IBM Profit, Sales Slip But New Units Grow -- WSJ

October 18 2016 - 3:03AM

Dow Jones News

By Rachael King

Profit and revenue at International Business Machines Corp.

declined, with the top line edging lower to mark its 18th

consecutive fall. Still, the company saw growth in newer businesses

such as cloud computing and artificial intelligence.

The Armonk, N.Y., company reported third-quarter earnings

Monday, saying revenue for the quarter was $19.23 billion, down

0.3%, as the company has attempted to transition into new lines of

business while its core products become increasingly pressured by

the move to computing services delivered over the internet.

Big Blue said net profit fell 4% to $2.9 billion during the

quarter ended in September amid weakness in its systems segment,

which includes mainframe computer hardware and operating-system

software.

"In the third quarter, we're at the back end of the mainframe

[sales] cycle, so we'd expect it to be down," said Martin

Schroeter, IBM senior vice president and chief financial officer in

an interview.

Shares of the company fell 3.19% to $149.84 in after-hours

trading.

Alongside falling revenue in some older lines of business,

revenue from cloud services across all IBM business segments grew

42% in constant currency to $3.4 billion, Mr. Schroeter said. Those

cloud services include SoftLayer, which sells access to computing

capacity over the internet, and Bluemix, which sells access to

software over the web, among other things. The cloud business

during the quarter added new customers including Dixons Carphone

Group, JFE Steel Co., Ltd. and Vodafone India.

Cloud computing is one of several faster-growing areas that IBM

calls strategic imperatives. Those businesses, which also include

artificial intelligence, data analytics and security, grew 15% in

constant currency during the third quarter compared with 12% during

the second quarter. They now represent 40% of IBM's overall

business.

"As long as we keep seeing growth in strategic imperatives,

people should be happy," said Greg McDowell, analyst at JMP

Securities.

IBM has invested heavily in such businesses. It spent $5.45

billion on acquisitions during the first nine months of the year,

compared with $821 million during the same period a year earlier.

It has bought 12 companies to spur growth in industry-specific

businesses.

In some cases, it has combined these acquisitions with its

artificial intelligence software known as Watson to create new

offerings. For example, its acquisition of Promontory Financial

Group, announced Sept. 29, will combine the risk management and

regulatory compliance consulting firm with Watson's abilities to

learn from past data and to respond to natural-language to help

financial services firms wade through tens of thousands of

regulatory changes described in millions of pages of records each

year.

"We'll continue to run the business of consulting as we always

do, but the consultants will help train and put the wisdom and

knowledge of that understanding into Watson," said Bridget van

Kralingen, senior vice president of IBM Global Industry Platforms,

in an interview.

This is similar to what IBM has done with Watson in the field of

oncology, helping hospitals to better match cancer patients to

clinical trials.

Acquisitions were expected to add an estimated $360 million to

revenue during the quarter, compared with the year-earlier period,

according to Toni Sacconaghi, an analyst at Bernstein Research.

Wall Street analysts had expected revenue of $19 billion for the

quarter, according to Thomson Reuters.

Excluding charges, per-share earnings totaled $3.29. Analysts

had expected adjusted earnings of $3.23 a share, according to

Thomson Reuters.

For the year, the company backed its forecast for per-share

operating earnings of at least $13.50 a share.

Write to Rachael King at rachael.king@wsj.com

(END) Dow Jones Newswires

October 18, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

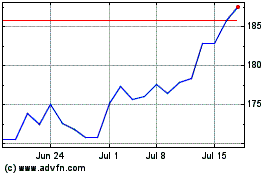

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024