Stocks Fall as Pound Regains Ground After Selloff

October 07 2016 - 4:10AM

Dow Jones News

Stocks turned lower Friday ahead of the U.S. jobs report, while

the British pound began to recover after briefly plunging over 6%

in Asian trade.

The pound was last up 0.7% against the dollar at $1.2438 after

falling to as low as $1.1819, its lowest level in over three

decades, during Asian trading hours. The selloff began after French

President Franç ois Hollande called for tough exit negotiations as

Britain leaves the European Union. Market participants said the

decline was accelerated by computerized trades at a time of low

liquidity.

"It is still early days to determine the end-result but one

thing seems certain: sterling will remain under severe pressure,"

said Vasileios Gkionakis, head of currency strategy at UniCredit

Research.

London's export-heavy FTSE 100 index, which tends to move

opposite to the British currency, rose 0.6% in the early minutes of

trading, even as the pan-European Stoxx Europe 600 edged down

0.2%

The moves came on the heels of a mildly downbeat session in Asia

as concerns over the U.K.'s access to the single market dampened

sentiment. Japan's Nikkei Stock Average fell 0.2%, while shares in

Hong Kong fell 0.6% and shares in Australia fell 0.3%.

Futures pointed to a 0.3% opening loss for the S&P 500, as

investors looked ahead to the monthly U.S. jobs report due later in

the day. U.S. government bond yields closed at a four month high on

Thursday as investor expectations grew for a robust reading.

Write to Riva Gold at riva.gold@wsj.com and Saumya Vaishampayan

at saumya.vaishampayan@wsj.com

(END) Dow Jones Newswires

October 07, 2016 03:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

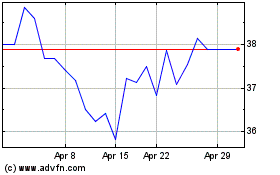

Unicredito (PK) (USOTC:UNCFF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Unicredito (PK) (USOTC:UNCFF)

Historical Stock Chart

From Sep 2023 to Sep 2024