Expanding Air Express Networks Fueling

Growth

Air Transport Services Group, Inc. (Nasdaq:ATSG), the leading

provider of medium wide-body freighter aircraft leasing, air cargo

transportation, and related services, today reported consolidated

financial results for the quarter ended June 30, 2016.

For the second quarter of 2016, compared with the second quarter

of 2015:

- Revenues increased 19 percent to $176.5

million. Excluding revenues from reimbursed expenses, revenues

increased 13 percent. This increase included contributions from

thirty-five Boeing 767 cargo aircraft leased to external customers

at June 30, six more than a year earlier. Eight of those

thirty-five leased 767s were operating for Amazon Fulfillment

Services Inc. (AFS), a subsidiary of Amazon.com, which ATSG began

serving in September 2015.

- Pre-tax Earnings from Continuing

Operations were $18.8 million, compared with $17.2 million in the

prior-year period. Adjusted Pre-Tax Earnings from Continuing

Operations, as defined in our Earnings Summary later in this

release, declined slightly to $16.3 million from $16.7 million,

reflecting $2.6 million in ramp-up costs stemming primarily from

flight crew compensation and training for the expanding Amazon and

DHL CMI operations. Adjusted Pre-Tax Earnings from Continuing

Operations exclude non-cash charges associated with pension costs,

lease incentive amortization, and the effects of financial

instrument transactions, including a non-cash mark-to-market

adjustment in the value of stock warrants granted to Amazon in

March.

- Adjusted EBITDA (Earnings Before

Interest, Taxes, Depreciation and Amortization) from Continuing

Operations, as adjusted for the same items excluded from Adjusted

Pre-Tax Earnings, increased 2 percent to $52.1 million.

- Net Earnings from Continuing Operations

on a GAAP basis were $11.5 million, or $0.12 per common share

diluted in the second quarter, versus $10.6 million, or $0.16 per

share a year ago. The 2016 Net Earnings from Continuing Operations

include non-cash, after-tax effects of lease incentive amortization

and the mark-to-market adjustment for stock warrants. Diluted

Earnings per Share exclude the mark-to-market gain, net of tax,

associated with the stock warrants.

- Adjusted Earnings per Share from

Continuing Operations for the second quarter of 2016 were $0.13 per

share diluted and excludes the lease incentive amortization as well

as the mark-to-market adjustment for the stock warrants, net of

tax. Adjusted Earnings per Share from Continuing Operations were

reduced by approximately $0.02 per share for the incremental

ramp-up costs of the expanded customer CMI operations referenced

above.

Adjusted Pre-Tax Earnings, Adjusted EBITDA, and Adjusted

Earnings per Share from Continuing Operations are non-GAAP

financial measures. Each is defined and reconciled to comparable

GAAP results in tables later in this release.

Joe Hete, President and Chief Executive Officer of ATSG, said,

“Our operating performance across the board in the second quarter

was strong, and yielded financial results that met or exceeded our

targets. Last week, we leased and began operating the tenth of

twenty 767 freighters we will fly for Amazon. We expect margins to

improve substantially in the second half as we approach our

year-end 2016 target of forty-three dry-leased 767 freighters, and

increase from twenty-two to thirty the number of those we operate

for customers under multi-year CMI agreements. We have increased

acquisitions of 767-300 airframes, and have secured the conversion

slots to satisfy strong customer demand.”

Revenue diversification continued to increase in the second

quarter. DHL accounted for 37 percent, Amazon 22 percent, and the

U.S. Military 13 percent of ATSG's second quarter 2016 revenues.

That compares with 48 percent of revenues for DHL and 18 percent

for the U.S. Military in the second quarter of 2015. Amazon became

an ATSG customer in September 2015.

First-half capital expenditures were $125 million, versus $76

million in the first half of 2015. That included purchases of seven

Boeing 767-300 aircraft, three in the second quarter, plus

freighter modification costs for those and other aircraft,

capitalized maintenance costs, and payments for other ground and

maintenance equipment. Due to an acceleration in the rate of

aircraft purchases to meet 2017 freighter demand, ATSG's 2016

capital spending is now projected to total $315 million, of which

$235 million is budgeted for fleet expansion.

In May, ATSG again increased its access to growth-related credit

by amending the credit facility agreement with its bank consortium.

The amendment increases by $100 million, to $425 million, the

revolver portion of the facility and provides greater flexibility

for the company to execute share repurchases. The interest rate

structure is unchanged. Outstanding debt against the revolver was

$240 million at June 30, 2016. Leverage against EBITDA was

approximately 1.8 times at quarter-end, and the variable interest

rate on the revolver balance was 2.2 percent.

ATSG spent $7.7 million to repurchase 0.55 million shares of its

common stock in the open market during the second quarter. That

does not include a negotiated $50 million direct purchase in July

of 3.8 million shares from a fund affiliate of Red Mountain Capital

Partners, ATSG's largest shareholder. Accordingly, those 3.8

million shares were removed from the company's diluted share count

beginning in July.

Segment Results

Cargo Aircraft Management (CAM)

CAM Second Quarter Six Months ($

in thousands)

2016 2015 2016

2015 Aircraft leasing and related revenues $ 48,373 $ 45,632

$ 100,099 $ 88,846 Lease incentive amortization (934 ) —

(934 ) — Total CAM Revenues $ 47,439 $ 45,632 $

99,165 $ 88,486 Pre-Tax Earnings $ 16,229

$ 14,441 $ 35,739 $

28,879

Significant Developments:

- CAM’s aircraft leasing and related

revenues increased 6 percent to $48.4 million for the second

quarter of 2016. Revenues from externally leased freighters and

aircraft engines increased 23 percent, driven by six more external

Boeing 767 dry leases than a year earlier.

- Pre-tax earnings for the quarter

increased 12 percent from the prior-year period. Depreciation

expenses on CAM's expanded fleet were higher than a year ago.

- CAM owned fifty-six Boeing cargo

aircraft in serviceable condition as of June 30, the same number as

in the first quarter but two more than last year. Eight CAM-owned

767-300s were awaiting, or in passenger-to-freighter modification.

In June, one 767-200 was being prepared for deployment in the third

quarter.

- The twenty 767s CAM will lease and

operate for Amazon include twelve Boeing 767-200s and eight

767-300s. Ten of the twelve 767-200s are now in operation for

Amazon; the two others will be delivered in the fourth quarter.

Three of the 767-300s will be leased to Amazon and placed into

service by year-end, and the remaining five by the end of the first

half of 2017. CAM began an eight-year lease of a 767-300 freighter

to Amerijet in July. Additionally, CAM expects to lease a 767-300

to DHL under an eight year term starting in September, bringing to

17 the total portfolio of 767 aircraft leased to DHL.

- More information about CAM's current

and projected in-service fleet is provided in a table at the end of

this release.

ACMI Services

ACMI Services Second Quarter Six

Months ($ in thousands)

2016 2015

2016 2015 Revenues Airline services $ 98,187 $

97,897 $ 199,840 $ 195,592 Reimbursables 15,958 5,995

29,261 13,768 Total ACMI Services Revenues $ 114,145

$ 103,892 $ 229,101 $ 209,360 Pre-Tax Earnings (Loss)

$ (7,130 ) $ 1,126 $ (17,486 ) $ (1,445

)

Significant Developments:

- Revenues increased ten percent to

$114.1 million. Airline services revenues were essentially flat at

$98.2 million as the airlines operated fewer aircraft on an ACMI

basis and more aircraft on a CMI basis. Block-hour utilization

increased 12 percent, primarily from expanded CMI operations.

- Lower pre-tax margins are attributable

to $3.0 million in higher expenses for scheduled heavy maintenance

events than in the second quarter a year ago, $2.4 million in

higher non-cash pension expense, and $2.6 million in increased

personnel costs to ramp up for expanding CMI operations for Amazon.

The 2015 period included a $2.0 million benefit from an insurance

settlement.

Other Activities

Other Activities Second Quarter Six

Months ($ in thousands)

2016 2015

2016 2015 Revenues $ 57,253 $ 32,179 $ 112,264

$ 67,785 Pre-Tax Earnings $ 4,130 $ 1,840

$ 7,998 $ 4,916

Significant Developments:

- Inter-company revenues increased $11.9

million during the second quarter of 2016 to $24.2 million, driven

by aircraft fuel and maintenance services for the company's

airlines to support the Amazon network.

- Results from all other activities in

the second quarter benefited from expanded aircraft maintenance for

Delta Air Lines and other customers, and increased package handling

services for Amazon and the United States Postal Service.

Impact of Warrants

The investment agreement ATSG completed with Amazon in March

granted warrants for them to acquire up to 19.9 percent of ATSG's

common shares over five years. ATSG's earnings in the second

quarter reflect the amortization of the lease incentive, which is

based on the value of the warrants, as a reduction to revenue. This

non-cash amortization is excluded from ATSG's calculation of

Adjusted Pre-tax Earnings, Adjusted EBITDA, Adjusted Earnings and

Adjusted Earnings per Share from Continuing Operations.

ATSG accounted for the majority of the initial tranche of 7.7

million warrants that vested in March under the equity method,

which led to a $35.8 million increase in equity at March 31,

reflecting the fair market value of then-issued warrants. However,

after shareholder approval of the Amazon investment agreement in

May 2016, warrant features were enabled that required the Company

to treat them as a mark-to-market financial instrument liability on

the balance sheet. Accordingly, changes in the market price of ATSG

common shares each quarter will affect the fair value of the

warrants and result in a change in the value of that liability.

This effect for the second quarter was a $5.8 million pre-tax gain,

which was recorded as a gain on financial instruments on the

Company's statement of earnings. Going forward, management expects

these items to continue to significantly impact GAAP net earnings

until all of the warrants are exercised or expire.

For purposes of calculating diluted earnings per share in

accordance with GAAP, the warrants were treated as an equity

instrument during the second quarter. Accordingly, the

mark-to-market gain on the stock warrants, net of tax, was

disregarded in calculating Diluted Earnings per Share from

Continuing Operations.

Outlook

This year's second quarter was the first full quarter of

operations under the five-year air transportation services

agreement with Amazon and the start of the second full year under

ATSG's four-year commercial arrangements with DHL. Those agreements

and others mean that forty-three 767s, or more than 80 percent of

ATSG's serviceable 767 freighter fleet, will be covered by

long-term dry lease agreements by the end of 2016.

"We are confident about the cash-generating power of ATSG's

businesses for many years to come," Hete said. "We continue to

estimate that Adjusted EBITDA from Continuing Operations will be

$218 million in 2016, after excluding our non-cash items as

described above. We are also confident about continued growth in

2017 and beyond, as we deliver on the opportunities that growing

e-commerce markets are creating."

Hete said that ATSG has the relationships and growth

opportunities in place to generate strong cash returns over several

years from its accelerated fleet investments and other initiatives.

"We will continue to invest and operate our businesses for maximum

performance. Having already repurchased 5.8 million of our shares

since May 2015, ATSG will continue to buy back shares at a moderate

pace, while having the flexibility to acquire blocks of shares on

an opportunistic basis. Allocating capital where it can provide the

best returns for shareholders remains our fundamental goal."

Conference Call

ATSG will host a conference call on Tuesday, August 9, 2016, at

10 a.m. Eastern Daylight Time to review its financial results for

the second quarter of 2016. Participants should dial (888) 771-4371

and international participants should dial (847) 585-4405 ten

minutes before the scheduled start of the call and ask for

conference pass code 43085407. The call will also be webcast

live (listen-only mode) via www.atsginc.com.

A replay of the conference call will be available by phone on

August 9, 2016, beginning at 2 p.m. and continuing through August

16, 2016, at (888) 843-7419 (international callers (630) 652-3042);

use pass code 43085407#. The webcast replay will remain

available via www.atsginc.com for 30

days.

About ATSG

ATSG is a leading provider of aircraft leasing and air cargo

transportation and related services to domestic and foreign air

carriers and other companies that outsource their air cargo lift

requirements. ATSG, through its leasing and airline subsidiaries,

is the world's largest owner and operator of converted Boeing 767

freighter aircraft. Through its principal subsidiaries, including

two airlines with separate and distinct U.S. FAA Part 121 Air

Carrier certificates, ATSG provides aircraft leasing, air cargo

lift, aircraft maintenance services and airport ground services.

ATSG's subsidiaries include ABX Air, Inc.; Airborne Global

Solutions, Inc.; Air Transport International, Inc.; Cargo Aircraft

Management, Inc.; and Airborne Maintenance and Engineering

Services, Inc. For more information, please see

www.atsginc.com.

Except for historical information contained herein, the matters

discussed in this release contain forward-looking statements that

involve risks and uncertainties. There are a number of important

factors that could cause Air Transport Services Group's ("ATSG's")

actual results to differ materially from those indicated by such

forward-looking statements. These factors include, but are not

limited to, our operating airlines' ability to maintain on-time

service and control costs; the number and timing of deployments and

redeployments of our aircraft to customers; the cost and timing

with respect to which we are able to purchase and modify aircraft

to a cargo configuration; the successful implementation and

operation of the new air network for Amazon; changes in market

demand for our assets and services; and other factors that are

contained from time to time in ATSG's filings with the U.S.

Securities and Exchange Commission, including its Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. Readers should

carefully review this release and should not place undue reliance

on ATSG's forward-looking statements. These forward-looking

statements were based on information, plans and estimates as of the

date of this release. ATSG undertakes no obligation to update any

forward-looking statements to reflect changes in underlying

assumptions or factors, new information, future events or other

changes.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

(In thousands, except per share data)

Three Months Ended Six Months Ended June

30, June 30, 2016 2015 2016

2015 REVENUES $ 176,549 $ 148,353 $ 353,934 $ 295,378

OPERATING EXPENSES Salaries, wages and benefits 53,647

42,036 106,066 85,715 Depreciation and amortization 33,132 31,400

65,666 60,393 Maintenance, materials and repairs 26,390 23,993

53,733 46,686 Fuel 17,168 12,275 33,799 23,053 Contracted ground

and aviation services 8,931 3,599 19,799 6,537 Travel 4,678 4,342

9,486 8,765 Rent 2,579 2,447 5,206 6,654 Landing and ramp 2,652

2,166 6,303 4,874 Insurance 1,087 546 2,236 1,804 Other operating

expenses 10,484 5,755 20,488 13,574

160,748 128,559 322,782 258,055

OPERATING INCOME 15,801 19,794 31,152 37,323 OTHER INCOME (EXPENSE)

Interest income 37 24 61 46 Interest expense (2,633 ) (2,839 )

(5,332 ) (5,904 ) Net gain on financial instruments 5,558

264 5,030 251 2,962 (2,551 ) (241 ) (5,607 )

EARNINGS FROM CONTINUING OPERATIONS

BEFORE INCOME TAXES 18,763 17,243 30,911 31,716 INCOME TAX EXPENSE

(7,235 ) (6,673 ) (11,212 ) (12,251 )

EARNINGS FROM CONTINUING OPERATIONS 11,528 10,570 19,699 19,465

EARNINGS FROM DISCONTINUED OPERATIONS, NET OF TAX 47

214 94 428 NET EARNINGS $ 11,575 $

10,784 $ 19,793 $ 19,893 EARNINGS PER

SHARE - Basic Continuing operations $ 0.18 $ 0.16 $ 0.31 $ 0.30

Discontinued operations — 0.01 — 0.01

NET EARNINGS PER SHARE $ 0.18 $ 0.17 $ 0.31 $

0.31 EARNINGS PER SHARE - Diluted Continuing

operations $ 0.12 $ 0.16 $ 0.25 $ 0.30 Discontinued operations —

— — — NET EARNINGS PER SHARE $ 0.12

$ 0.16 $ 0.25 $ 0.30 WEIGHTED

AVERAGE SHARES Basic 63,267 64,541 63,452

64,498 Diluted 66,763 65,471 65,910

65,404

AIR TRANSPORT SERVICES GROUP,

INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

June 30, December 31, 2016 2015

ASSETS CURRENT ASSETS: Cash and cash equivalents $ 25,242 $

17,697 Accounts receivable, net of allowance of $293 in 2016 and

$415 in 2015 51,510 57,986 Inventory 14,713 12,963 Prepaid supplies

and other 12,167 12,660 TOTAL CURRENT ASSETS 103,632

101,306 Property and equipment, net 934,219 875,401 Other

assets 75,240 26,285 Goodwill and intangibles 38,589 38,729

TOTAL ASSETS $ 1,151,680

$ 1,041,721 LIABILITIES AND

STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $

40,755 $ 44,417 Accrued salaries, wages and benefits 24,254 27,454

Accrued expenses 8,858 8,107 Current portion of debt obligations

41,637 33,740 Unearned revenue 12,081 12,963 TOTAL

CURRENT LIABILITIES 127,585 126,681 Long term debt 323,461 283,918

Post-retirement obligations 104,316 108,194 Other liabilities

61,777 61,913 Stock warrants 57,128 — Deferred income taxes 109,358

96,858 STOCKHOLDERS’ EQUITY: Preferred stock, 20,000,000

shares authorized, including 75,000 Series A Junior Participating

Preferred Stock — — Common stock, par value $0.01 per share;

85,000,000 shares authorized; 63,513,853 and 64,077,140 shares

issued and outstanding in 2016 and 2015, respectively 635 641

Additional paid-in capital 497,750 518,259 Accumulated deficit

(35,938 ) (55,731 ) Accumulated other comprehensive loss (94,392 )

(99,012 ) TOTAL STOCKHOLDERS’ EQUITY 368,055 364,157

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $

1,151,680 $ 1,041,721

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

PRE-TAX EARNINGS AND ADJUSTED PRE-TAX

EARNINGS SUMMARY

FROM CONTINUING OPERATIONS

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended Six Months Ended June

30, June 30, 2016 2015 2016

2015 Revenues CAM Aircraft leasing $

48,373 $ 45,632 $ 100,099 $ 88,486 Lease incentive amortization

(934 ) — (934 ) —

Total CAM 47,439 45,632

99,165 88,486

ACMI Services Airline services 98,187 97,897

199,840 195,592 Reimbursables 15,958 5,995 29,261

13,768

Total ACMI Services 114,145 103,892

229,101 209,360

Other Activities 57,253 32,179

112,264 67,785

Total Revenues 218,837 181,703

440,530 365,631 Eliminate internal revenues (42,288 ) (33,350 )

(86,596 ) (70,253 )

Customer Revenues $

176,549 $ 148,353 $

353,934 $ 295,378

Pre-tax Earnings from Continuing Operations CAM,

inclusive of interest expense 16,229 14,441 35,739 28,879

ACMI Services (7,130 ) 1,126 (17,486 ) (1,445 )

Other

Activities 4,130 1,840 7,998 4,916

Net, unallocated interest

expense (24 ) (428 ) (370 ) (885 )

Net gain on financial

instruments 5,558 264 5,030 251

Total Pre-tax Earnings from Continuing Operations $

18,763 $ 17,243 $ 30,911

$ 31,716 Adjustments to Pre-tax Earnings

from Continuing Operations Add non-service components of

retiree benefit costs, net 2,203 (260 ) 4,406 (520 ) Add debt

issuance charge from non-consolidating affiliate — — 1,229 — Add

lease incentive amortization 934 — 934 — Less net gain on financial

instruments (5,558 ) (264 ) (5,030 ) (251 )

Adjusted Pre-tax

Earnings from Continuing Operations $ 16,342

$ 16,719 $ 32,450

$ 30,945

Adjusted Pre-tax Earnings from Continuing Operations is defined

as Earnings from Continuing Operations Before Income Taxes less

financial instrument gains or losses, non-service components of

retiree benefit costs, lease incentive amortization and the

write-off of debt issuance costs from a non-consolidating

affiliate. Management uses Adjusted Pre-tax Earnings from

Continuing Operations to assess the performance of its operating

results among periods. Adjusted Pre-tax Earnings from Continuing

Operations is a non-GAAP financial measure and should not be

considered an alternative to Earnings from Continuing Operations

Before Income Taxes or any other performance measure derived in

accordance with GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIES

ADJUSTED EARNINGS FROM CONTINUING

OPERATIONS BEFORE INTEREST, TAXES,

DEPRECIATION AND AMORTIZATION

NON-GAAP RECONCILIATION

(In thousands)

Three Months Ended Six Months Ended June

30, June 30, 2016 2015 2016

2015 Earnings from Continuing Operations

Before Income Taxes $ 18,763 $ 17,243 $ 30,911 $ 31,716

Interest Income (37 ) (24 ) (61 ) (46 ) Interest Expense 2,633

2,839 5,332 5,904 Depreciation and Amortization 33,132

31,400 65,666 60,393

EBITDA from Continuing

Operations $ 54,491 $ 51,458 $ 101,848 $ 97,967 Add non-service

components of retiree benefit costs, net 2,203 (260 ) 4,406 (520 )

Add debt issuance costs from non-consolidating affiliate — — 1,229

— Add lease incentive amortization 934 — 934 — Less net gain on

financial instruments (5,558 ) (264 ) (5,030 ) (251 )

Adjusted EBITDA from Continuing Operations $

52,070 $ 50,934 $ 103,387 $ 97,196

EBITDA and Adjusted EBITDA from Continuing Operations are

non-GAAP financial measures and should not be considered as

alternatives to Earnings from Continuing Operations Before Income

Taxes or any other performance measure derived in accordance with

GAAP.

EBITDA from Continuing Operations is defined as Earnings from

Continuing Operations Before Income Taxes plus net interest

expense, depreciation, and amortization expense. Adjusted EBITDA

from Continuing Operations is defined as EBITDA from Continuing

Operations less financial instrument gains or losses, non-service

components of retiree benefit costs, amortization of lease

incentive costs recorded in revenue and the write-off of debt

issuance costs from a non-consolidating affiliate.

Management uses EBITDA from Continuing Operations as an

indicator of the cash-generating performance of the operations of

the Company. Management uses Adjusted EBITDA from Continuing

Operations to assess the performance of its operating results among

periods. EBITDA and Adjusted EBITDA from Continuing Operations

should not be considered in isolation or as a substitute for

analysis of the Company's results as reported under GAAP, or as an

alternative measure of liquidity.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESADJUSTED EARNINGS PER SHARE FROM CONTINUING

OPERATIONSNON-GAAP RECONCILIATION(In thousands)

The Company's financial results as reported under GAAP, include

the effects of stock warrants granted to a customer as a lease

incentive. The value of the stock warrants was recorded as a

customer lease incentive and is amortized over the term of the

related aircraft leases. The stock warrants were revalued as of

June 30, 2016, with the gain in fair value recorded to earnings.

Diluted earnings per share from continuing operations, as

calculated under GAAP, excludes the after tax effects of the gain

from revaluing the stock warrants at the end of the period.

Adjusted Earnings from Continuing Operations and Adjusted Earnings

per Share from Continuing Operations, non-GAAP measures presented

below, reflect the Company's results after removing the lease

incentive amortization and the warrant revaluation gain during the

period.

Three Months Ended Six Months Ended

June 30, June 30, 2016 2015

2016 2015 Earnings from Continuing

Operations - basic (GAAP) $ 11,528 $ 10,570 $ 19,699 $ 19,465

Gain from stock warrants, net of tax (3,664 ) — (3,405 ) —

Earnings from Continuing Operations - diluted (GAAP) 7,864

10,570 16,294 19,465 Lease incentive amortization, net of tax 595

— 595 —

Adjusted earnings from Continuing

Operations (non-GAAP) $ 8,459 $ 10,570 $ 16,889

$ 19,465

Weighted Average Shares - diluted

(GAAP) 66,763 65,471 65,910 65,404

Earnings per Share

from Continuing Operations - diluted (GAAP) $ 0.12 $ 0.16 $

0.25 $ 0.30 Effect of lease incentive amortization, net of tax 0.01

— 0.01 —

Adjusted earnings per Share from

Continuing Operations (non-GAAP) $ 0.13 $ 0.16 $

0.26 $ 0.30

Adjusted Earnings per Share from Continuing Operations equals

Adjusted Earnings from Continuing Operations divided by Weighted

Average Shares diluted.

Adjusted Earnings from Continuing Operations and Adjusted

Earnings per Share from Continuing Operations are non-GAAP

financial measures and should not be considered as alternatives to

Earnings from Continuing Operations or Earnings per Share from

Continuing Operations or any other performance measure derived in

accordance with GAAP.

Adjusted Earnings from Continuing Operations is

defined as Earnings from Continuing Operations less the

amortization of the lease incentive, net of taxes and less the

warrant revaluation gain, net of taxes. The amortization of the

lease incentive is recorded as a non-cash reduction to revenues

recognized during a period. Management uses Adjusted Earnings from

Continuing Operations and Adjusted Earnings per Share from

Continuing Operations to compare the performance of its operating

results among periods. Adjusted Earnings and Adjusted Earnings per

Share from Continuing Operations should not be considered in

isolation or as a substitute for analysis of the company's results

as reported under GAAP.

AIR TRANSPORT SERVICES GROUP, INC. AND

SUBSIDIARIESCARGO AIRCRAFT FLEET

Serviceable Aircraft By Type December

31, June 30, December 31,

2015 2016 2016 Projected

Operating Operating Operating Total

Owned Lease Total Owned Lease Total Owned Lease B767-200 36 36 — 36

36 — 36 36 — B767-300 11 11 — 12 12 — 17 17 — B757-200 5 4 1 5 4 1

4 4 — B757 Combi 4 4 — 4 4 — 4 4 —

Total Aircraft 56

55 1 57 56 1 61 61

— Serviceable Owned Aircraft By Contracted

Deployment December 31, June 30, December

31, 2015 2016 2016 Projected Dry leased

without CMI 15 13 13 Dry leased with CMI 15 22 30 ACMI/Charter 25

20 18 Staging/Unassigned — 1 —

55 56 61

Owned Aircraft In or Awaiting Cargo

Conversion December 31, June 30, December

31, 2015 2016 2016 Projected B767-300 2 8

7

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160808006242/en/

ATSG Inc.Quint O. Turner, 937-382-5591Chief Financial

Officer

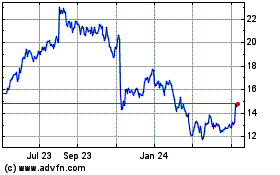

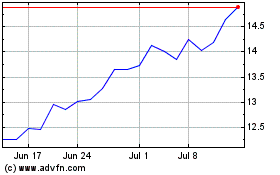

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Aug 2024 to Sep 2024

Air Transport Services (NASDAQ:ATSG)

Historical Stock Chart

From Sep 2023 to Sep 2024