American Energy Partners LP to Shut Down -- Update

May 18 2016 - 9:57PM

Dow Jones News

By Bradley Olson

American Energy Partners LP, the Oklahoma City oil and gas

company founded by the late shale pioneer Aubrey McClendon, plans

to shut itself down this summer.

About half of the 100 employees that remained there after Mr.

McClendon's death in a car crash in March were laid off Wednesday,

and the company plans to wind down operations completely over the

next three months, according to a person familiar with the

matter.

The plan to shutter the business, which has shrunk in recent

months as its oil-and-gas exploration units were spun off into

several subsidiaries, is the first step in what many anticipate

will be an extended process of untangling the complex estate of the

former billionaire who co-founded Chesapeake Energy Corp. in

1989.

"Aubrey's legacy will be carried forward by each of these

businesses as they continue to grow, by the numerous landmarks all

over our city in which he had a hand in developing and by the many

philanthropic organizations to which Aubrey gave generously," the

company said in a statement.

The decision to shut down American Energy Partners was made in

consultation with Mr. McClendon's family, the company said.

In a widely followed second act after his 2013 ouster from

Chesapeake, Mr. McClendon, his management team and a group of

private equity backers raised more than $15 billion and hired 800

employees to create 10 new energy exploration outfits. Most of

those workers have joined subsidiary companies created by private

equity backers including John Raymond of the Energy and Minerals

Group that were then spun off into stand-alone entities.

Those companies include Ascent Resources LLC, White Star Energy

LLC, Permian Resources LLC, Traverse Midstream LLC and Heritage

Resources Management. None of them will be affected by the decision

to close American Energy, the company said.

American Energy in January struck a deal with Argentina's

state-run oil company, YPF SA, to help develop a large shale field

in that country. At the time, YPF said Mr. McClendon's company

would make a $500 million commitment to energy exploration in

Argentina. Mr. McClendon had also leased a vast lease in

Australia.

Mr. McClendon died in a fiery wreck March 2, one day after being

indicted on one count of conspiring to rig the price of oil and gas

leases. His vehicle was traveling at a speed of 88 miles an hour

before it crashed into a concrete embankment. The day before he had

vowed to fight the charge.

He left behind a tangled financial legacy stemming from an array

of personal and philanthropic investments that were tied to loans

valued at more than $400 million. To finance his comeback attempt,

Mr. McClendon had pledged cash proceeds from his stake in the

Oklahoma City Thunder basketball team, a 2,000-bottle wine

collection and a broad set of investments from antique boats to

vacation homes.

Mr. McClendon's estate has been entered into probate and a court

in Oklahoma has begun to take petitions and hold hearings in the

matter. His will was filed last month with the court.

Write to Bradley Olson at Bradley.Olson@wsj.com

(END) Dow Jones Newswires

May 18, 2016 21:42 ET (01:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

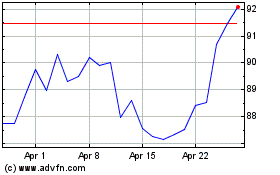

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Aug 2024 to Sep 2024

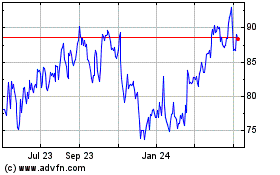

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Sep 2023 to Sep 2024