PURA PPS Potential Rated Very Bullish; Up $0.03 to $0.06 After Cannabis Extraction PR; Only 50 Million I/O; Potential to $1.00

July 19 2016 - 11:01AM

InvestorsHub NewsWire

New York, NY – July

19, 2016 – InvestorsHub NewsWire -- Wall Street Corner Report today

highlighted StockTA’s candle stick analysis indicating a

very bullish rating on the PPS potential of Puration, Inc.

(PURA).

After working quietly over the last year developing standardized

and repeatable cannabis extraction processes to produce

consistently high-quality extracts, Puration recently announced

plans to bring its extracts to market. In the past week, the

trading volume has exceeded the total number of shares traded over

the previous two years. The PPS has risen from $0.03 to $0.06

reaching a high of $0.09. With only 50 million shares I/O,

The Wall Street Corner Report believes PURA has the potential to

reach a $1.00 PPS.

Puration today announced a campaign to brand its cannabis extracts

as the leading concentrates for infusion into recognized food and

beverage consumer products:

Puration Announces Campaign to Brand

Cannabis Extract in Food and Beverage Consumer Products Market Led

by Beverage Industry Veteran

The Company was also featured today in a

Cannabis Industry article also mentioning PharmaCyte Biotech, Inc. (PMCB), GrowLife, Inc. (PHOT), Hemp, Inc. (HEMP) & Medical Marijuana,

Inc. (MJNA):

The Wall Street Corner Report considers

PURA comparable to an earlier version of

GW

Pharmaceuticals (GWPH) in that both are

developing commercial applications of cannabis extracts.

Wall Street Corner Report anticipates PURA to experience an

‘accumulation phase’ with the shareholder base expanding and

diversifying. As the Company’s news becomes more disseminated

throughout the market, Wall Street Corner Report

anticipates a rapid PPS increase to as high as

$1.00.

GWPH has a market cap of $2B - approximately

33 times revenue. The majority of revenue is non-cash

consideration while the company is still largely in a research

phase. If PURA were to achieve a

valuation at only 15 times its forecasted $3 million revenue, the

PPS would be $0.90.

This press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended

(the "Exchange Act"), and as such, may involve risks and

uncertainties. These forward looking statements relate to, amongst

other things, current expectation of the business environment in

which the company operates, potential future performance,

projections of future performance and the perceived opportunities

in the market. The company's actual performance, results and

achievements may differ materially from the expressed or implied in

such forward-looking statements as a result of a wide range of

factors.

Jack Taylor

info@wallstreetcornerreport.com

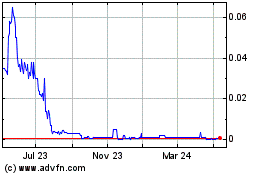

Growlife (CE) (USOTC:PHOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

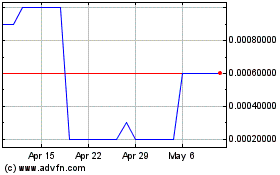

Growlife (CE) (USOTC:PHOT)

Historical Stock Chart

From Apr 2023 to Apr 2024