of interest between the Company and the clients, principals, affiliates and officers of Clinton Group that are stockholders of the Company does not mean that there will be actual conflicts of interest . Further, the existence of an actual or potential conflict of interest does not mean that it will be acted upon to the detriment of any stockholder . T RADEMARKS This presentation includes trademarks and tradenames owned by the Company and its subsidiaries, including “Imation”, “ GlassBridge ”, “ Nexsan ” and “UNITY” . Solely for convenience, these trademarks or tradenames may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that the Company will not assert, to the fullest extent, the Company’s rights to use these trademarks and tradenames . 2

RE - BIRTH OF IMATION Evolution of Imation over the Last 15 Months IDENTIFY PROBLEMS ACTIVE RESTRUCTURING PHASE 1 • Three Directors replaced at 2015 Annual Meeting • CEO resigned in Q3 ‘15 • Profitability and capital requirements of all business lines were examined • Executive bonus compensation was frozen and board compensation was significantly reduced • Company began examining strategic alternatives for excess capital • Legacy businesses wound down • Sold non - core assets (IronKey, HQ real estate, Memorex trademarks) • Significantly reduced cash burn and staved off potential future insolvency • Actively managed cash and investment securities (including liquidation of Sphere3D shares) • Capital deployed to purchase Connected Data to give Nexsan “on - trend,” disruptive technology, and Nexsan positioned for growth and profitability Eliminated money losing businesses, and harvested capital from non - core assets Investment in enhanced technology with Nexsan to create a disruptive product line PHASE 2 • Imation enters into definitive agreement for Nexsan Transaction (see slide 19) while preserving potential equity value upside from Nexsan’s ongoing development and market penetration • Pre - money valuation of $25 million versus current market capitalization of Imation of ~$ 23 million before the transaction was announced • Nexsan’s UNITY™ product line combines performance, scalability and value with private cloud file system synchronization and mobile data support and is the driver of future equity value EXECUTION & GROWTH • Imation enters into definitive agreement with Clinton Group, Inc. (“Clinton Group”) to jumpstart asset management business • Furthers the stated goal of developing a publicly traded asset management firm poised for long - term growth and capital appreciation • Previously established investment advisor will manage third party capital following closing of transactions with Clinton Group PATH FORWARD Two Corporate Transactions Imation consummates Nexsan Transaction to sell Nexsan equity while maintaining upside Launch GlassBridge ™ Asset Management Business and further corporate vision 2015 2016 2017 3

THE GLASSBRIDGE BRAND GlassBridge will initially showcase the investment benefits of technology driven asset management and transparency within a publicly listed company GlassBridge Asset Management’s theme is “Financial Solutions through Technology Driven Asset Management ” THE CORPORATE ENTITY WILL BE REBRANDED • Imation Corp. intends to rebrand as “GlassBridge Enterprises” following closing of transactions with Clinton Group • Imation Corp. intends to apply for a new NYSE ticker symbol • The corporate headquarters for GlassBridge Enterprises will remain in Minnesota THE INVESTMENT ADVISOR WILL BE GLASSBRIDGE ASSET MANAGEMENT • The Investment Advisor will be branded as GlassBridge Asset Management with logos, website, and more • Future press releases and branding will focus on mission statement, vision, narrative and establishing a unique position within the asset management industry 4

THE VISION THE ASSET MANAGEMENT WORLD CAN BENEFIT FROM INNOVATIVE THINKING • Goal is to develop an in - house asset management business focused on financial technology • Initially, GlassBridge Asset Management, LLC (“ GlassBridge ”), Imation's investment advisor subsidiary, will innovate within proven strategies such as technology - driven trading • Business plan contemplates multi - year growth through identified business models within asset management • Numerous growth avenues going forward provide opportunities for sustained performance MULTIPLE AVENUES FOR GROWTH AND SUCCESS • The company would act as an asset manager for third - party investor capital, and as opportunities arise, seed new investment programs, funds and products • “Alternative asset” classes include hedge funds and other non - traditional investment programs • There is a significant amount of investment management talent seeking robust infrastructure and centralized services • Recent regulatory changes, reporting requirements and demand for transparency make now an opportune time for launch PUBLIC COMPANY FORMAT AFFORDS NUMEROUS ADVANTAGES • The visibility and scrutiny of a public company will give clients additional confidence • The ability to use the public currency to attract managers or acquire firms is powerful • Valuation of these firms – given the visible, recurring revenue – provides an attractive liquidity option for successful managers Imation will continue its transition and become a publicly traded alternative asset manager 5

EXECUTIVE SUMMARY – GLASSBRIDGE TRANSACTION STRATEGIC AGREEMENT WITH CLINTON GROUP • Imation has entered into a strategic agreement with Clinton Group • GlassBridge bypasses traditional seeding models with typical long roll out, by instantly operating with Clinton Group’s quantitative equity strategy (the “Strategy”) and assistance with certain services • This transaction leverages Clinton Group’s investment strategy infrastructure and intellectual property thereby seeking to minimize the time to deliver profitability • Clinton Group will reserve exclusive capacity for Imation within its Strategy • GlassBridge will work to deliver third - party investors in GlassBridge’s offering at closing • Transaction Milestones: □ August 2015: Strategic Alternatives Committee formed to develop strategic value creation initiatives and make recommendations to the Board regarding the Company’s use of excess capital □ July 2016: Board received a formal transaction proposal from Clinton Group and subsequently formed a Special Committee of independent directors not directly or indirectly affiliated with Clinton Group and who are not members of Imation's management; the Special Committee explored and retained advisors to independently review the transaction □ Board received financial advice from Stifel Financial Corp. and Cypress Associates, LLC Transaction jumpstarts Imation’s transition into a diversified asset management firm GlassBridge intends to provide solutions for investors designed to address the failure of most current hedge fund platforms to live up to the expectation of enhanced risk adjusted returns Fixed and variable portions of revenue and expenses will match up well and are well - positioned to grow a consistently profitable business JUMPSTART ASSET MANAGEMENT • The proposed structure will assist Imation in overseeing the assets currently on the Company’s balance sheet to seek to build a sustainable, profitable business • Start building its own track record • The Board believes the strategy will provide an attractive risk - adjusted return on capital • GlassBridge and Clinton Group align to leverage proven leadership teams 6

THE OPPORTUNITY • Over one thousand* firms unwinding for a myriad of reasons has left a pool of investment talent without a home • The plan is to expand the business and raise capital focused solely on profitability for our investors • Advantages of public company scrutiny will be comforting to investors • Scale, expertise and capital base will provide staying power PLATFORM ADVANTAGES • GlassBridge will focus on coordination and interaction among strategies as opposed to the segregated silo approach • Platform with a public currency can provide source of liquidity to managers that otherwise do not have one The asset management world has left many investors unsatisfied MARKET OPPORTUNITY DAY 1: LAUNCH GLASSBRIDGE • At closing, GlassBridge will have infrastructure set up and investment products to market • Goal of achieving consistent competitive risk - adjusted returns and structural flexibility to add additional strategies and managers over time • GlassBridge will build its own independent organizational foundation, while still leveraging Clinton Group’s capabilities and infrastructure *Source: HFR/CNBC; Q4 2016 7

OPERATIONAL EFFICIENCY • Sophisticated and costly technology systems infrastructure can be employed across strategies • Aggregating multiple managers will mitigate cost of compliance, risk management and client services • Centralized marketing efficiency • Available capital to opportunistically seed/co - invest new strategies and launching new investment programs from time to time • Significantly lowers financing and stock borrowing costs STRUCTURAL EFFICIENCY • Clients perceive scale as a risk mitigant • Brand matters to many capital allocators • Clients care about firm - wide assets under management • Disaster recovery procedures and multiple geographic sites are valued by clients • Branded service providers lend credibility; they are more easily engaged by large managers • Robust governance with corporate - level administrative and compliance professionals The asset management world has left many investors unsatisfied MARKET OPPORTUNITY (CONTINUED) 8

SUPPLY OF TALENT • GlassBridge will serve as a platform that can be used to roll - up sub - scale managers and onboard investment talent □ Acquire small firms that cannot attain necessary critical mass □ Centralize compliance, back - office, marketing and risk management • Many talented professional investors are in search of a firm with which to associate □ Hundreds have been let go under the Volcker Rule □ Many have significant expertise □ Rely on robust infrastructure, which comes at a significant cost □ Other talented investment managers would like more autonomy but recognize onerous start - up requirements • There are also thousands of small hedge funds and alternative asset managers – with existing sub - scale client bases □ Often, these managers underestimate the difficulty of building robust infrastructure and raising capital □ As often, there is no source of liquidity for the manager in the event the business is successful MARKET OPPORTUNITY (CONTINUED) Recent regulatory changes have led to a glut of available talent 9

POSITIVE ASSET FLOWS INTO TECHNOLOGY DRIVEN ASSET MANAGEMENT • Investor asset flows into quantitative long/short strategies have doubled over the past 3 years* □ GlassBridge is poised to capitalize on this dynamic • As GlassBridge attracts assets it will enable us to generate fee revenue without being burdened by the cost of building out significant investment strategy infrastructure □ This transaction leverages Clinton Group’s investment strategy infrastructure and intellectual property and seeks to minimize the time to deliver profitability CAPACITY AGREEMENT Creating a new paradigm for asset management while driving profitability 0% 5% 10% 15% 20% 25% 30% 35% 40% 2013 2014 2015 I NVESTOR A LLOCATIONS TO Q UANTITATIVE E QUITY S TRATEGIES * Quantitative Equity Long / Short Strategies are gaining in popularity *Source: Valuewalk , Q2 2016. 10

TRANSACTION: IMATION RECEIVES INVESTMENT CAPACITY AND SERVICES CONSIDERATION TO CLINTON GROUP • Imation will issue 12 . 5 million shares of common stock Clinton Group upon the closing of the transaction, valued at approximately $ 7 . 8 million • In exchange for the shares, Imation will receive gross capacity within the Strategy of $ 1 billion – or $ 500 million long and $ 500 million short – for five years (the “Capacity ”) which it can adapt or modify at its discretion • The Capacity is available for Imation to utilize at its discretion, with the intention of Imation launching and operating its own self - branded multi - strategy fund • At Imation’s option, it may expand its access to capacity at Clinton Group up to a total of $ 1 . 5 billion ( $ 750 million long and $ 750 million short) for an additional 2 . 5 million shares (the “Capacity Expansion”) • Following the fifth anniversary of the transaction, Imation will have the option to extend the term of the Capacity for two one - year periods in exchange for $ 1 . 75 million per year ( $ 2 . 5 million per year in each case if Imation has previously opted for the Capacity Expansion ) • Clinton will not receive fees on any GlassBridge managed funds that utilize the Capacity IMATION TRADING CAPACITY • Imation will receive $ 500 million long and $ 500 million short of investment capacity within Clinton Group’s Strategy • Imation will generate fee revenue from the funds managed by GlassBridge (no fees will be payable to Clinton Group) • Leverages Clinton’s proven technology driven asset management strategy • The Strategy is market neutral and designed to provide returns that are not correlated to those of the overall stock market • The Strategy combines multiple layers of quantitative models and sophisticated risk management oversight that seek to provide investors with consistent long term performance • Flexibility allows for optimal capital allocation as the Company can deploy capital as opportunities present themselves • While we intend GlassBridge to primarily engage in the management of third - party assets, it may opportunistically make proprietary investments from time to time • For the duration of the relationship, Clinton Group will provide administrative, marketing and support services 11

GLASSBRIDGE JUMPSTART The strategic agreement with Clinton Group allows for an accelerated launch of GlassBridge BENEFITS TO LAUNCH A TECHNOLOGY DRIVEN ALTERNATIVE INVESTMENT STRATEGY • GlassBridge will innovate with a proven technology driven strategy that has the potential to generate fees at launch • Typical start up costs to launch and operate an institutional quality hedge fund include legal, audit, administrative, research and trade compliance costs • A competitive quantitative strategy requires significant infrastructure investments for information technology, quantitative research, intellectual property, individuals with advanced science degrees and significant data feed costs ASSET MANAGEMENT BUSINESS OVERVIEW • Manage capital for pension plan sponsors, institutional investors and high net worth individuals • Business model consists of management fees tied to the amount of capital under management and a performance fee that rewards the manager for investment returns □ At scale, management fees intended to cover fixed operating expenses; goal to have variable expenses covered by performance fee revenues • Recurring revenue and profit visibility are attractive to public market investors GlassBridge will benefit from Clinton Group’s significant investment strategy infrastructure to operate an efficient, technology - driven asset manager strategy 12 IMATION’S STOCKHOLDERS’ INTERESTS ARE ALIGNED WITH THE CLINTON GROUP • GlassBridge will focus on coordination and interaction among strategies as opposed to the segregated silo approach • Platform with a public currency can provide source of liquidity to managers that otherwise do not have one • This infrastructure cost would be out of reach for Imation but the Clinton Group is providing a de facto lease towards a long term relationship • GlassBridge will build its own independent organizational foundation, while still leveraging Clinton Group’s capabilities and infrastructure • Clinton Group interests are aligned with Imation stockholders and both parties want this investment to 12

GLASSBRIDGE – ACTIVITIES TO DATE Since announcement the firm has moved into the execution phase STRUCTURALLY EFFICIENT MIDDLE AND BACK OFFICE ARCHITECTURE TO PROVIDE FLEXIBILITY • Imation has formed GlassBridge with a structurally efficient sub - advisor architecture • The platform has been designed to integrate in - house and third party fund managers and provide next generation processes and controls for oversight and integrated management • GlassBridge is in the process of selecting service providers to support and execute the above infrastructure • The Board and Management Team are actively evaluating strategic acquisitions for portfolio management teams • Counterparty relationships – e.g. , administrator, prime broker, auditor – are being evaluated and in process of being implemented INSTITUTIONAL POLICIES AND PROCESSES • Institutional quality fund governance is being established (including investment, portfolio management, investment policy, and risk management committees) • Institutional level asset management policies are being created for asset allocation, strategy allocation, and portfolio construction • Risk management policies are being developed including guidelines for portfolio risk monitoring, risk corrective action and compliance monitoring • Detailed talent acquisition road map to maintain constant pipeline of talented portfolio managers and analysts GlassBridge will implement institutional quality policies and processes with structural efficiency 13

PUBLIC COMPANY FORMAT AFFORDS NUMEROUS POTENTIAL ADVANTAGES MULTIPLE AVENUES FOR GROWTH AND SUCCESS • The visibility and scrutiny of a public company will give clients additional comfort • The ability to use the public currency to attract managers or acquire firms is powerful • Valuation of these firms – given the visible, recurring revenue – provides an attractive liquidity option for successful managers • Stock can provide investors with a better liquidity option (and better financing) than a fund participation (LP) interest for investors seeking exposure to alternative investment strategies • Incentivize employees through equity participation • Issue stock for acquisitions that are accretive • Deferred tax assets provide advantages Imation will only be one of a handful of publicly traded asset management companies within the alternative investment space 14

ATTRACTIVE STOCK We expect that the stock will be attractive to public market investors , with the goal of providing current stockholders with a solid return: • Will benefit from scarcity value as one of the only publicly traded alternative asset management companies • Stock can provide investors with a better liquidity option (and better financing) than a fund participation (LP) interest for investors seeking exposure to alternative investment strategies TRANSPARENCY Potential clients of GlassBridge will take comfort in the scrutiny and published financials of a public company BUYING POWER As opportunities arise, the Company’s cash and assets can be used to promote economies of scale and growth through seeding new investment programs, building or buying new investment teams and making select proprietary investments FUNDRAISING BENEFITS The Company believes its ability to raise additional investor capital for its fund family should serve as a natural accelerant to earnings TURNKEY Focused on establishing a business which can launch immediately with access to a robust investment strategy infrastructure and improved capital allocation decisions INDUSTRY GROWTH Interest and investment allocation in quantitatively managed assets is growing VALUE CREATION FOR IMATION STOCKHOLDERS 15

Strictly Confidential. Not for Distribution. APPENDIX 16

BUILDING A PUBLICLY TRADED ASSET MANAGER FOR A NEW PARADIGM Pre - Closing Year 1 Post - Closing Year 2 & Beyond NEAR - TERM MARKET OPPORTUNITY NEAR - TERM PRODUCT: MULTI - STRATEGY FUND NEAR - TERM TACTICS LONG - TERM MARKET OPPORTUNITY LONG - TERM PRODUCT: MULTI - STRATEGY FUND LONG - TERM TACTICS • Demand for Clinton Group Equity (Quant) Strategy • Public company overlay allows LPs to invest in GP • Clinton Group Equity (Quant) Strategy • Opportunistic activism • New quant strategies • Leverage Clinton infrastructure • Identify and acquire subscale managers • Hire talent and bring on platform • After - fee returns are low • No “hedged” alpha • Computer - driven trading on trend • Taxes eat away at returns • No yield world • Pension funds need alternatives • Subscale asset managers looking for platforms • Clinton Equity (Quant) Strategy • Quantitative strategies • Low volatility strategies • Cash management solutions • Acquired funds • Organic growth / hire talent • Buy / build subscale managers executing a low total enterprise value (TEV) entry strategy • Develop research center and the best quant talent 17

Strictly Confidential. Not for Distribution. February 2016 August 2015 April 2016 October 2015 Imation employed best practices through all phases of the strategic transaction with Clinton Group • Board of Imation forms a ‘Strategic Alternatives Committee’ • Goal is to develop strategic value creation initiatives and make recommendations to the Board regarding the Company’s use of excess capital • Company announces initiative to explore alternative uses of excess capital. • The Company amended its cash investment policy to permit investments into stocks, index funds, mutual funds and other investment funds. • Board approved plan to establish a Registered Investment Advisor. • The Board receives a formal transaction proposal from Clinton Group. • The Board forms a ‘Special Committee’ of independent directors to represent Imation. • The Company explores and retains advisors and consultant to independently review the transaction. • Imation enters into a term sheet with Clinton Group detailing the terms of a proposed transaction. • The Board, in conjunction with management, continued to explore and develop initiatives relating to developing revenue generating product offerings. • The Board is introduced to Robert Picard, a 25 Year hedge fund industry veteran who has built 4 separate multi - billion alternative investment platforms. • The Company evaluates several business opportunities. July 2016 - November 2016 • Imation Special Committee engages Weinberg, Zareh and Geyerhahn LLP as Counsel to the Special Committee in addition to Winston & Strawn LLP who serves as counsel to Imation. • Special Committee engages Stifel Financial Corp . and Cypress Associates LLC as financial advisors. • Imation consultants perform independent reviews and due diligence on alternatives. • Imation sends feedback to Clinton Group and receives a revised transaction proposal • Term Sheet between Clinton Group and Imation is executed. TRANSACTION TIMELINE 18

NEXSAN TRANSACTION Transaction with Spear Point provides Nexsan additional runway for growth and puts Imation in a senior secured position in the capital structure with a conversion feature KEY TERMS FOR IMATION • Pre - money valuation of $25 million • NXSN Acquisition Corp. (“NXSN”), an affiliate of Spear Point Capital Management LLC, will purchase from Imation all of the common stock of Nexsan and its subsidiaries (including Connected Data) and thereafter will issue up to $10 million of convertible preferred equity, the proceeds of which will be used to provide additional capital to Nexsan. □ PIK dividends at a rate of 5% per annum for the first two years and 8% per annum thereafter □ Participating preferred equity with convertible feature at 120% of par • In exchange for its Nexsan common stock, Imation will receive 50% of the issued and outstanding common stock of NXSN and a $ 25 million senior secured convertible promissory note maturing three years from closing (the “Note”) □ The Note will bear cash interest at a rate of 5% per annum for the first two years and 8% per annum thereafter □ $10 million of the Note is convertible into common equity of NXSN at a premium of 25% • 45 Day “Go Shop” to secure a superior proposal • Board received financial advice from Cypress Associates, LLC IMPACT TO IMATION • Transaction provides Nexsan with the additional capital necessary to continue its trajectory of value creation with its emerging technology in enterprise file, synch and share • Transaction eliminates Imation’s need to fund Nexsan's ongoing requirements • New equity holders may want the opportunity to enhance growth through additional capital investments or other bolt - on acquisitions • Imation preserves potential upside from equity value creation at Nexsan and the growth of UNITY™ Transaction eliminates Imation’s need to fund Nexsan's ongoing requirements while preserving potential upside from equity value creation at Nexsan and the growth of UNITY™ 19

TERMS OF $25 MILLION PROMISSORY NOTE • Seniority : Secured obligation of NXSN ranking senior in right of payment to all other indebtedness • Principal: Will be increased dollar - for - dollar to the extent NXSN fails to syndicate $10 million of the convertible preferred equity within 6 months of closing • Maturity : 3 years from date of issuance • Security : First priority lien on all assets of NXSN, including the capital stock of Nexsan and its primary operating subsidiaries • Interest : Payable quarterly, and accruing at a rate 5% per annum for first 2 years of term, 8% thereafter, beginning on the 6 month anniversary of the date of issuance. Applicable interest rates will be increased by 1% per annum to the extent NXSN fails to sell $10 million of convertible equity • Conversion : $10 million of the note principal is convertible into common stock of NXSN at a conversion price of $1.25/share (representing a 25% premium) NOTE COVENANTS Without the consent of Imation, NXSN cannot take certain actions while the Note remains outstanding, including the following: • No incurrence of senior or other types of indebtedness, creation of liens, or making of certain restricted payments • No issuance of preferred stock or other senior equity other than up to $10 million of convertible preferred equity within 6 months of closing • No fundamental business changes, dispositions or changes in accounting methods or insurance coverages STOCKHOLDER AGREEMENT Upon the closing, Imation and the other holders of NXSN common and preferred stock will enter into a Stockholders Agreement, which will entitle Imation to certain oversight, consent and veto rights, including: • The right to appoint 2 out of the 5 members of the NXSN board of directors (Spear Point will appoint 2 other directors, and the fifth director will be independent • The right to consent to certain actions, such as amendments to organizational documents and issuance of capital stock NEXSAN TRANSACTION Transaction structure and governance agreements protect the value of Imation’s convertible note going forward In addition to the 50% of issued and outstanding common stock of NXSN to be received by Imation, the $25 million note is senior secured debt and contains covenants that afford Imation ongoing controls over the governance of Nexsan while the note principal remains outstanding 20

AUTHORIZED SHARE REPURCHASE PROGRAM SHARE REPURCHASE PROGRAM • Board recently authorized a share repurchase program • The repurchase of up to 5 million shares of common stock has been authorized • This authorization replaces the Board's previous share repurchase authorization from May 2, 2012 • To the extent Imation repurchases shares, the timing and manner of such repurchases will depend on a variety of factors including market conditions, regulatory requirements and other corporate considerations, as determined by Imation’s Audit and Finance Committee • Imation is not obligated to repurchase any specific number of shares under the repurchase program, and repurchases may be suspended or discontinued at any time without prior notice • Imation expects to finance the repurchases with existing cash balances Imation’s Board of Directors authorized a share repurchase program under which Imation may repurchase up to 5 million of its outstanding shares of common stock Under the share repurchase program, Imation may repurchase shares from time to time using a variety of methods, which may include open market transactions and privately negotiated transactions 21

This regulatory filing also includes additional resources:

v456603_ex99-1.pdf

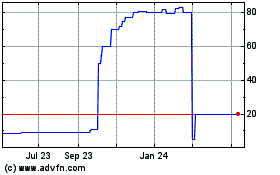

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Mar 2024 to Apr 2024

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Apr 2023 to Apr 2024