Rockwell Medical Reports Third Quarter Results

November 07 2016 - 4:01PM

Rockwell Medical, Inc. (NASDAQ:RMTI), a fully-integrated

biopharmaceutical company targeting end-stage renal disease (ESRD)

and chronic kidney disease (CKD) with innovative products and

services for the treatment of iron replacement, secondary

hyperparathyroidism and hemodialysis, reported results for the

third quarter of 2016.

Q3 2016 Financial

Highlights

- Sales were $12.8 million, or $1.6 million lower than Q3 2015,

primarily due to lower contract manufacturing sales.

- Gross profit was $1.6 million compared to $2.5 million in Q3

2015, due to lower contract manufacturing revenue and due to an

increase in manufacturing and costs related to our drug products.

- SG&A expense was $5.1 million compared $3.8 million in Q3

2015.

- R&D expense was $1.3 million and at the same level as in Q3

2015.

- Net loss was $4.5 million or ($0.09) per share compared to a

$2.4 million loss or ($0.05) per share in Q3 2015.

- Net loss in Q3 was lower sequentially by $0.8 million compared

to Q2 2016 due to lower R&D expenses.

- Cash and investments were $57.7 million as of September 30,

2016.

- Net working capital was $72.5 million as of September 30,

2016.

YTD 2016 Financial

Highlights

- Sales were $39.9 million, compared to $41.2 million in the

first nine months of 2015.

- Gross profit was $4.8 million compared to $6.9 million in the

first nine months of 2015.

- Gross profit was impacted by higher drug manufacturing costs, a

value add tax paid on the $4.0 million payment received from

Wanbang Biopharma and lower third party contract manufacturing

revenue.

- SG&A expense was $15.1 million compared $13.0 million in

the first nine months of 2015.

- R&D expense was $4.6 million compared to $2.9 million in

the first nine months of 2015.

- Net loss was $14.7 million or ($0.29) per share versus $8.7

million or ($0.17) per share in 2015.

YTD Corporate Highlights

- Triferic Phase-1 Healthy Volunteer Intravenous (IV)

Pharmacokinetic Study published in the September 2016 edition of

the Journal of Clinical Pharmacology.

- Entered into license agreement with ARAM Medical to market

Triferic in Saudi Arabia and other middle eastern countries.

- Received FDA approval to market Triferic powder packet.

- Partnered with Wanbang Biopharma to commercialize Triferic and

Calcitriol in the People's Republic of China, receiving up to

$39 million in milestone payments and ongoing profit on commercial

product sales in China.

Mr. Robert L. Chioini, Chairman and Chief

Executive Officer of Rockwell stated, “We continue to make solid

progress in our efforts to obtain transitional add-on reimbursement

for Triferic. We believe we are moving closer to our goal of

securing it. Multiple stakeholders have aided us and support add-on

reimbursement for Triferic. Concurrently, we have been educating

our customers and patients about Triferic and its unique benefits.

We also have advanced Triferic clinical development work for the

renal application outside the U.S. as well as additional

therapeutic indications. Overall, we are pleased with our progress,

which includes ensuring we have redundancy in our manufacturing and

supply capability.”

Conference Call

InformationRockwell Medical will be hosting a conference

call to review its second quarter 2016 results on Monday, November

7, 2016 at 4:30 pm ET. Investors are encouraged to call a few

minutes in advance at (877)-857-6150, or for international callers

(719)325-4825, passcode # 8926063 or to listen to the call via

webcast at the Rockwell Medical IR web page:

http://ir.rockwellmed.com/

About TrifericTriferic is the

only FDA approved drug indicated to replace iron and maintain

hemoglobin in hemodialysis patients suffering from anemia. Via

dialysate during each dialysis treatment, Triferic replaces the 5-7

mg iron loss that occurs in all patients, effectively maintaining

their iron balance. Unlike IV iron products, Triferic binds iron

immediately and completely to transferrin (carrier of iron in the

body) upon entering the blood and it is then transported directly

to the bone marrow to be incorporated into hemoglobin, with no

increase in ferritin (stored iron and inflammation) and no

anaphylaxis, addressing a significant unmet need in overcoming

Functional Iron Deficiency (FID) in ESRD patients. Please visit

www.triferic.com to view the Triferic mode-of-action (MOA) video

and for more information.

About Rockwell MedicalRockwell

Medical is a fully-integrated biopharmaceutical company targeting

end-stage renal disease (ESRD) and chronic kidney disease (CKD)

with innovative products and services for the treatment of iron

replacement, secondary hyperparathyroidism and hemodialysis.

Rockwell’s recent FDA approved drug

Triferic is indicated for iron replacement and maintenance of

hemoglobin in hemodialysis patients. Triferic delivers iron to

patients during their regular dialysis treatment, using dialysate

as the delivery mechanism. Triferic has demonstrated that it safely

and effectively delivers sufficient iron to the bone marrow and

maintains hemoglobin, without increasing iron stores (ferritin).

Rockwell intends to market Triferic to hemodialysis patients in the

U.S. dialysis market and globally.

Rockwell’s FDA approved generic drug Calcitriol

is for treating secondary hyperparathyroidism in dialysis patients.

Calcitriol (active vitamin D) injection is indicated in the

management of hypocalcemia in patients undergoing chronic renal

dialysis. It has been shown to significantly reduce elevated

parathyroid hormone levels. Reduction of PTH has been shown to

result in an improvement in renal osteodystrophy. Rockwell

intends to market Calcitriol to hemodialysis patients in the U.S.

dialysis market.

Rockwell is also an established manufacturer and

leader in delivering high-quality hemodialysis

concentrates/dialysates to dialysis providers and distributors in

the U.S. and abroad. As one of the two major suppliers in the U.S.,

Rockwell’s products are used to maintain human life by removing

toxins and replacing critical nutrients in the dialysis patient’s

bloodstream. Rockwell has three U.S. manufacturing/distribution

facilities.

Rockwell’s exclusive renal drug therapies

support disease management initiatives to improve the quality of

life and care of dialysis patients and are intended to deliver safe

and effective therapy, while decreasing drug administration costs

and improving patient convenience. Rockwell Medical is developing a

pipeline of drug therapies, including extensions of Triferic for

indications outside of hemodialysis. Please visit

www.rockwellmed.com for more information.

Certain statements in this press release

constitute "forward-looking statements" within the meaning of the

federal securities laws, including, but not limited to, Rockwell’s

intention to sell and market Calcitriol and Triferic. Words such as

“may,” “might,” “will,” “should,” “believe,” “expect,”

“anticipate,” “estimate,” “continue,” “predict,” “forecast,”

“project,” “plan”, “intend” or similar expressions, or statements

regarding intent, belief, or current expectations, are

forward-looking statements. While Rockwell Medical believes these

forward-looking statements are reasonable, undue reliance should

not be placed on any such forward-looking statements, which are

based on information available to us on the date of this release.

These forward looking statements are based upon current estimates

and assumptions and are subject to various risks and uncertainties,

including without limitation those set forth in Rockwell Medical’s

SEC filings. Thus, actual results could be materially different.

Rockwell Medical expressly disclaims any obligation to update or

alter statements whether as a result of new information, future

events or otherwise, except as required by law.

Triferic® is a registered trademark of Rockwell

Medical, Inc.

| |

|

| ROCKWELL MEDICAL, INC. AND

SUBSIDIARIES |

|

| CONSOLIDATED INCOME STATEMENTS |

|

| For the three and nine months ended September

30, 2016 and September 30, 2015 |

|

| (Unaudited) |

|

|

|

|

|

|

|

Three Months Ended

September 30, 2016 |

|

Three Months Ended

September 30, 2015 |

|

Nine Months Ended

September 30, 2016 |

|

Nine Months Ended

September 30, 2015 |

|

| Sales |

|

$ |

|

12,814,815 |

|

|

$ |

|

14,378,528 |

|

|

$ |

|

39,894,380 |

|

|

$ |

|

41,218,065 |

|

|

| Rebates |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

| Cost of Sales |

|

|

|

11,234,934 |

|

|

|

|

11,875,122 |

|

|

|

|

35,130,045 |

|

|

|

|

34,336,359 |

|

|

| Gross

Profit |

|

|

|

1,579,881 |

|

|

|

|

2,503,406 |

|

|

|

|

4,764,335 |

|

|

|

|

6,881,706 |

|

|

| Selling, General and

Administrative |

|

|

|

5,070,127 |

|

|

|

|

3,827,904 |

|

|

|

|

15,071,238 |

|

|

|

|

12,989,261 |

|

|

| Research and Product

Development |

|

|

|

1,261,863 |

|

|

|

|

1,246,727 |

|

|

|

|

4,639,617 |

|

|

|

|

2,931,577 |

|

|

| Operating

Income (Loss) |

|

|

|

(4,752,109 |

) |

|

|

|

(2,571,225 |

) |

|

|

|

(14,946,520 |

) |

|

|

|

(9,039,132 |

) |

|

| Interest and Investment

Income |

|

|

|

188,847 |

|

|

|

|

156,672 |

|

|

|

|

602,429 |

|

|

|

|

388,638 |

|

|

| Interest (Expense) |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

| Income

(Loss) Before Income Taxes |

|

|

|

(4,563,262 |

) |

|

|

|

(2,414,553 |

) |

|

|

|

(14,344,091 |

) |

|

|

|

(8,650,494 |

) |

|

| Income Tax Expense |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

(404,527 |

) |

|

|

|

— |

|

|

| Net

Income (Loss) |

|

$ |

|

(4,563,262 |

) |

|

$ |

|

(2,414,553 |

) |

|

$ |

|

(14,748,618 |

) |

|

$ |

|

(8,650,494 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic Earnings (Loss)

per Share |

|

$ |

|

(0.09 |

) |

|

$ |

|

(0.05 |

) |

|

$ |

|

(0.29 |

) |

|

$ |

|

(0.17 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Earnings (Loss)

per Share |

|

$ |

|

(0.09 |

) |

|

$ |

|

(0.05 |

) |

|

$ |

|

(0.29 |

) |

|

$ |

|

(0.17 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ROCKWELL MEDICAL, INC. AND

SUBSIDIARIES |

|

| CONSOLIDATED BALANCE SHEETS |

|

| As of September 30, 2016 and December 31,

2015 |

|

| (Unaudited) |

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

|

2016 |

|

2015 |

|

|

ASSETS |

|

|

|

|

|

|

|

| Cash and Cash

Equivalents |

|

$ |

|

19,293,454 |

|

|

$ |

|

31,198,182 |

|

|

| Investments Available

for Sale |

|

|

|

38,434,312 |

|

|

|

|

39,482,732 |

|

|

| Accounts Receivable,

net of a reserve of $39,000 in 2016 and $75,000 in 2015 |

|

|

|

8,031,196 |

|

|

|

|

5,046,733 |

|

|

| Inventory |

|

|

|

11,760,269 |

|

|

|

|

7,871,780 |

|

|

| Other Current

Assets |

|

|

|

2,264,583 |

|

|

|

|

1,026,889 |

|

|

| Total

Current Assets |

|

|

|

79,783,814 |

|

|

|

|

84,626,316 |

|

|

| Property and Equipment,

net |

|

|

|

1,506,155 |

|

|

|

|

1,646,568 |

|

|

| Intangible Assets |

|

|

|

42,555 |

|

|

|

|

165,657 |

|

|

| Goodwill |

|

|

|

920,745 |

|

|

|

|

920,745 |

|

|

| Other Non-current

Assets |

|

|

|

601,187 |

|

|

|

|

462,839 |

|

|

| Total

Assets |

|

$ |

|

82,854,456 |

|

|

$ |

|

87,822,125 |

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

| Accounts Payable |

|

$ |

|

3,396,789 |

|

|

$ |

|

3,995,216 |

|

|

| Accrued

Liabilities |

|

|

|

3,825,374 |

|

|

|

|

3,831,356 |

|

|

| Customer Deposits |

|

|

|

91,005 |

|

|

|

|

264,879 |

|

|

| Total

Current Liabilities |

|

|

|

7,313,168 |

|

|

|

|

8,091,451 |

|

|

| |

|

|

|

|

|

|

|

| Deferred License

Revenue |

|

|

|

19,783,978 |

|

|

|

|

17,410,852 |

|

|

| |

|

|

|

|

|

|

|

|

Shareholders’ Equity: |

|

|

|

|

|

|

|

| Common Shares, no par

value, 51,527,711 and 51,501,877 shares issued and outstanding |

|

|

|

265,648,345 |

|

|

|

|

257,773,494 |

|

|

| Accumulated

Deficit |

|

|

|

(209,286,794 |

) |

|

|

|

(194,538,176 |

) |

|

| Accumulated Other

Comprehensive Income |

|

|

|

(604,241 |

) |

|

|

|

(915,496 |

) |

|

| Total

Shareholders’ Equity |

|

|

|

55,757,310 |

|

|

|

|

62,319,822 |

|

|

| Total

Liabilities And Shareholders’ Equity |

|

$ |

|

82,854,456 |

|

|

$ |

|

87,822,125 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| ROCKWELL MEDICAL, INC. AND

SUBSIDIARIES |

|

| CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

| For the nine months ended September 30, 2016

and September 30, 2015 |

|

| (Unaudited) |

|

|

|

|

|

|

|

2016 |

|

2015 |

|

| Cash Flows From

Operating Activities: |

|

|

|

|

|

|

|

| Net

(Loss) |

|

$ |

|

(14,748,618 |

) |

|

$ |

|

(8,650,494 |

) |

|

|

Adjustments To Reconcile Net Loss To Net Cash Used In Operating

Activities: |

|

|

|

|

|

|

|

|

Depreciation and Amortization |

|

|

|

583,501 |

|

|

|

|

608,152 |

|

|

| Share

Based Compensation—Employees |

|

|

|

7,794,690 |

|

|

|

|

6,097,122 |

|

|

|

Restricted Stock Retained in Satisfaction of Tax Liabilities |

|

|

|

— |

|

|

|

|

(2,912,859 |

) |

|

| Loss on

Disposal of Assets |

|

|

|

7,340 |

|

|

|

|

4,292 |

|

|

| Loss on

Sale of Investments Available for Sale |

|

|

|

26,820 |

|

|

|

|

58,095 |

|

|

| Changes

in Assets and Liabilities: |

|

|

|

|

|

|

|

|

(Increase) in Accounts Receivable |

|

|

|

(2,984,463 |

) |

|

|

|

(1,424,485 |

) |

|

|

(Increase) in Inventory |

|

|

|

(3,888,489 |

) |

|

|

|

(3,495,096 |

) |

|

|

(Increase) in Other Assets |

|

|

|

(1,376,042 |

) |

|

|

|

(1,014,009 |

) |

|

|

(Decrease) in Accounts Payable |

|

|

|

(598,427 |

) |

|

|

|

(71,121 |

) |

|

|

(Decrease) in Other Liabilities |

|

|

|

(179,856 |

) |

|

|

|

(1,259,560 |

) |

|

| Increase

(decrease) in Deferred License Revenue |

|

|

|

2,373,126 |

|

|

|

|

(1,479,681 |

) |

|

| Changes

in Assets and Liabilities |

|

|

|

(6,654,151 |

) |

|

|

|

(8,743,952 |

) |

|

| Cash

(Used) In Provided By Operating Activities |

|

|

|

(12,990,418 |

) |

|

|

|

(13,539,644 |

) |

|

| Cash Flows From

Investing Activities: |

|

|

|

|

|

|

|

| Purchase

of Investments Available for Sale |

|

|

|

(23,158,809 |

) |

|

|

|

(21,800,000 |

) |

|

| Sale of

Investments Available for Sale |

|

|

|

24,491,678 |

|

|

|

|

1,468,656 |

|

|

| Purchase

of Equipment |

|

|

|

(328,322 |

) |

|

|

|

(336,856 |

) |

|

| Proceeds

on Sale of Assets |

|

|

|

1,000 |

|

|

|

|

4,800 |

|

|

| Cash

(Used In) Investing Activities |

|

|

|

1,005,547 |

|

|

|

|

(20,663,400 |

) |

|

| Cash Flows From

Financing Activities: |

|

|

|

|

|

|

|

| Proceeds

from Issuance of Common Shares and Purchase Warrants |

|

|

|

80,161 |

|

|

|

|

1,575,333 |

|

|

| Cash

Provided By Financing Activities |

|

|

|

80,161 |

|

|

|

|

1,575,333 |

|

|

| Effects of exchange

rate changes |

|

|

|

(18 |

) |

|

|

|

— |

|

|

| (Decrease) Increase In

Cash |

|

|

|

(11,904,728 |

) |

|

|

|

(32,627,711 |

) |

|

| Cash At Beginning Of

Period |

|

|

|

31,198,182 |

|

|

|

|

65,800,451 |

|

|

| Cash At End Of

Period |

|

$ |

|

19,293,454 |

|

|

$ |

|

33,172,740 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Michael Rice,

Investor Relations;

646-597-6979

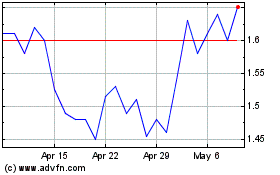

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rockwell Medical (NASDAQ:RMTI)

Historical Stock Chart

From Apr 2023 to Apr 2024