Current Report Filing (8-k)

October 05 2016 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 29, 2016

Apollo Commercial Real Estate Finance, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

(State or other jurisdiction

of incorporation)

|

|

001-34452

(Commission File Number)

|

|

27-0467113

(IRS Employer

Identification No.)

|

|

|

|

|

|

c/o Apollo Global Management, LLC

9 West 57th Street, 43rd Floor

New York, New York

(Address of principal executive offices)

|

|

10019

(Zip Code)

|

Registrant’s telephone number, including area code: (212) 515-3200

n/a

(Former name or

former address, if changed since last report.)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

On September 29, 2016, ACREFI Holdings DB, LLC (the “Seller”), an indirect wholly-owned subsidiary of Apollo Commercial Real Estate Finance,

Inc. (the “Company”), entered into a Master Repurchase Agreement with Deutsche Bank AG, Cayman Islands Branch (the “DB Facility”). The DB Facility provides for a maximum aggregate purchase price of $300.0 million for the

purchase, sale and repurchase of eligible whole mortgage loans or senior interests in whole mortgage loans secured by first mortgage liens on commercial or multifamily properties, or other assets of the Seller approved by Deutsche Bank AG, Cayman

Islands Branch in its sole discretion. Advances under the DB Facility accrue interest at a per annum pricing rate equal to the sum of (i) the applicable LIBOR plus (ii) the applicable spread, and have a maturity date of September 29,

2017, subject to two one-year extension options exercisable at the option of the Seller subject to certain conditions and the payment of a fee. Margin calls may occur any time at specified aggregate margin deficit thresholds. The DB Facility

contains customary covenants, including continuing to operate in a manner that allows the Company to qualify as a real estate investment trust for federal income tax purposes and financial covenants with respect to minimum consolidated tangible net

worth, maximum total indebtedness to consolidated tangible net worth, and minimum liquidity. The Company has agreed to provide a guarantee of the obligations of the Seller under the DB Facility.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

Apollo Commercial Real Estate Finance, Inc.

|

|

|

|

|

By:

|

|

/s/ Jai Agarwal

|

|

|

|

Name: Jai Agarwal

|

|

|

|

Title: Chief Financial Officer, Treasurer and

Secretary

|

Date: October 5, 2016

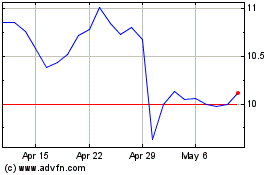

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Mar 2024 to Apr 2024

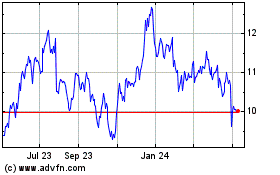

Apollo Commercial Real E... (NYSE:ARI)

Historical Stock Chart

From Apr 2023 to Apr 2024