Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-208506

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF

PROSPECTUS DATED JANUARY 11, 2016

|

New Issue

|

August 11, 2016

|

B2GOLD CORP.

Up to US$100,000,000

Common Shares

This Prospectus Supplement, together with the accompanying

short form base shelf prospectus dated January 11, 2016 (the

“

Prospectus

”), qualifies the distribution (the “

Offering

”) of

common shares (each, an “

Offered Share’’

) of B2Gold Corp.

(“

B2Gold

” or the “

Company

”) having an aggregate offering price of

up to US$100,000,000. B2Gold has entered into an equity distribution agreement

dated August 11, 2016 (the “

Distribution Agreement

”) with Canaccord

Genuity Corp., Canaccord Genuity Inc., HSBC Securities (Canada) Inc. and HSBC

Securities (USA) Inc. (collectively, the “

Agents

”) pursuant to which

B2Gold may distribute Offered Shares from time to time through the Agents, as

agents, for the distribution of the Offered Shares, in accordance with the terms

of the Distribution Agreement. See “Plan of Distribution”.

The outstanding common shares of the Company (“

Common

Shares

”) are listed for trading on the Toronto Stock Exchange (the

“

TSX

”) under the symbol “BTO” and on the NYSE MKT LLC (the “

NYSE

MKT

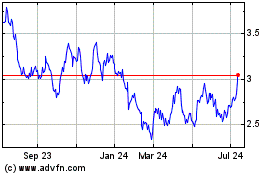

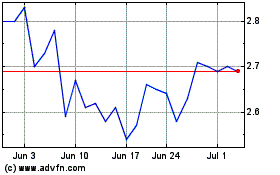

”) under the symbol “BTG”. On August 10, 2016, the last trading day before

the filing of this Prospectus Supplement, the closing trading price of the

Common Shares on the TSX was C$4.64 per Common Share and the closing trading price

of the Common Shares on the NYSE MKT was US$3.55 per Common Share. The TSX has

conditionally approved the listing of the Offered Shares offered hereunder,

subject to the Company fulfilling all of the listing requirements of the TSX.

The NYSE MKT has approved the listing of the Offered Shares offered hereunder.

Sales of Offered Shares, if any, under this Prospectus

Supplement and the accompanying Prospectus are anticipated to be made in

transactions that are deemed to be “at-the-market distributions” as defined in

National Instrument 44-102 -

Shelf Distributions

(“

NI 44-102

”),

including sales made directly on the TSX and the NYSE MKT or on any other existing

trading market for the Common Shares in Canada or the United States. The Offered Shares will be

distributed at the market prices prevailing at the time of the sale or at prices

to be negotiated with purchasers. As a result, prices may vary as between

purchasers and during the period of distribution.

There is no minimum amount

of funds that must be raised under the Offering. This means that the Offering

may terminate after only raising a small portion of the offering amount set out

above, or none at all.

See “Plan of Distribution”.

B2Gold will pay the Agents compensation for their services in

acting as agents in connection with the sale of Offered Shares pursuant to the

terms of the Distribution Agreement equal to 2% of the gross sale price per

Offered Share sold (the “

Commission

”). The Commission shall be divided

equally between the Agents regardless of which Agent effects the sale.

As sales agents, the Agents will not engage in any transactions

to stabilize the price of the Common Shares. No underwriter or dealer involved

in the distribution, no affiliate of such an underwriter or dealer and no person

or company acting jointly or in concert with such an underwriter or dealer has

over-allotted, or will over-allot, securities in connection with the

distribution or effected, or will effect, any other transactions that are

intended to stabilize or maintain the market price of the securities.

The purchase and ownership of Offered Shares is subject to

certain risks that should be considered carefully by prospective purchasers.

Please see “Risk Factors” in this Prospectus Supplement and the accompanying

Prospectus and the risk factors in the AIF (as herein defined) and other

documents incorporated herein and therein by reference, for a description of

risks involved in an investment in Offered Shares.

The Offering is made by a Canadian issuer that is permitted

under a multi-jurisdictional disclosure system adopted by the United States to

prepare this Prospectus Supplement in accordance with Canadian disclosure

requirements. Prospective investors should be aware that such requirements are

different from those applicable to issuers in the United States. Financial

statements incorporated herein by reference have been prepared in accordance

with International Financial Reporting Standards, as issued by the International

Accounting Standards Board (“IFRS”), and thus may not be comparable to financial

statements of United States companies.

Prospective investors should be aware that the acquisition,

holding or disposition of the Offered Shares may have tax consequences,

including the Canadian federal income tax consequences applicable to a foreign

controlled corporation that acquires Common Shares. Such consequences for

investors who are resident in, or citizens of, the United States or who are

resident in Canada may not be described fully herein. Prospective investors

should read the tax discussion contained in this Prospectus Supplement under the

heading “Certain Canadian Federal Income Tax Considerations” and “Certain United

States Federal Income Tax Considerations” and should consult their own tax

advisor with respect to their own particular circumstances.

The enforcement by investors of civil liabilities under the

U.S. federal securities laws may be affected adversely by the fact that the

Company is incorporated under the laws of the province of British Columbia, that

the majority of the Company’s officers and directors and some or all of the

experts named in this Prospectus Supplement and the accompanying Prospectus are

residents of a country other than the United States, and that a substantial

portion of the Company’s assets and the assets of said persons are located

outside the United States.

NEITHER THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION

(THE “SEC”) NOR ANY STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF

THE SECURITIES OFFERED HEREBY OR DETERMINED IF THIS PROSPECTUS SUPPLEMENT OR THE

ACCOMPANYING PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENCE.

HSBC Securities (Canada) Inc. and HSBC Securities (USA) Inc.

are affiliates of HSBC Bank USA, National Association, which acts as

administrative agent and a lender under the $350 million senior secured credit

facility entered into as of May 20, 2015, as amended from time to time (the

“Credit Facility”), of the Company and HSBC Securities (USA) Inc. acts as sole

lead arranger and sole bookrunner under the Credit Facility. Consequently, the

Company may be considered a “connected issuer” to HSBC Securities (Canada) Inc.

and HSBC Securities (USA) Inc. under applicable Canadian securities legislation.

In addition, the Company’s use of proceeds under the Offering may be deemed a

conflict of interest within the meaning of Rule 5121 of the Financial Industry

Regulatory Authority, Inc. (“FINRA”). See “Relationship Between the Company and Certain Agents

(Conflicts of Interest)” for further information.

Mr. George Johnson is a director of the Company and resides

outside of Canada. Mr. Johnson has appointed B2Gold Corp., Suite 3100, Three

Bentall Centre, 595 Burrard Street, Vancouver, British Columbia, Canada V7X 1J1,

as his agent for service of process in Canada. Prospective investors are advised

that it may not be possible for investors to enforce judgments obtained in

Canada against Mr. Johnson, even though he has appointed an agent for service of

process.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

________________________________

IMPORTANT NOTICE ABOUT INFORMATION IN THIS PROSPECTUS

SUPPLEMENT

AND THE ACCOMPANYING PROSPECTUS

This document is in two parts.

The first part is this Prospectus Supplement, which describes the specific terms

of the Offering and also adds to and updates information contained in the

accompanying Prospectus and the documents incorporated by reference herein and

therein. The second part is the accompanying Prospectus, which provides more

general information, some of which may not apply to the Offered Shares. If the

description of the Common Shares varies between this Prospectus Supplement and

the accompanying Prospectus, investors should rely on the information in this

Prospectus Supplement. Before you invest, you should carefully read this

Prospectus Supplement, the accompanying Prospectus, all information incorporated

by reference herein and therein, as well as the additional information described

under “Where You Can Find Additional Information” in this Prospectus Supplement.

These documents contain information you should consider when making your

investment decision. This Prospectus Supplement may add, update or change

information contained in the accompanying Prospectus or any of the documents

incorporated by reference herein ot therein. To the extent that any statement

made in this Prospectus Supplement is inconsistent with statements made in the

accompanying Prospectus or any documents incorporated by reference herein or

therein filed prior to the date of this Prospectus Supplement, the statements

made in this Prospectus Supplement will be deemed to modify or supersede those

made in the accompanying Prospectus and such documents incorporated by reference

herein or therein.

You should rely only on the

information contained or incorporated by reference in this Prospectus Supplement

and the accompanying Prospectus and on other information included in the

registration statement of which this Prospectus Supplement and the Prospectus

form a part. We have not, and the Agents have not, authorized any other person

to provide you with different information. If anyone provides you with different

or inconsistent information, you should not rely on it. The Company is offering

to sell, and seeking offers to buy, Offered Shares only in jurisdictions where

offers and sales are permitted. The distribution of this Prospectus Supplement

and the Offering in certain jurisdictions may be restricted by law. You should

assume that the information contained in this Prospectus Supplement and the

accompanying Prospectus, as well as information previously filed with the SEC

and with the securities regulatory authority in each of the provinces of Canada,

that is incorporated by reference herein and in the accompanying Prospectus, is

accurate only as of its respective date. The Company’s business, financial

condition, results of operations and prospects may have changed since those

dates.

This Prospectus Supplement does

not constitute, and may not be used in connection with, an offer to sell, or a

solicitation of an offer to buy, any securities offered by this Prospectus

Supplement by any person in any jurisdiction in which it is unlawful for such

person to make such an offer or solicitation.

This Prospectus Supplement is

deemed to be incorporated by reference into the Prospectus solely for the

purposes of the Offering. Other documents are also incorporated or deemed to be

incorporated by reference into this Prospectus Supplement and into the

Prospectus. See “Documents Incorporated by Reference”.

Unless the context otherwise

requires, references in this Prospectus Supplement and the accompanying

Prospectus to “B2Gold”, the “Company”, “we”, “us” and “our” refer to B2Gold

Corp. and include each of its subsidiaries as the context requires.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the

context otherwise requires, all references to dollar amounts in this Prospectus

Supplement and the accompanying Prospectus are references to United States

dollars. Unless stated otherwise, references to “C$” are to Canadian dollars and

references to “$”, “US dollars” or “US$” are to United States dollars.

Except as otherwise noted, the

financial information contained in the AIF (as defined herein) and the Company’s

financial statements and related management’s discussion and analysis of

financial position and results of operations that are incorporated by reference

into this Prospectus Supplement (see “Documents Incorporated by Reference”) are

expressed in United States dollars.

S-4

The high, low, average and

closing noon rates for the United States dollar in terms of Canadian dollars for

each of the six-month periods of the Company ended, June 30, 2016 and June 30,

2015 and the years ended December 31, 2015, December 31, 2014 and December 31,

2013, as quoted by the Bank of Canada, were as follows:

|

|

Six months ended

|

Year

ended

|

|

|

June 30,

|

December 31,

|

|

|

2015

|

2016

|

2013

|

2014

|

2015

|

|

Noon rate at the end of

period

|

C$1.2474

|

C$1.3009

|

C$1.0636

|

C$1.1601

|

C$1.3840

|

|

Average rate during period

|

C$1.2354

|

C$1.3302

|

C$1.0299

|

C$1.1045

|

C$1.2787

|

|

Highest rate during period

|

C$1.2803

|

C$1.4589

|

C$1.0697

|

C$1.1643

|

C$1.3990

|

|

Lowest rate during period

|

C$1.1728

|

C$1.2544

|

C$0.9839

|

C$1.0614

|

C$1.1728

|

On August 10, 2016, the noon

exchange rate for the United States dollar in terms of Canadian dollars, as

quoted by the Bank of Canada, was US$1.00=C$1.3060.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus Supplement and

the accompanying Prospectus, and the documents incorporated by reference herein

and therein, contain “forward-looking information” within the meaning of

applicable Canadian securities legislation and “forward-looking statements”

within the meaning of applicable U.S. securities legislation, including the number of Offered Shares sold, the price for the Offered Shares and the aggregate proceeds under the Offering, the participation of insiders in the Offering, the Company’s belief that it will not be a PFIC (as defined herein) for the current tax year or for the foreseeable future, projections of future financial and operational performance; statements with

respect to future events or future performance; production estimates;

anticipated operating and production costs and revenue; budgets; estimates of

capital expenditures; future demand for and prices of commodities and

currencies; and statements regarding anticipated exploration, development,

construction, production, permitting and other activities on the Company’s

properties, including finalizing the discussions regarding an establishment

convention and the structuring and ownership of the exploitation company that

will hold the Fekola Project with the Government of Mali; the construction of,

and the potential development and potential production from, the Fekola Project;

the Fekola Project being fully funded, on budget and on schedule to commence gold

production in late 2017; the potential to increase throughput and production at Fekola and the capital expenditures related thereto; satisfaction of conditions precedent, including the

completion and terms of definitive documentation, and completion and funding

under the equipment facility for the Fekola Project; the impact of the new

Burkinabe Mining Code on the Kiaka Project; the projections included in existing

technical reports, economic assessments, feasibility studies, including the

Fekola Feasibility Study (as defined herein), and geological models and the

completion of new studies, including updated life of mine plans, the potential to undertake an engineering study and an updated Kiaka Project feasibility study; statements

regarding planned upgrades and increases to throughput capacity at our mines;

the potential for expansion of mineral resources and mineral reserves or

conversion of mineral resources and mineral reserves from one category to

another; the potential for expansion of production capacity, including the cost

reduction and continued ramp up, improvements and expansion of gold production

at the Otjikoto Mine and development of the adjacent Wolfshag zone; the upgrade

of the Masbate plant; expansion options for the Masbate Gold Project and the mill feed at Masbate in the second half of 2016 containing a higher percentage of higher grade ore;

the impact of new mining legislation in the Philippines and the outcome of the

audit at Masbate; the

completion of permitting and resettlement activities in respect of the Jabali

Antenna Pit; production shortfalls as a result of delays in accessing ore at Jabali being fully offset; production from the Jabali Antenna Pit and increased production at

La Libertad Mine; projected capital investments and exploration; the adequacy of

capital, financing needs and the potential availability of and potential for

receiving further commitments under the Credit Facility; the delivery of ounces under prepaid sales arrangements; the potential

availability of flexible financing arrangements; the potential value of

acquisitions; the planned exploration at Fekola and Kiaka and the results thereof, the potential identification of new mineralization or discoveries there and the effect of adding mineralization from the Toega prospect on the economics of the Kiaka project; and estimates regarding the outcome of tax audits. Forward-looking information is necessarily based on estimates and

assumptions that are inherently subject to known and unknown risks,

uncertainties and other factors, many of which are beyond our ability to

control, that may cause our actual results, level of activity, performance or

achievements to be materially different from those expressed or implied by such

forward-looking information. Such factors include, without limitation, gold and

other metal price volatility; risks of not achieving production, cost or other

estimates; risks and uncertainties associated with mineral exploration and

development; discrepancies between actual and estimated mineral reserves and

mineral resources and metallurgical recoveries; various political, economic and

other risks associated with conducting operations in several different

countries; fluctuations in the price and availability of infrastructure and

energy and other commodities; inherent hazards and risks associated with mining

operations, including accidents; risks associated with hedging activities and

ore purchase commitments; risks of obtaining and maintaining necessary licenses,

permits and approvals from various governmental authorities; risks related to

compliance with environmental regulations and environmental hazards; risks

related to compliance with stringent laws and regulations and the effect of

changes in law and regulatory environment; risks associated with joint ventures;

risks associated with our minority shareholdings in the entity that owns the

Masbate Gold Project; our ability to continually obtain additional mineral

reserves for production of gold; the inability to identify appropriate

acquisition targets or complete desirable acquisitions or the failure to

integrate businesses and assets that we have acquired or may acquire in the

future; risks associated with our use of information publicly disclosed by the

former owners of our mines and property interests; fluctuations in foreign

currency exchange rates; our ability to obtain additional financing; uncertainty

relating to the outcome of our discussions with the Government of Mali;

political, economic and other uncertainties in certain jurisdictions where we

have property inte rests and conduct exploration and development activities; our

ability to successfully establish mining operations or the actual cost and

timing to establish mining operations at the Fekola Project; actual production,

development plans and costs of the Fekola Project may differ from estimates;

risks associated with our property interests and exploration activities in

developing countries; inability to comply with Philippines regulations or

political and legal developments in the Philippines related

to ownership of natural resources and operation, management and control of our

business; labour disputes; risks related to community relations and community

action; reliance on outside contractors to conduct certain mining and

exploration activities; adverse weather and climate issues; disruptions arising from conflicts with small scale

miners in certain countries; defective title to mineral claims, surface rights

or property or challenges over mineral rights relating to our properties; loss

of key personnel and our inability to attract and retain qualified personnel;

risks associated with our Common Shares; failures of information systems or

information security threats; potential losses, liabilities and damages related

to our business which are uninsured or uninsurable; competition with other

mining companies; risks associated with litigation; volatility of global

financial conditions; taxation, including changes in tax laws and interpretation

of tax laws; difficulty in achieving and maintaining the adequacy of internal

control over financial reporting as required by the SOX (as defined herein);

risks related to Aboriginal and local community title claims and related

consultation rights; and inability to comply with anti-corruption laws and

regulations, as well as other risks, uncertainties and other factors, including,

without limitation, those referred to under the heading “Risk Factors” in the

AIF (as defined herein), this Prospectus Supplement, the Prospectus and the

documents incorporated by reference herein and therein. Forward-looking

statements are not a guarantee of future performance, and actual results and

future events could materially differ from those anticipated in such statements.

All of the forward-looking statements contained in this Prospectus Supplement,

the Prospectus and the documents incorporated by reference herein and therein

are qualified by these cautionary statements. Although we have attempted to

identify important factors that could cause actual results to differ materially

from those contained in the forward-looking statements, there may be other

factors that cause actual results to differ materially from those which are

anticipated, estimated, or intended. There can be no assurance that such

information will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. You should not

place undue reliance on forward-looking statements. Our forward-looking

statements reflect current expectations regarding future events and operating

performance and speak only as of the date hereof and we expressly disclaim any

intention or obligation to update or revise any forward-looking statements,

whether as a result of new information, events or otherwise, except as may be

required by applicable securities laws.

S-5

CAUTIONARY NOTE TO UNITED STATES

INVESTORS

CONCERNING MINERAL RESERVE AND RESOURCE ESTIMATES

We are permitted under a

multi-jurisdictional disclosure system adopted by the securities regulatory

authorities in Canada and the United States to prepare this Prospectus

Supplement and the accompanying Prospectus, including the documents incorporated

by reference, in accordance with the requirements of Canadian securities laws,

which differ from the requirements of United States securities laws. All mineral

resource and reserve estimates included in this Prospectus Supplement and the

accompanying Prospectus, including the documents incorporated by reference, have

been prepared in accordance with National Instrument 43-101

Standards of

Disclosure for Mineral Projects

(“

NI 43-101

”). NI 43-101 is a rule

developed by the Canadian Securities Administrators that establishes standards

for all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. These standards differ significantly

from the mineral reserve disclosure requirements of the SEC set out in Industry

Guide 7. Consequently, mineral reserve and mineral resource information included

and incorporated by reference in this Prospectus Supplement and the accompanying

Prospectus is not comparable to similar information that would generally be

disclosed by U.S. companies in accordance with the rules of the SEC.

In particular, the SEC’s Industry

Guide 7 applies different standards in order to classify mineralization as a

reserve. As a result, the definitions of proven and probable mineral reserves

used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC

standards, mineralization may not be classified as a “reserve” unless the

determination has been made that the mineralization could be economically and

legally produced or extracted at the time the reserve determination is made.

Among other things, all necessary permits would be required to be in hand or

issuance imminent in order to classify mineralized material as reserves under

the SEC standards. Accordingly, mineral reserve estimates included and

incorporated by reference in this Prospectus Supplement and the accompanying

Prospectus may not qualify as “reserves” under SEC standards.

In addition, the information

included and incorporated by reference in this Prospectus Supplement and the

accompanying Prospectus uses the terms “mineral resources”, “measured mineral

resources”, “indicated mineral resources” and “inferred mineral resources” to

comply with the reporting standards in Canada. The SEC’s Industry Guide 7 does

not currently recognize mineral resources and U.S. companies are generally not

permitted to disclose mineral resources in documents they file with the SEC.

Investors are specifically cautioned not to assume that any part or all of the

mineral deposits in these categories will ever be converted into SEC defined

mineral reserves. Further, “inferred mineral resources” have a great amount of

uncertainty as to their existence and as to whether they can be mined legally or

economically. Therefore, investors are also cautioned not to assume that all or

any part of an inferred mineral resource exists. In accordance with Canadian

rules, estimates of “inferred mineral resources” cannot form the basis of

feasibility studies or, except in limited circumstances, other economic studies.

It cannot be assumed that all or any part of “indicated mineral resources” or

“inferred mineral resources” will ever be upgraded to a higher category or that

such mineral resources or any “measured mineral resources” will be classified as

mineral reserves. Investors are cautioned not to assume that any part of the

reported “measured mineral resources”, “indicated mineral resources” or

“inferred mineral resources” included and incorporated by reference in this

Prospectus Supplement and the accompanying Prospectus is economically or legally

mineable. Disclosure of “contained ounces” in a resource is permitted under NI

43-101; however, the SEC normally only permits issuers to report mineralization

that does not constitute “reserves” by SEC standards as in-place tonnage and

grade without reference to unit measures. In addition, the documents

incorporated by reference in this Prospectus Supplement and the accompanying

Prospectus include information regarding adjacent or nearby properties on which we have no right to

mine. The SEC does not normally allow U.S. companies to include such information

in their filings with the SEC. For the above reasons, information included and

incorporated by reference in this Prospectus Supplement and the accompanying

Prospectus that describes our mineral reserve and resource estimates or that

describes the results of pre-feasibility or other studies is not comparable to

similar information made public by U.S. companies subject to the reporting and

disclosure requirements of the SEC.

S-6

DOCUMENTS INCORPORATED BY REFERENCE

The following documents of the

Company, filed with the securities regulatory authorities in the jurisdictions

in Canada in which the Company is a reporting issuer and filed with, or

furnished to, the SEC, are specifically incorporated by reference into, and form

an integral part of, this Prospectus Supplement:

|

|

(a)

|

annual information form, dated March 29, 2016, for the

year ended December 31, 2015 (the “

AIF

”);

|

|

|

|

|

|

|

(b)

|

audited consolidated financial statements for the years

ended December 31, 2015 and 2014, together with the notes thereto and the

auditors’ report thereon;

|

|

|

|

|

|

|

(c)

|

management’s discussion and analysis of the financial

position and results of operations for the year ended December 31,

2015;

|

|

|

|

|

|

|

(d)

|

management information circular, dated May 4, 2016,

prepared in connection with our annual general meeting of shareholders

held on June 10, 2016;

|

|

|

|

|

|

|

(e)

|

unaudited condensed interim consolidated financial

statements for the three and six months ended June 30, 2016, together with

the notes thereto; and

|

|

|

|

|

|

|

(f)

|

management’s discussion and analysis of the financial

position and results of operations for the quarter ended June 30,

2016.

|

All documents of the type

referred to in section 11.1 of Form 44-101F1 of National Instrument 44-101 —

Short Form Prospectus Distributions

filed by the Company with the

securities commissions or similar regulatory authorities in the applicable

provinces of Canada after the date of this Prospectus Supplement, and before the

termination of the distribution, are also deemed to be incorporated by reference

into this Prospectus Supplement and the accompanying Prospectus.

In addition, to the extent that

any document or information incorporated by reference into this Prospectus

Supplement is included in any report on Form 6-K, Form 40-F, Form 20-F, Form

10-K, Form 10-Q or Form 8-K (or any respective successor form) that is filed

with or furnished to the SEC after the date of this Prospectus Supplement and

prior to the date that all Offered Shares offered hereunder are sold or the

Offering is otherwise terminated, such document or information shall be deemed

to be incorporated by reference as an exhibit to the registration statement of

which this Prospectus Supplement forms a part (in the case of documents or

information deemed furnished on Form 6-K or Form 8-K, only to the extent

specifically stated therein).

Any statement contained in this

Prospectus Supplement or in the accompanying Prospectus or in a document

incorporated or deemed to be incorporated by reference herein or therein shall

be deemed to be modified or superseded by this Prospectus Supplement to the

extent that a statement contained herein or in any other subsequently filed

document which also is or is deemed to be incorporated by reference herein

modifies or supersedes such statement. The modifying or superseding statement

need not state that it has modified or superseded a prior statement or include

any other information set forth in the document it modifies or supersedes. The

making of a modifying or superseding statement shall not be deemed an admission

for any purposes that the modified or superseded statement, when made,

constituted a misrepresentation, an untrue statement of a material fact or an

omission to state a material fact that is required to be stated or that is

necessary to make a statement not misleading in light of the circumstances in

which it was made. Any statement so modified or superseded shall not constitute

a part of this Prospectus Supplement or the accompanying Prospectus, except as

so modified or superseded.

Copies of the documents

incorporated herein by reference may be obtained on request without charge from

the Corporate Secretary of B2Gold at Suite 3100, Three Bentall Centre, 595

Burrard Street, Vancouver, British Columbia V7X 1J1, telephone: (604) 681-8371,

and are also available electronically on SEDAR at

www.sedar.com

and on

EGDAR at

www.sec.gov

.

S-7

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

certain information about the Company, the Offering and selected information

contained elsewhere in or incorporated by reference into this Prospectus

Supplement or the accompanying Prospectus. This summary is not complete and does

not contain all of the information that you should consider before deciding

whether to invest in the Offered Shares. For a more complete understanding of

the Company and the Offering, we encourage you to read and consider carefully

the more detailed information in this Prospectus Supplement and the accompanying

Prospectus, including the information incorporated by reference in this

Prospectus Supplement and the accompanying Prospectus, and in particular, the

information under the heading “Risk Factors” in this Prospectus Supplement and

the documents incorporated by reference into this Prospectus Supplement and the

accompanying Prospectus. All capitalized terms used in this summary refer to

definitions contained elsewhere in this Prospectus Supplement or the

accompanying Prospectus, as applicable.

Overview

We are a Vancouver-based gold

producer with four operating mines (the La Libertad mine (the “

La Libertad

Mine

”) and the Limon mine (the “

Limon Mine

”) in Nicaragua, the

Masbate mine (the “

Masbate Gold Project

”) in the Philippines and the

Otjikoto mine (the “

Otjikoto Mine

”) in Namibia) and the Fekola mine under

construction in Mali (the “

Fekola Project

”). In addition, the Company has

a portfolio of exploration and/or development projects in Mali, Colombia,

Burkina Faso, Nicaragua, Finland and Namibia.

More detailed information

regarding our business, operations, assets and properties can be found in the

AIF and other documents which are incorporated herein by reference. See

“Documents Incorporated by Reference”.

THE OFFERING

|

Offered Shares

|

Offered Shares having an aggregate offering price of up

to US$100,000,000.

|

|

|

|

|

Manner of offering

|

Sales of Offered Shares, if any, under this Prospectus

Supplement and the accompanying Prospectus will be made in transactions

that are deemed to be “at-the-market distributions” as defined in NI

44-102, including sales made directly on the TSX and the NYSE MKT or on any

other existing trading market for the Common Shares in Canada or the

United States.

The Offered Shares will be distributed either (i) at market prices

prevailing at the time of the sale of such Offered Shares or (ii) at

prices to be negotiated with purchasers. See “Plan of Distribution”.

|

|

|

|

|

Use of proceeds

|

The Company intends to use the net proceeds from the

Offering, if any, to fund ongoing general corporate expenditures,

discretionary capital programs, accelerated exploration at the Fekola

Project and exploration and feasibility work at the Kiaka Project. See

“Use of Proceeds”.

|

|

|

|

|

Risk factors

|

See “Risk Factors” in this Prospectus Supplement and the

accompanying Prospectus and the risk factors discussed or referred to in

the AIF and other documents incorporated by reference into this Prospectus

Supplement and the accompanying Prospectus for a discussion of factors

that should be read and considered before investing in the Offered Shares.

|

|

|

|

|

Tax considerations

|

Purchasing Offered Shares may have tax consequences. This

Prospectus Supplement and the accompanying Prospectus may not describe

these consequences fully for all investors. Investors should read the tax

discussion in this Prospectus Supplement and the accompanying Prospectus

and consult with their tax advisor. See “Certain Canadian Federal Income

Tax Considerations” and “Certain United States Federal Income

Tax Considerations” in this Prospectus Supplement.

|

|

|

|

|

Listing symbol

|

The Common Shares are listed for trading on the TSX under

the symbol “BTO” and the NYSE MKT under the symbol “BTG”.

|

S-8

|

Conflicts of Interest

|

HSBC Securities (Canada) Inc. and HSBC Securities (USA)

Inc. are affiliates of HSBC Bank USA, National Association, which acts as

administrative agent under the Credit Facility and HSBC Securities (USA)

Inc. acts as sole lead arranger and sole bookrunner under the Credit

Facility. The Company’s use of proceeds may be deemed a conflict of

interest within the meaning of FINRA Rule 5121. See “Relationship Between the Company and Certain

Agents (Conflicts of Interest)”.

|

S-9

RISK FACTORS

Investing in the Offered

Shares is speculative and involves risks. The following risk factors, as well as

risks currently unknown to B2Gold, could materially adversely affect our future

business, operations and financial condition and could cause them to differ

materially from the estimates described in this Prospectus Supplement, the

accompanying Prospectus or the documents incorporated by reference herein or

therein, each of which could cause purchasers of Offered Shares to lose part or

all of their investment. In addition to the other information contained in this

Prospectus Supplement, the accompanying Prospectus and the documents

incorporated by reference herein and therein, prospective investors should

carefully consider the factors set out below in evaluating B2Gold and its

business before making an investment in the Offered Shares.

Risks related to our business

Changes in the price of gold and other metals in the

world markets, which can fluctuate widely, significantly affect the

profitability of our operations and our financial condition and our ability to

develop new mines.

The profitability of our

operations is significantly affected by changes in the market price of gold and

other mineral commodities. Mineral prices fluctuate widely and are affected by

numerous factors beyond our control, including:

|

|

•

|

the level of interest rates;

|

|

|

•

|

the rate and anticipated rate of inflation;

|

|

|

•

|

world supply of mineral commodities;

|

|

|

•

|

consumption patterns;

|

|

|

•

|

purchases and sales of gold by central banks;

|

|

|

•

|

forward sales by producers;

|

|

|

•

|

production costs;

|

|

|

•

|

demand from the jewelry industry;

|

|

|

•

|

speculative activities;

|

|

|

•

|

stability of exchange rates;

|

|

|

•

|

the relative strength of the U.S. dollar and

other currencies;

|

|

|

•

|

changes in international investment patterns;

|

|

|

•

|

monetary systems; and

|

|

|

•

|

political and economic events.

|

The price of gold decreased by

approximately 10.3% over the 2015 fiscal year, with a decline in the price from

$1,184.25 per ounce on January 2, 2015 to $1,062.25 per ounce on December 31,

2015. As of August 10, 2016, the price of gold was $1,347.70. Current and future price

declines could cause commercial production or the development of new mines to be

impracticable. If gold prices decline significantly, or decline for an extended

period of time, we might not be able to continue our operations, develop our

properties, or fulfill our obligations under our permits and licenses, or under

our agreements with our partners. This could result in us losing our interest in

some or all of our properties, or being forced to cease operations or

development activities or to abandon or sell properties, which could have a

negative effect on our profitability and cash flow.

Our future revenues and earnings

could also be affected by the prices of other commodities such as fuel and other

consumable items. The prices of these commodities are affected by numerous

factors beyond our control.

Our failure to achieve production, cost and other

estimates could have a material adverse effect on our future cash flows,

profitability, results of operations and financial condition.

This Prospectus Supplement, the

accompanying Prospectus and the documents incorporated by reference herein and

therein contain estimates of future production, operating costs, capital costs

and other economic and financial measures with respect to our existing mines and

certain of our exploration and development stage projects. The estimates can

change or we may be unable to achieve them. Actual production, costs, returns

and other economic and financial performance may vary from the estimates

depending on a variety of factors, many of which are not within our control.

These factors include, but are not limited to:

|

|

•

|

actual ore mined varying from estimates of grade,

tonnage, dilution, and metallurgical and other characteristics;

|

|

|

•

|

short-term operating factors such as the need for

sequential development of ore bodies and the processing of new or

different ore grades from those planned;

|

S-10

|

|

•

|

mine failures, slope failures or equipment

failures;

|

|

|

•

|

industrial accidents;

|

|

|

•

|

natural phenomena such as inclement weather

conditions, floods, droughts, rock slides and earthquakes;

|

|

|

•

|

encountering unusual or unexpected geological

conditions;

|

|

|

•

|

changes in power costs and potential power

shortages;

|

|

|

•

|

exchange rate and commodity price fluctuations;

|

|

|

•

|

shortages of principal supplies needed for

operations, including explosives, fuels, water and equipment parts;

|

|

|

•

|

labour shortages or strikes;

|

|

|

•

|

litigation;

|

|

|

•

|

terrorism;

|

|

|

•

|

civil disobedience and protests;

|

|

|

•

|

restrictions or regulations imposed by

governmental or regulatory authorities;

|

|

|

•

|

permitting or licensing issues; or

|

|

|

•

|

shipping interruptions or delays.

|

Properties not yet in production,

or slated for expansion, are subject to higher risks as new mining operations

often experience unexpected problems during the start-up phase, and production

delays and cost adjustments can often happen. Failure to achieve production or

cost estimates or material increases in costs could have a material adverse

effect on our future cash flows, profitability, results of operations and

financial condition.

Mineral exploration and development involves significant

risks and uncertainties, which could have a material adverse effect on our

business, results of operations and financial condition.

Our business plans and

projections rely significantly on the planned exploration and development of our

non-producing properties. The exploration for and development of mineral

deposits involves significant risks that even a combination of careful

evaluation, experience and knowledge may not eliminate. While the discovery of

an ore body may result in substantial rewards, few properties that are explored

are ultimately developed into producing mines and no assurance can be given that

minerals will be discovered in sufficient quantities or having sufficient grade

to justify commercial operations or that funds required for development can be

obtained on a timely basis. Major expenses may be required to locate and

establish mineral reserves, to develop metallurgical processes and to construct

mining and processing facilities at a particular site. It is impossible to

ensure that the exploration or development programs we or any of our joint

venture partners plan will result in a profitable commercial mining

operation.

Whether a mineral deposit will be commercially viable depends

on a number of factors, including, but not limited to:

|

|

•

|

the particular attributes of the deposit, such as size,

grade, metallurgy and proximity to infrastructure;

|

|

|

•

|

metal prices which are highly cyclical;

|

|

|

•

|

the cost of operations and processing equipment; and

|

|

|

•

|

government regulations, including regulations relating to

prices, taxes, royalties, land tenure, land use, allowable production,

importing and exporting of minerals and environmental protection.

|

In addition, as a result of the

substantial expenditures involved in development projects, developments are

prone to material cost overruns versus budget. The capital expenditures and time

required to develop new mines are considerable and changes in cost or

construction schedules can significantly increase both the time and capital

required to build the mine. The project development schedules are also dependent

on obtaining the governmental approvals necessary for the operation of a mine.

Substantial expenditures are required to build mining and processing facilities

for new properties. The timeline to obtain these government approvals is often

beyond our control. It is not unusual in the mining industry for new mining

operations to experience unexpected problems during the start-up phase,

resulting in delays and requiring more capital than anticipated.

The combination of these factors

may result in our inability to develop our non-producing properties, to achieve

or maintain historical or estimated production, revenue or cost levels, or to

receive an adequate return on invested capital, which could have a material

adverse effect on our business, results of operations and financial condition.

S-11

Undue reliance should not be placed on estimates of

mineral reserves and mineral resources, since these estimates are subject to

numerous uncertainties. Our actual mineral reserves could be lower than mineral

reserve estimates and mineral resources may never be converted into mineral

reserves, which could adversely affect our operating results and financial

condition.

The figures for mineral reserves

and mineral resources are estimates only and no assurance can be given that the

anticipated tonnages and grades will be achieved, that the indicated level of

recovery will be realized or that mineral reserves could be mined or processed

profitably. There are numerous uncertainties inherent in estimating mineral

reserves and mineral resources, including many factors beyond our control. Such

estimation is a subjective process, and the accuracy of any mineral reserve or

mineral resource estimate is a function of the quantity and quality of available

data and of the assumptions made and judgments used in engineering and

geological interpretation. Short-term operating factors relating to the mineral

reserves, such as the need for orderly development of the ore bodies or the

processing of new or different ore grades, may cause the mining operation to be

unprofitable in any particular accounting period. In addition, there can be no

assurance that gold recoveries in small scale laboratory tests will be

duplicated in larger scale tests under on-site conditions or during production.

Fluctuation in gold prices,

results of drilling, metallurgical testing and production, increases in capital

and operating costs, including the cost of labour, equipment, fuel and other

required inputs and the evaluation of mine plans after the date of any estimate

may require revision of such estimate. The volume and grade of mineral reserves

mined and processed and the recovery rates may not be the same as currently

anticipated. Any material reductions in estimates of mineral reserves and

mineral resources, or of our ability to extract these mineral reserves, could

have a material adverse effect on our results of operations and financial

condition.

Mineral resources that are not

mineral reserves do not have demonstrated economic viability. Due to uncertainty

that may attach to inferred mineral resources, inferred mineral resources may

not be upgraded to measured and indicated mineral resources or proven and

probable reserves as a result of continued exploration.

Our operations across several different countries subject

us to various political, economic and other risks that could negatively impact

our operations and financial condition.

Our exploration, development and

production activities are conducted in various countries, including Nicaragua,

the Philippines, Namibia, Mali, Burkina Faso and Colombia and, as such, our

operations are exposed to various levels of political, economic and other risks

and uncertainties. These risks and uncertainties vary from country to country

and include, but are not limited to, the existence or possibility of terrorism;

hostage taking; military repression; extreme fluctuations in currency exchange

rates; high rates of inflation; labour unrest; the risks of war or civil unrest;

expropriation and nationalization; uncertainty as to the outcome of any

litigation in foreign jurisdictions; uncertainty as to enforcement of local

laws; environmental controls and permitting; restrictions on the use of land and

natural resources; renegotiation or nullification of existing concessions;

licenses; permits and contracts; illegal mining; changes in taxation policies;

restrictions on foreign exchange and repatriation; corruption; unstable legal

systems; changing political conditions; changes in mining and social policies;

“black economic empowerment” legislation; currency controls and governmental

regulations that favor or require the awarding of contracts to local contractors

or require foreign contractors to employ citizens of, or purchase supplies from,

a particular jurisdiction or require equity participation by local citizens; and

other risks arising out of foreign sovereignty issues.

We have interests in exploration

and development properties that are located in developing countries, including

Nicaragua, the Philippines, Namibia, Mali, Burkina Faso and Colombia and our

mineral exploration and mining activities may be affected in varying degrees by

political instability and governmental legislation and regulations relating to

foreign investment and the mining industry. Many of these countries have

experienced, or are currently experiencing, varying degrees of civil unrest.

Changes, if any, in mining or investment policies or shifts in political

attitude in Nicaragua, the Philippines, Namibia, Mali, Burkina Faso or Colombia

may materially adversely affect our operations or profitability.

Operations may be affected in varying degrees by:

|

|

•

|

government regulations with respect to, but not limited

to, restrictions on production, price controls, exchange controls, export

controls, currency remittance, income or other taxes, expropriation of

property, foreign investment, maintenance of claims, environmental

legislation, land use, land claims of local people, local content and

ownership (such as “black economic empowerment” laws), water use and mine

safety; and

|

|

|

•

|

the lack of certainty with respect to foreign legal

systems, which may not be immune from the influence of political pressure,

corruption or other factors that are inconsistent with the rule of law.

|

S-12

Failure to comply with applicable

laws, regulations, and permitting requirements may result in enforcement actions

thereunder, including orders issued by regulatory or judicial authorities

causing operations to cease or be curtailed, and may include corrective measures

requiring capital expenditures, installation of additional equipment, or

remedial actions. The occurrence of these various factors and uncertainties

cannot be accurately predicted and could have a material adverse effect on our

business, financial condition and results of operations.

Furthermore, in the event of a

dispute arising from our activities, we may be subject to the exclusive

jurisdiction of courts or arbitral proceedings outside of North America or may

not be successful in subjecting persons to the jurisdiction of courts in North

America, either of which could unexpectedly and adversely affect the outcome of

a dispute.

We are subject to taxation in several different

jurisdictions, and adverse changes to the taxation laws of such jurisdictions or

unanticipated tax consequences of corporate reorganizations, could have a

material adverse effect on our profitability.

We have operations and conduct

business in a number of different jurisdictions and we are subject to the

taxation laws of each such jurisdiction. These taxation laws are complicated and

subject to changes and are subject to review and assessment in the ordinary

course. Any such changes in taxation law or reviews and assessments could result

in higher taxes being payable by us, which could adversely affect our

profitability. Taxes may also adversely affect our ability to repatriate

earnings and otherwise deploy our assets.

In addition, we have recently

completed and may complete in the future, corporate reorganizations and

reorganizations of the entities holding our projects. In the event that such

reorganizations result in the imposition of an unanticipated tax or penalty, it

may have a material adverse effect on our business.

Fluctuations in the price and availability of

infrastructure and energy and other commodities could impact our profitability

and development of projects.

Mining, processing, development

and exploration activities depend, to one degree or another, on adequate

infrastructure. Reliable roads, bridges, power sources and water supply are

important determinants which affect capital and operating costs. Our inability

to secure adequate water and power resources, as well as other events outside of

our control, such as unusual or infrequent weather phenomena, sabotage,

community, or government or other interference in the maintenance or provision

of such infrastructure, could adversely affect our operations, financial

condition and results of operations.

Namibia is an arid country, where

water resources are scarce, and there is the possibility of drought based on

current weather patterns. Although the Government of Namibia currently pursues a

seawater desalination project, Namibia may in the short term experience water

shortages,

inter alia

, on account of the following: (i) demand for water

is increasing, both on account of growth in GDP as well as on account of

increased mining operations; and (ii) the seawater desalination project pursued

by the government may take several years to complete, may not be financed easily

or at all, and may experience delays or cancellations.

Profitability is affected by the

market prices and availability of commodities that we use or consume for our

operations and development projects. Prices for commodities like diesel fuel,

electricity, steel, concrete, and chemicals (including cyanide) can be volatile,

and changes can be material, occur over short periods of time and be affected by

factors beyond our control. Our operations use a significant amount of energy

and depend on suppliers to meet those needs; however, sometimes no alternative

source is available. Higher costs for construction materials like steel and

concrete, or tighter supplies, can affect the timing and cost of our development

projects.

If there is a significant and

sustained increase in the cost of certain commodities, we may decide that it is

not economically feasible to continue some or all of our commercial production

and development activities, and this could have an adverse effect on our

profitability.

Higher worldwide demand for

critical resources like input commodities, drilling equipment, tires and skilled

labour could affect our ability to acquire them and lead to delays in delivery

and unanticipated cost increases, which could have an effect on our operating

costs, capital expenditures and production schedules.

Further, we rely on certain key

third-party suppliers and contractors for equipment, raw materials and services

used in, and the provision of services necessary for, the development,

construction and continuing operation of our assets. As a result, our operations

at our sites are subject to a number of risks, some of which are outside of our

control, including negotiating agreements with suppliers and contractors on

acceptable terms, the inability to replace a supplier or contractor and its

equipment, raw materials or services in the event that either party terminates

the agreement, interruption of operations or increased costs in the event that a

supplier or contractor ceases its business due to insolvency or other unforeseen

events and failure of a supplier or contractor to perform under its agreement

with us. The occurrence of one or more of these risks could have a material

adverse effect on our business, results of operations and financial condition.

S-13

The Company may be unable to generate sufficient cash to

service its debt, the terms of the agreements governing its debt may restrict

the Company’s current or future operations and the indebtedness may have a

material adverse effect on the Company’s financial condition and results of

operations.

The Company's ability to make

scheduled payments on the Credit Facility and any other indebtedness will depend

on its financial condition and operating performance, which are subject to

prevailing economic and competitive conditions and to certain financial,

business, legislative, regulatory and other factors beyond its control. If the

Company’s cash flows and capital resources are insufficient to fund its debt

service obligations, the Company could face substantial liquidity problems and

could be forced to reduce or delay investments and capital expenditures or to

dispose of material assets or operations, seek additional debt or equity capital

or restructure or refinance the Company’s indebtedness, including indebtedness

under the Credit Facility. The Company may not be able to effect any such

alternative measures on commercially reasonable terms or at all and, even if

successful, those alternatives may not allow the Company to meet its scheduled

debt service obligations.

In addition, a breach of the

covenants, including the financial covenants under the Credit Facility or the

Company’s other debt instruments from time to time could result in an event of

default under the applicable indebtedness. Such a default may allow the

creditors to impose default interest rates or accelerate the related debt, which

may result in the acceleration of any other debt to which a cross acceleration

or cross default provision applies. In the event a lender accelerates the

repayment of the Company’s borrowings, the Company may not have sufficient

assets to repay its indebtedness.

The Credit Facility contains a

number of covenants that will impose significant operating and financial

restrictions on the Company and may limit the Company’s ability to engage in

acts that may be in its long term best interest. In particular, the Credit

Facility restricts the Company’s ability to dispose of assets and to use the

proceeds from those dispositions, to make dividends or distributions, to incur

additional indebtedness and grant security interests or encumbrances and to use

proceeds from future debt or equity financings. As a result of these

restrictions, the Company may be limited in how it conducts its business, may be

unable to raise additional debt or equity financing, or may be unable to compete

effectively or to take advantage of new business opportunities, each of which

restrictions may affect the Company’s ability to grow in accordance with its

strategy.

Further, the Company’s

maintenance of substantial levels of debt could adversely affect its financial

condition and results of operations and could adversely affect its flexibility

to take advantage of corporate opportunities. Substantial levels of indebtedness

could have important consequences to the Company, including:

|

|

•

|

limiting the Company’s ability to obtain additional

financing to fund future working capital, capital expenditures,

acquisitions or other general corporate requirements, or requiring the

Company to make non-strategic divestitures;

|

|

|

|

|

|

|

•

|

requiring a substantial portion of the Company’s cash

flows to be dedicated to debt service payments instead of other purposes,

thereby reducing the amount of cash flows available for working capital,

capital expenditures, acquisitions and other general corporate purposes;

|

|

|

|

|

|

|

•

|

increasing the Company’s vulnerability to general adverse

economic and industry conditions;

|

|

|

|

|

|

|

•

|

exposing the Company to the risk of increased interest

rates for any borrowings at variable rates of interest;

|

|

|

|

|

|

|

•

|

limiting the Company’s flexibility in planning for and

reacting to changes in the industry in which it competes;

|

|

|

|

|

|

|

•

|

placing the Company at a disadvantage compared to other,

less leveraged competitors; and

|

|

|

|

|

|

|

•

|

increasing the Company’s cost of borrowing.

|

Mining is inherently dangerous and subject to conditions

or events beyond our control, which could have a material adverse effect on our

business, and mineral exploration is speculative and uncertain.

Mining operations generally

involve a high degree of risk. Our operations are subject to all the hazards and

risks normally encountered in the exploration, development and production of

gold, including: unusual and unexpected geologic formations; seismic activity;

rock bursts; cave-ins or slides; flooding; pit wall failure; periodic

interruption due to inclement or hazardous weather conditions; and other

conditions involved in the drilling and removal of material, any of which could

result in damage to, or destruction of, mines and other producing facilities,

personal injury or death, damage to property, environmental damage and possible

legal liability. Milling operations are subject to hazards such

as fire, equipment failure or failure of retaining dams around tailings disposal

areas, which may result in environmental pollution and consequent liability.

S-14

Hedging activities and ore purchase commitments could

have a material adverse effect on our business, results of operations and

financial condition.

We have entered into a series of

“zero-cost put/call” collar contracts for gold with settlements scheduled up to

December 31, 2018 with an average floor price of $1,000 per ounce and an average

ceiling price of $1,720 per ounce. In addition, we have a series of Rand

denominated gold forward contracts outstanding for 110,790 ounces of gold with

settlements scheduled up to December 31, 2018 at an average price of 15,229 Rand

per ounce.

We have also entered into

pre-paid sales arrangements in the form of metal sales forward contracts for the

delivery of approximately 51,600 ounces of gold in each of 2017 and 2018, for

total cash prepaid amount proceeds of $120 million.

As at June 30, 2016, we had

entered into a series of forward contracts for the purchase of fuel, oil, gas,

and diesel, with settlements scheduled between August 2016 and May 2018. During

the six months ended June 30, 2016 we entered into a series of interest rate

swap contracts for a notional amount of $100 million. Under these contracts, the

Company pays a floating rate equal to the three month U.S. dollar Libor and

receives an average fixed rate of 1.04% . These contracts have scheduled

settlements between September 2016 and May 2019.

The majority of the Company’s

portfolio of fuel derivatives and Rand denominated gold forwards are marked to

market through the statement of operations. A 10% change in the forward price of

fuel would result in a $1.9 million change in the value of the fuel derivative

portfolio. A 10% change in the United States dollar forward price of gold would

result in a $14.5 million change in the value of the gold forward portfolio and

a 10% change in the Rand versus the United States dollar forward rate would

result in a $13.6 million change in the value of the gold forward portfolio. A

10% change in the United States dollar forward price of gold would result in a

$13.8 million change in the value of the gold pre-paid forward sales. Gold

forward contracts covering the remaining 21,000 ounces are excluded from IAS 39

and accounted for as executory contracts because they were entered into, and

continue to be held, for the purpose of delivery. No fair value gains or losses

on these contracts are recorded in the Company’s financial statements.

From time to time we may engage

in other commodity hedging transactions intended to reduce the risk associated

with fluctuations in metal prices, but there is no assurance that any such

transaction will be successful. Furthermore, hedging transactions may prevent us

from realizing the full benefit of price increases.

We require licenses, permits and approvals from various

governmental authorities to conduct our operations, the failure to obtain or

loss of which could have a material adverse effect on our business.

Our mining operations in the

Philippines, Mali, Namibia and Nicaragua, and our various exploration and

development projects are subject to receiving and maintaining licenses, permits

and approvals from appropriate governmental authorities, including those permits

required for the Fekola Project to be developed and to enter into production.

Although our mining operations currently have all required licenses, permits and

approvals that we believe are necessary for operations as currently conducted,

no assurance can be provided that we will be able to maintain and renew such

permits or obtain any other permits that may be required. In addition, there

have in the past been challenges to permits that were temporarily successful and

delays in the renewal of certain permits. In the case of our exploration and

development stage properties, if a development decision is made, we must obtain

appropriate licenses, permits and approvals from appropriate governmental

authorities before development may proceed. There is no assurance that delays

will not occur in connection with obtaining necessary renewals of authorizations

for existing operations, additional licenses, permits and approvals for future

operations, or additional licenses, permits and approvals associated with new

legislation. We may not be able to receive or continue to hold all

authorizations necessary to develop or continue operating at any particular

property. An inability to obtain or conduct our mining operations pursuant to

applicable authorizations would materially reduce our production and cash flow

and could undermine our profitability.

We are subject to risks relating to environmental

regulations and our properties may be subject to environmental hazards, which

may have a material adverse effect on our business, operations and financial

condition.

Our operations are subject to

local laws and regulations regarding environmental matters, including, without

limitation, the use or abstraction of water, land use and reclamation, air

quality and the discharge of mining wastes and materials. Any changes in these

laws could affect our operations and economics. Environmental laws and

regulations change frequently, and the implementation of new, or the

modification of existing, laws or regulations could harm us. We cannot predict

how agencies or courts in foreign countries will interpret existing laws and regulations or the effect that

these adoptions and interpretations may have on our business or financial

condition.

S-15

We may be required to make

significant expenditures to comply with governmental laws and regulations. Any

significant mining operations will have some environmental impact, including

land and habitat impact, arising from the use of land for mining and related

activities, and certain impact on water resources near the project sites,

resulting from water use, rock disposal and drainage run-off. We may also

acquire properties with known or undiscovered environmental risks. Any

indemnification from the entity from whom we have acquired such properties may

not be adequate to pay all the fines, penalties and costs (such as clean-up and

restoration costs) incurred related to such properties.

Production at our mines involves

the use of various chemicals, including certain chemicals that are designated as

hazardous substances, including sodium cyanide, as discussed below. Some of our

properties also have been used for mining and related operations for many years

before we acquired them and were acquired as is or with assumed environmental

liabilities from previous owners or operators. We have been required to address

contamination at our properties in the past and may need to continue to do so in

the future, either for existing environmental conditions or for leaks or

discharges that may arise from our ongoing operations or other contingencies.

Contamination from hazardous substances, either at our own properties or other

locations for which we may be responsible, may subject us to liability for the

investigation or remediation of contamination, as well as for claims seeking to

recover for related property damage, personal injury or damage to natural

resources. The occurrence of any of these adverse events could have a material

adverse effect on our future growth, results of operations and financial

position.

Production at certain of our

mines involves the use of sodium cyanide, which is a toxic material. Should

sodium cyanide leak or otherwise be discharged from the containment system, we

may become subject to liability for clean-up work that may not be insured. While

appropriate steps will be taken to prevent discharge of pollutants into the

ground water and the environment, we may become subject to liability for hazards

that we may not be insured against and such liability could be material.

While we believe we do not

currently have any material unrecognized environmental obligations, exploration,

development and mining activities may give rise in the future to significant

liabilities on our part to the government and third parties and may require us

to incur substantial costs of remediation. Additionally, we do not maintain

insurance against environmental risks. As a result, any claims against us may

result in liabilities that we will not be able to afford, resulting in the

failure of our business.

In some jurisdictions, forms of

financial assurance are required as security for reclamation activities. The

cost of our reclamation activities may materially exceed our provisions for

them, or regulatory developments or changes in the assessment of conditions at

closed operations may cause these costs to vary substantially, from prior

estimates of reclamation liabilities. Under the 2012 Mining Code in Mali, we are

required to post a reclamation bond with the State of Mali equal to 5% of

anticipated turnover. We are currently in discussions with the State of Mali as

to the details of this reclamation bond. Until the requirements of the

reclamation bond are finalized, we face the risk of being required to post a

higher than anticipated bond for such project.

Failure to comply with applicable

laws, regulations, and permitting requirements may result in enforcement actions

thereunder, including orders issued by regulatory or judicial authorities

causing operations to cease or be curtailed, and may include corrective measures

requiring capital expenditures, installation of additional equipment, or

remedial actions. Parties engaged in exploration operations may be required to

compensate those suffering loss or damage by reason of the exploration

activities and may have civil or criminal fines or penalties imposed for