First Trust Dynamic Europe Equity Income Fund Declares its Monthly Common Share Distribution of $0.121 Per Share for September

August 22 2016 - 4:54PM

Business Wire

First Trust Dynamic Europe Equity Income Fund (the “Fund”)

(NYSE: FDEU) has declared the Fund’s regularly scheduled monthly

common share distribution of $0.121 per share payable on September

15, 2016, to shareholders of record as of September 6, 2016. The

ex-dividend date is expected to be September 1, 2016. The monthly

distribution information for the Fund appears below.

First Trust Dynamic

Europe Equity Income Fund (FDEU):

Distribution per share: $0.121 Distribution Rate

based on the August 19, 2016 NAV of $18.15: 8.00% Distribution Rate

based on the August 19, 2016 closing market price of $16.35: 8.88%

The majority, and possibly all, of this distribution will be

paid out of net investment income earned by the Fund. A portion of

this distribution may come from net short-term realized capital

gains or return of capital. The final determination of the source

and tax status of all distributions paid in 2016 will be made after

the end of 2016.

The Fund is a non-diversified, closed-end management investment

company that seeks to provide a high level of current income. As a

secondary objective, the Fund seeks to focus on capital

appreciation. The Fund will seek to achieve its investment

objective by investing at least 80% of its Managed Assets in a

portfolio of equity securities of European companies of any market

capitalization, including, but not limited to, common and preferred

stocks that pay dividends, depositary receipts and real estate

investment trusts. The Fund will seek to focus its equity

investments on income-producing securities. The Fund will also seek

to utilize a dynamic currency hedging process, which will include,

at the discretion of the portfolio managers, the use of forward

foreign currency exchange contracts to hedge a portion of the

Fund’s currency exposure. To generate additional income, the Fund

will write (or sell) call options on portfolio equity securities

and certain broad-based securities indices in an amount up to 40%

of the value of its Managed Assets.

First Trust Advisors L.P., the Fund’s investment advisor, along

with its affiliate, First Trust Portfolios L.P., are privately-held

companies which provide a variety of investment services, including

asset management and financial advisory services, with collective

assets under management or supervision of approximately $99 billion

as of July 31, 2016 through unit investment trusts, exchange-traded

funds, closed-end funds, mutual funds and separate managed

accounts.

Henderson Global Investors (North America) Inc. (“Henderson”)

serves as the Fund’s investment sub-advisor. Henderson is an

indirect, wholly-owned subsidiary of Henderson Group plc

(“Henderson Group”), a London-based global investment management

firm that provides a full spectrum of investment products and

services to clients around the world. First Trust Advisors L.P. and

Henderson have engaged Henderson Investment Management Limited, a

registered investment adviser and an indirect, wholly-owned

subsidiary of Henderson Group, as the sub-sub-advisor responsible

for certain investment decisions of the Fund. With offices in 19

cities with more than 1,000 employees, Henderson Group managed

approximately $127 billion in assets as of June 30, 2016.

Past performance is no assurance of future results. Investment

return and market value of an investment in the Fund will

fluctuate. Shares, when sold, may be worth more or less than their

original cost.

Principal Risk Factors: The Fund is subject to risks, including

the fact that it is a non-diversified closed-end management

investment company.

Because the Fund will invest primarily in securities of non-U.S.

issuers, which are generally denominated in non-U.S. currencies,

there are risks not typically associated with investing in

securities of U.S. issuers. Non-U.S. issuers are subject to higher

volatility than securities of U.S. issuers. An investor may lose

money if the local currency of a non-U.S. market depreciates

against the U.S. dollar.

Investments in securities of issuers located in emerging market

countries are considered speculative and there is a heightened risk

of investing in emerging markets securities.

The Fund will engage in practices and strategies that will

result in exposure to fluctuations in foreign exchange rates, thus

subjecting it to foreign currency risk.

The Fund's use of derivatives may result in losses greater than

if they had not been used, may require the Fund to sell or purchase

portfolio securities at inopportune times, may limit the amount of

appreciation the Fund can realize on an investment, or may cause

the Fund to hold a security that it might otherwise sell.

Use of leverage can result in additional risk and cost, and can

magnify the effect of any losses.

The risks of investing in the Fund are spelled out in the

prospectus, shareholder reports and other regulatory filings.

The Fund’s daily closing New York Stock Exchange price and net

asset value per share as well as other information can be found at

www.ftportfolios.com or by calling 1-800-988-5891.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160822006046/en/

First Trust Dynamic Europe Equity Income FundPress Inquiries:

Jane Doyle, 630-765-8775Analyst Inquiries: Jeff Margolin,

630-915-6784Broker Inquiries: Jeff Margolin, 630-915-6784

First Trust Dynamic Euro... (NYSE:FDEU)

Historical Stock Chart

From Mar 2024 to Apr 2024

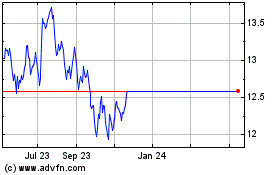

First Trust Dynamic Euro... (NYSE:FDEU)

Historical Stock Chart

From Apr 2023 to Apr 2024