Avinger, Inc. (NASDAQ:AVGR) (the “Company”), a leading developer of

innovative treatments for peripheral artery disease (“PAD”), today

reported results for the third quarter ended September 30, 2016.

Third Quarter and Recent Highlights

- Revenue of $5.3 million, a 95% increase compared to the third

quarter of 2015

- Added 17 Lumivascular™ accounts, expanding the installed base

of the Company's Lumivascular platform to 143 accounts

- Completed a public offering of common stock which resulted in

net proceeds of $31.5M

- Established national sales agreements with HealthTrust

Purchasing Group and the U.S. Department of Veterans Affairs

- Launched upgraded Lightbox L250 imaging console and began

shipments of Pantheris® with enhanced plaque cutting

capability

- Received expanded FDA indications for Pantheris as a diagnostic

imaging device

“We are very pleased with our sales execution this quarter,

which reflects the proactive changes made to the sales

organization, as well as our recent success in signing contracts

with large healthcare providers,” said Jeff Soinski, Avinger’s

president and CEO. “Additionally, we closed a significant financing

this quarter which allows us to continue to focus on driving

adoption of our Lumivascular technology.”

Dr. John B. Simpson, Avinger's founder and executive chairman,

stated, “In addition to ramping our revenues, we also have

increased and upgraded our product offerings, and have made good

progress on our R&D pipeline with regulatory filings planned in

upcoming quarters. Our new catheters and Lightbox reflect our

continued focus on responding to physician feedback, and our

planned future products should allow us to better treat patients

with more complex lesions in more tortuous locations, smaller

vessels below the knee and eventually in the coronary

arteries.”

Third Quarter 2016 Financial Results

Total revenue was $5.3 million for the third quarter ended

September 30, 2016, a 95% increase from the third quarter of 2015

and a 14% increase from the second quarter of 2016. Revenue related

to Lightbox imaging consoles was $1.4 million, a 65% increase

compared to the third quarter of 2015 and a 43% increase from the

second quarter of 2016. Revenue from disposable devices was $3.9

million, a 110% increase compared to the third quarter of 2015 and

a 5% increase from the second quarter of 2016. Revenue results

reflect the second full quarter of Pantheris sales following FDA

clearance on March 1, 2016 as well as continued strong adoption of

the Lumivascular platform by new hospital customers.

Gross margin for the third quarter of 2016 was 30%, down from

36% in the comparable quarter of 2015 and increased from 22% in the

second quarter of 2016. The year-over-year decrease was primarily

attributable to the growth of the Company’s manufacturing

infrastructure associated with the commercial launch of Pantheris

and a higher proportion of Lumivascular accounts participating in

the Company’s placement-to-purchase and rental programs, and the

improvement compared to the second quarter of 2016 related

primarily to reduced warranty costs and the higher gross margin

associated with revenues related to Lightbox imaging consoles.

Operating expenses for the third quarter of 2016 were $13.0

million, compared to $10.8 million in the third quarter of 2015.

This growth was primarily attributable to expansion of the

Company’s commercial organization and marketing expenses associated

with the launch of Pantheris.

Loss from operations for the third quarter of 2016 was $11.4

million, compared to $9.9 million for the third quarter of 2015,

and net loss for the third quarter of 2016 was $13.0 million,

compared to $13.3 million for the third quarter of 2015. Loss per

share for the third quarter of 2016 was $0.73, compared to $1.08

for the third quarter of 2015. The decreased loss per share

primarily reflects the issuance of 9.9 million shares in the

Company’s follow-on public offering which closed on August 16,

2016.

Adjusted EBITDA, a non-GAAP measure, was a loss of $9.3 million

for the third quarter of 2016, compared to a loss of $8.3 million

for the third quarter of 2015.

Cash and cash equivalents totaled $43.3 million as of September

30, 2016, compared to $43.1 million as of December 31, 2015.

2016 OutlookThe Company has narrowed its

expected range for 2016 revenues to $20 million to $21 million,

representing year-over-year growth ranging from 87% to 96%. This

compares to the previous range of $19 million to $23 million.

Net loss per share for 2016 is projected to be $(3.28) to

$(3.46), which reflects the increased weighted-average share count

of 16.5 million. This is compared to the previous guidance of

$(4.35) to $(4.55).

Consistent with the Company’s previous guidance, Adjusted

EBITDA, a non-GAAP measure, for 2016 is projected to be a loss of

$40 million to $43 million.

No reconciliation of the Company’s 2016 Adjusted EBITDA

guidance, which excludes estimates for stock-based compensation

expense, depreciation and amortization, is included in the

financial schedules attached to this press release. The Company is

not able to accurately forecast the excluded items at the level of

precision that would be required to be included in the most

directly comparable GAAP financial measure without unreasonable

efforts.

Conference Call Avinger will hold a conference

call today, November 3, 2016 at 1:30pm PT/4:30pm ET to discuss its

third quarter 2016 financial results. Individuals may listen to the

call by dialing (844) 776-7820 for domestic callers or (661)

378-9536 for international callers and referencing Conference ID:

96290958. To listen to a live webcast, please visit the investor

relations section of Avinger's website at: www.avinger.com.

A replay of the call will be available beginning November 3,

2016 at 4:30pm PT/7:30pm ET through 4:30pm PT/7:30pm ET on

November 4, 2016. To access the replay, dial (855) 859-2056 or

(404) 537-3406 and reference Conference ID: 96290958. The webcast

will also be available on Avinger's website for one year following

the completion of the call.

About Avinger, Inc. Avinger, Inc. is a

commercial-stage medical device company that designs, manufactures

and sells image-guided, catheter-based systems for the treatment of

patients with peripheral artery disease (PAD). PAD is characterized

by a build-up of plaque in the arteries that supply blood to the

legs and feet. The company’s mission is to dramatically improve the

treatment of vascular disease through the introduction of products

based on its Lumivascular platform, the only intravascular

image-guided system of therapeutic catheters available in this

market. Avinger’s current Lumivascular products include the

Lightbox imaging console, the Ocelot family of catheters, which are

designed to penetrate total arterial blockages, known as chronic

total occlusions, or CTOs, and Pantheris, the first-ever

image-guided atherectomy device, designed to precisely remove

arterial plaque in PAD patients. For more information, please visit

www.avinger.com.

Forward-Looking StatementsThis news release

contains forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934 and the Private Securities Litigation Reform

Act of 1995. These forward-looking statements include statements

regarding the long-term outlook for the adoption of Lumivascular

technology, future regulatory filings and product offerings, the

use of Lumivascular technology in more complex lesions and in the

coronary arteries, expectations for growth, and financial and

operating guidance. Such statements are based on current

assumptions that involve risks and uncertainties that could cause

actual outcomes and results to differ materially. These risks and

uncertainties, many of which are beyond our control, include our

dependency on a limited number of products; ability to demonstrate

the benefits of our lumivascular platform; the resource

requirements related to Pantheris; the outcome of clinical trial

results; potential exposure to third-party product liability and

intellectual property litigation; lack of long-term data

demonstrating the safety and efficacy of our lumivascular platform

products; reliance on third-party vendors; dependency on physician

adoption; reliance on key personnel; and requirements to obtain

regulatory approval to commercialize our products; as well as the

other risks described in the section entitled “Risk Factors” and

elsewhere in our second quarter Form 10-Q filing made with the

Securities and Exchange Commission on August 5, 2016. These

forward-looking statements speak only as of the date hereof and

should not be unduly relied upon. Avinger disclaims any obligation

to update these forward-looking statements.

Use of Non-GAAP Financial Measures

To supplement our condensed financial statements prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), we also provide Adjusted EBITDA in this release. Management

of the company believes that Adjusted EBITDA, considered together

with GAAP financial information, provides useful information for

investors by excluding stock-based compensation expense,

depreciation and amortization, which are not indicative of the

company's core operating performance. Reconciliations of Adjusted

EBITDA used in this release to the most directly comparable GAAP

measures for the respective periods can be found in the

reconciliation of GAAP to non-GAAP financial information

immediately following the financial tables. We use Adjusted EBITDA

for financial and operational decision-making purposes and as a

means to evaluate period-to-period comparisons. We believe that

Adjusted EBITDA provides useful information about our operating

results, enhance the overall understanding of past financial

performance and future prospects and allow for greater transparency

with respect to key metrics used by management in its financial and

operational decision making. Non-GAAP financial measures have

limitations as analytical tools, are likely different than those

provided by other companies in our industry and should not be

considered in isolation or as a substitute for our financial

results prepared in accordance with GAAP.

| Avinger,

Inc. |

|

|

|

| Statements of

Operations Data |

|

|

|

| (in thousands,

except per share data) |

|

|

|

|

(unaudited) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

|

|

|

September 30, |

|

September 30, |

|

|

|

| |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

Revenues |

|

$ |

5,316 |

|

|

$ |

2,721 |

|

|

$ |

14,535 |

|

|

$ |

7,856 |

|

|

|

|

| Cost of

revenues |

|

|

3,742 |

|

|

|

1,750 |

|

|

|

10,747 |

|

|

|

4,672 |

|

|

|

|

| |

Gross

profit |

|

|

1,574 |

|

|

|

971 |

|

|

|

3,788 |

|

|

|

3,184 |

|

|

|

|

| |

|

|

|

|

30 |

% |

|

|

36 |

% |

|

|

26 |

% |

|

|

41 |

% |

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

| |

Research and development |

|

|

3,591 |

|

|

|

3,955 |

|

|

|

11,505 |

|

|

|

11,766 |

|

|

|

|

| |

Selling, general and administrative |

|

|

9,414 |

|

|

|

6,892 |

|

|

|

31,036 |

|

|

|

19,802 |

|

|

|

|

| |

|

Total operating

expenses |

|

|

13,005 |

|

|

|

10,847 |

|

|

|

42,541 |

|

|

|

31,568 |

|

|

|

|

| Loss from

operations |

|

|

(11,431 |

) |

|

|

(9,876 |

) |

|

|

(38,753 |

) |

|

|

(28,384 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

27 |

|

|

|

11 |

|

|

|

88 |

|

|

|

23 |

|

|

|

|

| Interest

expense |

|

|

(1,553 |

) |

|

|

(1,334 |

) |

|

|

(3,959 |

) |

|

|

(4,002 |

) |

|

|

|

| Other

income (expense), net |

|

|

(12 |

) |

|

|

(2,058 |

) |

|

|

(7 |

) |

|

|

(1,525 |

) |

|

|

|

| Loss before

provision for income taxes |

|

|

(12,969 |

) |

|

|

(13,257 |

) |

|

|

(42,631 |

) |

|

|

(33,888 |

) |

|

|

|

| Provision

for income taxes |

|

|

- |

|

|

|

(7 |

) |

|

|

- |

|

|

|

- |

|

|

|

|

| Net loss

and comprehensive loss |

|

|

(12,969 |

) |

|

|

(13,250 |

) |

|

|

(42,631 |

) |

|

|

(33,888 |

) |

|

|

|

| Adjustment

to net loss resulting from convertible preferred stock

modification |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,384 |

) |

|

|

|

| Net loss

and comprehensive loss attributable to common stockholders |

|

$ |

(12,969 |

) |

|

$ |

(13,250 |

) |

|

$ |

(42,631 |

) |

|

$ |

(36,272 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss

attributable to common stockholders per share, basic and

diluted |

|

$ |

(0.73 |

) |

|

$ |

(1.08 |

) |

|

$ |

(2.97 |

) |

|

$ |

(3.32 |

) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average common shares used to |

|

|

|

|

|

|

|

|

|

|

|

| |

compute net

loss per share, basic and diluted |

|

|

17,694 |

|

|

|

12,280 |

|

|

|

14,378 |

|

|

|

10,935 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Avinger,

Inc. |

|

| Balance Sheets

Data |

|

| (in

thousands) |

|

|

(unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

September

30, |

|

December

31, |

|

| |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

| |

|

Cash and

cash equivalents |

|

$ |

43,281 |

|

|

$ |

43,059 |

|

|

| |

|

Accounts

receivable, net |

|

|

4,693 |

|

|

|

2,060 |

|

|

| |

|

Inventories |

|

|

7,080 |

|

|

|

5,405 |

|

|

| |

|

Prepaid

expenses and other current assets |

|

|

773 |

|

|

|

533 |

|

|

| |

Total

current assets |

|

|

55,827 |

|

|

|

51,057 |

|

|

| |

|

|

|

|

|

|

|

| Property and equipment, net |

|

|

4,401 |

|

|

|

2,822 |

|

|

| Other assets |

|

|

211 |

|

|

|

225 |

|

|

| |

Total

assets |

|

$ |

60,439 |

|

|

$ |

54,104 |

|

|

| |

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

| |

|

Accounts

payable |

|

$ |

1,326 |

|

|

$ |

1,113 |

|

|

| |

|

Accrued

compensation |

|

|

2,823 |

|

|

|

3,083 |

|

|

| |

|

Accrued

expenses and other current liabilities |

|

|

2,822 |

|

|

|

3,285 |

|

|

| |

Total

current liabilities |

|

|

6,971 |

|

|

|

7,481 |

|

|

| |

|

|

|

|

|

|

|

| Borrowings |

|

|

40,713 |

|

|

|

29,565 |

|

|

| Other long-term liabilities |

|

|

840 |

|

|

|

1,469 |

|

|

| |

|

Total

liabilities |

|

|

48,524 |

|

|

|

38,515 |

|

|

| |

|

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

| |

Preferred

stock |

|

|

- |

|

|

|

- |

|

|

| |

Common

stock |

|

|

23 |

|

|

|

13 |

|

|

| |

Additional

paid-in capital |

|

|

250,784 |

|

|

|

211,837 |

|

|

| |

Accumulated

deficit |

|

|

(238,892 |

) |

|

|

(196,261 |

) |

|

| |

|

Total stockholders’

equity |

|

|

11,915 |

|

|

|

15,589 |

|

|

| |

|

Total liabilities and

stockholders’ equity |

|

$ |

60,439 |

|

|

$ |

54,104 |

|

|

| |

|

|

|

|

|

|

|

| Avinger,

Inc. |

| Adjusted

EBITDA |

| (in

thousands) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

September 30, |

|

September 30, |

| |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Loss from

operations |

$ |

(11,431 |

) |

|

$ |

(9,876 |

) |

|

$ |

(38,753 |

) |

|

$ |

(28,384 |

) |

| Add:

Stock-based compensation |

|

1,712 |

|

|

|

1,211 |

|

|

|

5,301 |

|

|

|

3,691 |

|

| Add:

Depreciation and amortization |

|

404 |

|

|

|

320 |

|

|

|

1,095 |

|

|

|

960 |

|

| |

Adjusted

EBITDA |

$ |

(9,315 |

) |

|

$ |

(8,345 |

) |

|

$ |

(32,357 |

) |

|

$ |

(23,733 |

) |

| |

|

|

INVESTOR CONTACT

Matt Ferguson

Avinger, Inc.

(650) 241-7917

ir@avinger.com

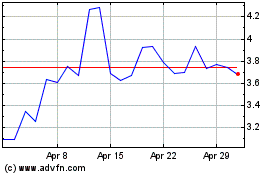

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Aug 2024 to Sep 2024

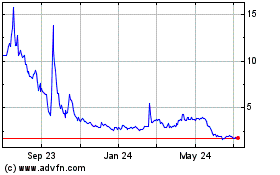

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Sep 2023 to Sep 2024