Robbins Arroyo LLP: MGT Capital Investments, Inc. (MGT) Misled Shareholders According to a Recently Filed Class Action

October 05 2016 - 7:29PM

Business Wire

Shareholder rights law firm Robbins Arroyo LLP announces that a

class action complaint was filed against MGT Capital Investments,

Inc. (NYSE MKT: MGT) in the U.S. District Court for the Southern

District of New York. The complaint is brought on behalf of all

purchasers of MGT securities between May 9, 2016 and September 20,

2016, for alleged violations of the Securities Exchange Act of 1934

by MGT's officers and directors. MGT, together with its

subsidiaries, acquires, develops, and monetizes assets in the

online, mobile, and casino gaming space.

View this information on the law firm's Shareholder Rights Blog:

www.robbinsarroyo.com/shareholders-rights-blog/mgt-capital-investments-inc

MGT Accused of Failing to Disclose Risks of Listing Its Stock

on the New York Stock Exchange ("NYSE")

According to the complaint, on May 9, 2016, MGT announced that

it was acquiring the assets of an internet security startup known

as D-Vasive, Inc. Under the terms of the acquisition, MGT would

purchase D-Vasive for $300,000 and 23.8 million shares of

newly-issued MGT stock, and cyber security pioneer and founder of

D-Vasive's controlling entity John McAfee would become the

Executive Chairman and Chief Executive Officer of MGT. MGT further

elaborated, "With the acquisition of D-Vasive technology as a

starting point, we expect to grow MGT into a successful and major

force in the space." MGT subsequently announced that it would also

acquire Demonsaw LLC, agreeing to issue another 20 million shares

of its common stock to acquire Demonsaw. As a result, MGT's stock

price surged more than 1,200% in the month following these

announcements.

However, the complaint alleges that MGT officials failed to

disclose the risks associated with listing new shares on the NYSE

and that MGT was under inquiry by the U.S. Securities and Exchange

Commission ("SEC"). On September 19, 2016, MGT revealed that it had

received a subpoena from the SEC days earlier which requested

certain undisclosed information. Then, on September 20, 2016, MGT

disclosed that the NYSE was refusing to list the 43.8 million

shares of MGT required to complete the acquisitions. On this news,

MGT stock fell 42%, closing at $1.89 per share on September 20,

2016.

MGT Shareholders Have Legal Options

Concerned shareholders who would like more information about

their rights and potential remedies can contact attorney Darnell R.

Donahue at (800) 350-6003, DDonahue@robbinsarroyo.com, or via the

shareholder information form on the firm's website.

Robbins Arroyo LLP is a nationally recognized leader in

shareholder rights law. The firm represents individual and

institutional investors in shareholder derivative and securities

class action lawsuits, and has helped its clients realize more than

$1 billion of value for themselves and the companies in which they

have invested.

Attorney Advertising. Past results do not guarantee a similar

outcome.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161005006535/en/

Robbins Arroyo LLPDarnell R. Donahue619-525-3990 or Toll Free

800-350-6003DDonahue@robbinsarroyo.comwww.robbinsarroyo.com

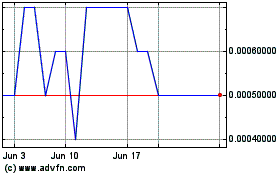

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

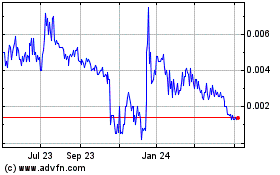

MGT Capital Investments (PK) (USOTC:MGTI)

Historical Stock Chart

From Apr 2023 to Apr 2024