Potbelly Corporation (NASDAQ:PBPB) today reported financial results

for the third fiscal quarter ended September 25, 2016.

Key highlights for the thirteen weeks ended September

25, 2016 compared to the thirteen weeks ended September 27, 2015

include:

- Total revenues increased 8.1% to $103.8 million from $96.0

million.

- Company-operated comparable store sales increased 0.6%.

- Eight new shops opened, including six company-operated shops

and two franchised shops.

- GAAP net income attributable to Potbelly Corporation increased

28.1% to $1.8 million from net income of $1.4 million. GAAP diluted

EPS increased 40.0% to $0.07 from $0.05.

- Adjusted net income attributable to Potbelly Corporation

increased 37.8% to $3.0 million from adjusted net income of $2.2

million. Adjusted diluted EPS increased 50.0% to $0.12 from

$0.08.

- EBITDA increased 7.8% to $8.4 million from $7.8 million.

- Adjusted EBITDA increased 11.1% to $12.0 million from $10.8

million.

Key highlights for the thirty-nine weeks ended September

25, 2016 compared to the thirty-nine weeks ended September 27, 2015

include:

- Total revenues increased 9.7% to $304.8 million from $277.8

million.

- Company-operated comparable store sales increased 1.9%.

- Twenty-two new shops opened, including fifteen company-operated

shops and seven franchised shops.

- GAAP net income attributable to Potbelly Corporation increased

42.4% to $6.3 million from net income of $4.4 million. GAAP diluted

EPS increased 60.0% to $0.24 from $0.15.

- Adjusted net income attributable to Potbelly Corporation

increased 36.1% to $8.1 million from adjusted net income of $5.9

million. Adjusted diluted EPS increased 55.0% to $0.31 from

$0.20.

- EBITDA increased 16.2% to $27.1 million from $23.3

million.

- Adjusted EBITDA increased 12.2% to $34.6 million from $30.8

million.

Aylwin Lewis, Chairman and Chief Executive

Officer of Potbelly Corporation, commented, “During the third

quarter, we delivered revenue growth of 8%. Our sales growth was

impacted by the slowing consumer trends that began in April and

persisted through the third quarter. However, we are pleased with

our flow through to the bottom line, where we delivered adjusted

net income growth of 38% and adjusted diluted EPS growth of

50%.”

Lewis continued, “We remain focused on executing

on the fundamentals of our business to drive sales growth and

profitability through targeted investments and disciplined cost

management. We remain on track to achieve our guidance for the

fiscal year for comparable sales growth of 1% to 2%, adjusted net

income growth of at least 20%, and adjusted diluted earnings per

share in the range of $0.36 to $0.38.”

2016 Outlook

For the full fiscal year of 2016, management currently

expects:

- Company-operated comparable store sales growth of approximately

1% to 2%;

- 50 – 60 total new shop openings, including 40 – 45

company-operated shop openings;

- An effective tax rate that is expected to range from 37% to

39%;

- Adjusted net income of at least 20% growth;

- Full year adjusted diluted earnings per share to range from

$0.36 to $0.38; and

- Comparable categories of adjustments to net income as discussed

in the “Reconciliation of Non-GAAP Financial Measures to GAAP

Financial Measures.”

(Projected adjusted net income growth and adjusted diluted

earnings per share set forth above are measures not recognized

under GAAP. Please see “Non-GAAP Financial Measures”

below.)

Conference Call

A conference call and audio webcast has been scheduled for 5:00

p.m. Eastern time today to discuss these results. Details of the

conference call are as follows:

| Date: |

|

Tuesday, November 1,

2016 |

| Time: |

|

5:00 p.m. Eastern

time |

| Dial-In #: |

|

877-407-0784 U.S. &

Canada |

| |

|

201-689-8560

International |

|

Confirmation code: |

|

13647589 |

Alternatively, the conference call will be webcast at

www.potbelly.com on the “Investor Relations” webpage. For

those unable to participate, an audio replay will be available from

8:00 p.m. Eastern time on Tuesday, November 1, 2016 through

midnight Tuesday, November 8, 2016. To access the replay, please

call 844-512-2921 (U.S. & Canada) or 412-317-6671

(International) and enter confirmation code 13647589. A web-based

archive of the conference call will also be available at the above

website.

About Potbelly

Potbelly Corporation is a fast-growing neighborhood sandwich

concept offering toasty warm sandwiches, signature salads and other

fresh menu items served by engaging people in an environment that

reflects the Potbelly brand. Our Vision is for our customers to

feel that we are their “Neighborhood Sandwich Shop” and to tell

others about their great experience. Our Mission is to make people

really happy and to improve every day. Our Passion is to be “The

Best Place for Lunch.” The Company owns and operates over 350 shops

in the United States and our franchisees operate over 40 shops

domestically, in the Middle East, the United Kingdom and Canada.

For more information, please visit our website at

www.potbelly.com.

Definitions

The following definitions apply to these terms as used

throughout this press release:

- Revenues – represent net company-operated

sandwich shop sales and our franchise operations. Net

company-operated shop sales consist of food and beverage sales, net

of promotional allowances and employee meals. Franchise royalties

and fees consist of an initial franchise fee, a franchise

development agreement fee and royalty income from the

franchisee.

- Company-operated comparable store sales –

represents the change in year-over-year sales for the comparable

company-operated store base open for 15 months or longer.

- Adjusted EBITDA – represents net income before

depreciation and amortization expense, interest expense, provision

for income taxes and pre-opening costs, adjusted to eliminate the

impact of other items, including certain non-cash as well as

certain other items that we do not consider representative of our

on-going operating performance.

- Adjusted net income – represents net income,

excluding impairment, gain or loss on disposal of property and

equipment and store closure expense as well as costs associated

with moving our corporate headquarters.

- Shop-level profit – represents income from

operations less franchise royalties and fees, general and

administrative expenses, depreciation expense, pre-opening costs

and impairment and loss on disposal of property and equipment.

- Shop-level profit margin – represents

shop-level profit expressed as a percentage of net company-operated

sandwich shop sales.

Non-GAAP Financial Measures

We prepare our financial statements in accordance with Generally

Accepted Accounting Principles (“GAAP”). Within this press release,

we make reference to adjusted EBITDA, adjusted net income,

shop-level profit and shop-level profit margin, which are non-GAAP

financial measures. The Company includes these non-GAAP financial

measures because management believes they are useful to investors

in that they provide for greater transparency with respect to

supplemental information used by management in its financial and

operational decision making.

Management uses adjusted EBITDA and adjusted net income to

evaluate the Company’s performance excluding the impact of certain

non-cash charges and other special items that affect the

comparability of results in past quarters, are expected in future

quarters and in order to have comparable financial results to

analyze changes in our underlying business from quarter to quarter.

Management uses shop-level profit and shop-level profit margin as

key metrics to evaluate the profitability of incremental sales at

our shops, to evaluate our shop performance across periods and to

evaluate our shop financial performance against our

competitors.

Accordingly, the Company believes the presentation of these

non-GAAP financial measures, when used in conjunction with GAAP

financial measures, is a useful financial analysis tool that can

assist investors in assessing the Company’s operating performance

and underlying prospects. This analysis should not be considered in

isolation or as a substitute for analysis of our results as

reported under GAAP. This analysis, as well as the other

information in this press release, should be read in conjunction

with the Company’s financial statements and footnotes contained in

the documents that the Company files with the U.S. Securities and

Exchange Commission (“SEC”). The non-GAAP financial measures used

by the Company in this press release may be different from the

methods used by other companies. For more information on the

non-GAAP financial measures, please refer to the table,

“Reconciliation of Non-GAAP Financial Measures to GAAP Financial

Measures.”

This release includes certain non-GAAP forward-looking

information (including but not limited to under the heading “—2016

Outlook”), namely adjusted net income and adjusted diluted earnings

per share. The Company believes that a quantitative

reconciliation of such forward-looking information to the most

comparable financial measure calculated and presented in accordance

with GAAP cannot be made available without unreasonable

efforts. A reconciliation of these non-GAAP financial measures

would require the Company to predict the timing and likelihood of

outcomes that determine future impairments and the tax benefit of

any such future impairments. Neither of these measures, nor

their probable significance, can be reliably quantified due to the

inability to forecast future impairments.

Forward-Looking Statements

Except for the historical information contained in this press

release, the matters addressed are forward-looking statements

within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements, written, oral

or otherwise made, represent the Company’s expectation or belief

concerning future events. Without limiting the foregoing, the words

“believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,”

“plans,” “strives,” “goal,” “estimates,” “forecasts,” “projects” or

“anticipates” and similar expressions are intended to identify

forward-looking statements. By nature, forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from those projected or implied by the

forward-looking statement. Forward-looking statements are based on

current expectations and assumptions and currently available data

and are neither predictions nor guarantees of future events or

performance. You should not place undue reliance on forward-looking

statements, which speak only as of the date hereof. See “Risk

Factors” and “Cautionary Statement on Forward-Looking Statements”

included in our most recent annual report on Form 10-K and other

risk factors described from time to time in subsequent

quarterly reports on Form 10-Q, all of which are available on our

website at www.potbelly.com.

| |

| Potbelly Corporation |

| Consolidated Statements of Operations and

Margin Analysis – Unaudited |

| (Amounts in thousands, except share and per

share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the 13 Weeks Ended |

|

For the 39 Weeks Ended |

|

|

|

September 25, |

|

September 27, |

|

September 25, |

|

September 27, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sandwich shop sales, net |

|

$ |

103,224 |

|

|

|

99.5 |

% |

|

$ |

95,564 |

|

|

|

99.5 |

% |

|

$ |

303,116 |

|

|

|

99.5 |

% |

|

$ |

276,527 |

|

|

|

99.6 |

% |

| Franchise

royalties and fees |

|

|

558 |

|

|

|

0.5 |

|

|

|

475 |

|

|

|

0.5 |

|

|

|

1,657 |

|

|

|

0.5 |

|

|

|

1,229 |

|

|

|

0.4 |

|

| Total

revenues |

|

|

103,782 |

|

|

|

100.0 |

|

|

|

96,039 |

|

|

|

100.0 |

|

|

|

304,773 |

|

|

|

100.0 |

|

|

|

277,756 |

|

|

|

100.0 |

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sandwich

shop operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost

of goods sold, excluding depreciation |

|

|

28,478 |

|

|

|

27.4 |

|

|

|

27,256 |

|

|

|

28.4 |

|

|

|

83,224 |

|

|

|

27.3 |

|

|

|

78,854 |

|

|

|

28.4 |

|

| Labor and

related expenses |

|

|

30,163 |

|

|

|

29.1 |

|

|

|

27,663 |

|

|

|

28.8 |

|

|

|

88,260 |

|

|

|

29.0 |

|

|

|

79,415 |

|

|

|

28.6 |

|

| Occupancy

expenses |

|

|

13,111 |

|

|

|

12.6 |

|

|

|

11,855 |

|

|

|

12.3 |

|

|

|

39,042 |

|

|

|

12.8 |

|

|

|

34,741 |

|

|

|

12.5 |

|

| Other

operating expenses |

|

|

11,338 |

|

|

|

10.9 |

|

|

|

10,501 |

|

|

|

10.9 |

|

|

|

32,570 |

|

|

|

10.7 |

|

|

|

30,128 |

|

|

|

10.8 |

|

| General

and administrative expenses |

|

|

9,999 |

|

|

|

9.6 |

|

|

|

9,232 |

|

|

|

9.6 |

|

|

|

30,827 |

|

|

|

10.1 |

|

|

|

27,706 |

|

|

|

10.0 |

|

|

Depreciation expense |

|

|

5,656 |

|

|

|

5.4 |

|

|

|

5,510 |

|

|

|

5.7 |

|

|

|

16,996 |

|

|

|

5.6 |

|

|

|

15,949 |

|

|

|

5.7 |

|

|

Pre-opening costs |

|

|

340 |

|

|

|

0.3 |

|

|

|

510 |

|

|

|

0.5 |

|

|

|

731 |

|

|

|

0.2 |

|

|

|

1,587 |

|

|

|

0.6 |

|

|

Impairment and loss on disposal of property and

equipment |

|

|

1,855 |

|

|

|

1.8 |

|

|

|

1,133 |

|

|

|

1.2 |

|

|

|

2,880 |

|

|

|

0.9 |

|

|

|

1,965 |

|

|

|

0.7 |

|

|

Total expenses |

|

|

100,940 |

|

|

|

97.3 |

|

|

|

93,660 |

|

|

|

97.5 |

|

|

|

294,530 |

|

|

|

96.6 |

|

|

|

270,345 |

|

|

|

97.3 |

|

| Income

from operations |

|

|

2,842 |

|

|

|

2.7 |

|

|

|

2,379 |

|

|

|

2.5 |

|

|

|

10,243 |

|

|

|

3.4 |

|

|

|

7,411 |

|

|

|

2.7 |

|

| Interest

expense, net |

|

|

33 |

|

|

|

0.0 |

|

|

|

56 |

|

|

|

0.1 |

|

|

|

102 |

|

|

|

0.0 |

|

|

|

180 |

|

|

|

0.1 |

|

| Income

before income taxes |

|

|

2,809 |

|

|

|

2.7 |

|

|

|

2,323 |

|

|

|

2.4 |

|

|

|

10,141 |

|

|

|

3.3 |

|

|

|

7,231 |

|

|

|

2.6 |

|

| Income

tax expense |

|

|

960 |

|

|

|

0.9 |

|

|

|

866 |

|

|

|

0.9 |

|

|

|

3,732 |

|

|

|

1.2 |

|

|

|

2,780 |

|

|

|

1.0 |

|

| Net

income |

|

|

1,849 |

|

|

|

1.8 |

|

|

|

1,457 |

|

|

|

1.5 |

|

|

|

6,409 |

|

|

|

2.1 |

|

|

|

4,451 |

|

|

|

1.6 |

|

| Net

income attributable to non- controlling interests |

|

|

54 |

|

|

|

0.1 |

|

|

|

56 |

|

|

|

0.1 |

|

|

|

153 |

|

|

|

0.1 |

|

|

|

58 |

|

|

|

0.0 |

|

| Net

income attributable to Potbelly Corporation |

|

$ |

1,795 |

|

|

|

1.7 |

% |

|

$ |

1,401 |

|

|

|

1.5 |

% |

|

$ |

6,256 |

|

|

|

2.1 |

% |

|

$ |

4,393 |

|

|

|

1.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income per common share attributableto common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.07 |

|

|

|

|

$ |

0.05 |

|

|

|

|

$ |

0.24 |

|

|

|

|

$ |

0.15 |

|

|

|

|

Diluted |

|

$ |

0.07 |

|

|

|

|

$ |

0.05 |

|

|

|

|

$ |

0.24 |

|

|

|

|

$ |

0.15 |

|

|

|

| Weighted

average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

25,240,374 |

|

|

|

|

|

27,850,394 |

|

|

|

|

|

25,772,846 |

|

|

|

|

|

28,450,063 |

|

|

|

|

Diluted |

|

|

25,829,970 |

|

|

|

|

|

28,369,775 |

|

|

|

|

|

26,341,913 |

|

|

|

|

|

29,137,537 |

|

|

|

| Potbelly Corporation |

| Reconciliation of Non-GAAP Financial Measures

to GAAP Financial Measures – Unaudited |

| (Amounts in thousands, except share and per

share data) |

| |

|

|

|

|

|

|

|

|

|

|

For the 13 Weeks Ended |

|

For the 39 Weeks Ended |

|

|

|

September 25, |

|

September 27, |

|

September 25, |

|

September 27, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Net

income attributable to Potbelly Corporation, as

reported |

|

$ |

1,795 |

|

|

$ |

1,401 |

|

|

$ |

6,256 |

|

|

$ |

4,393 |

|

|

Impairment and closures(1) |

|

|

1,869 |

|

|

|

1,231 |

|

|

|

2,897 |

|

|

|

2,517 |

|

| Tax

benefit of impairment and closures(2) |

|

|

(677 |

) |

|

|

(465 |

) |

|

|

(1,066 |

) |

|

|

(967 |

) |

| Adjusted

net income attributable to Potbelly Corporation |

|

$ |

2,987 |

|

|

$ |

2,167 |

|

|

$ |

8,087 |

|

|

$ |

5,943 |

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to Potbelly Corporation per share,

basic |

|

$ |

0.07 |

|

|

$ |

0.05 |

|

|

$ |

0.24 |

|

|

$ |

0.15 |

|

| Net

income attributable to Potbelly Corporation per share,

diluted |

|

$ |

0.07 |

|

|

$ |

0.05 |

|

|

$ |

0.24 |

|

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

net income attributable to Potbelly Corporation per share,

basic |

|

$ |

0.12 |

|

|

$ |

0.08 |

|

|

$ |

0.31 |

|

|

$ |

0.21 |

|

| Adjusted

net income attributable to Potbelly Corporation per share,

diluted |

|

$ |

0.12 |

|

|

$ |

0.08 |

|

|

$ |

0.31 |

|

|

$ |

0.20 |

|

|

|

|

|

|

|

|

|

|

|

| Shares

used in computing adjusted net income attributable to

Potbelly Corporation: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

25,240,374 |

|

|

|

27,850,394 |

|

|

|

25,772,846 |

|

|

|

28,450,063 |

|

|

Diluted |

|

|

25,829,970 |

|

|

|

28,369,775 |

|

|

|

26,341,913 |

|

|

|

29,137,537 |

|

|

|

|

For the 13 Weeks Ended |

|

For the 39 Weeks Ended |

|

|

|

|

September 25, |

|

September 27, |

|

September 25, |

|

September 27, |

|

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

| Net

income attributable to Potbelly Corporation, as

reported |

|

$ |

1,795 |

|

|

$ |

1,401 |

|

|

$ |

6,256 |

|

|

$ |

4,393 |

|

|

|

Depreciation expense |

|

|

5,656 |

|

|

|

5,510 |

|

|

|

16,996 |

|

|

|

15,949 |

|

|

| Interest

expense, net |

|

|

33 |

|

|

|

56 |

|

|

|

102 |

|

|

|

180 |

|

|

| Income

tax expense |

|

|

960 |

|

|

|

866 |

|

|

|

3,732 |

|

|

|

2,780 |

|

|

|

EBITDA |

|

$ |

8,444 |

|

|

$ |

7,833 |

|

|

$ |

27,086 |

|

|

$ |

23,302 |

|

|

|

Impairment and closures(3) |

|

|

1,869 |

|

|

|

1,231 |

|

|

|

2,897 |

|

|

|

2,347 |

|

|

|

Pre-opening costs(4) |

|

|

340 |

|

|

|

510 |

|

|

|

731 |

|

|

|

1,587 |

|

|

|

Stock-based compensation |

|

|

800 |

|

|

|

667 |

|

|

|

2,266 |

|

|

|

1,795 |

|

|

| Public

company costs(5) |

|

|

510 |

|

|

|

529 |

|

|

|

1,617 |

|

|

|

1,792 |

|

|

| Adjusted

EBITDA |

|

$ |

11,963 |

|

|

$ |

10,770 |

|

|

$ |

34,597 |

|

|

$ |

30,823 |

|

|

| Potbelly Corporation |

| Reconciliation of Non-GAAP Financial Measures

to GAAP Financial Measures – Unaudited |

| (Amounts in thousands, except selected

operating data) |

| |

|

|

|

|

|

|

|

|

|

|

|

For the 13 Weeks Ended |

|

For the 39 Weeks Ended |

|

|

|

September 25, |

|

September 27, |

|

September 25, |

|

September 27, |

|

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| Income

from operations |

|

$ |

2,842 |

|

|

$ |

2,379 |

|

|

$ |

10,243 |

|

|

$ |

7,411 |

|

| Less:

Franchise royalties and fees |

|

|

558 |

|

|

|

475 |

|

|

|

1,657 |

|

|

|

1,229 |

|

| General

and administrative expenses |

|

|

9,999 |

|

|

|

9,232 |

|

|

|

30,827 |

|

|

|

27,706 |

|

|

Depreciation expense |

|

|

5,656 |

|

|

|

5,510 |

|

|

|

16,996 |

|

|

|

15,949 |

|

|

Pre-opening costs |

|

|

340 |

|

|

|

510 |

|

|

|

731 |

|

|

|

1,587 |

|

|

Impairment and loss on disposal of property and

equipment |

|

|

1,855 |

|

|

|

1,133 |

|

|

|

2,880 |

|

|

|

1,965 |

|

|

Shop-level profit [Y] |

|

$ |

20,134 |

|

|

$ |

18,289 |

|

|

$ |

60,020 |

|

|

$ |

53,389 |

|

| Total

revenues |

|

$ |

103,782 |

|

|

$ |

96,039 |

|

|

$ |

304,773 |

|

|

$ |

277,756 |

|

| Less:

Franchise royalties and fees |

|

|

558 |

|

|

|

475 |

|

|

|

1,657 |

|

|

|

1,229 |

|

| Sandwich

shop sales, net [X] |

|

$ |

103,224 |

|

|

$ |

95,564 |

|

|

$ |

303,116 |

|

|

$ |

276,527 |

|

|

Shop-level profit margin [Y÷X] |

|

|

19.5 |

% |

|

|

19.1 |

% |

|

|

19.8 |

% |

|

|

19.3 |

% |

|

|

|

For the 13 Weeks Ended |

|

For the 39 Weeks Ended |

|

|

|

September 25, |

|

September 27, |

|

September 25, |

|

September 27, |

|

|

|

2016 |

|

2015 |

|

2016 |

|

2015 |

|

Selected Operating Data |

|

|

|

|

|

|

|

|

| Shop

Activity: |

|

|

|

|

|

|

|

|

|

Company-operated shops, end of period |

|

|

387 |

|

|

|

358 |

|

|

|

387 |

|

|

|

358 |

|

| Franchise

shops, end of period |

|

|

41 |

|

|

|

31 |

|

|

|

41 |

|

|

|

31 |

|

| Revenue

Data: |

|

|

|

|

|

|

|

|

|

Company-operated comparable store sales |

|

|

0.6 |

% |

|

|

3.7 |

% |

|

|

1.9 |

% |

|

|

4.6 |

% |

| |

|

|

|

|

|

|

|

| Footnotes to

the Press Release, Reconciliation of Non-GAAP Financial Measures to

GAAP Financial Measures & Selected

Operating Data |

| |

|

|

|

| (1 |

) |

|

This adjustment includes costs related to

impairment of long-lived assets, gain or loss on disposal of

property and equipment and shop closure expenses. Shop closure

expenses are recorded in general and administrative expenses in the

consolidated statement of operations. Additionally, the thirteen

and thirty-nine weeks ended September 27, 2015 include costs

associated with the Company moving its corporate headquarters,

which are recorded in the consolidated statement of operations in

general and administrative expenses, as well as pre-opening for the

occupancy-related costs. |

| (2 |

) |

|

For the thirteen weeks ended September 25, 2016

and September 27, 2015, the tax benefit associated with impairment

and closures is based on effective tax rates of 36.2% and 37.8%,

respectively. For the thirty-nine weeks ended September 25, 2016

and September 27, 2015, the tax benefit associated with impairment

and closures is based on effective tax rates of 36.8% and 38.4%,

respectively. |

| (3 |

) |

|

This adjustment includes costs related to

impairment of long-lived assets, gain or loss on disposal of

property and equipment and shop closure expenses. Shop closure

expenses are recorded in general and administrative expenses in the

consolidated statement of operations. Additionally, the thirteen

and thirty-nine weeks ended September 27, 2015 include costs

associated with the Company moving its corporate headquarters,

which are recorded in the consolidated statement of operations in

general and administrative expenses. |

| (4 |

) |

|

Pre-opening costs are expensed as incurred and

primarily consist of travel, employee payroll and training costs

incurred prior to the opening of a shop, as well as occupancy costs

incurred from the date the Company takes site possession to shop

opening. Additionally, the thirty-nine weeks ended September 27,

2015 includes pre-opening rent for the new corporate office

location of $0.2 million. |

| (5 |

) |

|

This adjustment includes on-going public company

costs, which primarily consist of legal and accounting fees.

|

Contact:

Investor Relations

Investors@Potbelly.com

312-428-2950

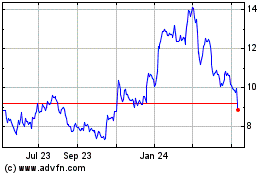

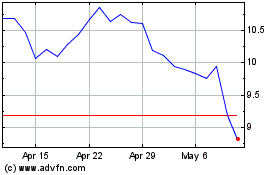

Potbelly (NASDAQ:PBPB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Potbelly (NASDAQ:PBPB)

Historical Stock Chart

From Apr 2023 to Apr 2024