Zedge, Inc. (NYSE MKT:ZDGE) today announced results for the

first quarter of its fiscal year 2017, the three months ended

October 31, 2016.

First Quarter FY 2017 Operational and

Financial Highlights(Results are for the 1st quarter FY

2017 and are compared to the 1st quarter FY 2016 except where

otherwise noted.)

- MAU (Monthly Active Users) for the last

30 days of the quarter increased 2.6% to 31.6 million

- Total installs at October 31, 2016

increased 32.6% to 230.5 million

- Revenue decreased 6.9% to $2.4

million

- Average revenue per MAU decreased 10.7%

to $0.0233

- Income from operations decreased 73.0%

to $113 thousand

- Net income per diluted share of $0.02

compared to $0.04

- Working capital – current assets less

current liabilities - increased 150% to $6.2 million at October 31,

2016 from $2.5 million at October 31, 2015

Management Remarks“Zedge

remains focused on growing our user base and improving engagement

to facilitate future revenue growth. We are energized seeing the

early fruits of this commitment in the first quarter results,

particularly the uptick in our monthly active user base,” commented

Tom Arnoy, co-founder and CEO. “We are confident that there is

substantial untapped potential in this category and believe that

our continued investments in building the right team, optimizing

the user experience and expanding our product portfolio will help

us in realizing our goals.”

Jonathan Reich, CFO and COO of Zedge, said, “Our first quarter

results generate optimism, particularly with the return to user

growth. The increase in MAU, one of our key performance indicators,

is a good harbinger for revenue expansion and we remain focused on

improving this metric in coming quarters. Furthermore, we

re-introduced Zedge Ringtones on iTunes in November in the U.S. and

Canada before releasing it globally in December. We expect that

this will positively impact ARPMAU in the second quarter.”

Financial Results by Quarter (in

thousands of USD)

Q1 FY2017

Q4 FY2016 Q1 FY2016

Change1Q16 to 1Q17

Revenue $2,383 $2,452

$2,559 (6.9%) Direct cost of revenue

$367 $367 $295

+24.4% SG&A $1,756

$2,439 $1,685 +4.2% Depreciation &

amortization $138 $135

$160 (13.8%) Write-off of software and

technology development operating expense $9

$281 - +$9 Income (loss)

from operations $113 ($771)

$419 ($306) Net gain (loss) from FX and

other $51 ($17)

($54) +$105 (Provision for) benefit from income taxes

($1) $9 ($40)

+$39 Net income (loss) $163

($780) $325 ($162)

Diluted earnings (loss) per share $0.02

($0.08) $0.04 ($0.02) Total

current assets less total current liabilities

$6,196 $6,126 $2,476

+$3,720

Earnings Conference

CallZedge’s management will host an earnings conference

call beginning at 5:30 PM Eastern time today, December 8th.

Management’s presentation of the results, outlook and strategy will

be followed by Q&A with investors.

To participate in the call, please dial toll-free 1-888-317-6003

(from the U.S.) or 1-412-317-6061 (outside the U.S.) at least five

minutes before the 5:30 PM Eastern start, ask for the Zedge

earnings conference call, and enter the conference ID: 5453687.

The conference call will also be webcast, and can be accessed

both live and for three months following the call through this URL:

http://services.choruscall.com/links/zdge161205nbyzxpUE.html.

Forward Looking

StatementsAll statements above that are not purely about

historical facts, including, but not limited to, those in which we

use the words “believe,” “anticipate,” “expect,” “plan,” “intend,”

“estimate,” “target” and similar expressions, are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. While these forward-looking statements

represent our current judgment of what may happen in the future,

actual results may differ materially from the results expressed or

implied by these statements due to numerous important factors. Our

filings with the SEC provide detailed information on such

statements and risks, and should be consulted along with this

release. To the extent permitted under applicable law, we assume no

obligation to update any forward-looking statements.

About ZedgeZedge is a

content platform, and global leader in smartphone personalization,

with more than 230 million app installs and 32 million monthly

active users. People use Zedge to make their smartphones more

personal; to express their emotions, tastes and interests using

wallpapers, icons, widgets, ringtones and more. The Zedge platform

enables brands, artists and creators to share their smartphone

personalization content with their fans in order to extend their

reach, reinforce their message and gain valuable insight into how

customers interact with their content.

ZEDGE, INC. CONSOLIDATED BALANCE

SHEETS

October 31,2016 July 31,2016

(Unaudited) (in thousands, except par value)

Assets Current assets: Cash and cash equivalents $ 5,983 $

5,978 Trade accounts receivable, net of allowance for doubtful

accounts of $0 at October 31, 2016 and July 31, 2016 1,679 1,668

Prepaid expenses 192 210 Other current assets 332

107 Total current assets 8,186 7,963 Property and

equipment, net 2,058 1,843 Goodwill 2,411 2,361 Other assets

262 266 Total assets $ 12,917 $ 12,433

Liabilities and stockholders’

equity

Current liabilities: Trade accounts payable $ 74 $ 36 Accrued

expenses 1,835 1,487 Deferred revenue 8 15 Due to IDT Corporation

73 299 Total current liabilities

1,990 1,837 Commitments and contingencies

Stockholders’ equity: Preferred stock, $.01 par value; authorized

shares—2,400; no shares issued —

—

Class A common stock, $.01 par value;

authorized shares—2,600; 525 shares issued andoutstanding at

October 31, 2016 and July 31, 2016

5 5

Class B common stock, $.01 par value;

authorized shares—40,000; 8,865 and 8,819 shares issuedand

outstanding at October 31, 2016 and July 31, 2016, respectively

89 88 Additional paid-in capital 21,139 21,045 Accumulated other

comprehensive loss (744 ) (817 ) Accumulated deficit (9,562

) (9,725 ) Total stockholders’ equity 10,927

10,596 Total liabilities and stockholders’ equity $

12,917 $ 12,433

ZEDGE,

INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME(Unaudited)

Three Months EndedOctober

31,

2016 2015 (in

thousands, except per share data) Revenues $ 2,383 $

2,559 Costs and expenses:

Direct cost of revenues (exclusive of

amortization of capitalizedsoftware and technology development

costs included below)

367 295 Selling, general and administrative 1,756 1,685

Depreciation and amortization 138 160 Write-off of capitalized

software and technology development costs 9

— Income from operations 113 419 Interest and other

income 1 1 Net gain (loss) resulting from foreign exchange

transactions 50 (55 ) Income before

income taxes 164 365 Provision for income taxes (1 )

(40 ) Net income 163 325 Other comprehensive income (loss):

Changes in foreign currency translation adjustment 73

(92 ) Total other comprehensive income (loss)

73 (92 ) Total comprehensive income $ 236

$ 233 Earnings per share attributable to

Zedge, Inc. common stockholders: Basic $ 0.02 $ 0.04

Diluted $ 0.02 $ 0.04 Weighted-average

number of shares used in calculation of earnings per share: Basic

9,261 8,161 Diluted

10,458 8,934

ZEDGE, INC.CONSOLIDATED

STATEMENTS OF CASH FLOWS(Unaudited)

Three Months EndedOctober

31,

2016 2015

(in thousands) Operating activities Net income $ 163

$ 325 Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 138 160

Deferred income taxes 5 — Stock-based compensation 27 6 Change in

assets and liabilities: Trade accounts receivable (11 ) (330 )

Prepaid expenses and other current assets (264 ) (106 ) Other

assets (2 ) 4 Trade accounts payable and accrued expenses 392 511

Due to IDT Corporation (226 ) (93 ) Deferred revenue (7 )

(4 ) Net cash provided by operating activities 215 473

Investing activities Capitalized software and technology

development costs and purchase of equipment (349 )

(183 ) Net cash used in investing activities (349 ) (183 )

Financing activities Proceeds from exercise of stock options

124 — Net cash provided by financing

activities 124 — Effect of exchange rates on cash and cash

equivalents 15 (27 ) Net increase in cash and

cash equivalents 5 263 Cash and cash equivalents at beginning of

period 5,978 2,170 Cash and cash

equivalents at end of period $ 5,983 $ 2,433

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161208005203/en/

Zedge, Inc.Jonathan Reichir@zedge.net

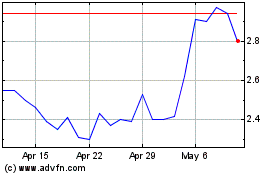

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zedge (AMEX:ZDGE)

Historical Stock Chart

From Apr 2023 to Apr 2024