SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of July, 2016

Commission File Number: 001-02413

Canadian

National Railway Company

(Translation of registrant’s name into English)

935 de la Gauchetiere Street West

Montreal, Quebec

Canada

H3B 2M9

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F

¨

Form 40-F

x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

¨

No

x

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

¨

No

x

Indicate by check mark whether by furnishing the

information contained in this Form, the Registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes

¨

No

x

If “Yes” is marked, indicate below the

file number assigned to the registrant in connection with Rule 12g3-2(b):

N/A

Canadian National Railway Company

Table of Contents

|

|

|

|

|

Item

|

|

|

|

|

|

|

1.

|

|

CN announces US$650-million debt offering

|

Item 1

NEWS RELEASE

CN announces US$650-million debt offering

MONTREAL, July 28, 2016 —

CN (TSX: CNR) (NYSE: CNI) today announced a public debt offering of US$650 million 3.20% Notes due 2046. CN expects to

close the offering on Aug. 2, 2016, subject to customary closing conditions.

CN plans to use the net proceeds from the offering for general corporate

purposes, including the redemption and refinancing of outstanding indebtedness, and share repurchases.

The debt offering is being made in the United

States under an effective shelf registration statement CN filed on Jan. 5, 2016. The joint book-running managers of the debt offering are: Merrill Lynch, Pierce, Fenner & Smith Incorporated, RBC Capital Markets, LLC, and Wells Fargo Securities,

LLC. The co-managers of the debt offering are Citigroup Global Markets Inc., HSBC, BMO Capital Markets, BNP PARIBAS, MUFG, Scotiabank, SMBC Nikko, TD Securities, and US Bancorp.

A copy of the prospectus supplement and the accompanying prospectus for the offering may be obtained by contacting: Merrill Lynch, Pierce, Fenner & Smith

Incorporated, 200 North College Street, NC1-004-03-43, Charlotte, NC 28255, Attention: Prospectus Department, toll-free: 1-800-294-1322, email: dg.prospectus_requests@baml.com; RBC Capital Markets, LLC, Three World Financial Center, 200 Vesey

Street, 8th Floor, New York, NY 10281, Attention: Debt Capital Markets, toll-free: (866) 375-6829, email: usdebtcapitalmarkets@rbccm.com; or Wells Fargo Securities, LLC, 608 2nd Avenue South, Suite 1000, Minneapolis, MN 55402, Attention: WFS

Customer Service, toll-free: 1-800-645-3751, email: wfscustomerservice@wellsfargo.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor will there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any

such jurisdiction.

Forward-Looking Statements

Certain information included in this news release constitutes “forward-looking statements” within the meaning of the United States Private Securities

Litigation Reform Act of 1995 and under Canadian securities laws, including statements relating to potential debt refinancing as well as with respect to the timing and completion of the proposed debt offering, which is subject to customary

termination rights and closing conditions. By their nature, these forward-looking statements involve risks, uncertainties and assumptions and CN’s Board of Directors has discretion in the use of the proceeds from the offering to which this news

release relates. The Company cautions that its assumptions may not materialize and that the current economic conditions render such assumptions, although reasonable at the time they were made, subject to greater uncertainty. Forward-looking

statements may be identified by the use of terminology such as “believes,” “expects,” “anticipates,” “assumes,” “outlook,” “plans,” “targets,” or other similar words.

Forward-looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors which may cause the

actual results or performance of the Company to be materially different from the outlook or any future results or performance implied by such statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

Important risk factors that could affect the forward-looking statements include, but are not limited to, the effects of general economic and business conditions; industry competition; inflation, currency and interest rate fluctuations; changes in

fuel prices; legislative and/or regulatory developments; compliance with environmental laws and regulations; actions by regulators; security threats; reliance on technology; transportation of hazardous materials; various events which could disrupt

operations, including natural events such as severe weather, droughts, floods and earthquakes; effects of climate change; labor negotiations and disruptions; environmental claims; uncertainties of investigations, proceedings or other types of claims

and litigation; risks and liabilities arising from derailments; and other risks detailed from time to time in reports filed by CN with securities regulators in Canada and the United States. Reference should be made to Management’s Discussion

and Analysis in CN’s annual and interim reports, Annual Information Form and Form 40-F, filed with Canadian and U.S. securities regulators and available on CN’s website, for a description of major risk factors.

Forward-looking statements reflect information as of the date on which they are made. CN assumes no obligation to update or revise forward-looking statements

to reflect future events, changes in circumstances, or changes in beliefs, unless required by applicable securities laws. In the event CN does update any forward-looking statement, no inference should be made that CN will make additional updates

with respect to that statement, related matters, or any other forward-looking statement.

CN’s transports more than C$250 billion worth of goods annually for a wide range of business sectors,

ranging from resource products to manufactured products to consumer goods, across a rail network of approximately 20,000 route-miles spanning Canada and mid-America. CN – Canadian National Railway Company, along with its operating railway

subsidiaries – serves the cities and ports of Vancouver, Prince Rupert, B.C., Montreal, Halifax, New Orleans, and Mobile, Ala., and the metropolitan areas of Toronto, Edmonton, Winnipeg, Calgary, Chicago, Memphis, Detroit, Duluth,

Minn./Superior, Wis., and Jackson, Miss., with connections to all points in North America.

Contacts:

|

|

|

|

|

Media

|

|

Investment Community

|

|

Mark Hallman

|

|

Paul Butcher

|

|

Director

|

|

Vice-President

|

|

Communications and Public Affairs

|

|

Investor Relations

|

|

(905) 669-3384

|

|

(514) 399-0052

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CANADIAN NATIONAL RAILWAY COMPANY

|

|

|

|

|

|

|

Date: July 28, 2016

|

|

|

|

By:

|

|

/s/ Cristina Circelli

|

|

|

|

|

|

|

|

Name: Cristina Circelli

|

|

|

|

|

|

|

|

Title: Deputy Corporate Secretary and General Counsel

|

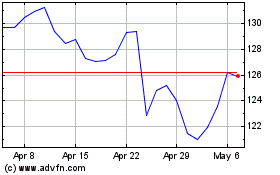

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian National Railway (NYSE:CNI)

Historical Stock Chart

From Apr 2023 to Apr 2024