CMO Today: Mondelez Wants Hershey, And Maybe Its Brand Too

July 01 2016 - 8:18AM

Dow Jones News

By Mike Shields

HERSHEY KISS: Mondelez International, maker of food products

like Oreo and Ritz, made a $23 billion bid for Hershey Co., reports

The Wall Street Journal. Besides creating a company that has all

the makings of a six-year-old's ideal dinner (cookies, crackers and

chocolate), the potential maneuver could yield an interesting

marketing twist: Mondelez, a company with a name that nobody gets,

offered to assume the beloved brand of Hershey (one that

practically evokes childhood), CMO Today reports. Hershey rejected

the approach, so this may not come to fruition, but if the merger

dance resumes, this would be a way for Mondelez to ditch its

much-mocked moniker. The name blends two words of Latin

origin--"monde" (translation: world) and "delez" (translation:

delicious). It seems that some people don't appreciate how cool

Latin is in 2016. "I would put Mondelez up there with some of the

worst corporate names," said Kelly O'Keefe, a marketing professor

at Virginia Commonwealth University's Brandcenter.

LION'S SHARE: Media mogul John Malone is a big-picture thinker

who excels at complicated, tax-efficient mergers and always seems

to come out with significant control over whatever emerges. Lions

Gate's acquisition of premium cable network Starz for $4.4 billion

in a cash-and-stock deal is no exception. Mr. Malone is Starz's

largest voting shareholder, owns 3% of Lions Gate, and is on the

studio's board. The deal is part of Mr. Malone's bigger plan to

consolidate smaller entertainment players, as WSJ reports, and

Lions Gate, which has been investing in its TV production, can

supply programming to Starz, which boasts 24 million subscribers.

As Reuters Breakingviews reports, the structure of the deal is

"classic Malone." There are both non-voting shares and voting

shares being used as currency, and Mr. Malone will get enough of

the latter to have a nice big seat at the table, as usual.

SHARING IS HARD: First, Facebook telegraphed its plans to

de-emphasize content from media companies in favor of posts from

friends and family, after reports that people aren't posting on the

social network as much as they used to. Now, Instagram is facing

the same sort of problem, reports The Information. The obvious

culprit in Instagram's case is Snapchat, given they are both

image-centric and target a young demographic. It's just more fun

for the kids these days to post snaps over heavily filtered photos

of appetizers and landscapes. But there's possibly something larger

at play: the longer people are on social networks, the more

integral they become to their lives. Yet they also get old, and

digital media always provides something new and shiny. So Instagram

and Facebook have to constantly evolve or risk getting dropped to

people's social second tier.

BIG STREAMIN': Jay Z's Tidal streaming music service has had a

string of leadership challenges since the rap mogul purchased it

last year--three CEOs and counting. The product launched in a

crowded marketplace, considering Spotify's rapid ascension, and the

buzz hasn't been great (except when Tidal stood out as the only

place where you could stream old Prince songs and Beyonce's new

album). Is Apple coming to the rescue? Apple is in talks to acquire

Tidal, but no deal is imminent, reports WSJ. A Tidal spokesman said

Tidal executives hadn't held talks with Apple. It's not clear what

Tidal would bring Apple financially (Jay Z bought the service last

year for $56 million from Swedish company Aspiro), but the

artist-friendly service has strong connections with artists like

Kanye West and Madonna. Plus, if you're in the music business, it

seems like you want to be on good terms with the Queen Bey

(Beyonce).

Elsewhere

Dish Network's Sling TV service--its skinny bundle aimed at

cord-cutters--has added a slew of NBCUniversal networks, including

USA, Bravo, Syfy and NBC Sports Network as well as local NBC

affiliates. [ Mashable]

Disney has agreed to acquire a one-third stake in the video unit

of MLB Advanced Media, according to Bloomberg, valuing it at $3.5

billion. As part of the deal, the media giant has a four-year

option to purchase another 33%. [ Bloomberg]

News Corporation has acquired the U.K. based radio company

Wireless Group for $220 million Euros. [ The Guardian]

The broadcast TV upfronts are pretty much done, reports Ad Age,

with ABC and Fox doing the usual bragging about volume and price

increases after CBS and CW had already wrapped up the bulk of their

selling. NBC has a bit more selling to do. [ Ad Age]

Adnan Syed, the subject of the first season of the popular

podcast "Serial," has been granted a new trial in Baltimore. Mr.

Syed was convicted of murder in 2000. [ NYT]

Fiery talk show host Nancy Grace is planning to leave Headline

News after more than a decade on the air. [ Hollywood Reporter]

Spotify is accusing Apple of deliberately rejecting Spotify's

recent app update. The Swedish music streaming company has sent

Apple's legal team a letter claiming that Apple wants to force

Spotify use Apple's billing system in its app, potentially making

it harder for Spotify to acquire customers. [ Recode]

New York Times CEO Mark Thompson told CNN's Brian Stelter that

"there's a least a decade, maybe more, of profitable activity" for

the company's print newspaper business. [ CNN]

IBT Media, which owns IBTimes.com and Newsweek, laid off at

least 30 staffers on Thursday. [ Politico]. The company also moved

Newsweek "into a separate operational entity." [ Ad Age]

A Massachusetts judge is seeking more information on Sumner

Redstone's health and details of his estate planning as he weighs

the merits of a lawsuit challenging the mogul's mental capacity,

brought by Viacom Inc. Chairman and Chief Executive Philippe Dauman

and board member George Abrams. [ WSJ]

About Us

Follow us on Twitter: @wsjCMO, @digitalshields, @VranicaWSJ,

@JackMarshall, @nftadena, @perlberg, @srabil, @asharma

Subscribe to our morning newsletter, delivered straight to your

inbox, at http://on.wsj.com/CMOTodaySignup.

Write to Mike Shields at mike.shields @wsj.com

(END) Dow Jones Newswires

July 01, 2016 08:03 ET (12:03 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

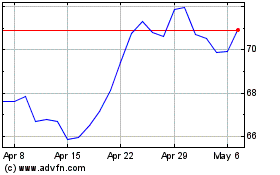

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

Mondelez (NASDAQ:MDLZ)

Historical Stock Chart

From Sep 2023 to Sep 2024