NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD SEPTEMBER 21, 2016

TO OUR STOCKHOLDERS

:

NOTICE IS HEREBY GIVEN that the 2016 Annual Meeting of Stockholders (the “Annual Meeting”) of Sundance Strategies, Inc., a Nevada corporation (the “Company”), will be held on Wednesday, September 21, 2016, at 3:00 p.m. Mountain Daylight Time at 4626 North 300 West, Provo, Utah 84604. The Annual Meeting will be held for the following purposes, as more fully described in the proxy statement accompanying this notice:

|

|

1.

|

ELECTION OF DIRECTORS.

To elect the three (3) directors named in the attached proxy statement;

|

|

|

|

|

|

|

2.

|

RATIFICATION OF AUDITORS.

To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending March 31, 2017; and

|

|

|

|

|

|

|

3.

|

ANY OTHER BUSINESS

that may properly come before the Annual Meeting or any adjournments or postponements thereof.

|

The foregoing items of business are more fully described in the Proxy Statement accompanying this notice.

We recommend that stockholders vote “FOR” Proposals No. 1 and 2. Only stockholders of record at the close of business on July 27, 2016 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting and any adjournments or postpo

n

ements thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to assure your representation at the Annual Meeting, you are urged to mark, sign, date and return the enclosed proxy card promptly in the postage-paid envelope enclosed for that purpose. Should you receive more than one proxy card because your shares are registered in different names and addresses, each proxy card should be signed and returned to assure that all your shares will be voted. Stockholders may have a choice of voting their shares over the Internet. If Internet voting is available to you, voting instructions are printed on the proxy card(s) sent to you.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on September 21, 2016

: This notice of annual meeting of stockholders, the proxy statement, and our annual report on Form 10-K for 2016 are available at www.proxyvote.com.

Sincerely,

Randall F. Pearson

President, Chief Financial Officer and Director

Provo, Utah

July 29, 2016

TABLE OF CONTENTS

|

|

Page

|

|

|

|

ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

|

VOTING AND RELATED MATTERS

|

|

|

|

|

EXECUTIVE OFFICERS AND DIRECTORS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

|

|

|

|

|

|

|

|

|

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

|

|

|

|

|

REPORT OF THE BOARD OF DIRECTORS

|

|

|

|

|

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

|

|

|

|

|

PROPOSAL NO. 2 – RATIFICATION OF APPOINTMENT OF BDO USA LLP

|

|

|

|

|

|

|

|

|

|

|

ANNUAL REPORT ON FORM 10-K

|

|

|

|

|

|

|

|

ANNUAL MEETING OF STOCKHOLDERS

We have sent you this Proxy Statement and the enclosed Proxy Card because our Board is soliciting your proxy to vote at our 2016 Annual Meeting of Stockholders to be held on Wednesday, September 21, 2016 (the “Annual Meeting”), at our offices at 4626 North 300 West, Provo, Utah 84604, at 3:00 p.m., Mountain Daylight Time, and at any adjournments or postponements thereof. Directions to the Annual Meeting may be obtained by emailing randy@sundancestrategies.com.

|

|

·

|

This Proxy Statement summarizes information about the proposals to be considered at the Meeting and other information you may find useful in determining how to vote.

|

|

|

·

|

The Proxy Card is the means by which you actually authorize another person to vote your shares in accordance with your instructions.

|

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

We are mailing the Notice of Annual Meeting of Stockholders, this Proxy Statement and Proxy Card to the holders of the Company’s common stock of record as of July 27, 2016 (the “Record Date”) for the first time on or about July 29, 2016. On the Record Date, there were 44,128,441 shares of common stock outstanding.

In this mailing, we are also including our Form 10-K for the fiscal year ended March 31, 2016 (“Fiscal 2016”), which Form 10-K, together with the additional cover materials attached thereto, constitutes our 2016 Annual Report to Stockholders (“2016 Annual Report”). In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the 2016 Annual Report so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date.

Questions regarding the Annual Meeting, submission of a proxy, voting of shares or obtaining additional copies of the Proxy Statement or the enclosed proxy card should be directed to Randall F. Pearson at randy@sundancestrategies.com. If your broker, dealer, commercial bank, trust company or other nominee holds your shares, you should also call your broker, dealer, commercial bank, trust company or other nominee for additional information

VOTING AND RELATED MATTERS

Voting Procedures

As a stockholder of Sundance, you have a right to vote on certain business matters affecting us. The proposals that will be presented at the Annual Meeting and upon which you are being asked to vote are discussed below in the “Proposals” section. Each share of Sundance common stock you owned as of the Record Date entitles you to one vote on each proposal presented at the Annual Meeting.

Methods of Voting

You may vote over the Internet, by phone, by mail or in person at the Annual Meeting. Please be aware that if you vote over the Internet, you may incur costs such as Internet access charges for which you will be responsible.

Voting over the Internet.

You can vote via the Internet. The website address for Internet voting is provided on your proxy card. You will need to use the control number appearing on your proxy card to vote via the Internet. You can use the Internet to transmit your voting instructions up until 11:59 p.m. Eastern Time on September 20, 2016. Internet voting is available 24 hours a day. If you vote via the Internet, you do not need to return a proxy card.

Voting by Mail.

If you received a printed proxy card, you can vote by marking, dating and signing it, and returning it in the postage-paid envelope provided. Please promptly mail your proxy card to ensure that it is received prior to the closing of the polls at the Annual Meeting.

Voting in Person at the Meeting.

If you attend the Annual Meeting and plan to vote in person, we will provide you with a ballot at the Annual Meeting. If your shares are registered directly in your name, you are considered the stockholder of record and you have the right to vote in person at the Annual Meeting. If your shares are held in the name of your broker or other nominee, you are considered the beneficial owner of shares held in street name. As a beneficial owner, if you wish to vote at the Annual Meeting, you will need to bring to the Annual Meeting a legal proxy from your broker or other nominee authorizing you to vote those shares.

Revoking Your Proxy

You may revoke your proxy at any time before it is voted at the Annual Meeting. To do this, you must:

|

|

·

|

enter a new vote over the Internet or by signing and returning a replacement proxy card;

|

|

|

·

|

provide written notice of the revocation to Randall F. Pearson at our principal executive office, 4626 North 300 West, Suite No. 365, Provo, Utah 84604; or

|

|

|

·

|

attend the Annual Meeting and vote in person.

|

Quorum and Voting Requirements

Stockholders of record at the close of business on the Record Date, are entitled to receive notice and vote at the meeting. On the Record Date, there were 44,128,441 issued and outstanding shares of our common stock. Each holder of common stock voting at the meeting, either in person or by proxy, may cast one vote per share of common stock held on the Record Date on all matters to be voted on at the meeting. Stockholders may not cumulate votes in the election of directors.

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote constitutes a quorum for the transaction of business at the meeting. Assuming that a quorum is present:

|

|

(1)

|

a plurality of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors will be required to elect Board nominees;

|

|

|

(2)

|

the ratification of the appointment of BDO USA, LLP as our independent registered accounting firm for the year ending March 31, 2017 will be approved if a majority of the shares of common stock outstanding as of the Record Date that are present and represented and entitled to vote at the Annual Meeting vote in favor of the proposal.

|

Votes cast by proxy or in person at the meeting will be tabulated by the election inspectors appointed for the meeting and who will determine whether a quorum is present. The election inspectors will treat abstentions and broker non-votes (i.e., shares held by a broker or nominee that are represented at the Annual Meeting, but with respect to which such broker or nominee is not instructed to vote on a particular proposal and does not have discretionary voting power) as shares that are present for purposes of determining the presence of a quorum. With regard to Proposals No. 1 and 2, broker non-votes and votes marked “withheld” will not be counted towards the tabulations of votes cast on such proposal presented to the stockholders, will not have the effect of negative votes and will not affect the outcome of the election of the directors or independent registered accounting firm.

If your shares are held by a bank or broker in street name, it is important that you cast your vote if you want it to count in the election of directors and independent registered accounting firm.

Voting of Proxies

When a proxy is properly executed and returned, the shares it represents will be voted at the meeting as directed. If no specification is indicated, the shares will be voted in accordance with the Board of Directors’ recommendations, as follow:

|

|

(1)

|

“for” the election of each Board nominee set forth in this proxy statement unless the authority to vote for such directors is withheld;

|

|

|

(2)

|

“for” the ratification of the Board of Directors’ appointment of BDO USA, LLP as our independent registered accounting firm for the year ending March 31, 2017; and

|

|

|

(3)

|

at the discretion of your proxy holder, on any other matter that may be properly brought before the meeting.

|

Voting Results

Voting results will be announced at the Annual Meeting and published in a Current Report on Form 8-K that will be filed with the Securities and Exchange Commission within four business days after the Annual Meeting.

Proxy Solicitation

We will bear the cost of this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for reasonable expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by our directors, officers or employees, personally, by telephone, facsimile, Internet or other means, without additional compensation. Except as described above, we do not presently intend to solicit proxies other than by mail.

EXECUTIVE OFFICERS AND DIRECTORS

Our executive officers and directors and their ages as of March 31, 2016, are as follows:

|

Name

|

|

Age

|

|

Position(s)

|

|

Kraig T. Higginson*

|

|

61

|

|

Chairman of the Board of Directors

|

|

Randall F. Pearson*

|

|

62

|

|

President, Chief Financial Officer and Director

|

|

Matthew G. Pearson

|

|

49

|

|

Chief Operating Officer

|

|

Ty Mattingly*

|

|

53

|

|

Director

|

|

*

|

|

Nominee for election to Board

|

Executive Officers

Randall F. Pearson

, 62, is our President and Chief Financial Officer and serves as a member of our Board of Directors. Mr. Pearson’s biographical information can be found under “Directors” below.

Matthew G. Pearson

, 49, has served as our Chief Operating Officer since 2013. There are no family relationships between Mr. Pearson and any director or executive officer of the Company. Mr. Pearson has 25 years of experience in corporate finance, real estate brokerage and development. He was a cofounding partner with EHI, LLC,

which was established in August of 2009. EHI, LLC is a Life Settlement Securitization Company, which worked through an almost $1,000,000,000 securitization of a pool of life settlement policies. During his tenure at the company, Mr. Pearson managed every aspect of the company’s business since inception, including transaction design and implementation, policy selection, ownership structure for the corporate entities to ensure appropriate tax treatment, to creation and consummation of agreements with 20 vendors required to structure and complete the bond offering tied to the securitization. From July 2011 until he was hired as COO with the Company, he was also a partner in Evolution Capital Partners, a company in the business of providing loans to small cap publicly-traded companies.

Directors

Kraig T. Higginson

, 61, has served as the Chairman of our Board of Directors since January 2015. Prior to that time, he served as Chief Executive Officer of VIA Motors, Inc. (“Via Motors”), a hybrid electric vehicle company (PHEV), from November 2010 to January 2014, where he was responsible for overseeing the management and business of Via Motors and its employees. From October 2003 until November 2010, he served as Chairman of the Board of Directors of Raser Technologies, Inc. (“Raser Technologies”), which was an NYSE listed company at that time. Mr. Higginson resigned as a director of Raser Technologies on February 11, 2011. Raser Technologies filed bankruptcy proceedings on April 29, 2011, and was subsequently delisted from NYSE. Mr. Higginson also founded American Telemedia Network, Inc. (“American Telemedia”), a publicly-traded NASDAQ company that developed a nationwide satellite network broadcasting data, video programming and advertising to shopping centers and malls, and he served as President and Chief Executive Officer of American Telemedia from 1984 through 1988.

Mr. Higginson brings to the Board of Directors leadership experience and business management expertise that includes serving as CEO of two public companies, one trading on the NYSE and the other on NASDAQ. Mr. Higginson also has experience serving on other boards and has been involved in many other business ventures.

Ty Mattingly

, 53, has served as a member of our Board of Directors since 2013. Since 2004 Mr. Mattingly has been a successful and active private equity and angel investor. He co-founded SBI-Razorfish in 1998, and led its growth to become a major independent interactive marketing firm in the country. This was accomplished by acquiring many of the largest publicly and privately held interactive marketing firms in the world. He sold the firm to Aquantive, which was later acquired by Microsoft. Prior to co-founding SBI-Razorfish, Mr. Mattingly was the co-founder and Senior Vice President of Sales and Business Development for Novonyx, a joint venture between Novell and Netscape, which was later acquired by Novell. Prior to his accomplishments at Novonyx, he worked at Novell and IBM in a variety of senior executive, management and marketing roles. Mr. Mattingly graduated from the College of Engineering at Brigham Young University, where he was a member of the 1984 NCAA National Championship Football Team and an Academic All-American.

Mr. Mattingly provides the Board of Directors with expertise in corporate finance and marketing. Having co-founded one of the largest interactive marketing firms, Mr. Mattingly’s experience with marketing and global finance is extremely essential to the complex business model operated by Sundance Strategies, Inc.

Randall F. Pearson

, 62, has served as our President and Chief Financial Officer and as a member of our Board of Directors since 2013. Mr. Pearson was employed by JWD Management Corp., dba, Video II for 26 years, resigning in May, 2011. He became the President of ANEW LIFE in February, 2013. While working at JWD, he served in various positions, including National Sales Manager, Vice President of Operations, Vice President, President and CEO. Video II has provided movie and DVD rental and other related services for grocery chains nationwide. Mr. Pearson managed the video rental program in 900 different grocery store locations. He has also fully managed the program that included videos and DVDs for sale, as well as other products in over 1,400 locations. He oversaw a full service merchandising program with representatives that serviced the products Video II supplied to the grocery stores, supervising over 70 employees at Video II’s corporate offices and over 450 employees in 33 states. Video II was one of the larger video “rackers” in the U.S. During this same time frame, Mr. Pearson also owned and managed his own residential and commercial investment properties, and has focused on those activities since leaving JWD in 2011. Mr. Pearson attended Brigham Young University from 1972 to 1977, studying Business Management, obtained a real estate broker’s license in 1977 and received a Series 7 Securities License in 1978.

Mr. Pearson brings to the Board of Directors experience in executive roles and a background of leading a nationwide organization through a sustained growth pattern and managing financial oversight. His experience in product development, strategic growth and financial oversight add much needed experience to our management team.

Significant Employees

Lisa L. Fuller, Esq.

, 49, has served as our general legal counsel since 2013. She is licensed in California, Texas and Oklahoma, with 12 years of law firm experience and seven years of in house counsel experience, in the areas of tax, contracts, corporations and partnerships, estate planning, insurance and exempt organizations. From 2009 to the beginning of April 2013, she was general legal counsel for NorthStar Life Services, LLC, of Irvine, California, the Servicer of the current portfolio of policies underlying the Company’s NIBs, where she managed a four person legal department; Structured international and domestic companies and transactions, reviewed and negotiated contracts; Managed all company litigation; tax planning (U.S. and internationally, with a focus in Luxembourg, Germany and the Cayman Islands); and oversaw the purchase of a European financial institution and assisted with obtaining various approvals from regulators related to business plans and deposits. She also served as general legal counsel for Pacifica Group, LLC, of Irvine, California, a predecessor of NorthStar, from 2006 until 2009, where, in addition to other services similar to those performed for NorthStar, she lobbied for the passage of regulations related to life settlements. She graduated from New York University, New York, NY, with an LL.M. Degree in Taxation, 1993; the University of Oklahoma, Norman, OK, receiving a J.D. Degree, 1992; and Trinity University, San Antonio, TX, receiving a B.A. Degree in Finance, 1988. Lisa is a member of the Bar Associations of Oklahoma and Texas.

Currently, our directors are elected on an annual basis. The term of each director’s service expires at our next annual meeting of stockholders and at such time as his or her successor is duly elected and qualified. We do not have employment agreements with our officers.

There are no family relationships between any of our director nominees or executive officers and any other of our director nominees or executive officers.

BOARD OF DIRECTORS

Our Bylaws provide that the size of our Board is to be determined by resolution of the Board. Our Board has fixed the exact number of directors at three. Our Board currently consists of three members.

The Board has nominated Mr. Kraig T. Higginson, Mr. Randall F. Pearson and Mr. Ty Mattingly for election at the Annual Meeting. The nominees have agreed to serve if elected, and management has no reason to believe that the nominees will be unavailable for service. If any nominee is unable or declines to serve as a director at the time of the Annual Meeting or any adjournment or postponement thereof, the proxies will be voted for such other nominees as may be designated by the present Board.

We are subject to a number of technological, regulatory, product, legal and other types of risks. The Board is responsible for overseeing these risks, and we employ a number of procedures to help them carry out that duty. For example, Board members regularly consult with executive management about pending issues and expected challenges, and at each Board meeting directors receive updates from, and have an opportunity to interview and ask questions of, key personnel and management. Furthermore, because our Chief Executive Officer serves as a member of our Board, we believe that the Board has a direct channel and better access to insights into our performance, business and challenges.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based upon the position and direction of the Company and the membership of the Board. The Board has determined at this time that the Company’s Chairman should not be its Chief Executive Officer.

The Board believes that of the current directors or nominees, Messrs. Higginson and Mattingly would qualify as independent directors as that term is defined in the listing standards of The NASDAQ Capital Market if we were listed on The NASDAQ Capital Market. Such independence definition includes a series of objective tests, including that the director is not an employee of the Company and has not engaged in various types of business dealings with the Company. As Mr. Pearson is also employed by the Company, the Board has determined that Mr. Pearson is not currently independent. Although the Company’s common stock is not listed on The NASDAQ Capital Market, the Company has applied The NASDAQ Capital Market independence rules to make its independence determinations.

Committees of the Board of Directors

The Board has not established an Audit Committee, a Compensation Committee or a Nominating Committee. Therefore, the Board has not adopted written charters for any of these committees. Because we have only three directors and two executive officers, we believe that we are able to effectively manage the issues normally considered by such committees. The Board also does not have an audit committee financial expert. We believe we are currently able to manage our audit and financial reporting obligations without an audit committee financial expert. However, as we grow, we will consider adding an audit committee financial expert.

In evaluating a director candidate, our Board of Directors will review his or her qualifications including capability, availability to serve, conflicts of interest, general understanding of business, understanding of the Company’s business and technology, educational and professional background, personal accomplishment and other relevant factors. Our Board of Directors has not established any specific qualification standards for director nominees and we do not have a formal diversity policy relating to the identification and evaluation of nominees for director, although from time to time the Board of Directors may identify certain skills or attributes as being particularly desirable to help meet specific needs that have arisen. Our Board of Directors may also interview prospective nominees in person or by telephone. After completing this evaluation, the Board of Directors will determine the nominees.

The Board has not adopted a formal process for considering director candidates who may be recommended by stockholders. However, our policy is to give due consideration to any and all such candidates. A stockholder may submit a recommendation for director candidates to us at our corporate offices, to the attention of Randall F. Pearson. We do not pay fees to any third parties to assist us in identifying potential nominees.

Number of Meetings

The Board held a total of two (2) meetings during 2016. Each incumbent director attended all of the Board meetings. Although we do not have a formal policy regarding attendance by directors at our annual meeting, we encourage directors to attend.

EXECUTIVE COMPENSATION

Executive Compensation Discussion and Analysis

The following discussion and analysis provides information regarding our executive compensation objectives and principles, procedures, practices and decisions, and is provided to help give perspective to the numbers and narratives that follow in the tables in this section. This discussion will focus on our objectives, principles, practices and decisions with regards to the compensation of Randall Pearson and Matthew Pearson, our named executive officers (“Named Executive Officers”) for Fiscal Year 2016.

Executive Compensation Objectives and Principles

The overall objective of our executive compensation program is to help create long-term value for our stockholders by attracting and retaining talented executives, rewarding superior operating and financial performance, and aligning the long-term interests of our executives with those of our stockholders. Accordingly, our executive compensation program incorporates the following principles:

|

|

·

|

Compensation should be based upon individual job responsibility, demonstrated leadership ability, management experience, individual performance, and Company performance.

|

|

|

·

|

Compensation should reflect the fair market value of the services received. We believe that a fair and competitive pay package is essential to attract and retain talented executives in key positions.

|

|

|

·

|

Compensation should reward executives for long-term strategic management and enhancement of stockholder value.

|

|

|

·

|

Compensation should reward performance and promote a performance oriented environment.

|

Executive Compensation Procedures

We believe that compensation paid to our executive officers should be closely aligned with our performance and the performance of each individual executive officer on both a short-term and a long-term basis, should be based upon the value each executive officer provides to us, and should be designed to assist us in attracting and retaining the best possible executive talent, which we believe is critical to our long-term success. To attain our executive compensation objectives and implement the underlying compensation principles, we follow the procedures described below.

Role of the Board

. The Board has responsibility for establishing and monitoring our executive compensation programs and for making decisions regarding the compensation of our Named Executive Officers. The Board sets the compensation package of the Named Executive Officers. Our President, Mr. Randall Pearson, suggests items to be considered by the Board from time to time, including the compensation package for the other Named Executive Officer; and participates in meetings in which the compensation package of the other Named Executive Officer is discussed.

The Board relies on its judgment in making compensation decisions after reviewing our performance and evaluating our executives’ leadership abilities and responsibilities with our Company and their current compensation arrangements. The Board’s assessment process is designed to be flexible so as to better respond to the evolving business environment and individual circumstances.

Role of Compensation Consultant

. We have not engaged a compensation consultant.

Elements of Compensation

Our executive compensation objectives and principles are implemented through the use of the following elements of compensation, each discussed more fully below:

|

|

·

|

Annual Incentive Bonuses

|

|

|

·

|

Stock-Based Compensation

|

Base Salary

. The Board approved the salaries of all our executive officers for Fiscal Year 2016. Base salaries are offered to ensure that our executive officers receive an ongoing level of compensation. Salary decisions concerning these officers were based upon a variety of considerations consistent with the compensation philosophy stated above. First, salaries were competitively set relative to both other companies in our industry and other comparable companies. The Board considered each officer’s level of responsibility and individual performance, including an assessment of the person’s overall value to the Company. In addition, internal equity among employees was factored into the decision. Finally, the Board considered our financial performance and our ability to absorb any increases in salaries.

Annual Incentive Bonuses

. Annual incentive bonuses are designed to reward extraordinary performance by our executives. For Fiscal Year 2016, the Board did not precisely define the parameters of a bonus program for the Named Executive Officers, and no bonuses were awarded to the Named Executive Officers.

Stock-Based Compensation

.

Each Named Executive Officer is eligible to receive stock-based compensation. Stock-based compensation is designed to more closely align the interests of management with those of our stockholders. We do not have any securities authorized for issuance under an equity compensation plan, or any policies for allocating compensation between long-term and currently paid out compensation or between cash and non-cash compensation or among different forms of non-cash compensation. No stock-based compensation was awarded to the Named Executive Officers in Fiscal Year 2016.

Other Benefits

. Our Named Executive Officers receive the same benefits that are available to all other full time employees, including the payment of health, dental, life and disability insurance premiums.

Deductibility of Executive Compensation

Internal Revenue Service (“IRS”) Code Section 162(m) limits the amount that we may deduct for compensation paid to our principal executive officer and to each of our three most highly compensated officers (other than our principal financial officer) to $1.0 million per person, unless certain exemption requirements are met. Exemptions to this deductibility limit may be made for various forms of performance-based compensation. In the past, annual salary and bonus compensation to our executive officers has not exceeded $1.0 million per person, so the compensation has been deductible. In addition to salary and bonus compensation, upon the exercise of stock options that are not treated as incentive stock options, the excess of the current market price over the option price, or option spread, is treated as compensation and accordingly, in any year, such exercise may cause an officer’s total compensation to exceed $1.0 million. Under certain regulations, option spread compensation from options that meet certain requirements will not be subject to the $1.0 million cap on deductibility. The Board cannot predict how the deductibility limit may impact our compensation program in future years.

The Board reviews and considers the deductibility of executive compensation under Section 162(m) of the IRS Code. In certain situations, the Board may approve compensation that will not meet the requirements of IRS Code Section 162(m) in order to ensure competitive levels of total compensation for its executive officers.

BOARD REPORT

The Board has reviewed the foregoing Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K, and discussed the Compensation Discussion and Analysis with the Company’s management. Based on such review and discussions with management, the Board concluded that the foregoing Compensation Discussion and Analysis be included in this Proxy Statement.

BOARD OF DIRECTORS

Kraig T. Higginson

Randall F. Pearson

Ty Mattingly

Summary Compensation Table

The following information presents the compensation paid to our principal executive officers in Fiscal Year 2016 and 2015. We refer to these executive officers as the Named Executive Officers.

|

Name and

Principal Position

|

Year

|

Salary

($)

|

|

Bonus

($)

|

|

Stock Awards

($)

|

|

Option Awards

($)

|

|

Non-Equity

Incentive Plan

Compensation

($)

|

|

All Other

Compensation

($)

|

|

|

Total

($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Randall F. Pearson

|

2016

|

|

120,000

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

120,000

|

|

|

Chief Financial Officer

|

2015

|

|

120,000

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

|

120,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Matthew G. Pearson

|

2016

|

|

210,000

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

210,000

|

|

|

Chief Operating Officer

|

2015

|

|

210,000

|

|

|

2,500

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

|

212,500

|

|

Outstanding Equity Awards at Fiscal Year End

The following table presents for each named executive officer, information regarding outstanding stock options and stock awards held as of March 31, 2016.

|

|

|

Option Awards

|

|

|

Stock Awards

|

|

|

Named Executive Officer

|

|

Number of

securities

underlying

unexercised

options

exercisable(1)

|

|

|

Number of

securities

underlying

unexercised

options

unexercisable(2)

|

|

|

Option

exercise

price ($)

|

|

|

Option

expiration

date

|

|

|

Numbers

of shares

or units

of stock

that

have not

vested

|

|

|

Market

value of

shares or

units of

stock that

have not

vested ($)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

The options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the shares of common stock on the date of exercise.

|

|

|

|

|

(2)

|

The remainder of Mr. Randall Pearson’s unvested options will vest on 3/31/2017. Mr. Matthew Pearson’s unvested options will vest at a rate of 11,111 options per month, and will be fully vested by 9/11/2016.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows information regarding the beneficial ownership of our common stock as of June 30, 2016 by (a) each stockholder, or group of affiliated stockholders, that we know owns more than 5% of our outstanding common stock; (b) each of our named executive officers; (c) each of our directors; and (d) all of our current directors and executive officers as a group. The table is based upon information supplied by directors, executive officers and principal stockholders, and Schedules 13D and 13G filed with the Securities and Exchange Commission.

Percentage ownership in the table below is based on 44,128,441 shares of common stock outstanding as of June 30, 2016. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, and generally includes voting power and/or investment power with respect to the securities held. Any securities not outstanding but which are subject to options or warrants exercisable within 60 days of June 30, 2016 are deemed outstanding and beneficially owned for the purpose of computing the percentage of outstanding common stock beneficially owned by the stockholder holding such options or warrants, but are not deemed outstanding for the purpose of computing the percentage of common stock beneficially owned by any other stockholder.

Unless otherwise indicated, each of the stockholders listed below has sole voting and investment power with respect to the shares beneficially owned. The address for each director or named executive officer is c/o Sundance Strategies, Inc., Attention: Randall F. Pearson, 4626 North 300 West, Suite No. 365, Provo, Utah 84604.

|

Name and Address of Beneficial Owner

|

|

Shares Beneficially Owned

|

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Directors and Named Executive Officers

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All executive officers and directors as a group (4 persons)

|

|

|

|

|

|

|

|

|

|

5% Stockholders Not Listed Above

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Smartrade Consulting, Inc. (7)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Less than 1.0%.

|

(1)

|

Mr. Higginson’s ownership includes 750,000 shares owned by Eclipse Fund LLC; 320,000 shares owned by Radion Energy LLC; and 370,000 shares owned by Ecosystems Resources LLC.

|

|

|

|

|

(2)

|

Mr. Mattingly’s ownership includes 4,000,000 shares owned in the name of Primary Colors, LLC; 1,500,000 shares owned in the name of North Shore Foundation, LLP. Mr. Mattingly is the beneficial owner of Primary Colors, LLC and North Shore Foundation, LLP. It also includes 437,500 shares underlying vested stock options.

|

|

|

|

|

(3)

|

Mr. Randy Pearson’s ownership includes 437,500 shares underlying stock options that have vested, or will vest within 60 days of June 30, 2016.

|

|

|

|

|

(4)

|

Mr. Matthew Pearson’s ownership consists of 377,778 shares underlying stock options that vested, or will vest within 60 days of June 30, 2016.

|

|

|

|

|

(5)

|

ZOE, LLC and Radiant Life, LLC are beneficially owned by Mitchell D. Burton, for an aggregate percentage of ownership of approximately 45%. The address of ZOE, LLC is 4626 N. 300 W., Provo, Utah 84604. The address of Radiant Life, LLC is 4626 N. 300 W., Provo, Utah 84604.

|

|

|

|

|

(6)

|

Primary Colors, LLC is beneficially owned by Ty Mattingly, a director of the Company. The address of Primary Colors, LLC is 22 West 620 South, Orem, Utah 84058.

|

|

|

|

|

(7)

|

Smartrade Consulting, Inc. is held by Summit Trustees PLLC for the beneficial owner, Lam Ping of Hong Kong. The address of Smartrade Consulting, Inc. is 22G Tower 4, The Metropolis, 8 Mau Yip Road, Tsung Kwan Q, N.T., Hong Kong

|

|

|

|

|

(8)

|

Mr. Dickman’s ownership includes 421,875 shares underlying vested stock options. Mr. Dickman’s address is 13559 Tuscalee Way, Draper, Utah 84020

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Review and Approval of Related Person Transactions

Before engaging in a related person transaction, the transaction is presented to non-interested board members for approval. In considering related person transactions, the non-interested board members are guided by their fiduciary duty to our stockholders. The Board of Directors does not have any written or oral policies or procedures regarding the review, approval and ratification of transactions with related person. Additionally, each of our directors and executive officers are required to annually complete a directors’ and officers’ questionnaire that elicits information about related person transactions. Approval of a related person transaction is provided either verbally or in writing.

Related Person Transactions

Other than as described below, there were no material transactions, or series of similar transactions, during our last two fiscal years, or any currently proposed transactions, or series of similar transactions, to which we or any of

our subsidiaries was or is to be a party, in which the amount involved exceeded the lesser of $120,000 or 1% of the average of our total assets at year-end for the last two completed fiscal years and in which any director, executive officer or any security holder who is known to us to own of record or beneficially more than 5% of any class of our common stock, or any member of the immediate family of any of the foregoing persons, had an interest, except as stated below.

As of March 31, 2016, the Company had borrowed $3,820,178 from related persons under notes payable and lines-of-credit agreements that were entered into in February 2015 (the “February 2015 Agreements”) and July 2015 (the “July 2015 Agreements”), that allow for borrowings of up to $3,100,000 and $2,130,000, respectively, through the earlier of June 30, 2017, or when the Company completes a successful equity raise, at which time principal and interest is due in full. Each of the February 2015 Agreements and the July 2015 Agreements incur interest at 7.5 percent, allow for origination fees and are collateralized by Investment in NIBs. The Company borrowed $1,500,000 under the February 2015 Agreement during the year ended March 31, 2015, and borrowed $2,570,178 under the July 2015 Agreement during the year ended March 31, 2016. The Company also repaid $200,000 of principal owed under the July 2015 Agreement during the year ended March 31, 2016 and, as of June 30, 2016, the Company has $1,500,000 outstanding under the February 2015 Agreement and $2,375,178 outstanding under the July 2015 Agreement. The February 2015 Agreement is with Radiant Life, LLC, an entity partially owned by Mr. Higginson, the Chairman of the Board of Directors and a stockholder, and the July 2015 Agreement is with Mr. Higginson, the Chairman of the Board of Directors and a stockholder.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and persons who beneficially own more than 10% of our Class A Common Stock ("Reporting Persons") to file reports with the Securities and Exchange Commission regarding their ownership of our Class A Common Stock and changes in that ownership. As a practical matter, the company assists its directors and executive officers by monitoring transactions and completing and filing Section 16(a) reports on their behalf. Based solely on a review of the reports filed for Fiscal Year 2016and on written representations from our directors and executive officers, we believe that all required reports under Section 16(a) were filed on a timely basis.

REPORT OF THE BOARD OF DIRECTORS

Because we do not have an audit committee, the Board is responsible for monitoring our financial auditing, accounting, and financial reporting processes and our system of internal controls. Our management has primary responsibility for our internal controls and reporting process. Our independent registered public accounting firm, Mantyla McReynolds, LLC (“Mantyla”), was responsible for performing an independent audit of our consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States) ("PCAOB") and issuing an opinion thereon. The Board’s responsibility is to monitor these processes. In this context, the Board met and held discussions with management and Mantyla. Management represented to the Board Committee that the consolidated financial statements for the Fiscal Year 2016 were prepared in accordance with generally accepted accounting principles.

The Board hereby reports as follows:

|

|

·

|

The Board has reviewed and discussed the audited consolidated financial statements and accompanying management's discussion and analysis of financial condition and results of operations with our management and Mantyla. This discussion included Mantyla's judgments about the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

|

|

|

·

|

The Board also discussed with Mantyla the matters required to be discussed under generally accepted auditing standards and Auditing Standard No. 16, as amended (Communications with Audit Committees), as adopted by the PCAOB, and under applicable SEC and PCAOB requirements.

|

|

|

·

|

Mantyla also provided to the Board the written disclosures and the letter required by applicable requirements of the PCAOB regarding Mantyla's communications with the Board concerning

|

|

|

independence, and the Board has discussed with Mantyla the accounting firm's independence. The Board also considered whether non-audit services provided by Mantyla during the last fiscal year were compatible with maintaining the accounting firm's independence.

|

|

|

·

|

Based on the review and discussions referred to above, we included the audited consolidated financial statements in our Annual Report on Form 10-K for the year ended March 31, 2016, for filing with the Securities and Exchange Commission

|

THE BOARD OF DIRECTORS

Kraig T. Higginson

Randall F. Pearson

Ty Mattingly

PROPOSALS

PROPOSAL NO. 1 – ELECTION OF DIRECTORS

There are currently three members of our Board. Historically, the Board has consisted of only three members. The terms of all of our directors are scheduled to expire at the 2016 Annual Meeting of Stockholders, at which time all three of the incumbents will stand for re-election.

Nominees

The Board has nominated the following individuals to serve on the Board of Directors.

|

Name

|

|

Age

|

|

Positions Held

|

|

Director Since

|

|

Officer Since

|

|

|

|

|

|

|

|

|

|

|

|

Kraig T. Higginson

|

|

61

|

|

Chairman of the Board of Directors

|

|

January 2015

|

|

N/A

|

|

Randall F. Pearson

|

|

62

|

|

President, Chief Financial Officer and Director

|

|

April 2013

|

|

March 2013

|

|

Ty Mattingly

|

|

53

|

|

Director

|

|

March 2013

|

|

N/A

|

Business background and biographical information on Kraig T. Higginson, Randall F. Pearson and Ty Mattingly is set forth above under “Executive Officers and Directors—Directors.”

Vote Required

A plurality of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors will be required to elect Board nominees. The three nominees receiving the highest number of affirmative votes cast at the Annual Meeting will be elected as our directors. Proxies cannot be voted for a greater number of persons than the number of nominees named.

The Board recommends that stockholders vote “

FOR

” the election of each of the above-listed nominees.

Unless marked otherwise, proxies received will be voted “FOR” the election of each of these director nominees.

PROPOSAL NO. 2 – RATIFICATION OF APPOINTMENT OF BDO USA, LLP

The Board of Directors has engaged the registered public accounting firm of BDO USA, LLP as our independent registered public accounting firm to audit our financial statements for the year ending March 31, 2017. Mantyla McReynolds, LLC audited our financial statements for the year ended March 31, 2016. Mantyla McReynolds, LLC merged with BDO USA, LLP on July 1, 2016. As a result of this transaction, the Board opted to appoint BDO USA, LLP as the Company’s independent registered public accounting firm. Stockholder ratification of such selection is not required by our Bylaws or other applicable legal requirement. However, our Board is submitting the selection of BDO USA, LLP to stockholders for ratification as a matter of good corporate practice. In the event that stockholders fail to ratify the selection, our Board of Directors will reconsider whether or not to retain that firm. Even if the selection is ratified, our Board of Directors in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if our Board of Directors believes that such a change would be in our and our stockholders’ best interests.

Mantyla McReynolds, LLC’s reports on the Company’s financial statements as of and for the fiscal years ended March 31, 2016 and 2015, did not contain any adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the Company’s fiscal years ended March 31, 2016 and 2015, and through July 21, 2016, there were no disagreements between the Company and Mantyla on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Mantyla, would have caused Mantyla to make reference to the subject matter of the disagreements in connection with its audit reports on the Company’s financial statements. During the Company’s past fiscal years ended March 31, 2016 and 2015 and the interim period through July 21, 2016, Mantyla did not advise the Company of any of the matters specified in Item 304(a)(1)(v) of Regulation S-K.

During the Company’s two most recently completed fiscal years and through the date of engagement of BDO, neither the Company nor anyone on behalf of the Company consulted with BDO regarding (a) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements as to which the Company received a written report or oral advice that was an important factor in reaching a decision on any accounting, auditing or financial reporting issue; or (b) any matter that was the subject of a disagreement or a reportable event as defined in Items 304(a)(1)(iv) and (v), respectively, of Regulation S-K.

Principal Accountant Fees and Services

The following table presents approximate fees for professional services rendered by Mantyla McReynolds, LLC for the audit of our annual financial statements for the fiscal years ending March 31, 2016 and March 31, 2015 and approximate fees billed for other services rendered by Mantyla McReynolds, LLC during those periods.:

Audit fees

consist of Mantyla McReynolds, LLC's fees for services related to their audits of our annual financial statements, their review of financial statements included in our quarterly reports on SEC Form 10-Q, their review of SEC filed registration statements, and fees for services that are normally incurred in connection with statutory and regulatory filings or engagements, such as the issuance of consents and comfort letters.

Audit-related fees

consist of fees for assurance related services that are reasonably related to the performance of the audit or review of our consolidated financial statements but are not considered "audit fees."

Tax fees

consist of fees rendered for services on tax compliance matters including tax return preparation, assistance with tax audits of previously filed tax returns, and tax consulting and advisory services.

All other fees

consist of fees for professional services rendered by our independent registered public accounting firm for permissible non-audit services, if any. We did not incur any fees under this category in 2016 or 2015.

Audit Committee Pre-Approval Policies and Procedures

Our Board has determined to pre-approve all audit and permissible non-audit services and so does not feel a pre-approval policy is necessary at this time. Our Board pre-approved all audit and permissible non-audit services. These services may have included a

u

dit services, audit-related services, tax services and other services. Our Board approved these services on a case-by-case basis.

Attendance at Annual Meeting

Representatives from BDO USA, LLP are expected to be present at the annual meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to appropriate questions.

The proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm to audit our financial statements for the year ending March 31, 2017 will be approved if a majority of the shares of common stock outstanding as of the Record Date that are present and represented and entitled to vote at the Annual Meeting vote in favor of the proposal.

The Board recommends that stockholders vote “

FOR

” the proposal to ratify the appointment of BDO USA, LLP as our independent registered public accounting firm to audit our financial statements for the year ending March 31, 2017.

Unless marked otherwise, proxies received will be voted “FOR” Proposal No. 2.

OTHER BUSINESS

We know of no other matters to be submitted to the stockholders at the Annual Meeting. If any other matters properly come before the stockholders at the Annual Meeting, the persons named on the enclosed proxy card intend to vote the shares they represent as the Board may recommend.

ANNUAL REPORT ON FORM 10-K

This proxy statement is being furnished to you with a copy of our annual report on Form 10-K for the year ended March 31, 2016. We will provide, without charge, additional copies of our annual report on Form 10-K to each stockholder of record as of the Record Date that requests a copy in writing. Any exhibits listed in the annual report on Form 10-K report also will be furnished upon request at the actual expense we incur in furnishing such exhibit. Any such requests should be directed to Randall F. Pearson at our executive offices set forth above.

STOCKHOLDER PROPOSALS

Stockholders may present proposals for action at a future meeting if they comply with SEC rules, state law and our Bylaws.

Pursuant to Rule 14a-8 under the Exchange Act, some stockholder proposals may be eligible for inclusion in the proxy statement for our 2017 Annual Meeting of Stockholders (the “2017 Annual Meeting”). These stockholder proposals, along with proof of ownership of our stock in accordance with Rule 14a-8(b)(2), must be received by us not later than March 31, 2017, which is 120 calendar days prior to the anniversary date of the mailing of this proxy statement. Stockholders are also advised to review our Bylaws which contain additional advance notice requirements, including requirements with respect to advance notice of stockholder proposals (other than non-binding proposals presented under Rule 14a-8) and director nominations.

The proxies to be solicited by us through our Board for our 2017 Annual Meeting will confer discretionary authority on the proxy holders to vote on any stockholder proposal presented at that meeting, unless we receive notice of such stockholder’s proposal not later than June 14, 2017, which is 45 calendar days prior to the anniversary date of the mailing of this proxy statement.

Stockholder proposals must be in writing and should be addressed to c/o Sundance Strategies, Inc., Attention: Randall F. Pearson, 4626 North 300 West, Suite No. 365, Provo, Utah 84604. It is recommended that stockholders submitting proposals utilize certified mail, return receipt requested in order to provide proof of timely receipt. The Chairman of the Annual Meeting reserves the right to reject, rule out of order or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions set forth in our Bylaws and conditions established by the SEC.

We have not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this year’s Annual Meeting. The enclosed proxy grants the proxy holders discretionary authority to vote on any matter properly brought before this year’s Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Randall F. Pearson

President,

Chief Financial Officer and Director

July 29, 2016

Provo, Utah

SUNDANCE STRATEGIES, INC.

Annual Meeting of Stockholders

September 21, 2016 3:00 PM (MDT)

This proxy is solicited by the Board of Directors

The stockholder(s) hereby appoint(s) Randall F. Pearson as proxy, with the power to appoint his substitute(s), and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common stock of SUNDANCE STRATEGIES, INC. that the stockholder(s) is/are entitled to vote at the Annual Meeting of Stockholders to be held at 03:00 PM, MDT on 9/21/2016, at 4626 North 300 West, Provo, Utah 84604, and any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors’ recommendations.

Continued and to be signed on reverse side

VOTE BY INTERNET - www.proxyvote.com

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE - 1-800-690-6903

Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

x

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

The Board of Directors recommends you vote FOR the following:

1. Election of Directors

|

Nominees

|

|

|

|

|

|

For

|

Against

|

Abstain

|

|

1. Kraig T. Higginson

|

☐

|

☐

|

☐

|

|

|

|

|

|

|

2. Randall F. Pearson

|

☐

|

☐

|

☐

|

|

|

|

|

|

|

3. Ty Mattingly

|

☐

|

☐

|

☐

|

The Board of Directors recommends you vote FOR the following proposal:

|

|

For

|

Against

|

Abstain

|

2. To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for the year ending March 31, 2017.

|

☐

|

☐

|

☐

|

|

|

|

|

|

NOTE

: Such other business as may properly come before the meeting or any adjournment thereof.

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name, by authorized officer.

|

|

|

|

|

|

|

Signature [PLEASE SIGN WITHIN BOX]

|

Date

|

|

Signature (Joint Owners)

|

Date

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting:

The Notice & Proxy Statement and Annual Report on Form 10K are available at

www.proxyvote.com

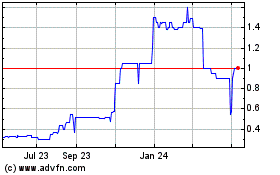

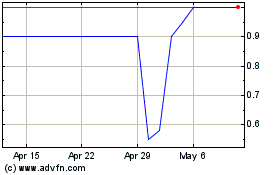

Sundance Strategies (QB) (USOTC:SUND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sundance Strategies (QB) (USOTC:SUND)

Historical Stock Chart

From Apr 2023 to Apr 2024