Amended Tender Offer Statement by Issuer (sc To-i/a)

June 28 2016 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO/A

(Amendment No. 1)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

PROVECTUS

BIOPHARMACEUTICALS, INC.

(Name of Subject Company and Filing Person (Issuer))

Warrants to Purchase Common Stock

(Title of Class of Securities)

74373P116

(CUSIP Number

of Common Stock Underlying Warrants)

Peter R. Culpepper

Provectus Biopharmaceuticals, Inc.

7327 Oak Ridge Highway, Suite A

Knoxville, TN 37931

(866) 594-5999

(Name,

Address, and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With

copies to:

Tonya Mitchem Grindon, Esq.

Lori B. Metrock, Esq.

Baker Donelson Bearman Caldwell & Berkowitz PC

211 Commerce St., Suite 800

Nashville, TN 37201

Telephone: (615) 726-5600

CALCULATION

OF FILING FEE

|

|

|

|

|

Transaction Valuation

(1)

|

|

Amount of Filing Fee

(2)

|

|

$12,270,787.60

|

|

$1,235.67

|

|

|

|

(1)

|

Estimated for purposes of calculating the amount of the filing fee only. Provectus Biopharmaceuticals, Inc. (the “Company”) is offering, until July 28, 2016 (unless the offer is extended), to holders of

the Company’s 51,149,594 unregistered warrants to purchase 51,149,594 shares of common stock, which were issued between November 2011 and December 2015 (the “Existing Warrants”), to temporarily modify the terms of such Existing

Warrants so that each Existing Warrant holder who tenders Existing Warrants during the offering period for early exercise in accordance with the terms of the offer (i) may exercise such Existing Warrants at a discounted exercise price of $0.75

per share and (ii) will receive, in addition to the shares of common stock purchased upon such exercise of the Existing Warrants, new warrants to purchase the same number of shares of the Company’s common stock at an exercise price of

$0.85 per share that will expire June 19, 2020. The transaction valuation is calculated pursuant to Rule 0-11(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as the product of 51,149,594 and $0.2399. The

transaction valuation assumes the tender of 51,149,594 Existing Warrants by the Existing Warrant holders as a result of this tender offer and was determined by using the average of the high and low prices of the Company’s warrants reported on

the NYSE MKT as of May 11, 2016, which was $0.2399.

|

|

(2)

|

The amount of filing fee is calculated pursuant to Rule 0-11(d) of the Exchange Act. The filing fee equals $100.70 for each $1,000,000 of the value of the transaction, and was calculated as the product of the

transaction valuation of $12,270,787.60 multiplied by 0.0001007.

|

|

x

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or

the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $9,477.41*.

|

|

Filing Party: Provectus Biopharmaceuticals, Inc.

|

|

Form or Registration No.: Registration Statement on Form S-4.

|

|

Date Filed: May 13, 2016.

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

*

|

Pursuant to Rule 457(p) under the Securities Act, the Company offset the entire amount of the registration fee due under the Company’s Registration Statement on Form S-4 with the remaining amount of the filing fee

associated with the unsold securities from the Company’s registration statement on Form S-4, filed with the Securities and Exchange Commission on December 31, 2015, as amended (File No. 333-208816), registering securities for a

maximum aggregate offering price of $111,342,577.86 (the “Prior Registration Statement”). Of that amount, the Company sold securities with an aggregate offering price of approximately $14,505,222.90 (calculated by adding (1) the

product of 7,798,507, which is the number of warrants tendered for exchange pursuant to the Company’s prior offer to exchange outstanding warrants (“Prior Existing Warrants”) for new warrants (the “Prior Replacement

Warrants”), as described in the Prior Registration Statement (the “First Warrant Exchange Offer”), multiplied by $0.75, which was the original exercise price of the Prior Existing Warrants and was the price the Company used to

calculate the registration fee in the Prior Registration Statement, and (2) the product of 7,798,507, which is the number of Prior Replacement Warrants issued by the Company in the First Warrant Exchange Offer, multiplied by $1.11, which

represents the per share exercise price of the Prior Replacement Warrants of $0.85, plus the price per Prior Replacement Warrant based on the average of the high and low prices of the Company’s warrants trading under the symbol

“PVCTWS” on the NYSE MKT on December 28, 2015), leaving a balance of unsold securities under the Prior Registration Statement with an aggregate offering price of $96,837,354.96. The associated filing fee for the portion of such unsold

securities under the Prior Registration Statement ($9,751.52), calculated under Rule 457(o), was used by the Company to offset the entire amount of the registration fee due of $9,477.41.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

¨

|

third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

¨

|

going-private transaction subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final

amendment reporting the results of the tender offer:

¨

EXPLANATORY NOTE

This Amendment No. 1 (this “Amendment No. 1”) amends and supplements the Tender Offer Statement on Schedule TO (as amended,

the “Schedule TO”) filed with the Securities and Exchange Commission by Provectus Biopharmaceuticals, Inc. (the “Company”), a Delaware corporation, on May 13, 2016. This Schedule TO relates to an offer by the Company to

holders of the Company’s 51,149,594 unregistered warrants to purchase common stock that were issued between November 2011 and December 2015 (the “Existing Warrants”). Capitalized terms used herein but not otherwise defined have the

meanings set forth in the Schedule TO.

This Amendment No. 1 is being filed solely to extend the expiration date of the Offer to 4:00

p.m. Eastern time on July 28, 2016, unless further extended or terminated. Other than the expiration date, the terms of the Offer have not changed.

Pursuant to Rule 12b-15 under the Securities Exchange Act of 1934, as amended, this Amendment No. 1 amends and restates the items of the

Schedule TO that are being amended and restated hereby, and unaffected items and exhibits in the Schedule TO are not included herein. This Amendment No. 1 should be read in conjunction with the Schedule TO and the related Offer

Letter/Prospectus as the same may be further amended or supplemented and filed with the Securities and Exchange Commission.

|

Item 1.

|

SUMMARY TERM SHEET

|

The information set forth in Item 4 below is incorporated

herein by reference.

|

Item 4.

|

TERMS OF TRANSACTION

|

This Amendment No. 1 amends and supplements Items 1 and 4 of

the Schedule TO as follows:

Extension of the Offer

The Company is extending the expiration date of the Offer until 4:00 p.m. Eastern Time on July 28, 2016, unless further extended. The

Offer had been previously scheduled to expire at 4:00 p.m. Eastern Time on June 28, 2016. Throughout the Schedule TO, the Offer and the other offering materials and acceptance and exercise documents, all references to the expiration date of the

Offer are hereby amended to extend the expiration date of the Offer until 4:00 p.m. Eastern Time on July 28, 2016.

On or about

June 28, 2016, the Company intends to advise the holders of the Existing Warrants of the extension of the Offer. A copy of the letter to be sent to holders of the Existing Warrants is attached hereto as Exhibit (a)(1)(v) and is hereby

incorporated herein by reference.

Clarification of Withdrawal Rights

If you change your mind and do not want to participate in the Offer, you may submit a Notice of Withdrawal to Broadridge Corporate Issuer

Solutions, Inc. (“Broadridge”) at the address indicated in the Offer Letter/Prospectus filed with the Securities and Exchange Commission on May 13, 2016 at any time prior to the expiration date, which is now July 28, 2016. The

Notice of Withdrawal must be properly completed and must be returned to Broadridge on or prior to the expiration date.

The Exhibit Index appearing after the signature page hereto is incorporated by

reference.

|

ITEM 13.

|

INFORMATION REQUIRED BY SCHEDULE 13E-3

|

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

PROVECTUS BIOPHARMACEUTICALS, INC.

|

|

|

|

|

By

|

|

/s/ Peter R. Culpepper

|

|

|

|

Peter R. Culpepper

|

|

|

|

Interim Chief Executive Officer and Chief Operating Officer

|

Dated: June 28, 2016

EXHIBIT INDEX

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

(a)(l)(i)*

|

|

Offer Letter/Prospectus, dated May 13, 2016 (incorporated by reference to the Company’s Registration Statement on Form S-4 filed on May 13, 2016).

|

|

|

|

|

(a)(1)(ii)*

|

|

Form of Letter of Transmittal (incorporated by reference to Exhibit 99.1 of the Company’s Registration Statement on Form S-4 filed on May 13, 2016).

|

|

|

|

|

(a)(1)(iii)*

|

|

Form of Notice of Guaranteed Delivery (incorporated by reference to Exhibit 99.2 of the Company’s Registration Statement on Form S-4 filed on May 13, 2016).

|

|

|

|

|

(a)(1)(iv)*

|

|

Form of Letter to Warrant Holders (incorporated by reference to Exhibit 99.3 of the Company’s Registration Statement on Form S-4 filed on May 13, 2016).

|

|

|

|

|

(a)(1)(v)

|

|

Supplemental Information Letter to Existing Warrant Holders

|

|

|

|

|

(a)(2)

|

|

None.

|

|

|

|

|

(a)(3)

|

|

None.

|

|

|

|

|

(a)(4)

|

|

Exhibit (a)(1)(i) is incorporated by reference.

|

|

|

|

|

(a)(5)

|

|

None.

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

(d)(i)*

|

|

Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.1 to the Current Report on Form 8-K filed on June 19, 2015).

|

|

|

|

|

(d)(ii)*

|

|

First Amendment to Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.3 of the Company’s Registration Statement on Form

S-4 (Registration No. 333-208816) filed on December 31, 2015).

|

|

|

|

|

(d)(iii)*

|

|

Second Amendment to Warrant Agreement between Provectus Biopharmaceuticals, Inc. and Broadridge Corporate Issuer Solutions, Inc. (incorporated by reference to Exhibit 4.4 of the Company’s Registration Statement on

Form S-4 filed on May 13, 2016).

|

|

|

|

|

(d)(iv)*

|

|

Specimen Replacement Warrant (incorporated by reference to Exhibit (d)(iii) of the Company’s Schedule TO filed on December 31, 2015).

|

|

|

|

|

(g)

|

|

None.

|

|

|

|

|

(h)*

|

|

Tax opinion of Baker, Donelson, Bearman, Caldwell & Berkowitz, PC (incorporated by reference to Exhibit 8.1 of the Company’s Registration Statement on Form S-4 filed on May 13, 2016).

|

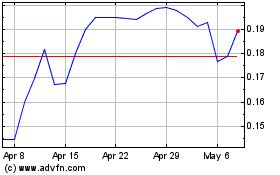

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

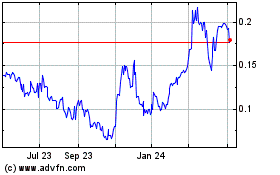

Provectus Biopharmaceuti... (QB) (USOTC:PVCT)

Historical Stock Chart

From Apr 2023 to Apr 2024