Total Sales Increased 24.2%

Comparable Sales Increased 16.7%

Diluted EPS Increased 26.1% to $1.40

Company Raises Guidance for Fiscal Year

2016

Ulta Beauty (NASDAQ:ULTA) today announced financial results for

the thirteen week period (“Third Quarter”) and thirty-nine week

period (“First Nine Months”) ended October 29, 2016, which compares

to the same periods ended October 31, 2015.

“Ulta Beauty’s top line accelerated in the third quarter,

driving record sales and earnings performance,” said Mary Dillon,

Chief Executive Officer. “Our associates continue to execute

against our growth strategies, resulting in success across several

areas: new brand acquisition, increased Ulta Beauty brand

awareness, rapid growth in our loyalty program, improving supply

chain performance, and robust e-commerce growth.”

For the Third Quarter

- Net sales increased 24.2% to $1,131.2

million from $910.7 million in the third quarter of fiscal

2015;

- Comparable sales (sales for stores open

at least 14 months and e-commerce sales) increased 16.7% compared

to an increase of 12.8% in the third quarter of fiscal 2015. The

16.7% comparable sales increase was driven by 11.1% growth in

transactions and 5.6% growth in average ticket;

- Retail comparable sales increased

14.3%, including salon comparable sales growth of 10.3%;

- Salon sales increased 16.7% to $60.4

million from $51.7 million in the third quarter of fiscal

2015;

- E-commerce sales grew 59.1% to $73.6

million from $46.2 million in the third quarter of fiscal 2015,

representing 240 basis points of the total company comparable sales

increase of 16.7%;

- Gross profit increased 90 basis points

to 37.8% from 36.9% in the third quarter of fiscal 2015, due to

product margin expansion and leverage in fixed store costs, partly

offset by planned supply chain deleverage related to supply chain

investments;

- Selling, general and administrative

(SG&A) expense as a percentage of net sales increased 80 basis

points to 24.8%, compared to 24.0% in the third quarter of fiscal

2015, primarily due to investments to support growth initiatives

and deleverage of corporate overhead costs, in part due to a $1.8

million impairment charge related to a Louisiana store impacted by

the August floods;

- Pre-opening expenses increased to $6.9

million, compared to $6.1 million in the third quarter of fiscal

2015. Real estate activity in the third quarter of fiscal 2016

included 42 new stores, one relocation and six remodels compared to

45 new stores, two relocations and two remodels in the third

quarter of fiscal 2015;

- Operating income increased 26.1% to

$139.7 million, or 12.4% of net sales, compared to $110.8 million,

or 12.2% of net sales, in the third quarter of fiscal 2015;

- Net income increased 23.2% to $87.6

million compared to $71.1 million in the third quarter of fiscal

2015; and

- Income per diluted share increased

26.1% to $1.40 compared to $1.11 in the third quarter of fiscal

2015.

For the First Nine Months

- Net sales increased 23.3% to $3,274.2

million from $2,655.8 million in the first nine months of fiscal

2015;

- Comparable sales (sales for stores open

at least 14 months and e-commerce sales) increased 15.4% compared

to an increase of 11.4% in the first nine months of fiscal 2015.

The 15.4% comparable sales increase was driven by 10.6% growth in

transactions and 4.8% growth in average ticket;

- Retail comparable sales increased

13.6%, including salon comparable sales growth of 8.7%;

- Salon sales increased 15.2% to $178.2

million from $154.7 million in the first nine months of fiscal

2015;

- E-commerce comparable sales grew 50.8%

to $190.5 million from $126.3 million in the first nine months of

fiscal 2015, representing 180 basis points of the total company

comparable sales increase of 15.4%;

- Gross profit increased 110 basis points

to 36.7% from 35.6% in the first nine months of fiscal 2015;

- SG&A expense as a percentage of net

sales increased 70 basis points to 23.1% compared to 22.4% in the

first nine months of fiscal 2015. This includes 10 basis points

related to the impairment charges in the second and third quarters

of fiscal 2016 for the Chicago and Louisiana store closures;

- Pre-opening expenses increased to $14.2

million, compared to $13.3 million in the first nine months of

2015. Real estate activity in the first nine months of 2016

included 79 new stores, two relocations and eleven remodels

compared to 89 new stores, four relocations and four remodels in

the first nine months of fiscal 2015;

- Operating income increased 27.8% to

$430.6 million, or 13.2% of net sales, compared to $336.8 million,

or 12.7% of net sales, in the first nine months of fiscal

2015;

- Net income increased 27.0% to $269.5

million compared to $212.2 million in the first nine months of

fiscal 2015; and

- Income per diluted share increased

29.7% to $4.28 compared to $3.30 in the first nine months of fiscal

2015.

Balance Sheet

Merchandise inventories at the end of the third quarter of

fiscal 2016 totaled $1,137.0 million, compared to $884.4 million at

the end of the third quarter of fiscal 2015, representing an

increase of $252.6 million. Average inventory per store increased

16.5%, compared to the third quarter of fiscal 2015. The increase

in inventory was primarily driven by 89 net new stores, the scaling

up of the Greenwood, Indiana and the opening of the Dallas, Texas

distribution centers, investments in inventory to ensure high

in-stock levels to support sales growth, and incremental inventory

for new brands and in-store prestige brand boutiques. Average

inventory per store, excluding the investment in the new Dallas,

Texas distribution center, increased 9.8%.

The Company ended the third quarter of fiscal 2016 with $243.1

million in cash and short-term investments.

Share Repurchase Program

For the first nine months, including the Accelerated Share

Repurchase and activity under the 10b5-1 plan, the Company has

repurchased 1,449,594 shares of its stock at a cost of $297 million

at an average price of approximately $205. As of October 29, 2016,

approximately $148 million remained available under the $425

million share repurchase program announced in March 2016.

Store Expansion

During the third quarter, the Company opened 42 stores located

in Albuquerque, NM; Allentown, PA; American Fork, UT; Brick, NJ;

Brownsville, TX; Castle Rock, CO; Cheyenne, WY; Conway, AR;

Danbury, CT; Edmond, OK; Fairfield, CA; Farmington, NM; Fenton, MI;

Frisco, TX; Goshen, IN; Houston, TX; Houston, TX; Hutchinson, KS;

Lapeer, MI; Las Vegas, NV; Marysville, WA; Menomonee Falls, WI;

Meridian, ID; Morristown, TN; Ontario, CA; Orange, CA; Oshkosh, WI;

Oxford, MS; Peachtree City, GA; Prattville, AL; Redding, CA;

Rochester, NH; San Antonio, TX; Seminole, FL; Shelby Township, MI;

Sherman, TX; Smyrna, TN; Temecula, CA; Valley Stream, NY; Warner

Robins, GA; Wayne, NJ and Wichita, KS. The Company ended the third

quarter with 949 stores and square footage of 10,012,142,

representing a 10% increase in square footage compared to the third

quarter of fiscal 2015.

Outlook

For the fourth quarter of fiscal 2016, the Company currently

expects net sales in the range of $1,516 million to $1,541 million,

compared to actual net sales of $1,268.3 million in the fourth

quarter of fiscal 2015. Comparable sales for the fourth quarter of

2016, including e-commerce sales, are expected to increase 12% to

14%. The Company reported a comparable sales increase of 12.5% in

the fourth quarter of 2015.

Income per diluted share for the fourth quarter of fiscal 2016

is estimated to be in the range of $2.08 to $2.13. This compares to

income per diluted share for the fourth quarter of fiscal 2015 of

$1.69.

The Company is raising its previously announced fiscal 2016

guidance. The Company plans to:

- achieve comparable sales growth of

approximately 13% to 15%, including the impact of the e-commerce

business;

- increase total sales in the low

twenties percentage range, compared to previous guidance of high

teens percentage;

- grow e-commerce sales in the 40%

range;

- expand square footage by approximately

11% with the opening of 100 net new stores;

- remodel 12 locations;

- deliver earnings per share growth in

the high twenties percentage range, compared to previous guidance

of mid-twenties percent growth, including the impact of the new

Dallas distribution center, the accelerated rollout of prestige

brand boutiques, the accelerated share repurchase program, and

continued open market share repurchases; and

- incur capital expenditures in the $390

million range in fiscal 2016, compared to $299 million in fiscal

2015. The planned increase in capital expenditures includes

approximately $80 million to fund an accelerated rollout of

prestige brand boutiques and enhancements to the Ulta Beauty

Collection and fragrance fixtures in hundreds of stores.

Conference Call Information

A conference call to discuss third quarter results is scheduled

for today, December 1, 2016 at 5:00 p.m. Eastern Time. Investors

and analysts interested in participating in the call are invited to

dial (877) 705-6003. The conference call will also be web-cast live

at http://ir.ulta.com and remain available for 90 days. A replay of

this call will be available until 11:59 p.m. (ET) on December 15,

2016 and can be accessed by dialing (844) 512-2921 and entering

conference ID number 13650257.

About Ulta Beauty

Ulta Beauty (NASDAQ: ULTA) is the largest beauty retailer in the

United States and the premier beauty destination for cosmetics,

fragrance, skin, hair care products and salon services. Since

opening its first store in 1990, Ulta Beauty has grown to become

the top national retailer providing All Things Beauty, All in One

Place™. The Company offers more than 20,000 products from over 500

well-established and emerging beauty brands across all categories

and price points, including Ulta Beauty’s own private label. Ulta

Beauty also offers a full-service salon in every store featuring

hair, skin and brow services. Ulta Beauty is recognized for its

commitment to personalized service, fun and inviting stores and its

industry-leading Ultamate Rewards loyalty program. As of October

29, 2016 Ulta Beauty operates 949 retail stores across 48 states

and the District of Columbia and also distributes its products

through its website, which includes a collection of tips, tutorials

and social content. For more information, visit www.ulta.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, which reflect our current

views with respect to, among other things, future events and

financial performance. You can identify these forward-looking

statements by the use of forward-looking words such as “outlook,”

“believes,” “expects,” “plans,” “estimates,” “targets,”

“strategies” or other comparable words. Any forward-looking

statements contained in this press release are based upon our

historical performance and on current plans, estimates and

expectations. The inclusion of this forward-looking information

should not be regarded as a representation by us or any other

person that the future plans, estimates, targets, strategies or

expectations contemplated by us will be achieved. Such

forward-looking statements are subject to various risks and

uncertainties, which include, without limitation: the impact of

weakness in the economy; changes in the overall level of consumer

spending; the possibility that we may be unable to compete

effectively in our highly competitive markets; the possibility that

cybersecurity breaches and other disruptions could compromise our

information or result in the unauthorized disclosure of

confidential information; the possibility that the capacity of our

distribution and order fulfillment infrastructure and the

performance of our newly opened distribution centers may not be

adequate to support our recent growth and expected future growth

plans; our ability to gauge beauty trends and react to changing

consumer preferences in a timely manner; our ability to attract and

retain key executive personnel; customer acceptance of our rewards

program and technological and marketing initiatives; our ability to

sustain our growth plans and successfully implement our long-range

strategic and financial plan; the possibility that our continued

opening of new stores could strain our resources and have a

material adverse effect on our business and financial performance;

the possibility of material disruptions to our information systems;

changes in the wholesale cost of our products; the possibility that

new store openings and existing locations may be impacted by

developer or co-tenant issues; weather conditions that could

negatively impact sales; our ability to successfully execute our

common stock repurchase program or implement future common stock

repurchase programs; and other risk factors detailed in our public

filings with the Securities and Exchange Commission (the “SEC”),

including risk factors contained in our Annual Report on Form 10-K

for the fiscal year ended January 30, 2016, as such may be amended

or supplemented in our subsequently filed Quarterly Reports on Form

10-Q. Our filings with the SEC are available at www.sec.gov. Except

to the extent required by the federal securities laws, the Company

does not undertake to publicly update or revise its forward-looking

statements, whether as a result of new information, future events

or otherwise.

Exhibit 1

Ulta Salon, Cosmetics & Fragrance, Inc.

Consolidated Statements of Income (In thousands, except

per share data) 13 Weeks Ended

13 Weeks Ended October 29, October 31,

2016 2015 (Unaudited) (Unaudited) Net

sales $ 1,131,232 100.0 % $ 910,700

100.0 % Cost of sales 704,179 62.2 %

575,062 63.1 % Gross profit 427,053

37.8 % 335,638 36.9 % Selling, general and administrative

expenses 280,464 24.8 % 218,763 24.0 % Pre-opening expenses

6,928 0.6 % 6,106

0.7 % Operating income 139,661 12.4 % 110,769 12.2 % Interest

income, net (211 ) 0.0 % (283 )

0.0 % Income before income taxes 139,872 12.4 % 111,052 12.2

% Income tax expense 52,310 4.6 %

39,982 4.4 % Net income $ 87,562

7.7 % $ 71,070 7.8 % Net

income per common share: Basic $ 1.40 $ 1.11 Diluted $ 1.40 $ 1.11

Weighted average common shares outstanding: Basic 62,371

63,882 Diluted 62,692 64,196

Exhibit 2

Ulta Salon, Cosmetics & Fragrance, Inc.

Consolidated Statements of Income (In thousands, except

per share data) 39 Weeks Ended

39 Weeks Ended October 29, October 31,

2016 2015 (Unaudited) (Unaudited) Net

sales $ 3,274,163 100.0 % $ 2,655,821

100.0 % Cost of sales 2,071,842 63.3 %

1,710,524 64.4 % Gross profit 1,202,321

36.7 % 945,297 35.6 % Selling, general and administrative

expenses 757,568 23.1 % 595,185 22.4 % Pre-opening expenses

14,159 0.4 % 13,301

0.5 % Operating income 430,594 13.2 % 336,811 12.7 %

Interest income, net (774 ) 0.0 %

(870 ) 0.0 % Income before income taxes 431,368 13.2

% 337,681 12.7 % Income tax expense 161,826

4.9 % 125,496 4.7 % Net income $

269,542 8.2 % $ 212,185

8.0 % Net income per common share: Basic $ 4.30 $ 3.31

Diluted $ 4.28 $ 3.30 Weighted average common shares

outstanding: Basic 62,625 64,050 Diluted 62,932 64,383

Exhibit 3

Ulta Salon, Cosmetics & Fragrance, Inc.

Condensed Consolidated Balance Sheets (In thousands)

October 29, January 30,

October 31, 2016 2016

2015 (Unaudited) (Unaudited)

Assets Current assets: Cash and cash

equivalents $ 133,108 $ 345,840 $ 209,552 Short-term investments

110,000 130,000 150,209 Receivables, net 65,708 64,992 50,939

Merchandise inventories, net 1,137,023 761,793 884,407 Prepaid

expenses and other current assets 85,611 72,548 70,467 Prepaid

income taxes 7,015 – 2,133 Deferred income taxes –

– 20,483 Total current

assets 1,538,465 1,375,173

1,388,190 Property and equipment, net 1,001,938 847,600

844,238 Deferred compensation plan assets 10,798

8,145 7,570 Total assets

$ 2,551,201 $ 2,230,918 $

2,239,998

Liabilities and stockholders’ equity

Current liabilities: Accounts payable $ 425,071 $ 196,174 $ 291,269

Accrued liabilities 229,569 187,351 166,707 Accrued income taxes

– 12,702 –

Total current liabilities 654,640 396,227 457,976 Deferred

rent 361,667 321,789 324,314 Deferred income taxes 62,669 59,527

72,646 Other long-term liabilities 20,141

10,489 10,903 Total liabilities

1,099,117 788,032 865,839 Commitments and contingencies

Total stockholders’ equity 1,452,084

1,442,886 1,374,159 Total

liabilities and stockholders’ equity $ 2,551,201 $

2,230,918 $ 2,239,998

Exhibit 4

Ulta Salon, Cosmetics & Fragrance, Inc.

Consolidated Statements of Cash Flows (In thousands)

39 Weeks Ended October 29,

October 31, 2016 2015

(Unaudited) Operating activities Net

income $ 269,542 $ 212,185 Adjustments to reconcile net income to

net cash provided by operating activities: Depreciation and

amortization 151,014 119,051 Deferred income taxes 3,142 (1,555 )

Non-cash stock compensation charges 14,203 11,126 Excess tax

benefits from stock-based compensation (9,001 ) (8,608 ) Loss on

disposal of property and equipment 6,822 2,647 Change in operating

assets and liabilities: Receivables (716 ) 1,501 Merchandise

inventories (375,230 ) (303,178 ) Prepaid expenses and other

current assets (13,063 ) (3,919 ) Income taxes (10,716 ) (12,929 )

Accounts payable 228,897 100,491 Accrued liabilities 11,247 427

Deferred rent 39,878 30,187 Other assets and liabilities

6,999 1,547 Net cash provided by

operating activities 323,018 148,973

Investing

activities Purchases of short-term investments (60,000 )

(50,000 ) Proceeds from short-term investments 80,000 50,000

Purchases of property and equipment (281,203 )

(231,909 ) Net cash used in investing activities (261,203 )

(231,909 )

Financing activities Repurchase of common

shares (296,994 ) (121,272 ) Stock options exercised 16,188 17,877

Excess tax benefits from stock-based compensation 9,001 8,608

Purchase of treasury shares (2,742 )

(1,874 ) Net cash used in financing activities

(274,547 ) (96,661 ) Net decrease in cash and

cash equivalents (212,732 ) (179,597 ) Cash and cash equivalents at

beginning of period 345,840

389,149 Cash and cash equivalents at end of period $

133,108 $ 209,552

Exhibit 5

2016 Store

Expansion

Total stores open at Number of

stores Number of stores beginning of

the opened during the closed during the Total

stores open at Fiscal 2016 quarter

quarter quarter end of the

quarter 1st Quarter 874 13 1 886 2nd Quarter 886 24 3 907 3rd

Quarter 907 42 0 949

Gross square feet for Total

gross square stores opened or Gross square feet

Total gross square feet at beginning expanded

during the for stores closed feet at end of the

Fiscal 2016 of the quarter

quarter during the quarter

quarter 1st Quarter 9,225,957 132,812 10,192 9,348,577 2nd

Quarter 9,348,577 253,023 46,408 9,555,192 3rd Quarter 9,555,192

456,950 0 10,012,142

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161201006392/en/

Ulta BeautyScott SetterstenChief Financial Officer(630)

410-4807orLaurel LefebvreVice President, Investor Relations(630)

410-5230orKaren MayDirector, Public Relations(630) 410-5457

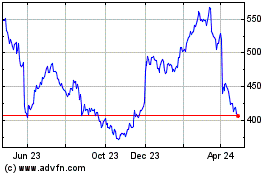

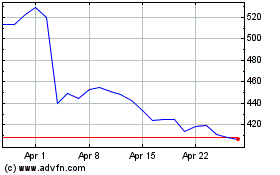

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ulta Beauty (NASDAQ:ULTA)

Historical Stock Chart

From Apr 2023 to Apr 2024