Gary Cohn's visit to Trump Tower on Tuesday has rekindled

questions about whether the longtime Goldman Sachs Group Inc. No. 2

has tired of life as an understudy.

Mr. Cohn, who has been Chief Executive Lloyd Blankfein's top

deputy for a decade, met with Donald Trump Tuesday. It isn't clear

whether the president-elect is considering Mr. Cohn for a position;

Politico reported Wednesday that Mr. Cohn could be a contender to

head the Office of Management and Budget.

A possible position in the Trump administration comes at a time

when Mr. Cohn's role at Goldman has already been in question. The

56-year-old president and chief operating officer has had

conversations in recent months about leaving the bank, according to

people familiar with the matter.

His departure would scrap Goldman's most-obvious succession

plan, yet elevate a new crop of executives eyeing Mr. Blankfein's

job. It would also signal that Mr. Blankfein, who weathered the

financial crisis, survived a bout with cancer and has settled into

a role as a senior industry statesman, isn't going anywhere.

That has become more accepted within Goldman's executive ranks

in recent months. Michael Sherwood, who ran Goldman's international

business from London and had once been seen as a potential

successor, said as much last week when he announced his

retirement.

"Some people want [the CEO job] passionately; I just didn't,"

Mr. Sherwood said in an interview. "One of those people, by the

way, is named Lloyd and he's not going anywhere. He doesn't say

'one more year;' he says 'five more years."

That has left little room for Mr. Cohn and created what some

executives describe as a talent bottleneck. Mr. Blankfein has been

CEO since 2006, and his inner circle of confidants has seen little

turnover, leaving few opportunities for promotion lower down the

ranks.

Some executives describe growing frustration with the stasis,

even while acknowledging that steady leadership likely helped

Goldman weather the crisis and rally support for strategic

changes.

As second-in-command, Mr. Cohn oversees Goldman's daily

operations. He joined Goldman in 1990 and became a partner in

1994—a class that also included Mr. Trump's nominee for Treasury

Secretary, Steven Mnuchin.

Mr. Cohn's background reflects the sort of Midwestern voters who

helped power Mr. Trump to a surprise victory. Born in Ohio the son

of an electrician, Mr. Cohn's first job was selling window frames

and aluminum siding in Cleveland, and he later sold silver on Wall

Street.

In recent years, he has taken on a more public-facing role and

struck clients and colleagues as more polished. He has cultivated

relationships in Silicon Valley, where Mr. Blankfein is less at

ease, and is close to executives such as Uber Technologies Inc.'s

Travis Kalanick and Tesla Motors Inc.'s Elon Musk.

Messrs Blankfein and Cohn rose together through Goldman's

trading division, and Mr. Cohn was once seen as the likely

successor to his longtime friend and boss. But as Mr. Blankfein

remained in the job longer than many expected, odds lengthened for

Mr. Cohn and began to favor the crown effectively skipping a

generation.

Should Mr. Cohn opt to seek opportunities outside the firm, his

role as chief operating officer and president would likely be split

between among two executives, people familiar with the matter have

said. Goldman has a history of co-executives, and Mr. Cohn split

the No. 2 job for several years with Jon Winkelried, who left the

firm in 2009.

Elevating two executives would widen Mr. Blankfein's circle of

lieutenants and deepen the bench of seasoned executives who could

replace him down the line.

It also would avoid anointing a clear successor, keeping the

palace intrigue alive. Speculation on Goldman's next chief is a

favorite Wall Street parlor game.

The likeliest candidates to replace Mr. Cohn, according to

people familiar with the matter, are Chief Financial Officer Harvey

Schwartz and investment-banking co-chief David Solomon. Outside

candidates include R. Martin Chavez, Goldman's chief technologist,

and Stephen Scherr, the strategist who was recently put in charge

of Goldman's push into consumer banking.

Who is tapped will say much about how dramatically the

regulatory changes pushed through since the crisis have reshaped

Goldman's priorities and power centers.

Mr. Schwartz, like Messrs. Blankfein and Cohn, came up through

the firm's securities arm. Elevating him would show Goldman

sticking to its trading guns even as that business, which once

minted billions, has been cuffed by regulation.

Mr. Solomon is an investment banker who has forged relationships

with many of the world's biggest companies. He spent his early Wall

Street days in junk bonds and in his current role has pushed

Goldman to get bigger in debt underwriting. A rare lateral partner,

he joined Goldman from Bear Stearns in 1999.

The elevation of Mr. Chavez, which insiders say is less likely

but possible, would show that Goldman increasingly sees itself a

technology firm powered by coders rather than superstar bankers and

traders. Mr. Chavez oversees some 9,000 engineers, about

one-quarter of Goldman's head count.

But Mr. Chavez's group doesn't officially produce any revenue,

and overseeing a moneymaking business has been an unofficial

prerequisite for running the firm.

Messrs. Blankfein and Cohn have been close friends for years.

Both come from unprivileged backgrounds and began their ascent at

Goldman's lowliest division, trading metals in J. Aron's dingy

offices, removed from Goldman's posh banking suites.

But it has been a long, and so far fruitless, wait for Mr. Cohn

to get the top job. In 2012, the board discussed making Mr. Cohn

CEO and keeping Mr. Blankfein as chairman, but decided against it,

The Wall Street Journal reported. Soon after, Mr. Blankfein began

setting up dinners between board members and younger executives,

which many took as a sign that while Mr. Cohn remained the

front-runner, he had competition.

In 2014, Mr. Blankfein said of his CEO chair: "A job like this

is hard to come by. I'll be slow to get out of it."

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

November 30, 2016 13:45 ET (18:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

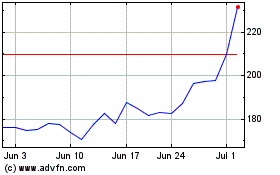

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Sep 2023 to Sep 2024