UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

SCHEDULE 13D

Under the

Securities Exchange Act of 1934

(Amendment No. )*

T2 Biosystems, Inc.

(Name of Issuer)

Common Stock ($0.001 par value per share)

(Title of Class of Securities)

89853L104

(CUSIP Number)

Seymour Liebman

Executive Vice President, Chief Administrative Officer & General Counsel

Canon U.S.A., Inc.

One

Canon Park

Melville, New York 11747

(631) 330-5191

(Name, Address and Telephone

Number of Person Authorized

to Receive Notices and Communications)

September 21, 2016

(Date of Event which Requires

Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the

subject of this Schedule 13D and is filing this Schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note

: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits.

See

§ 240.13d-7(b) for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of

the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see

the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

NAME OF REPORTING PERSON:

Canon U.S.A., Inc.

|

|

|

|

2.

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

|

|

3.

|

|

SEC USE ONLY

|

|

|

|

4.

|

|

SOURCE OF FUNDS

WC

|

|

|

|

5.

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) OR

2(e)

¨

|

|

|

|

6.

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

New York

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH

|

|

|

|

7.

|

|

|

|

SOLE VOTING POWER

0

|

|

|

|

|

|

|

8.

|

|

|

|

SHARED VOTING POWER

6,055,341

|

|

|

|

|

|

|

9.

|

|

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

|

|

|

|

10.

|

|

|

|

SHARED DISPOSITIVE POWER

6,055,341

|

|

|

|

|

|

|

|

|

|

11.

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,055,341

|

|

|

|

12.

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

|

|

13.

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.9%

1

|

|

|

|

14.

|

|

TYPE OF REPORTING PERSON

CO

|

1

Based on 30,429,301 shares of common stock issued and outstanding as of September 21, 2016, after giving

effect to the purchase of 6,055,341 shares of common stock by Canon U.S.A., Inc. pursuant to that certain Stock Purchase Agreement, dated as of September 21, 2016, by and between Canon U.S.A., Inc. and T2 Biosystems, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1.

|

|

NAME OF REPORTING PERSON:

Canon Inc.

|

|

|

|

2.

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a)

¨

(b)

¨

|

|

|

|

3.

|

|

SEC USE ONLY

|

|

|

|

4.

|

|

SOURCE OF FUNDS

AF

|

|

|

|

5.

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) OR

2(e)

¨

|

|

|

|

6.

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Japan

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH REPORTING

PERSON

WITH

|

|

|

|

7.

|

|

|

|

SOLE VOTING POWER

0

|

|

|

|

|

|

|

8.

|

|

|

|

SHARED VOTING POWER

6,055,341

|

|

|

|

|

|

|

9.

|

|

|

|

SOLE DISPOSITIVE POWER

0

|

|

|

|

|

|

|

10.

|

|

|

|

SHARED DISPOSITIVE POWER

6,055,341

|

|

|

|

|

|

|

|

|

|

11.

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,055,341

|

|

|

|

12.

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES

¨

|

|

|

|

13.

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

19.9%

2

|

|

|

|

14.

|

|

TYPE OF REPORTING PERSON

HC; CO

|

|

2

|

Based on 30,429,301 shares of common stock issued and outstanding as of September 21, 2016, after giving effect to the purchase of 6,055,341 shares of common stock by Canon U.S.A., Inc. pursuant to that certain Stock

Purchase Agreement, dated as of September 21, 2016, by and between Canon U.S.A., Inc. and T2 Biosystems, Inc.

|

|

ITEM 1.

|

SECURITY AND ISSUER

|

This Schedule 13D (this “Schedule 13D”)

relates to the common stock, par value $0.001 per share (the “Common Stock”), of T2 Biosystems, Inc., a Delaware corporation (the “Company”). The principal executive offices of the Company are located at 101 Hartwell Avenue,

Lexington, Massachusetts 02421.

|

ITEM 2.

|

IDENTITY AND BACKGROUND

|

The persons filing this Schedule 13D are (i)

Canon U.S.A., Inc., a New York corporation (“Canon USA”), and (ii) Canon Inc., a corporation organized under the laws of Japan (“Canon”). Canon USA and Canon are sometimes referred to collectively in this Schedule 13D as the

“Reporting Persons” and each is sometimes referred to in this Schedule 13D as a “Reporting Person.” Canon is the sole stockholder of Canon USA.

Canon USA (including its sales subsidiaries) is a leading provider of consumer, business-to-business, and industrial digital

imaging solutions in North and South America. Its principal business address is One Canon Park, Melville, New York 11747.

Canon is one of the world’s leading manufacturers of office multifunction devices, plain paper copying machines, laser

printers, inkjet printers, cameras and lithography equipment. Its principal business address is 30-2, Shimomaruko 3-chome, Ohta-ku, Tokyo 146-8501, Japan.

During the last five years, none of the Reporting Persons nor, to the knowledge of each of the Reporting Persons, any of the

persons listed on Schedules I or II hereto, (i) has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) has been a party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with

respect to such laws.

The name, business address, present principal occupation or employment and citizenship of each

director and executive officer of Canon USA are set forth on Schedule I hereto and are incorporated herein by reference. The name, business address, present principal occupation or employment and citizenship of each director and executive officer of

Canon are set forth on Schedule II hereto and are incorporated herein by reference.

|

ITEM 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

On September 21,

2016 (the “Closing Date”), pursuant to a Stock Purchase Agreement, dated as of September 21, 2016 (the “Purchase Agreement”), by and between Canon USA and the Company, Canon USA purchased 6,055,341 shares of Common Stock (the

“Shares”) for an aggregate purchase price of $39,723,036.96 (the “Transaction”). The funds used to acquire the Shares came from the working capital of Canon USA.

|

ITEM 4.

|

PURPOSE OF TRANSACTION

|

Canon USA purchased the Shares for investment

purposes in the ordinary course of business, subject to the following.

In connection with the Transaction, the Company

and Canon USA also entered into (i) a Voting and Standstill Agreement, dated as of September 21, 2016 (the “Voting and Standstill Agreement”), and (ii) a Registration Rights Agreement, dated as of September 21, 2016 (the “Registration

Rights Agreement”).

Voting and Standstill Agreement

Pursuant to the Voting and Standstill Agreement, until September 21, 2018 (the “Standstill Period”), Canon USA will

be bound by certain “standstill” provisions which generally will prevent it and certain affiliates (together, the “Standstill Parties”) from (i) purchasing outstanding shares of Common Stock or Common Stock equivalents in excess

of 19.9% of the outstanding shares of Common Stock, (ii) making, encouraging or supporting a third-party tender offer, (iii) calling a meeting of the Company’s stockholders, (iv) nominating for election to the Company’s board of directors

(the “Board”) a person whose nomination has not been approved by a majority of the Board, (v) soliciting proxies in opposition to the recommendation of the Board, (vi) depositing shares of Common Stock in a voting trust or subjecting any

such shares to any voting arrangement with third parties, (vii) otherwise acting or seeking to control the Board or the management or policies of the Company, (viii) assisting or working with a third party with respect to such actions or (ix)

publicly requesting or proposing in writing that the Company amend or waive any of these limitations.

Notwithstanding the

foregoing provisions of the Voting and Standstill Agreement, the Standstill Parties may (i) submit a nonpublic proposal related to a tender offer, exchange offer, merger, consolidation, acquisition, sale, business combination, recapitalization or

other extraordinary transaction involving the Company (an “Acquisition Proposal”) to the Company or the Board and (ii) following any third-party Acquisition Proposal that is publicly disclosed or announced, submit an alternate Acquisition

Proposal, including any requests for the Company to waive the standstill provisions of the Voting and Standstill Agreement, to the Company, Board or stockholders of the Company, or take any other action, whether or not otherwise prohibited by the

standstill provisions, in connection with such alternate Acquisition Proposal.

In addition, during the Standstill Period, subject to the terms and conditions of

the Voting and Standstill Agreement, the Company agreed to use commercially reasonable efforts to provide the Standstill Parties the opportunity to participate in private placements or registered public offerings of the Company’s equity

securities up to the lesser of (i) the Standstill Parties’ pro rata portion of the securities being offered and (ii) 19.9% of the outstanding shares of Common Stock after the closing of such offering.

Until March 21, 2018 (the “Lock-Up Period”), Canon USA has also agreed not to transfer or dispose of any shares of

Common Stock, except (i) to its controlled affiliates or to a parent holding company that become bound by the Voting and Standstill Agreement, or (ii) in a tender offer, merger, consolidation, recapitalization or similar transaction approved by a

majority of the Board. Following the expiration of the Lock-Up Period, for so long as the Standstill Parties beneficially own at least five million shares of Common Stock or such lesser number which then constitutes at least 10% of the outstanding

shares of Common Stock (the “Ownership Threshold”), Canon USA has agreed not to transfer or dispose of any shares of Common Stock, except (i) to the Company; (ii) to its controlled affiliates or to a parent holding company that become

bound by the Voting and Standstill Agreement; (iii) in a tender offer, merger, consolidation, recapitalization or similar transaction approved by a majority of the Board or other change of control transaction approved by the Board; (iv) pursuant to

a registered public offering in accordance with the Registration Rights Agreement; (v) pursuant to Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”); or (vi) pursuant to privately negotiated sales in transactions

exempt from the registration requirements of the Securities Act; provided, that Canon USA may not make any sales of Common Stock to a person or entity Canon USA knows is a competitor of the Company (other than to its controlled affiliates or to a

parent holding company that become bound by the Voting and Standstill Agreement).

For so long as the Standstill Parties

meet the Ownership Threshold, Canon USA has agreed generally to vote its shares in accordance with the recommendation of a majority of the Board except with respect to change of control transactions.

For so long as the Standstill Parties meet the Ownership Threshold, the Company has agreed to give Canon USA certain Board

designation rights and to initially appoint Seymour Liebman, Executive Vice President, Chief Administrative Officer and General Counsel of Canon USA, as a Class I director on the Board, and to nominate Mr. Liebman or another Canon USA designee for

election and reelection to such position, provided in each case that such Canon USA designee is reasonably acceptable to the nominating and governance committee of the Board. The Company has the right to terminate this Board nomination provision

upon the uncured material breach by Canon USA or its affiliates of the standstill provisions of the Voting and Standstill Agreement.

The rights and restrictions applicable to Canon USA under the Voting and Standstill Agreement are subject to termination upon

the mutual written agreement of the Company and Canon USA or the occurrence of a change of control of the Company.

Registration Rights Agreement

Pursuant to the Registration Rights Agreement, on or before March 21, 2017, the Company has agreed to prepare and file with

the Securities and Exchange Commission (the “Commission”) a registration statement on Form S-3 for purposes of registering the resale of Canon USA’s shares of Common Stock or, if the Company is not at such time eligible for the use of

Form S-3, on or before June 21, 2017, prepare and file a registration statement on Form S-1 or alternative form that permits the resale of Canon USA’s shares with the Commission. The Company has also agreed to use commercially reasonable

efforts to cause such registration statement to be declared effective by September 21, 2017, if the Company is eligible to use Form S-3, or by December 21, 2017, if the Company is not eligible to use Form S-3.

The Company has also agreed, among other things, to indemnify Canon USA, its controlling persons and their officers,

directors, partners, members, stockholders, employees and agents under the registration statement from certain liabilities and to pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and

selling commissions) incident to the Company’s obligations under the Registration Rights Agreement.

The foregoing

description of the terms of the Purchase Agreement, the Voting and Standstill Agreement and the Registration Rights Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the

Purchase Agreement, the Voting and Standstill Agreement and the Registration Rights Agreement, copies of which are filed as exhibits hereto and are incorporated herein by reference.

Canon USA intends to act in accordance with the terms of the Voting and Standstill Agreement and the Registration Rights

Agreement for as long as such agreements remain in effect. Subject to the foregoing, each Reporting Person expects to evaluate on an ongoing basis the Company’s financial condition and prospects and its interest in, and intentions with respect

to, the Company and their investment in the securities of the Company, which review may be based on various factors, including, without limitation, the Company’s business and financial condition, results of operations and prospects, general

economic and industry conditions, the price and availability of shares of the Company’s capital stock, the conditions of the securities markets in general and those for the Company’s securities in particular, as well as other developments

and other investment opportunities. Accordingly, subject to compliance with the terms of the Voting and Standstill Agreement, each Reporting Person reserves the right to change its intentions, as it deems appropriate. In particular, subject to

compliance with the terms of the Voting and Standstill Agreement, each Reporting Person may at any time and from time to time, in the open market, in privately negotiated transactions or otherwise, increase their investment in securities of the

Company or dispose of all or a portion of the securities of the Company that the Reporting Persons now own or may hereafter acquire, including, without limitation, sales pursuant to the exercise of the registration rights provided by the

Registration Rights Agreement described above. In addition, the Reporting Persons may engage in discussions with management and members of the Board regarding the Company, including, but not limited to, the Company’s business and financial

condition, results of operations and prospects. The Reporting Persons may take positions with respect to and seek to influence the Company regarding the matters discussed above. Such suggestions or positions may include one or more plans or

proposals that relate to or would result in any of the actions required to be reported herein. The Reporting Persons also reserve the right, subject to applicable law, to consider participating in a business combination transaction that would result

in an acquisition of all of the Company’s outstanding Common Stock. To the knowledge of each Reporting Person, each of the persons listed on Schedules I or II hereto may make similar evaluations from time to time or on an ongoing basis.

Other than as described above in this Item 4, none of the Reporting Persons nor,

to their knowledge, any person listed on Schedules I or II hereto, has any plans or proposals that relate to, or would result in, any actions or events specified in clauses (a) through (j) of Item 4 to Schedule 13D.

|

ITEM 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

(a) and (b)

(i) As of the date hereof, following the closing of the

Transaction, Canon USA beneficially owns 6,055,341 shares of Common Stock. Such shares represent 19.9% of the issued and outstanding shares of Common Stock of the Company as of September 21, 2016 immediately following the closing of the

Transaction (based on information set forth in the Purchase Agreement).

(ii) As of the date hereof, Canon, as the direct parent of Canon USA,

may be deemed to be the beneficial owner of 6,055,341 shares of Common Stock held by Canon USA. Such shares represent 19.9% of the issued and outstanding shares of Common Stock of the Company as of September 21, 2016 immediately following the

closing of the Transaction (based on information set forth in the Purchase Agreement).

(iii) To the knowledge of each Reporting Person, none of the persons listed on

Schedules I or II hereto beneficially owns any shares of Common Stock.

Each Reporting Person has shared power to vote or

direct the vote and to dispose or direct the disposition of shares of Common Stock beneficially owned by such Reporting Person as indicated herein.

(c) Other than as set forth in Item 4, no transactions were effected by the

Reporting Persons or, to the knowledge of the Reporting Persons, any of the persons listed on Schedules I or II hereto, during the 60 day period immediately preceding September 21, 2016.

(d) To the knowledge of each Reporting Person, no one other than the Reporting

Persons, has the right to receive, or the power to direct the receipt of, dividends from, or the proceeds from the sale of, any shares of Common Stock beneficially owned by the Reporting Persons.

(e) Not applicable.

|

ITEM 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO THE SECURITIES OF THE ISSUER

|

The information set forth in Items 3, 4 and 5 of this Schedule 13D is incorporated by reference into this Item 6.

Pursuant to the Voting and Standstill Agreement, effective as of the Closing Date, Seymour Liebman, Executive Vice President,

Chief Administrative Officer and General Counsel of Canon USA, was appointed to the Board as a Class I director. For his service as a director of the Company, Mr. Liebman will be entitled to the same cash and equity compensation as other

non-employee directors of the Company. Accordingly, in connection with his appointment to the Board, the Company granted to Mr. Liebman an option to purchase 66,176 shares of Common Stock at an exercise price per share of $6.50, which was the

closing price of the Common Stock on the NADAQ Global Market on the Closing Date. Such option will vest and become exercisable (subject to continued service to the Company as a director) in substantially equal installments on each of the first

three anniversaries of the grant date, provided that such option, to the extent outstanding, will become fully vested and exercisable immediately prior to the occurrence of a change in control.

Except as otherwise expressly described herein, no contracts, arrangements, understandings or similar relationships exist with

respect to the securities of the Company among any of the Reporting Persons and any person or entity.

|

ITEM 7.

|

MATERIAL TO BE FILED AS EXHIBITS

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

Exhibit 10.1

|

|

Stock Purchase Agreement, dated September 21, 2016, by and between the Company and Canon USA (incorporated herein by reference to Exhibit 10.1 to the Current Report on Form 8-K of the Company filed with the Commission on September

22, 2016).

|

|

|

|

|

Exhibit 10.2

|

|

Voting and Standstill Agreement, dated September 21, 2016, by and between the Company and Canon USA (incorporated herein by reference to Exhibit 10.2 to the Current Report on Form 8-K of the Company filed with the Commission on

September 22, 2016).

|

|

|

|

|

Exhibit 10.3

|

|

Registration Rights Agreement, dated September 21, 2016, by and between the Company and Canon USA (incorporated herein by reference to Exhibit 10.3 to the Current Report on Form 8-K of the Company filed with the Commission on

September 22, 2016).

|

|

|

|

|

Exhibit 99.1

|

|

Joint Filing Agreement, dated September 30, 2016.

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this

statement is true, complete and correct.

Dated: September

30, 2016

|

|

|

|

|

CANON U.S.A., INC.

|

|

|

|

|

By:

|

|

/s/ Seymour Liebman

|

|

|

|

Name: Seymour Liebman

|

|

|

|

Title: Executive Vice President, Chief Administrative Officer and General Counsel

|

|

|

|

CANON INC.

|

|

|

|

|

By:

|

|

/s/ Toshizo Tanaka

|

|

|

|

Name: Toshizo Tanaka

|

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

SCHEDULE I

INFORMATION CONCERNING CANON U.S.A., INC.’S EXECUTIVE OFFICERS AND DIRECTORS

The name of each executive officer and director of Canon U.S.A., Inc. is set forth below.

The business address of each person listed below is c/o Canon U.S.A., Inc., One Canon Park, Melville, New York 11747.

The present principal occupation or employment and the citizenship status of each of the listed persons is set forth below.

|

|

|

|

|

|

|

|

|

Name

|

|

Present Principal Occupation

|

|

|

|

Country of Citizenship

|

|

Yoroku Adachi

(Executive Officer and Director)

|

|

Chairman and Chief Executive Officer of Canon U.S.A., Inc.

|

|

|

|

Japan

|

|

Yuichi Ishizuka

(Executive Officer and Director)

|

|

President and Chief Operating Officer of Canon U.S.A., Inc.

|

|

|

|

Japan

|

|

Seymour Liebman

(Executive Officer)

|

|

Executive Vice President, Chief Administrative Officer and General Counsel of Canon

U.S.A., Inc.; Senior Managing Executive Officer of Canon Inc.

|

|

|

|

U.S.A.

|

|

Yoshinori Shimono

(Executive Officer)

|

|

Senior Vice President, Chief Financial Officer and Treasurer Finance and Accounting

of Canon U.S.A., Inc.

|

|

|

|

Japan

|

|

Toyo Kuwamura

(Executive Officer)

|

|

Executive Vice President and General Manager Business Imaging Solutions Group of

Canon U.S.A., Inc.

|

|

|

|

Japan

|

|

Fujio Mitarai

(Director)

|

|

Chairman and Chief Executive Officer of Canon Inc.

|

|

|

|

Japan

|

SCHEDULE II

INFORMATION CONCERNING CANON INC.’S EXECUTIVE OFFICERS AND DIRECTORS

The name of each executive officer and director of Canon Inc. is set forth below.

The business address of each person listed below is c/o Canon Inc., 30-2, Shimomaruko 3-chome, Ohta-ku, Tokyo 146-8501, Japan.

The present principal occupation or employment and the citizenship status of each of the listed persons is set forth below.

|

|

|

|

|

|

|

|

|

Name

|

|

Present Principal Occupation

|

|

|

|

Country of Citizenship

|

|

Fujio Mitarai

(Executive Officer and Director)

|

|

Chairman and Chief Executive Officer of Canon Inc.

|

|

|

|

Japan

|

|

Toshizo Tanaka

(Executive Officer and Director)

|

|

Executive Vice President and Chief Financial Officer of Canon Inc.

|

|

|

|

Japan

|

|

Masaya Maeda

(Executive Officer and Director)

|

|

President and Chief Operating Officer of Canon Inc.

|

|

|

|

Japan

|

|

Shigeyuki Matsumoto

(Executive Officer and Director)

|

|

Senior Managing Director and Chief Technology Officer of Canon Inc.

|

|

|

|

Japan

|

|

Yoroku Adachi

(Executive Officer)

|

|

Chairman and Chief Executive Officer of Canon U.S.A., Inc.

|

|

|

|

Japan

|

|

Yuichi Ishizuka

(Executive Officer)

|

|

President and Chief Operating Officer of Canon U.S.A., Inc.

|

|

|

|

Japan

|

|

Toshio Homma

(Executive Officer)

|

|

Chief Executive, Office Imaging Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Hideki Ozawa

(Executive Officer)

|

|

President and Chief Executive Officer of Canon (China) Co., Ltd.

|

|

|

|

Japan

|

|

Seymour Liebman

(Executive Officer)

|

|

Executive Vice President, Chief Administrative Officer and General Counsel of Canon

U.S.A., Inc.; Senior Managing Executive Officer of Canon Inc.

|

|

|

|

U.S.A.

|

|

Rokus van Iperen

(Executive Officer)

|

|

President of Canon Europa N.V. and Canon Europe Ltd.

|

|

|

|

The Netherlands

|

|

|

|

|

|

|

|

|

|

Yasuhiro Tani

(Executive

Officer)

|

|

Group Executive of Digital System Technology Development HQ of Canon Inc.

|

|

|

|

Japan

|

|

Kenichi Nagasawa

(Executive Officer)

|

|

Group Executive of Corporate Intellectual Property and Legal HQ of Canon

Inc.

|

|

|

|

Japan

|

|

Naoji Otsuka

(Executive Officer)

|

|

Chief Executive of Inkjet Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Masanori Yamada

(Executive Officer)

|

|

Group Executive of Network Visual Solution Business Promotion HQ of Canon

Inc.

|

|

|

|

Japan

|

|

Aitake Wakiya

(Executive Officer)

|

|

Group Executive of Finance & Accounting HQ of Canon Inc.

|

|

|

|

Japan

|

|

Akiyoshi Kimura

(Executive Officer)

|

|

Group Executive of Corporate Planning Development HQ of Canon Inc.

|

|

|

|

Japan

|

|

Eiji Osanai

(Executive Officer)

|

|

Group Executive of Production Engineering HQ of Canon Inc.

|

|

|

|

Japan

|

|

Masaaki Nakamura

(Executive Officer)

|

|

Group Executive of Facilities Management HQ of Canon Inc.

|

|

|

|

Japan

|

|

Hiroyuki Suematsu

(Executive Officer)

|

|

Group Executive of Quality Management HQ of Canon Inc.

|

|

|

|

Japan

|

|

Shigeyuki Uzawa

(Executive Officer)

|

|

Chief Executive of Optical Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Akio Noguchi

(Executive Officer)

|

|

Group Executive of Mixed Reality Solution Business Promotion HQ of Canon

Inc.

|

|

|

|

Japan

|

|

Ryuichi Ebinuma

(Executive Officer)

|

|

Deputy Group Executive of R&D HQ of Canon Inc.

|

|

|

|

Japan

|

|

Kazuto Ogawa

(Executive Officer)

|

|

Executive Vice President of Canon (China) Co., Ltd

|

|

|

|

Japan

|

|

Shunsuke Inoue

(Executive Officer)

|

|

Group Executive of Device Technology Development HQ of Canon Inc.

|

|

|

|

Japan

|

|

Takayuki Miyamoto

(Executive Officer)

|

|

Chief Executive of Peripheral Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Katsumi Iijima

(Executive Officer)

|

|

Group Executive of Information & Communication Systems HQ of Canon

Inc.

|

|

|

|

Japan

|

|

|

|

|

|

|

|

|

|

Soichi

Hiramatsu

(Executive Officer)

|

|

Group Executive of Procurement HQ of Canon Inc.

|

|

|

|

Japan

|

|

Kazuhiko Noguchi

(Executive Officer)

|

|

Group Executive of Public Affairs HQ of Canon Inc.

|

|

|

|

Japan

|

|

Masato Okada

(Executive Officer)

|

|

Deputy Chief Executive of Image Communication Products Operations of Canon

Inc.

|

|

|

|

Japan

|

|

Nobutoshi Mizusawa

(Executive Officer)

|

|

Deputy Group Executive of R&D HQ of Canon Inc.

|

|

|

|

Japan

|

|

Yoichi Iwabuchi

(Executive Officer)

|

|

Deputy Group Executive of Digital System Technology Development HQ of Canon

Inc.

|

|

|

|

Japan

|

|

Hiroaki Takeishi

(Executive Officer)

|

|

Deputy Chief Executive of Optical Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Takashi Takeya

(Executive Officer)

|

|

Senior General Manager of Global Logistics Management Center of Canon Inc.

|

|

|

|

Japan

|

|

Nobuyuki Tainaka

(Executive Officer)

|

|

Senior General Manager of Global Legal Administration Center of Canon Inc.

|

|

|

|

Japan

|

|

Takanobu Nakamasu

(Executive Officer)

|

|

Executive Vice President of Canon Europe Ltd.

|

|

|

|

Japan

|

|

Toshihiko Kusumoto

(Executive Officer)

|

|

Deputy Chief Executive of Office Imaging Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Akiko Tanaka

(Executive Officer)

|

|

President and Chief Executive Officer of Canon BioMedical, Inc.

|

|

|

|

Japan

|

|

Go Tokura

(Executive Officer)

|

|

Chief Executive of Image Communication Products Operations of Canon Inc.

|

|

|

|

Japan

|

|

Ritsuo Mashiko

(Executive Officer)

|

|

President of Oita Canon Inc.

|

|

|

|

Japan

|

|

Hisahiro Minokawa

(Executive Officer)

|

|

Senior General Manager of Human Resources Management and Organization Center of

Canon Inc.

|

|

|

|

Japan

|

|

Noriko Gunji

(Executive Officer)

|

|

President and Chief Executive Officer of Canon Singapore Pte Ltd.

|

|

|

|

Japan

|

|

Kunitaro Saida

(Director)

|

|

Attorney, Ginza Seiwa Law Office

|

|

|

|

Japan

|

|

|

|

|

|

|

|

|

|

Haruhiko Kato

(Director)

|

|

President & CEO of Japan Securities Depository Center, Incorporated

|

|

|

|

Japan

|

|

Makoto Araki

(Audit and Supervisory Board Member)

|

|

Audit and Supervisory Board Member of Canon Inc.

|

|

|

|

Japan

|

|

Kazuto Ono

(Audit and Supervisory Board Member)

|

|

Audit and Supervisory Board Member of Canon Inc.

|

|

|

|

Japan

|

|

Tadashi Ohe

(Audit and Supervisory Board Member)

|

|

Attorney

|

|

|

|

Japan

|

|

Osami Yoshida

(Audit and Supervisory Board Member)

|

|

Certified Public Accountant

|

|

|

|

Japan

|

|

Kuniyoshi Kitamura

(Audit and Supervisory Board Member)

|

|

Audit and Supervisory Board Member of Canon Inc.

|

|

|

|

Japan

|

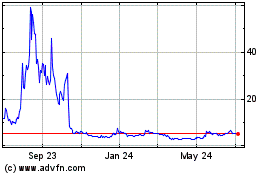

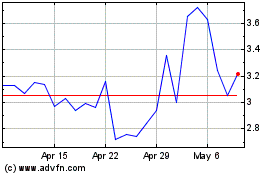

T2 Biosystems (NASDAQ:TTOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

T2 Biosystems (NASDAQ:TTOO)

Historical Stock Chart

From Apr 2023 to Apr 2024