Chesapeake Swaps Debt for Stock -- Update

May 12 2016 - 4:27PM

Dow Jones News

By Lisa Beilfuss

Chesapeake Energy Corp. on Thursday said it would swap 4.1% of

its shares outstanding for debt, the latest move by the beleaguered

energy company to ease its debt load as it struggles with low

natural-gas prices.

The Oklahoma City company, one of the biggest U.S. producers of

natural gas, disclosed in a regulatory filing that it will issue

28.1 million shares, worth $122.5 million based on Wednesday's

closing price, to redeem $153 million in debt.

The agreement by bondholders to make the swap suggests they may

not see the company as headed toward bankruptcy. In the event of a

bankruptcy, bondholders are paid first whereas stockholders are

lower on the chain.

Chesapeake has a significant amount of debt due starting in

2017, and "they're starting to find creative ways to ease that wall

of maturities coming," said Tim Revzan, analyst at CRT Sterne Agee.

"It's not a game changer," but the move shows that Chesapeake is

willing to explore options for bringing down debt while waiting for

gas prices to bounce, Mr. Revzan said.

Chesapeake shares initially jumped on the news. But in afternoon

trading Thursday, the stock fell 5.1% -- dragging its decline over

the past 12 months to 73%.

Chesapeake shares rose 5.5% in premarket trading, to $4.60. If

the stock were to open at that level, it would still have tumbled

67% over the past 12 months.

In February, investors wiped away half of the stock's value

after a report said Chesapeake was working with bankruptcy

advisers, though it said that the advisers were looking at ways to

strengthen its balance sheet and that it had no current plans to

pursue a bankruptcy.

The company had about $9.4 billion in debt on its books at

quarter end, according to Mr. Revzan, a result of big spending

while energy prices were high.

"No one is expecting an imminent bankruptcy," Mr. Revzan said

Thursday. "On the margin, [the debt swap] makes the wall of

maturities that much smaller," he said, though "this action barely

moves the needle for them, especially as it pertains to 2017 debt

maturities."

"No one is expecting an imminent bankruptcy," Mr. Revzan said

Thursday, "but on the margin, [the debt swap] makes the wall of

maturities that much smaller."

Chesapeake made a similar, but much smaller, swap in March. The

company has also sold off assets to shore up its cash, and last

month it amended its credit facility agreement with lenders.

"They have a couple of years of a liquidity runway," Mr. Revzan

said. "But what they really need is $3 or higher gas prices."

Natural gas traded recently at $2.16 a million British thermal

units.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

May 12, 2016 16:12 ET (20:12 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

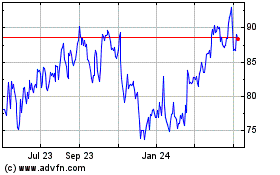

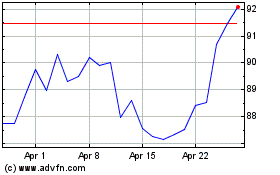

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024