By Ellie Ismailidou and Wallace Witkowski, MarketWatch

Weak data on retail sales, wholesale prices weigh on the

benchmarks

U.S. stocks retreat to session lows Friday, putting weekly gains

in jeopardy, as weakness in shares of mining and chemical

companies, along with a rise in active oil rigs, blunted an advance

in the energy sector and rising oil prices.

The slump kept all three main stock-market benchmarks, which all

hit all-time highs on the same day for the first time since 1999

(http://www.marketwatch.com/story/slumping-oil-prices-look-set-to-keep-lid-on-us-stock-rally-2016-08-11)

on Thursday, below their record levels.

The S&P 500 index was down 5 points, or 0.2%, at 2,181,

weighed by 3% declines in Alcoa Inc.(AA) and Nucor Corp.(NUE), and

Dow Chemical Co.(DOW), followed by a 0.4% loss in the financials

sector. Three of the index's 10 sectors were in positive territory,

with energy leading the gains, up 0.5%. Earlier, the index dropped

as low as 2,179.30.

The Dow Jones Industrial Average slipped 65 points, or 0.3%, to

18,549, pulled down by a 2.1% drop in DuPont (DD) and a 1% drop in

Microsoft Corp.(MSFT) but buoyed by a 1.4% gain in Exxon Mobil

Corp.(XOM)The Dow industrials had earlier touched a session low of

18,535.86.

Meanwhile the Nasdaq Composite Index was off 7 points, or 0.1%,

at 5,221, after being down by as many as 13 points earlier.

Stocks had dipped to fresh lows on the session following a climb

in oil rigs for a seventh week in a row

(http://www.marketwatch.com/story/oil-futures-pare-gains-after-data-show-7th-straight-weekly-rise-in-the-us-oil-rig-count-2016-08-12),

taking some steam out of energy gains. Oil futures rose 1.6%

following choppy action earlier, as officials from Saudi Arabia

sparked fresh hopes for a collective production freeze

(http://www.marketwatch.com/story/oil-prices-extend-gains-after-saudi-hints-over-freeze-pact-2016-08-12).

Crude is on track for a weekly gain of over 5%.

Meanwhile, investors grappled with weaker-than-expected retail

sales data and an unexpected drop in wholesale prices.

U.S. retail sales stalled in July after three straight monthly

gains, according to government data released Friday.

(http://www.marketwatch.com/story/retail-sales-stall-in-july-2016-08-12)Retail

sales, which have increased 2.3% over the past 12 months, are an

important part of consumer spending, which is the backbone of the

U.S. economy.

Meanwhile, U.S. wholesale prices fell 0.4% in July, the biggest

drop since September 2015, according to a government report

released Friday

(http://www.marketwatch.com/story/us-wholesale-prices-fall-sharply-in-july-2016-08-12).

(http://www.marketwatch.com/story/us-wholesale-prices-fall-sharply-in-july-2016-08-12)

June business inventories

(http://www.marketwatch.com/story/us-june-business-inventories-rise-02-2016-08-12-10103229)

came in as expected, rising 0.2%, and the Producer Price Index was

down 0.4% after jumping 0.5% in June, while over the past year

overall producer prices are down 0.2% in unadjusted terms.

On the bright side, consumer sentiment ticked up

(http://www.marketwatch.com/story/consumer-sentiment-ticks-up-in-august-despite-higher-expenses-lower-wage-gains-2016-08-12)

in early August as better views of the economy offset declines in

views about personal finances.

While stocks turned negative after the release, gold gained, the

dollar slumped and Treasury yields plunged to their second-lowest

level in history. The weak data are likely to firm the view for

some market participants that the economy isn't strong enough to

tolerate a rate increase in September, or later in 2016.

"Based on the PPI and retail-sales figures, all indications now

look like a [Federal Reserve] rate increase in 2016 is clearly off

the table," said Tom di Galoma managing director at Seaport Global

Holdings, in an email shortly after the release.

Sector performance also reflected the market's expectation of

interest rates being "lower for longer," said Diane Jaffee, senior

portfolio manager at TCW. Investors betting the Fed will remain on

hold, pile into bond-like equities, most notably utility stocks,

Jaffee said.

But at the same time, the strong gains in energy shares tells a

different story, one of a potentially stronger risk appetite and

further gains for the broader market, she said.

Among individual retailers, J.C. Penney Co. Inc.'s (JCP) shares

gained 3.8% after the retailer reported narrower-than-expected

second-quarter losses, though sales were just below estimates

(http://www.marketwatch.com/story/jc-penney-shares-fall-despite-smaller-second-quarter-losses-2016-08-12).

Meanwhile, Nordstrom Inc.(JWN) shares jumped 7.7% after posting

better-than-expected sales and raised profit projections for the

year

(http://www.marketwatch.com/story/nordstrom-profit-tops-view-as-revenue-declines-2016-08-11).

Friday's moves came after on Thursday retailers like Macy's

Inc.(M) and Kohl's Corp.(KSS) all posted better-than-expected

quarterly earnings,

(http://www.marketwatch.com/story/nordstroms-stock-soars-amid-hopes-for-upbeat-results-for-a-change-2016-08-11)

(http://www.marketwatch.com/story/nordstroms-stock-soars-amid-hopes-for-upbeat-results-for-a-change-2016-08-11)helping

the broader market jump to all-time highs. Macy's was down 1.1% on

Friday, after closing 17% higher on Thursday, while Kohl's on

Friday added 1% to Thursday's 16% gain.

See:3 reasons this U.S. stock-market rally won't stop

(http://www.marketwatch.com/story/this-time-its-different-3-reasons-the-us-stock-rally-wont-stop-2016-08-12)

Other markets: Asian markets closed higher, with some credit

going to the upbeat U.S. action on Thursday. But European stocks

were roughly flat

(http://www.marketwatch.com/story/european-stocks-battle-for-the-black-and-another-win-2016-08-12),

though still on track for sizable weekly gains.

Other individual movers: Beyond the retailers, Nvidia Corp.

shares (NVDA) rose 3.9% after the maker of graphics chips late

Thursday posted better-than-expected earnings

(http://www.marketwatch.com/story/nvidia-rises-to-record-highs-before-and-after-earnings-report-2016-08-11).

Silicon Graphics International Corp.(SGI) jumped 29% following

news late Thursday that Hewlett Packard Enterprise Co.(HPE) plans

to pay $275 million

(http://www.marketwatch.com/story/hewlett-packard-enterprise-buying-silicon-graphics-for-275-million-2016-08-11)

for the maker of server, storage and software products.

--Victor Reklaitis in London contributed to this article.

(END) Dow Jones Newswires

August 12, 2016 13:36 ET (17:36 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

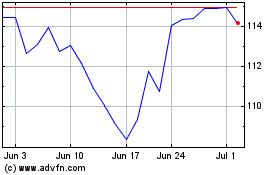

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

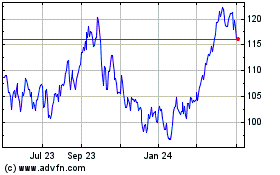

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024