Achieved as reported revenue and mid-teen

comparable sales growth and delivered consolidated Adjusted EBITDA

margin expansion versus the prior year

Arcos Dorados Holdings, Inc. (NYSE:ARCO) (“Arcos Dorados” or the

“Company”), Latin America’s largest restaurant chain and the

world’s largest McDonald’s franchisee, today reported unaudited

results for the third quarter ended September 30, 2016.

Third Quarter 2016 Key Results

- As reported consolidated revenues

increased 2.9% to $775.7 million versus the third quarter of 2015.

On a constant currency basis1, consolidated revenues grew 15.3%, or

12.4% excluding Venezuela.

- Systemwide comparable sales rose 15.6%

year-over-year, or 11.8% excluding Venezuela.

- Adjusted EBITDA increased 24.0% to

$63.2 million year-over-year. Constant currency Adjusted EBITDA

grew 45.9% year-over-year, or 29.5% excluding Venezuela.

- Consolidated Adjusted EBITDA margin

expanded approximately 140 basis points, or 130 basis points

excluding Venezuela.

- As reported General and Administrative

expenses (G&A) decreased by $6.5 million, or 10.5%

year-over-year, and remained approximately flat on a constant

currency basis.

- As reported net loss was $1.8 million,

compared to a net loss of $35.9 million in the same period last

year.

“We achieved as reported revenue and mid-teen comparable sales

growth, and delivered a meaningful expansion in the consolidated

Adjusted EBITDA margin in the third quarter. The latter reflects

important efficiencies in payroll and reduced G&A costs,

providing us operating leverage in spite of challenging market

conditions. Our focus going forward is on modernizing restaurants,

piloting technology platforms and updating menu offerings to ensure

the best customer experience. These strategic changes are

positioning us at the forefront of a recovery in economic growth in

the region”, said Sergio Alonso, Chief Executive Officer of Arcos

Dorados.

Third Quarter 2016

Results

Consolidated

Figure 1. AD Holdings Inc Consolidated: Key Financial

Results

(In millions of U.S. dollars, except as

noted)

3Q15

(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16

(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 2,122

2,140 0.8 %

Sales by Company-operated Restaurants 724.3 (89.9 ) 108.3 742.8 2.5

% 15.0 % Revenues from franchised restaurants 29.4 (3.8 ) 7.3 32.9

12.0 % 24.9 %

Total Revenues 753.7 (93.7

) 115.6 775.7 2.9 % 15.3

% Systemwide Comparable Sales 15.6 %

Adjusted EBITDA

50.9 (11.2 ) 23.4 63.2

24.0 % 45.9 % Adjusted EBITDA Margin

6.8 % 8.1 %

Net income (loss) attributable to AD

(35.9 ) (12.3 ) 46.4 (1.8

) 94.9 % 129.2 % No. of shares

outstanding (thousands) 210,538 210,711

EPS (US$/Share)

-0.17

-0.01

(3Q16 = 3Q15 + Currency Translation + Constant Currency Growth).

Refer to “Definitions” section for further detail.

Arcos Dorados’ third quarter as reported revenues increased by

2.9% as constant currency revenue growth of 15.3% more than offset

depreciation of local currencies. While the Argentine peso and

Venezuelan bolivar both depreciated, the Brazilian real appreciated

8% year-over-year. Constant currency revenue growth was driven by a

15.6% expansion in systemwide comparable sales, due to average

check growth, partially offset by a modest decline in traffic.

Third quarter consolidated as reported Adjusted EBITDA increased

24.0% as constant currency growth more than offset the currency

translation impact, mainly in Argentina and Venezuela. Brazil was

the key contributor to expanded Adjusted EBITDA during the quarter,

followed by the Caribbean division and NOLAD, while SLAD’s result

declined due to margin contraction and the year-over-year

depreciation of the Argentine peso. Additionally, the Corporate

segment contributed positively to consolidated Adjusted EBITDA

during the quarter.

The Adjusted EBITDA margin expanded by almost 140 basis points

to 8.1%, supported by margin expansion in Brazil, the Caribbean

division, NOLAD and the Corporate segment, partially offset by

margin contraction in SLAD. The key drivers for margin expansion

were efficiencies in Payroll and G&A expenses, which more than

offset higher Food and Paper (F&P) costs as a percentage of

revenues. Additionally, Adjusted EBITDA benefited from the

refranchising of certain company-operated restaurants, as part of

the Company’s asset monetization strategy. Excluding the

refranchising inflows, consolidated Adjusted EBITDA margin

increased by about 60 basis points.

As reported, consolidated G&A decreased by 10.5%

year-over-year, or over 100 basis points as a percentage of

revenues. Importantly, G&A remained broadly flat year-over-year

on a constant currency basis. This reflects efficiencies related to

the reorganization plan implemented in the fourth quarter of 2015,

which more than offset inflation-driven growth in G&A expenses,

including Argentine peso denominated corporate expenses.

Consolidated – excluding Venezuela

Figure 2. AD Holdings Inc Consolidated - Excluding Venezuela:

Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q15

(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16

(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 1,988

2,007 1.0 %

Sales by Company-operated Restaurants 716.6 (70.3 ) 87.8 734.1 2.4

% 12.3 % Revenues from franchised restaurants 28.6 (1.6 ) 4.9 31.9

11.7 % 17.2 %

Total Revenues 745.1 (71.9

) 92.7 766.0 2.8 % 12.4

% Systemwide Comparable Sales 11.8 %

Adjusted EBITDA

51.4 (4.0 ) 15.2 62.6

21.8 % 29.5 % Adjusted EBITDA Margin

6.9 % 8.2 %

Net income (loss) attributable to AD

(32.3 ) (1.5 ) 35.3 1.5

104.8 % 109.3 % No. of shares

outstanding (thousands) 210,538 210,711

EPS (US$/Share)

-0.15

0.01

Excluding the Company’s Venezuelan operation, as reported

revenues increased by 2.8% year-over-year as constant currency

growth of 12.4% more than offset the depreciation of the Argentine

peso, as well as other currencies in the Company’s territory.

Constant currency growth was supported by an 11.8% increase in

systemwide comparable sales, driven by average check growth.

Adjusted EBITDA increased 21.8% on an as reported basis, as

constant currency growth more than offset currency translation

impacts. In constant currency terms, Adjusted EBITDA increased

29.5%. The Adjusted EBITDA margin expanded by about 130 basis

points to 8.2%. The result reflects efficiencies in Payroll costs

and G&A expenses, partially offset by higher F&P costs as a

percentage of revenues. Adjusted EBITDA excluding Venezuela also

benefited from the refranchising of certain company-operated

restaurants, as part of the Company’s asset monetization

initiative.

Non-operating Results

Non-operating results for the third quarter reflected a $3.3

million foreign currency exchange loss, versus a loss of $27.9

million last year. The result was due to the significantly higher

depreciation of the Brazilian real during the third quarter of 2015

versus the same period this year, combined with an increased net

exposure to the Brazilian real. Net interest expense increased $3.7

million year-over-year to $18.2 million in the quarter, mainly due

to higher interest expenses on the BRL-denominated debt, which more

than offset lower interest expenses on the 2023 USD notes.

The Company reported an income tax expense of $18.0 million in

the quarter, compared to an income tax expense of $14.1 million in

the prior year period.

Third quarter net loss attributable to the Company totaled $1.8

million, compared to a net loss of $35.9 million in the same period

of 2015. The improvement reflects stronger operating results

coupled with lower foreign exchange losses, partially offset by

higher net interest and income tax expenses. The third quarter 2016

operating result included the recognition of $5.8 million related

to the Company’s refranchising initiative, which was recorded

within “Other operating income (expense), net” line on the

Company’s income statement.

The Company reported a basic net loss per share of $0.01 in the

third quarter of 2016, compared to a loss per share of $0.17 in the

previous corresponding period. Total weighted average shares for

the third quarter of 2016 were 210,710,861, as compared to

210,537,949 in the third quarter of 2015, reflecting the issuance

of shares as a result of the partial vesting of restricted share

units.

Analysis by

Division2:

Brazil Division

Figure 3. Brazil Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q15

(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 869

890 2.4 %

Total Revenues 311.8 27.1 18.2

357.0 14.5 % 5.8 % Systemwide

Comparable Sales 6.3 %

Adjusted EBITDA 26.2

2.7 10.3 39.2 49.6 % 39.5

% Adjusted EBITDA Margin 8.4 %

11.0 %

Brazil’s as reported revenues increased by 14.5%, supported by

constant currency growth as well as the 8% year-over-year average

appreciation of the Brazilian real. Excluding the benefit of

currency translation, constant currency revenues increased 5.8%

year-over-year, supported by 6.3% comparable sales growth and the

contribution of new restaurant openings, partially offset by the

refranchising of certain company-operated restaurants during the

last twelve months. The latter generated a net negative

contribution to constant currency revenue growth. Systemwide

comparable sales were driven by average check growth, partially

offset by a modest decline in traffic against a backdrop of

continued soft consumer spending. Traffic was also impacted by a

tough comparison with the Minions Happy Meal campaign in the prior

year quarter.

Marketing activities in the quarter included the “Novinhos

Cheddar” campaign, the launch of the McFlurry Kit Kat in the

dessert category and the continuation of the affordability

platform. The Happy Meal performed well with “Talking Tom” and “The

Secret Life of Pets” properties Also in the quarter, the Company

launched the McShake Ovomaltine, which has performed strongly since

its introduction.

As reported Adjusted EBITDA increased by 49.6% year-over-year

and 39.5% on a constant currency basis. The Adjusted EBITDA margin

expanded by about 260 basis points to 11.0%, as efficiencies in

Payroll, G&A and Occupancy and Other Operating expenses more

than offset higher F&P costs as a percentage of revenues.

Additionally, a positive variance in Other Operating Income as a

percentage of revenues, which included $5.8 million from the

Company’s refranchising initiative, contributed to margin expansion

in the quarter. Excluding the refranchising inflows, Brazil’s

Adjusted EBITDA margin increased by nearly 100 basis points.

Increased F&P costs as a percentage of revenues mainly reflect

the higher FX rate at which the Company hedged its exposure to

imported goods.

NOLAD

Figure 4. NOLAD Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q15(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 514

515 0.2 %

Total Revenues 93.5 (6.8 ) 8.1

94.7 1.4 % 8.6 % Systemwide

Comparable Sales 5.6 %

Adjusted EBITDA 9.0

(0.4 ) 1.9 10.5 17.3 %

21.4 % Adjusted EBITDA Margin 9.6 %

11.1 %

NOLAD’s as reported revenues increased by 1.4% year-over-year as

constant currency growth of 8.6% more than offset currency

translation impacts, mainly from the 14% year-over-year average

depreciation of the Mexican peso. Systemwide comparable sales

increased 5.6%, largely driven by average check growth combined

with a modest increase in traffic across the division.

Marketing initiatives in the quarter included the launch of the

new affordability platform, “McTrio 3x3”, “Talking Tom” in the

Happy Meal and the McFlurry Snickers in the dessert category, among

others.

As reported Adjusted EBITDA increased by 17.3%, or 21.4% on a

constant currency basis, continuing a trend of strong performance

and margin expansion. The Adjusted EBITDA margin expanded by about

150 basis points to 11.1% in the third quarter, mainly driven by

efficiencies in G&A, Occupancy and Other Operating expenses and

Payroll as a percentage of revenues. F&P costs as a percentage

of revenues remained broadly flat during the quarter.

SLAD

Figure 5. SLAD Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q15(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 383

383 0.0 %

Total Revenues 252.3 (92.0 )

61.8 222.1 -12.0 % 24.5 %

Systemwide Comparable Sales 25.3 %

Adjusted EBITDA

31.0 (10.8 ) 2.6 22.8

-26.4 % 8.4 % Adjusted EBITDA Margin

12.3 % 10.3 %

The SLAD division’s as reported revenues decreased by 12.0%

mainly due to the 62% year-over-year average depreciation of the

Argentine peso. On a constant currency basis, revenues increased

24.5% year-over-year. Systemwide comparable sales increased 25.3%,

primarily driven by average check growth and an increase in

traffic.

Marketing activities in the quarter included the Grand Big Mac

campaign, “Talking Tom” in the Happy Meal, the launch of the

McFlurry “Abuela Goye” in the dessert category and the continuation

of the Company’s affordability platform, among others.

Adjusted EBITDA decreased 26.4% on an as reported basis but rose

8.4% in constant currency terms. The Adjusted EBITDA margin

contracted by about 200 basis points to 10.3%, driven by higher

F&P and Occupancy and Other Operating expenses, partially

offset by efficiencies in Payroll costs as a percentage of

revenues. F&P costs rose as a percentage of revenues in the

quarter, primarily due to price adjustments below cost increases

designed to sustain traffic in Argentina’s difficult consumer

environment.

Caribbean Division

Figure 6. Caribbean Division: Key Financial Results

(In millions of U.S. dollars, except as

noted)

3Q15(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 356

352 -1.1 %

Total Revenues 96.2 (22.0 ) 27.6

101.8 5.8 % 28.7 % Systemwide

Comparable Sales 37.0 %

Adjusted EBITDA 2.6

(7.2 ) 10.7 6.2 132.2 %

405.3 % Adjusted EBITDA Margin 2.8 %

6.0 %

The Caribbean division’s as reported revenues increased by 5.8%,

as constant currency growth exceeded currency translation impacts

derived from the remeasurement of the results of the Venezuelan

operation at a weaker year-over-year average exchange rate.

Revenues in constant currency rose 28.7% year-over-year. Systemwide

comparable sales increased by 37.0%, with average check growth more

than offsetting a decrease in traffic.

Marketing initiatives in the quarter included “Talking Tom” in

the Happy Meal, the Grand Big Mac campaign, the McFlurry “Jet

Cruji” and the continuation of “Almuerzos Colombianos” in the

affordability platform, among others.

As reported Adjusted EBITDA totaled $6.2 million in the third

quarter, compared with $2.6 million in the prior year quarter. The

Adjusted EBITDA margin expanded to 6.0% from 2.8%, driven by

efficiencies in all key cost line items.

Caribbean Division – excluding Venezuela

Figure 7. Caribbean Division - Excluding Venezuela: Key

Financial Results

(In millions of U.S. dollars, except as

noted)

3Q15(a)

CurrencyTranslation(b)

ConstantCurrencyGrowth(c)

3Q16(a+b+c)

% AsReported

% ConstantCurrency

Total Restaurants (Units) 222

219 -1.4 %

Total Revenues 87.6 (0.2 ) 4.7

92.1 5.1 % 5.4 % Systemwide

Comparable Sales 4.6 %

Adjusted EBITDA 3.1

(0.0 ) 2.5 5.6 79.5 %

80.0 % Adjusted EBITDA Margin 3.6 %

6.1 %

As reported revenues in the Caribbean division, excluding

Venezuela, increased by 5.1% as constant currency growth of 5.4%

more than offset currency translation impacts. Constant currency

growth was supported by the ongoing strong performance of the

Colombian operation. Comparable sales increased by 4.6%, mainly

driven by traffic growth.

Adjusted EBITDA totaled $5.6 million, compared to $3.1 million

in the same period of 2015. The Adjusted EBITDA margin expanded by

about 250 basis points to 6.1%, mainly driven by efficiencies in

F&P costs, G&A and Occupancy and Other Operating expenses,

partially offset by higher Payroll costs as a percentage of

revenues.

New Unit Development

New Unit Development

Figure 8. Total Restaurants (eop)*

September

2016

June

2016

March

2016

December

2015

September

2015

Brazil 890 884 883 883 869 NOLAD 515 516 516 518 514 SLAD 383 382

382 384 383 Caribbean 352 353 355 356 356

TOTAL 2,140

2,135 2,136 2,141 2,122 LTM Net

Openings 18 15 17 20 36 * Considers

Company-operated and franchised restaurants at period-end

The Company opened 33 new restaurants during the twelve-month

period ended September 30, 2016, resulting in a total of 2,140

restaurants. Also during the period, the Company added 133 Dessert

Centers bringing the total to 2,693. McCafés totaled 315 as of

September 30, 2016.

Balance Sheet & Cash Flow Highlights

Cash and cash equivalents were $112.2 million at September 30,

2016. The Company’s total financial debt (including derivative

instruments) was $611.6 million. Net debt was $499.3 million and

the Net Debt/Adjusted EBITDA ratio was 2.0x at September 30,

2016.

Net cash provided by operating activities was $50.5 million in

the third quarter of 2016, while cash used in financing activities

amounted to $65.5 million. The latter included $61.0 million

related to the final payment of the remaining outstanding amount of

the BRL 2016 Notes which matured on July 13, 2016. During the

quarter, capital expenditures totaled $24.2 million.

Figure 9. Consolidated Financial Ratios

(In thousands of U.S. dollars, except

ratios)

September 30 December 31

2016 2015 Cash & cash equivalents 112,207

112,519 Total Financial Debt (i) 611,552 650,452 Net Financial Debt

(ii) 499,345 537,933 Total Financial Debt / LTM Adjusted EBITDA

ratio 2.5 2.8 Net Financial Debt / LTM Adjusted EBITDA ratio

2.0 2.3 (i)Total financial debt includes short-term debt,

long-term debt and derivative instruments (including the asset

portion of derivatives amounting to $0.99 million and $6.7 million

as a reduction of financial debt as of September 30, 2016 and

December 31, 2015, respectively). (ii) Total financial debt less

cash and cash equivalents.

First Nine Months of

2016

For the nine months ended September 30, 2016, the Company’s as

reported revenues declined by 7.3% to $2,121.5 million with

constant currency growth of 13.8% more than offset by currency

translation impacts. As reported Adjusted EBITDA was $152.2

million, a 13.7% increase compared to the first nine months of

2015. On a constant currency basis, Adjusted EBITDA increased by

49.0%. The reported Adjusted EBITDA margin expanded by about 130

basis points to 7.2%, as leverage in G&A expenses and Payroll

costs more than offset higher F&P costs as a percentage of

revenues. Adjusted EBITDA benefited from G&A savings as a

result of the optimization plan carried out in the fourth quarter

of 2015. Additionally, Adjusted EBITDA included $10.7 million from

the refranchising of some company-operated restaurants primarily in

Brazil. Excluding the refranchising inflows, the consolidated

Adjusted EBITDA margin increased by about 80 basis points.

Year-to-date consolidated net income amounted to $57.7 million,

compared with a loss of $57.2 million in the same period of 2015.

Net income in the first nine months of 2016 reflected stronger

operating results, which included $59.0 million from asset

monetization initiatives, coupled with a positive foreign exchange

result, partially offset by income tax and net interest expenses.

The net loss in the first nine months of 2015 reflected weaker

operating results, which included impairment charges and inventory

write downs related to the Venezuelan operation, coupled with

negative foreign exchange results and net interest expenses.

Excluding the Venezuelan operation, the Company’s revenues

declined by 7.7%, but increased by 10.9% on a constant currency

basis. Adjusted EBITDA increased by 7.1%, as reported, and 27.5% on

a constant currency basis. The reported Adjusted EBITDA margin

expanded by about 100 basis points to 7.4%, as leverage in G&A

and Payroll costs more than offset higher F&P as a percentage

of revenues.

During the first nine months of 2016, capital expenditures

totaled $52.1 million.

Quarter Highlights & Recent

Developments

Asset Monetization Initiative

The Company had received cumulative cash proceeds of around

$112.0 million through September 30, 2016 as a result of its asset

monetization initiatives, since they were launched. Approximately

$93.0 million related to the redevelopment of certain real estate

assets and $19.0 million to the refranchising of a number of

company-operated restaurants.

Brazilian Real (“BRL”) Denominated 2016

Notes

On July 13, 2016, the Company paid at maturity the remaining BRL

201 million of outstanding principal of the original BRL 675

million principal of the 2016 Notes. Proceeds from the four-year

BRL 613.9 million secured loan agreement obtained by the Company’s

Brazilian subsidiary on March 29, 2016 were the primary source of

financing for this payment.

Covenants under the Master Franchise

Agreement (MFA)

The MFA requires the Company, among other obligations, to

maintain a minimum fixed charge coverage ratio of 1.50x, as well as

a maximum leverage ratio of 4.25x. As of September 30, 2016, the

fixed charge coverage ratio was 1.67x and the leverage ratio was

4.08x.

Definitions:

Systemwide comparable sales growth:

refers to the change, measured in constant currency, in our

Company-operated and franchised restaurant sales in one period from

a comparable period for restaurants that have been open for

thirteen months or longer. While sales by our franchisees are not

recorded as revenues by us, we believe the information is important

in understanding our financial performance because these sales are

the basis on which we calculate and record franchised revenues, and

are indicative of the financial health of our franchisee base.

Constant currency basis: refers to

amounts calculated using the same exchange rate over the periods

under comparison to remove the effects of currency fluctuations

from this trend analysis.

To better discern underlying business trends, this release uses

non-GAAP financial measures that segregate year-over-year growth

into two categories: (i) currency translation, (ii) constant

currency growth. (i) Currency translation reflects the impact on

growth of the appreciation or depreciation of the local currencies

in which we conduct our business against the US dollar (the

currency in which our financial statements are prepared). (ii)

Constant currency growth reflects the underlying growth of the

business excluding the effect from currency translation.

About Arcos Dorados

Arcos Dorados is the world’s largest McDonald’s franchisee in

terms of systemwide sales and number of restaurants, operating the

largest quick service restaurant chain in Latin America and the

Caribbean. It has the exclusive right to own, operate and grant

franchises of McDonald’s restaurants in 20 Latin American and

Caribbean countries and territories, including Argentina, Aruba,

Brazil, Chile, Colombia, Costa Rica, Curaçao, Ecuador, French

Guyana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico,

St. Croix, St. Thomas, Trinidad & Tobago, Uruguay and

Venezuela. The Company operates or franchises over 2,100

McDonald’s-branded restaurants with over 90,000 employees and is

recognized as one of the best companies to work for in Latin

America. Arcos Dorados is traded on the New York Stock Exchange

(NYSE: ARCO). To learn more about the Company, please visit the

Investors section of our website: www.arcosdorados.com/ir

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements. The

forward-looking statements contained herein include statements

about the Company’s business prospects, its ability to attract

customers, its affordable platform, its expectation for revenue

generation and its outlook and guidance for 2016. These statements

are subject to the general risks inherent in Arcos Dorados'

business. These expectations may or may not be realized. Some of

these expectations may be based upon assumptions or judgments that

prove to be incorrect. In addition, Arcos Dorados' business and

operations involve numerous risks and uncertainties, many of which

are beyond the control of Arcos Dorados, which could result in

Arcos Dorados' expectations not being realized or otherwise

materially affect the financial condition, results of operations

and cash flows of Arcos Dorados. Additional information relating to

the uncertainties affecting Arcos Dorados' business is contained in

its filings with the Securities and Exchange Commission. The

forward-looking statements are made only as of the date hereof, and

Arcos Dorados does not undertake any obligation to (and expressly

disclaims any obligation to) update any forward-looking statements

to reflect events or circumstances after the date such statements

were made, or to reflect the occurrence of unanticipated

events.

Use of Non-GAAP Financial Measures

In addition to financial measures prepared in accordance with

the general accepted accounting principles (GAAP), within this

press release and the accompanying tables, we use a financial

measure titled ‘Adjusted EBITDA’. We use Adjusted EBITDA to

facilitate operating performance comparisons from period to period.

Adjusted EBITDA is defined as our operating income plus

depreciation and amortization plus/minus the following losses/gains

included within other operating expenses, net and within general

and administrative expenses in our statement of income: gains from

sale or insurance recovery of property and equipment, write-offs of

property and equipment, impairment of long-lived assets,

stock-based compensation in connection with the Company’s initial

public listing, and the ADBV Long-Term Incentive Plan incremental

compensation from modification.

We believe Adjusted EBITDA facilitates company-to-company

operating performance comparisons by backing out potential

differences caused by variations such as capital structures

(affecting net interest expense and other financial charges),

taxation (affecting income tax expense) and the age and book

depreciation of facilities and equipment (affecting relative

depreciation expense), which may vary for different companies for

reasons unrelated to operating performance. For more information,

please see Adjusted EBITDA reconciliation in Note 9 of our

quarterly financial statements (6-K Form) filed today with the

S.E.C.

Third Quarter 2016 Consolidated Results

(In thousands of U.S. dollars, except per share data)

Figure 10. Third Quarter & First Nine Months 2016

Consolidated Results

(In thousands of U.S. dollars, except per

share data)

For Three-Months ended For Nine-Months

ended September 30, September 30,

2016 2015

2016 2015 REVENUES

Sales by Company-operated restaurants 742,767 724,326

2,032,856 2,196,499 Revenues from franchised restaurants

32,889 29,369

88,615 91,255

Total Revenues

775,656 753,695

2,121,471

2,287,754 OPERATING COSTS AND EXPENSES

Company-operated restaurant expenses: Food and paper (269,737 )

(256,781 ) (740,453 ) (776,799 ) Payroll and employee benefits

(160,671 ) (162,712 ) (444,682 ) (498,809 ) Occupancy and other

operating expenses (198,449 ) (195,309 ) (557,546 ) (599,835 )

Royalty fees (37,689 ) (36,601 ) (103,388 ) (111,901 ) Franchised

restaurants - occupancy expenses (14,233 ) (12,961 ) (40,023 )

(42,051 ) General and administrative expenses (55,818 ) (62,342 )

(157,817 ) (195,488 ) Other operating income (expenses), net

(502 ) (6,151 ) 46,921

(22,742 )

Total operating costs and expenses

(737,099 )

(732,857 ) (1,996,988 )

(2,247,625 ) Operating income

38,557 20,838

124,483

40,129 Net interest expense (18,196 ) (14,482 )

(53,233 ) (47,679 ) Gain (Loss) from derivative instruments (22 )

(97 ) (52 ) (222 ) Foreign currency exchange results (3,306 )

(27,939 ) 28,900 (47,951 ) Other non-operating expense, net

(796 ) (18 ) (1,562 )

(182 )

Income (loss) before income taxes

16,237 (21,698 )

98,536 (55,905

) Income tax (expense) benefit (18,003 )

(14,134 ) (40,732 )

(1,077 )

Net income (loss) (1,766

) (35,832 )

57,804 (56,982 ) Less:

Net income attributable to non-controlling interests

(68 ) (92 ) (145 ) (202 )

Net income (loss) attributable to Arcos Dorados Holdings

Inc. (1,834 )

(35,924 ) 57,659

(57,184 ) Earnings (loss) per share

information ($ per share): Basic net income per common share

$ (0.01 ) $ (0.17 )

$ 0.27 $ (0.27 )

Weighted-average number of common shares outstanding-Basic

210,710,861 210,537,949

210,625,380 210,401,634

Adjusted EBITDA Reconciliation

Operating income 38,557 20,838 124,483

40,129 Depreciation and amortization 24,736 27,399 74,326 83,259

Operating charges excluded from EBITDA computation

(135 ) 2,709 (46,640 )

10,465

Adjusted EBITDA

63,158 50,946

152,169 133,853

Adjusted EBITDA Margin as % of total revenues

8.1 % 6.8 %

7.2 % 5.9 %

Third Quarter 2016 Results by Division

(In thousands of U.S. dollars)

Figure 11. Third Quarter & First Nine Months 2016

Consolidated Results by Division

(In thousands of U.S. dollars)

3Q YTD Three-Months ended

% Incr. Constant Nine-Months

ended % Incr. Constant September

30, / Currency September

30, / Currency 2016

2015 (Decr) Incr/(Decr)%

2016 2015 (Decr)

Incr/(Decr)% Revenues Brazil 357,034

311,815 14.5 % 5.8 % 955,062 1,028,589 -7.1 % 4.9 % Caribbean

101,759 96,152 5.8 % 28.7 % 298,045 292,860 1.8 % 27.6 % NOLAD

94,743 93,451 1.4 % 8.6 % 268,203 271,217 -1.1 % 6.9 % SLAD 222,120

252,277 -12.0 % 24.5 % 600,161 695,088 -13.7 % 24.0 %

TOTAL

775,656 753,695 2.9 % 15.3

% 2,121,471 2,287,754 -7.3 %

13.8 % Operating Income

(loss) Brazil 27,602 12,739 116.7 % 102.3 % 71,962

58,522 23.0 % 42.1 % Caribbean (2,594 ) (5,376 ) -51.7 % -253.1 %

(16,959 ) (29,980 ) 43.4 % 137.9 % NOLAD 5,441 2,122 156.4 % 153.5

% 55,800 1,535 3535.2 % 4008.9 % SLAD 19,543 26,632 -26.6 % 11.5 %

44,496 61,445 -27.6 % 11.4 % Corporate and Other (11,435 ) (15,279

) -25.2 % 8.1 % (30,816 ) (51,393 ) 40.0 % 11.4 %

TOTAL

38,557 20,838 85.0 % 152.2

% 124,483 40,129 210.2 %

349.9 % Adjusted

EBITDA Brazil 39,172 26,177 49.6 % 39.5 % 104,967

100,602 4.3 % 19.9 % Caribbean 6,150 2,649 132.2 % 405.3 % 10,067

(484 ) 2180.0 % 5808.7 % NOLAD 10,518 8,963 17.3 % 21.4 % 25,983

21,442 21.2 % 22.7 % SLAD 22,796 30,983 -26.4 % 8.4 % 54,880 75,012

-26.8 % 8.7 % Corporate and Other (15,478 ) (17,826 ) -13.2 % 12.3

% (43,728 ) (62,719 ) 30.3 % 9.6 %

TOTAL 63,158

50,946 24.0 % 45.9

% 152,169 133,853 13.7

% 49.0 % Figure 12. Average Exchange

Rate per Quarter* Brazil

Mexico Argentina

Venezuela 3Q16 3.25 18.76 14.95

646.01 3Q15 3.54 16.44

9.25 199.11 * Local $ per 1 US$

Summarized Consolidated Balance Sheets

(In thousands of U.S. dollars)

Figure 13. Summarized Consolidated Balance Sheets

(In thousands of U.S. dollars)

September 30 December 31

2016 2015 ASSETS

Current assets Cash and cash equivalents 112,207 112,519

Accounts and notes receivable, net 66,643 63,348 Other current

assets (1) 205,300 203,129

Total current assets 384,150

378,996 Non-current assets Property and

equipment, net 848,637 833,357 Net intangible assets and goodwill

47,064 49,486 Deferred income taxes 75,164 63,321 Other non-current

assets (2) 86,267 78,042

Total non-current assets 1,057,132

1,024,206 Total assets

1,441,282 1,403,202

LIABILITIES AND EQUITY

Current liabilities Accounts

payable 185,457 187,685 Taxes payable (3) 103,487 97,587 Accrued

payroll and other liabilities 131,486 93,112 Other current

liabilities (4) 12,805 30,824 Provision for contingencies 469 512

Financial debt (5) 21,188 165,866 Deferred income taxes

1,890 1,728

Total current

liabilities 456,782

577,314 Non-current liabilities Accrued

payroll and other liabilities 23,439 19,381 Provision for

contingencies 24,553 20,066 Financial debt (6) 591,358 491,327

Deferred income taxes 7,249 8,224

Total non-current liabilities

646,599 538,998 Total

liabilities 1,103,381

1,116,312 Equity Class A shares of common

stock 373,967 371,857 Class B shares of common stock 132,915

132,915 Additional paid-in capital 13,000 12,606 Retained earnings

250,817 193,158 Accumulated other comprehensive losses

(433,364 ) (424,263 )

Total Arcos Dorados Holdings

Inc shareholders’ equity 337,335

286,273 Non-controlling interest in

subsidiaries 566 617

Total

equity 337,901

286,890 Total liabilities and equity

1,441,282 1,403,202 (1)

Includes "Other receivables", "Inventories", "Prepaid expenses and

other current assets", and "Deferred income taxes". (2) Includes

"Miscellaneous", "Collateral deposits", "Derivative instruments"

and "McDonald´s Corporation indemnification for contingencies". (3)

Includes "Income taxes payable" and "Other taxes payable". (4)

Includes "Royalties payable to McDonald´s Corporation" and

"Interest payable". (5) Includes "Short-term debt", "Current

portion of long-term debt" and "Derivative instruments". (6)

Includes "Long-term debt, excluding current portion" and

"Derivative instruments".

1 For a definition of constant currency results please refer to

page 14 of this document.

2 As from January 1, 2016, the Company made changes in the

allocation of certain expenses previously included in the corporate

segment to the operating divisions in order to align the financial

statement presentation with the revised allocation used by the

Company’s management as from that date. In accordance with ASC 280,

Segment Reporting, the Company has restated its comparative segment

information based on the new allocation of expenses.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161102005475/en/

Investor RelationsArcos DoradosDaniel Schleiniger, +54 11

4711 2675Sr. Director of Corporate Communications & Investor

Relationsdaniel.schleiniger@ar.mcd.comorMediaMBS Value

PartnersKatja Buhrer, +1 917 969

3438katja.buhrer@mbsvalue.comwww.arcosdorados.com/ir

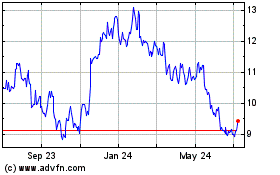

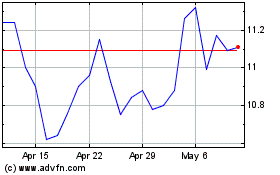

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arcos Dorados (NYSE:ARCO)

Historical Stock Chart

From Apr 2023 to Apr 2024