Citizens Financial Says Revenue, Profit Rise on Loan and Deposit Growth

October 21 2016 - 9:43AM

Dow Jones News

By Austen Hufford

Citizens Financial Group Inc. reported revenue and profit

increases for its third quarter, driven by increases in loans and

deposits.

The Providence, R.I.-based regional bank, which went public at

the end of 2014, said average loans increased 8.3% from a year

earlier on increases in commercial and retail lending as deposits

rose 6.3%.

In all, Citizens earned $290 million, or 56 cents a share, up

from $213 million, or 40 cents a share, a year prior. On an

adjusted basis, earnings were 52 cents. Revenue increased 14% to

$1.38 billion.

Analysts polled by Thomson Reuters were expecting earnings of 48

cents a share on $1.32 billion in revenue.

Fee-based income rose 23% to $435 million primarily due to a $72

million sale of a troubled debt restructuring portfolio and also

due to mortgage banking fees, service charges and fees, foreign

exchange and letter of credit fees.

Citizens said expenses increased 8.5% from a year prior, driven

by a reduction in restructuring charges and special items that was

partially offset by an increase in salary and employee benefits

largely related to a change in timing of merit increases.

The lender's provision for potential loan losses was $86

million, up from a $76 million provision in the same quarter last

year, but down from the around $90 million in each of the previous

three quarters, largely due to net charge offs.

Shares, up 18% in the past three months, rose 2.9% in premarket

trading.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

October 21, 2016 09:28 ET (13:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

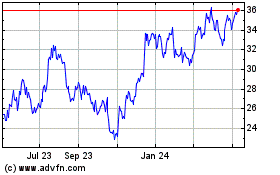

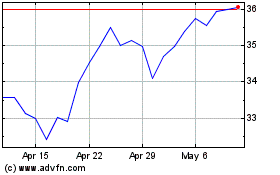

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Citizens Financial (NYSE:CFG)

Historical Stock Chart

From Sep 2023 to Sep 2024