The first ship carrying natural gas from the Gulf Coast is

expected to depart soon, marking the emergence of the U.S. as a

major exporter and the globalization of the once highly

regionalized gas trade.

But the debut of a shale-fueled gas-export industry is raising

questions about whether too many sellers are chasing too few

buyers, deepening another boom-and-bust cycle. The price of

liquefied natural gas has dropped 50% over the past year in Asia,

the world's largest and traditionally most lucrative market for

LNG.

The destination of the Gulf Coast gas is likely to be South

America, with Petró leo Brasileiro SA in negotiations to buy the

cargo—which could depart the Louisiana bayou as early as next week,

according to people familiar with the transaction. Petrobras didn't

immediately respond to requests for comment.

It also comes as the company behind the effort, Cheniere Energy

Inc., tries to right itself after a messy boardroom drama that led

to the firing of Chief Executive Charif Souki in December. Since

then, Cheniere—under the leadership of its board of directors—has

scaled back the company's ambitions set by Mr. Souki, laying off an

oil-trading team that he had recruited to expand the business and

filing a lawsuit earlier this month to claw back $46 million of

company funds he invested in what people familiar with the suit say

was his friend's firm.

Cheniere, the first company to secure government permits to

export U.S. gas, was initially founded to import LNG to the U.S.,

but reinvented itself as an exporter after a boom in shale-gas

output. It hasn't turned an annual profit in its 20 years in

business and has become a proxy for a larger debate about LNG.

Two high-profile investors have taken opposite positions in the

stock. Last August, Carl Icahn disclosed a stake in Cheniere and

won two board seats. He currently owns 13.8% of the company. At

about the same time, James Chanos of Kynikos Associates LP began to

bet against Cheniere's stock by shorting it, convinced the LNG glut

is here to stay.

"Much like iron ore and some of the other [resource] debacles of

the last several years, everybody came to the same conclusion at

the same point and began building capacity," Mr. Chanos said in an

interview. "This is going to be a tough business for the next five,

six or seven years," he said.

Representatives for Mr. Icahn didn't respond to requests for

comment.

Demand from Asian markets, which make up 70% of the global

market, has stagnated and LNG exports to China fell in 2015 for the

first time ever, according to Wood Mackenzie.

The world's appetite for North American LNG will be limited to

about 6.5 billion cubic feet a day in the next eight years,

according to analyses by Canadian bank CIBC and the U.S. Department

of Energy. Cheniere has regulatory approval for nearly all of that

volume—6.3 billion cubic feet a day—from a pair of export

terminals.

That suggests trouble for dozens of other LNG projects—from

Maryland to Oregon—under construction or on the drawing boards.

"Not all of those are going to get built," said Kenneth Medlock,

author of a recent U.S. government study on the market impacts of

LNG exports.

LNG spot prices in Asia have to dropped less than $7 per million

British thermal units. As recently as December, Cheniere assumed a

healthy margin of at least $3.25 per million Btu from Asia-bound

sales, but its latest outlook released last month trims that margin

to $2 per million Btu.

In a sign of a possible cash flow squeeze, Cheniere last month

refinanced up to $2.8 billion in debt to delay maturities until

2020, according to a person familiar with the deal.

Earlier this month Cheniere filed a lawsuit in Houston seeking

to recover $46 million lent to a liquefaction company called

Parallax Energy LLC. Parallax was created by Martin Houston, a

former executive at BG Group PLC. Parallax informed Cheniere that

it "was unable to satisfy current payment obligations," according

to the complaint. Parallax didn't respond to requests for

comment.

Cheniere insulated itself from a downturn in LNG prices by

signing long-term contracts with energy giants such as BG

Group—which is being acquired by Royal Dutch Shell PLC—and Total SA

of France. Both committed to 20-year obligations which pay out

guaranteed annual fees for processing gas, regardless of the amount

of LNG they actually take delivery of. Cheniere expects to get its

first payment from BG this year for $520 million.

Critics note that Cheniere's other contracted buyers aren't

blue-chip firms, and that its profit margins may be eroded by

higher-than-expected costs for maintenance of facilities located in

a marshy wetland.

Cheniere's sprawling export terminal at Sabine Pass, a two-hour

drive from its Houston headquarters, was built on ground so squishy

construction crews mixed cement into the soil and drove

steel-reinforced concrete pilings 95 feet underground. From this

stabilized surface arose an industrial jungle with giant racks of

pipes to chill the gas and 140-foot-tall tanks to store it.

Nearly 90% of the processing capacity of the first pair of

refrigeration units, known as trains, at Sabine Pass are being

built under long-term contracts. Cheniere plans to build a total of

at least five trains at that flagship plant.

The company expects to spend nearly $18 billion at Sabine Pass

and another $16 billion on a Corpus Christi plant, where

construction of the first two trains—out of a possible five—began

last May. Under Mr. Souki's vision, these facilities would allow

Cheniere to ship 10% of current U.S. gas production abroad. The

company envisioned up to 11 trains from these plus two other

yet-to-be-built Gulf Coast plants by 2025.

Cheniere's new management appears to have shelved those

expansion proposals, which it had planned to jointly develop with

Parallax before the lawsuit, by scrubbing any mention of them from

its latest presentation materials.

Write to Chester Dawson at chester.dawson@wsj.com, Bradley Olson

at Bradley.Olson@wsj.com and Christian Berthelsen at

christian.berthelsen@wsj.com

(END) Dow Jones Newswires

February 17, 2016 18:15 ET (23:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

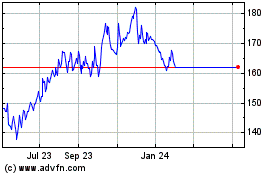

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024