Innovative Industrial Properties Prices Initial Public Offering

December 01 2016 - 7:30AM

Business Wire

Innovative Industrial Properties, Inc. (the “Company”) (NYSE:

IIPR) announced today the pricing of its initial public offering of

3,350,000 shares of common stock at a public offering price of

$20.00 per share. The Company granted the underwriters of the

offering a 30-day option to purchase up to an additional 502,500

shares of the Company’s common stock at the initial public offering

price to cover over-allotments, if any. The shares are expected to

begin trading on December 1, 2016 on the New York Stock Exchange

under the symbol “IIPR.” The offering is expected to close on

December 6, 2016, subject to customary conditions.

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg

Thalmann Financial Services Inc. (NYSE MKT:LTS), and Compass Point

Research & Trading LLC are acting as joint book-running

managers for the offering. Aegis Capital Corp. and National

Securities Corporation are acting as co-managers for the

offering.

A registration statement relating to these securities was

declared effective by the Securities and Exchange Commission on

November 30, 2016. This offering is being made only by means of a

prospectus. A copy of the final prospectus related to the offering

may be obtained, when available, from Ladenburg Thalmann & Co.

Inc., 570 Lexington Avenue, 11th Floor, New York, NY 10022, or by

email at prospectus@ladenburg.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor will there be

any sale of these securities, in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

jurisdiction.

About Innovative Industrial

Properties

Innovative Industrial Properties, Inc. is a self-advised

Maryland corporation focused on the acquisition, ownership and

management of specialized industrial properties leased to

experienced, state-licensed operators for their regulated

medical-use cannabis facilities. Innovative Industrial Properties

intends to elect to be taxed as a real estate investment trust.

Forward-Looking

Statements

This press release contains statements that we believe to be

“forward-looking statements” within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

All statements other than historical facts, including, without

limitation, statements regarding the closing of the offering and

any exercise of the over-allotment option by the underwriters, are

forward-looking statements. When used in this press release, words

such as we “expect,” “intend,” “plan,” “estimate,” “anticipate,”

“believe” or “should” or the negative thereof or similar

terminology are generally intended to identify forward-looking

statements. Such forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially from those expressed in, or implied by, such statements.

Investors should not place undue reliance upon forward-looking

statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161201005467/en/

Innovative Industrial Properties, Inc.Paul Smithers,

858-997-3332Chief Executive Officer

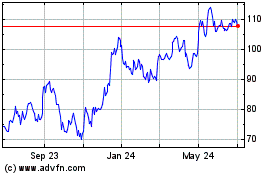

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Aug 2024 to Sep 2024

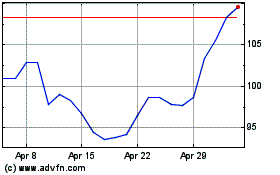

Innovative Industrial Pr... (NYSE:IIPR)

Historical Stock Chart

From Sep 2023 to Sep 2024