United

States

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 12, 2016

CHINA

JO-JO DRUGSTORES, INC.

(Exact

name of Registrant as specified in charter)

| Nevada |

|

001-34711 |

|

98-0557852 |

(State or other jurisdiction

of Incorporation) |

|

(Commission File

No.) |

|

(IRS Employer

Identification No.) |

1st

Floor, Yuzheng Plaza, No. 76, Yuhuangshan Road

Hangzhou,

Zhejiang Province, People’s Republic of China

(Address

of principal executive offices) (Zip Code)

Registrant's

telephone number, including area code: +86 (571) 88077078

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written communications pursuant to Rule 425 under the Securities Act (17CFR230.425)

☐

Soliciting material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c))

Item

2.02. Results of Operations and Financial Condition.

On

February 12, 2016, China Jo-Jo Drugstores, Inc. (the “Company”) issued a press release announcing certain financial

results for the third quarter ended December 31, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

This

information under this Item 2.02 and the Press Release attached to this Form 8-K as Exhibit 99.1 shall be deemed to be “furnished”

and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed incorporated by

reference in any filing under the Exchange Act or the Securities Act of 1933, as amended.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

The

following is filed as an exhibit to this report:

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

Press Release, dated February 12, 2016. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

CHINA JO-JO DRUGSTORES, INC. |

| |

|

|

| Date: February 12, 2016 |

By: |

/s/

Lei Liu |

| |

Name: |

Lei Liu |

| |

Title: |

Chief Executive Officer |

3

Exhibit 99.1

China

Jo-Jo Drugstores Reports Third Quarter Fiscal Year 2016 Financial Results

-Q3’16

Revenue up 15.9% y-o-y;

-Total

online pharmacy revenues continue to ramp growing 96.7% y-o-y;

-Total

online pharmacy gross profit grew 194% y-o-y

-Official

branded online website sales grew 535.3% y-o-y

HANGZHOU,

China, February 12, 2016 /PRNewswire/ -- China Jo-Jo Drugstores, Inc. (NASDAQ CM: CJJD) (the "Company" or "China

Jo-Jo"), a leading China-based pharmacy with retail, wholesale and online distribution of pharmaceutical and health care

products, today announced financial results for the third-quarter ended December 31, 2015.

Third

Quarter FY 2016 Highlights vs. the Comparable Period

| ● | Revenues

roughly totaled $24.7 million up 15.9%, consisting of segmental revenue: |

| o | Revenue

from Retail Drugstores roughly totaled $12.9 million, down 2.7% and represents

52.3% of total revenues as compared to 62.3% in the prior year; |

| o | Revenue

from Online Pharmacy roughly totaled $8.6 million, an increase of 96.7% and represents

35.0% of revenues as compared to 20.6% in the prior year; |

| o | Revenues

from the Wholesale Business roughly totaled $3.1 million, a decrease of 13.8%

and represents 12.7% of revenues as compared to 17.1% in the prior year. |

| ● | Gross

profit of roughly $4.8 million, an increase of 52.3% as compared to the prior year |

| o | Retail

drugstore gross profit increased 20.3% to roughly $2.8 million as compared to the prior

year; |

| o | Online

pharmacy gross profit increased 194.1% to roughly $1.8 million as compared to the prior

year. |

| ● | Gross

margin of 19.6% for the third quarter of fiscal 2016 as compared to 14.9% in the prior

year |

| o | Retail

drugstore gross margin increased to 21.6% as compared to 17.5% in the prior year; |

| o | Online

pharmacy gross margin increased to 21.3% as compared to 14.2% in the prior year. |

| ● | Net

loss of $0.62 million or ($0.04) per fully diluted share, compared with net income of

$0.13 million or $0.01 per fully diluted share in the prior year. |

| ● | Non-GAAP*

net loss of $0.38 million or ($0.02) per fully diluted share, compared with Non-GAAP

net income of $0.65 million or $0.04 per fully diluted share in the prior year. |

9

Months FY 2016 Financial Highlights vs. the Comparable Period

| ● | First

nine months FY 2016 revenue totaled $68.6 million up 22.0% from $56.2 million in the

prior year; |

| ● | Gross

profit roughly totaled $13.2 million up 56.1% from $8.5 million in the prior year; |

| ● | Gross

margin of 19.2% as compared to 15.0% in the prior year; |

| ● | Net

loss of $0.36 million or ($0.02) per fully diluted share, as compared with a net loss

of $0..26 million or ($0.02) per fully diluted share in the prior year; |

| ● | Non-GAAP*

net loss of $0.01 million or ($0.00) per fully diluted share, compared with Non-GAAP

net income of $0.34 million or $0.02 per fully diluted share in the prior year. |

*We

make reference to certain non-GAAP financial measures, consisting of non-cash adjustments to net income which include, share based

compensation and changes in the value of derivatives. Management believes that such adjusted financial results are useful to investors

in evaluating our operating performance because it presents a meaningful measure of corporate performance. See the non-GAAP reconciliation

table below. Any non-GAAP measures should not be considered as a substitute for, and should only be read in conjunction with measures

of financial performance prepared in accordance with GAAP.

Reconciliation

to non-GAAP Financial Measures

| | |

Three Months Ended | | |

Nine months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| Net Income (Loss) | |

$ | (617,529 | ) | |

$ | 127,525 | | |

$ | (355,743 | ) | |

$ | (257,324 | ) |

| Share based compensation expense | |

| 248,066 | | |

| 397,665 | | |

| 514,321 | | |

| 543,175 | |

| Change in fair value of derivative liabilities | |

| (15,444 | ) | |

| 127,432 | | |

| (173,510 | ) | |

| 51,074 | |

| Adjusted net income (loss) | |

| (384,907 | ) | |

| 652,622 | | |

| (14,932 | ) | |

| 336,925 | |

| Adjusted net income (loss) per share - diluted | |

$ | (0.02 | ) | |

$ | 0.04 | | |

$ | (0.00 | ) | |

$ | 0.02 | |

Management

Comments

Mr.

Lei Liu, Chairman and CEO commented, “We are pleased with China Jo-Jo’s sales growth both in online and retail pharmacy

sales. We are seeing improvements in gross margin from increased volume in our online business as our revenue mix continues to

shift to our fast growing online business. From a sequential perspective we are expecting a strong quarter to end the fiscal year,

as efforts to monetize the growth opportunity in China’s online pharmacy space continues. Our focus on exploring customers’

needs in both offline and online platforms will help in maximizing the ways for which we leverage our cost basis across the businesses.

Mr.

Liu continued, “While the Company implements operating strategies in line with China’s secular consumer growth trends,

China Jo-Jo draws closer to the tipping point for continuous GAAP operating profitability, and a fiscal run rate of over $100

million in annual organic revenues. The investments and efforts in building critical mass to service China’s consumer needs

in the pharmacy space is taking shape, creating new opportunities to diversify our revenue base while drawing on and retaining

new customers. Closer collaborations with several large local pharmaceutical vendors are also providing cost advantages while

enhancing China Jo-Jo’s brand reputation through the selling of trusted, premium branded products.

“Synergies

found in our ecosystem, are providing compelling solutions in answer to China’s relentless call for healthcare reform including:

ending hospital domination in prescription sales, broader access to pharmacy products and healthcare services including access

to supplemental insurance benefits that cover social insurance shortfalls. On the consumer side, China Jo-Jo is utilizing its

e-service platforms to drive segment revenue while promoting increased foot traffic to retail locations across Zhejiang province

in a concerted effort to enhance same store sales. The end result is a steady expansion in gross profit from our retail drugstores

and a step change in gross profit from our online pharmacy segment due to the Company’s strategic initiatives to grow e-pharmacy.

China Jo-Jo’s customer loyalty program continues to expand and has grown to more than 2 million customers, as we seek innovative

ways to provide pharmacy products and services that positively affect China Jo-Jo’s bottom line,” concluded Mr. Liu.

Third

Quarter Financial Summary

Revenue

increased by $3,388,007 or 15.9% for the three months ended December 31, 2015, as compared to the prior year, as a result

of the rapid expansion of our online pharmacy business, partially offset by decline in our wholesale business.

Gross

profit increased by $1,665,300 or 52.3% as compared to the prior year as a result of increased gross margin of retail and

online drugstores and an increase in online pharmacy sales. At the same time, gross margin increased from 14.9% to

19.6% due to higher retail profit margins and better product mix.

Sales

and marketing expenses increased by $1,102,453

or 50.5% as compared to the prior year. The increase is attributable to increases in labor cost, service fees incurred from e-commerce

platforms and commercial health insurance providers which direct insured sales to our own official website. As a result, such

expenses as a percentage of our revenue increased to 13.3%, from 10.2% as compared to the same year ago period. We expect future

sales and marketing expenses to grow as our online business continues to expand.

General

and administrative expense increased by $1,246,335

or 200.3% as compared to the prior year. Such expenses as a percentage of revenue increased to 7.6% from 2.9% for the prior year.

General and administrative expenses reflects variance of accounts receivable and advances to vendors allowance as stated in the

Company’s 10Q, including a reversal of approximately $1.4 million allowance in the three months ended December 31, 2014.

Excluding such an effect, general and administrative expense actually decreased.

Net

loss from operations was $307,752, as compared

to income from operations of $375,736 in the year ago period. Diluted loss per share

is ($0.04), as compared to 0.01 in the prior year.

As

of December 31, 2015, we had cash of approximately $4,339,272. The

Company’s total current assets as of December 31, 2015, were $44,473,871 and total current liabilities

were $40,768,247, which resulted in a positive net working capital of $3,705,624.

9

Months Segmental Business Update

Retail

drugstore sales accounted for approximately 55.7% of total revenue for the nine months ended December 31, 2015, increased

by $1,913,789, or 5.3%, to $38,202,495. Same-store sales decreased by approximately $758,296, or 2.2%, while new stores contributed

approximately $2,377,789 in revenue in the nine months ended December 31, 2015. Other growth in sales revenue is attributed to

growth in clinic sales and China Jo-Jo branded nutritional supplement sales. In recent quarter, same store sales growth has been

impeded due to due to government budget control. However, same store sales growth is expected to grow due to increasing demand

for healthcare products over time. The Company continues to adapt its operating strategies to maximize same store sales growth

including: product adaptability to community demand; mobile device product search; close monitoring of chronicle disease customers,

and cooperation with certain large reputable vendors to promote sales of their brand name products. One retail location was closed

in the period as it was the last remaining store without government insurance coverage in Hangzhou. The Company hopes to open

or acquire news stores over time.

Online

pharmacy sales increased by approximately $11,252,275, or 113.5% for the nine months ended December 31, 2015, as compared

to the prior year. For the nine months period, cooperation with business-to-consumer online vendors have expanded to include Taobao,

JD and www.yhd.com, our product details are listed on their online platforms, directing customers back to our website.

China Jo-Jo’s own official website sales in the nine months ended December 31, 2015 has increased by 456.9% as compared

to the prior year. The Company continues to benefit from cooperation with large insurance companies such as The People’s

Insurance Company (Group) of China. The expansion of commercial health insurance in China continues to expand as a supplementary

insurance as often times China’s social health insurance does not provide complete insurance coverage to consumers.

Wholesale

revenue decreased by $792,436 or 7.9% primarily

as a result of discontinuing volume-driven sales strategy.

CHINA

JO-JO DRUGSTORES, INC AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

December 31, | | |

March 31, | |

| | |

2015 | | |

2015 | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash | |

$ | 4,339,272 | | |

$ | 4,023,581 | |

| Financial assets available for sale | |

| - | | |

| 1,307,200 | |

| Restricted cash | |

| 12,743,153 | | |

| 8,992,101 | |

| Notes receivable | |

| 35,443 | | |

| 138,952 | |

| Trade accounts receivable, net | |

| 8,751,355 | | |

| 9,237,743 | |

| Inventories | |

| 10,261,025 | | |

| 10,538,591 | |

| Other receivables, net | |

| 1,441,827 | | |

| 1,130,264 | |

| Advances to suppliers, net | |

| 5,479,954 | | |

| 4,717,352 | |

| Other current assets | |

| 1,421,842 | | |

| 2,200,838 | |

| Total current assets | |

| 44,473,871 | | |

| 42,286,622 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, net | |

| 5,719,417 | | |

| 7,056,781 | |

| | |

| | | |

| | |

| OTHER ASSETS | |

| | | |

| | |

| Long-term investment | |

| 107,870 | | |

| - | |

| Farmland assets | |

| 1,683,586 | | |

| 1,704,359 | |

| Long term deposits | |

| 2,436,953 | | |

| 2,584,025 | |

| Other noncurrent assets | |

| 2,579,146 | | |

| 2,734,798 | |

| Intangible assets, net | |

| 2,918,279 | | |

| 3,142,003 | |

| Total other assets | |

| 9,725,834 | | |

| 10,165,185 | |

| Total assets | |

$ | 59,919,122 | | |

$ | 59,508,588 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Short-term loan payable | |

$ | - | | |

$ | 32,680 | |

| Accounts payable, trade | |

| 14,919,756 | | |

| 15,915,915 | |

| Notes payable | |

| 17,068,740 | | |

| 15,752,969 | |

| Other payables | |

| 2,812,922 | | |

| 2,931,869 | |

| Other payables - related parties | |

| 2,489,592 | | |

| 2,729,740 | |

| Customer deposits | |

| 2,440,184 | | |

| 3,759,050 | |

| Taxes payable | |

| 482,234 | | |

| 328,111 | |

| Accrued liabilities | |

| 554,819 | | |

| 509,537 | |

| Total current liabilities | |

| 40,768,247 | | |

| 41,959,871 | |

| | |

| | | |

| | |

| Purchase option and warrant liability | |

| 141,817 | | |

| 315,327 | |

| Total liabilities | |

| 40,910,064 | | |

| 42,275,198 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Preferred stock; $0.001 par value; 10,000,000 shares authorized; nil issued and outstanding as of December 31, 2015 and March 31, 2015 | |

| - | | |

| - | |

| Common stock; $0.001 par value; 250,000,000 shares authorized; 17,735,504 and 15,650,504 shares issued and outstanding as of December 31, 2015 and March 31, 2015 | |

| 17,736 | | |

| 15,651 | |

| Additional paid-in capital | |

| 22,512,969 | | |

| 19,301,233 | |

| Statutory reserves | |

| 1,309,109 | | |

| 1,309,109 | |

| Accumulated deficit | |

| (7,759,951 | ) | |

| (7,404,210 | ) |

| Accumulated other comprehensive income | |

| 2,929,195 | | |

| 3,972,543 | |

| Total stockholders' equity | |

| 19,009,058 | | |

| 17,194,326 | |

| Noncontrolling interests | |

| - | | |

| 39,064 | |

| Total equity | |

| 19,009,058 | | |

| 17,233,390 | |

| Total liabilities and stockholders' equity | |

$ | 60,485,334 | | |

$ | 59,508,588 | |

CHINA

JO-JO DRUGSTORES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | |

For the three months ended

December 31, | | |

For the nine months ended

December 31, | |

| | |

2015 | | |

2014 | | |

2015 | | |

2014 | |

| REVENUES, NET | |

$ | 24,708,046 | | |

$ | 21,320,039 | | |

$ | 68,596,964 | | |

$ | 56,223,336 | |

| | |

| | | |

| | | |

| | | |

| | |

| COST OF GOODS SOLD | |

| 19,860,713 | | |

| 18,138,006 | | |

| 55,396,941 | | |

| 47,765,427 | |

| | |

| | | |

| | | |

| | | |

| | |

| GROSS PROFIT | |

| 4,847,333 | | |

| 3,182,033 | | |

| 13,200,023 | | |

| 8,457,909 | |

| | |

| | | |

| | | |

| | | |

| | |

| SELLING EXPENSES | |

| 3,286,637 | | |

| 2,184,184 | | |

| 9,801,761 | | |

| 5,886,541 | |

| GENERAL AND ADMINISTRATIVE EXPENSES | |

| 1,868,448 | | |

| 622,113 | | |

| 3,628,520 | | |

| 2,449,489 | |

| TOTAL OPERATING EXPENSES | |

| 5,155,085 | | |

| 2,806,297 | | |

| 13,430,281 | | |

| 8,336,030 | |

| | |

| | | |

| | | |

| | | |

| | |

| (LOSS) INCOME FROM OPERATIONS | |

| (307,752 | ) | |

| 375,736 | | |

| (230,258 | ) | |

| 121,879 | |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER EXPENSES, NET | |

| (290,122 | ) | |

| (106,773 | ) | |

| (219,771 | ) | |

| (275,301 | ) |

| CHANGE IN FAIR VALUE OF DERIVATIVE LIABILITIES | |

| 15,444 | | |

| (127,431 | ) | |

| 173,510 | | |

| (51,074 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) BEFORE INCOME TAXES | |

| (582,430 | ) | |

| 141,532 | | |

| (276,519 | ) | |

| (204,496 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| 35,099 | | |

| 14,007 | | |

| 79,224 | | |

| 52,828 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) | |

| (617,529 | ) | |

| 127,525 | | |

| (355,743 | ) | |

| (257,324 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME ATTRIBUTABLE TO NONCONTROLLING INTEREST | |

| - | | |

| (987 | ) | |

| - | | |

| 932 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET INCOME (LOSS) ATTRIBUTABLE TO CHINA JO-JO DRUGSTORES, INC. | |

| (617,529 | ) | |

| 126,538 | | |

| (355,743 | ) | |

| (256,392 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER COMPREHENSIVE (LOSS) INCOME | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (268,795 | ) | |

| 52,740 | | |

| (1,043,348 | ) | |

| 111,200 | |

| | |

| | | |

| | | |

| | | |

| | |

| COMPREHENSIVE (LOSS) INCOME | |

$ | (886,324 | ) | |

$ | 179,278 | | |

$ | (1,399,091 | ) | |

$ | (145,192 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF SHARES: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 17,180,830 | | |

| 15,199,092 | | |

| 16,459,195 | | |

| 14,867,218 | |

| Diluted | |

| 17,180,830 | | |

| 15,596,554 | | |

| 16,459,195 | | |

| 14,867,218 | |

| | |

| | | |

| | | |

| | | |

| | |

| INCOME (LOSS) PER SHARES: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.04 | ) | |

$ | 0.01 | | |

$ | (0.02 | ) | |

$ | (0.02 | ) |

| Diluted | |

$ | (0.04 | ) | |

$ | 0.01 | | |

$ | (0.02 | ) | |

$ | (0.02 | ) |

CHINA

JO-JO DRUGSTORES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

Nine months ended

December 31, | |

| | |

2015 | | |

2014 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net loss | |

$ | (355,743 | ) | |

$ | (257,324 | ) |

| Adjustments to reconcile

net (loss) income to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,163,994 | | |

| 1,240,323 | |

| Stock-based compensation | |

| 520,953 | | |

| 527,357 | |

| Bad debt provision | |

| (1,369,786 | ) | |

| (3,126,039 | ) |

| Inventory reserve | |

| - | | |

| 277,603 | |

| Change in fair value

of purchase option derivative liability | |

| (173,510 | ) | |

| 51,074 | |

| Change in operating assets: | |

| | | |

| | |

| Accounts receivable,

trade | |

| 243,666 | | |

| 1,566,629 | |

| Notes receivable | |

| 99,199 | | |

| (108,096 | ) |

| Inventories | |

| (413,472 | ) | |

| (2,976,220 | ) |

| Other receivables | |

| (142,734 | ) | |

| (619,695 | ) |

| Advances to suppliers | |

| (413,238 | ) | |

| 1,916,591 | |

| Other current assets | |

| 678,339 | | |

| 55,012 | |

| Long term deposit | |

| - | | |

| 220,146 | |

| Other noncurrent assets | |

| - | | |

| 280,399 | |

| Change in operating liabilities: | |

| | | |

| | |

| Accounts payable, trade | |

| (93,695 | ) | |

| (1,236,808 | ) |

| Other payables and accrued

liabilities | |

| 277,298 | | |

| 390,535 | |

| Customer deposits | |

| (1,146,504 | ) | |

| 494,570 | |

| Taxes

payable | |

| 205,734 | | |

| 75,296 | |

| Net

cash used in operating activities | |

| (919,499 | ) | |

| (1,228,647 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING

ACTIVITIES: | |

| | | |

| | |

| Purchase of equipment | |

| (171,314 | ) | |

| (898,522 | ) |

| Decrease in Financial

assets available for sale | |

| 1,279,200 | | |

| - | |

| Acquisition of business,

net | |

| - | | |

| (936,288 | ) |

| Investment in a joint

venture | |

| (111,930 | ) | |

| - | |

| Payments on construction-in-progress | |

| - | | |

| (96,636 | ) |

| Additions

to leasehold improvements | |

| - | | |

| (189,143 | ) |

| Net

cash provided by (used in) investing activities | |

| 995,956 | | |

| (2,120,589 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING

ACTIVITIES: | |

| | | |

| | |

| Proceeds from short-term

bank loan | |

| 23,115 | | |

| 32,510 | |

| Repayment of short-term

bank loan | |

| (55,095 | ) | |

| (162,550 | ) |

| Repayment of third

parties loan | |

| - | | |

| (79,116 | ) |

| Change in restricted

cash | |

| (4,423,287 | ) | |

| (6,848,423 | ) |

| Repayments of notes payable | |

| (15,415,543 | ) | |

| (14,132,390 | ) |

| Proceeds from notes payable | |

| 17,711,172 | | |

| 21,206,663 | |

| (Repayment of) Proceeds

from other payables-related parties | |

| (179,934 | ) | |

| 529,115 | |

| Proceeds

from equity financing | |

| 2,699,500 | | |

| - | |

| Net

cash provided by financing activities | |

| 359,928 | | |

| 545,809 | |

| | |

| | | |

| | |

| EFFECT

OF EXCHANGE RATE ON CASH | |

| (120,694 | ) | |

| 92,543 | |

| INCREASE IN CASH | |

| 315,691 | | |

| (2,710,884 | ) |

| CASH,

beginning of period | |

| 4,023,581 | | |

| 4,445,276 | |

| CASH,

end of period | |

$ | 4,339,272 | | |

$ | 1,734,392 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE

OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Cash

paid for interest | |

$ | 151,258 | | |

$ | 4,621 | |

| Cash

paid for income taxes | |

$ | 48,424 | | |

$ | 59,755 | |

| Issuance

of common stocks in exchange of debts | |

$ | - | | |

$ | 941,613 | |

| Non-cash financing activities: | |

| | | |

| | |

| Issuance

of stock purchase options to an investment bank | |

$ | 147,728 | | |

$ | - | |

Use

of non-GAAP financial measures

To

supplement China Jo-Jo's consolidated financial results presented in accordance with GAAP, China Jo-Jo uses the following measures

defined as non-GAAP financial measures by the SEC: net income (loss) excluding share-based compensation expenses and change in

fair value of derivative liabilities, and diluted net income (loss) per share excluding share-based compensation expenses and

change in the fair value of derivatives liabilities. The presentation of these non-GAAP financial measures is not intended to

be considered in isolation or as a substitute for the financial information prepared and presented in accordance with GAAP.

China

Jo-Jo believes that these non-GAAP financial measures provide meaningful supplemental information regarding its performance and

liquidity by excluding share-based compensation expenses and change in fair value of derivative liabilities that may not be indicative

of its operating performance from a cash perspective. China Jo-Jo believes that both management and investors benefit from referring

to these non-GAAP financial measures in assessing its performance and when planning and forecasting future periods. These non-GAAP

financial measures also facilitate management's internal comparisons to China Jo-Jo's historical performance and liquidity. China

Jo-Jo computes its non-GAAP financial measures using the same consistent method from quarter to quarter. China Jo-Jo believes

these non-GAAP financial measures are useful to investors in allowing for greater transparency with respect to supplemental information

used by management in its financial and operational decision making. A limitation of using these non-GAAP measures is that they

exclude share-based compensation and change in fair value of derivative liabilities charge that has been and will continue to

be for the foreseeable future a significant recurring expense in our business. Management compensates for these limitations by

providing specific information regarding the GAAP amounts excluded from each non-GAAP measure. The table under the heading Reconciliation

to non-GAAP Financial Measures in the beginning of the release has more details on the reconciliations between GAAP financial

measures that are most directly comparable to non-GAAP financial measures.

Forward

Looking Statement

Statements

in this press release regarding the Company that are not historical facts are forward-looking statements and are subject to risks

and uncertainties that could cause actual future events or results to differ materially from such statements. Any such forward-looking

statements, including, but not limited to, financial guidance, are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. These statements can be identified by the use of forward-looking terminology such as

"believe," "expect," "estimate," "may," "will," "should," "project,"

"plan," "seek," "intend," "anticipate," the negatives thereof, or comparable terminology.

Such statements typically involve risks and uncertainties and may include financial projections or information regarding the progress

of new product development. It is routine for the Company's internal projections and expectations to change as the quarter and

year progresses, and therefore it should be clearly understood that the internal projections and beliefs upon which the Company

bases its expectations may change. Although these expectations may change, the Company is under no obligation to inform you if

they do. Actual results could differ materially from the expectations reflected in such forward-looking statements as a result

of numerous factors, including the risks associated with the effect of changing economic conditions in the People's Republic of

China, variations in cash flow, reliance on collaborative retail partners and on new product development, variations in new product

development, risks associated with rapid technological change, and the potential of introduced or undetected flaws and defects

in products. Readers are referred to the reports and documents filed from time to time by the Company with the Securities and

Exchange Commission for a discussion of these and other important risk factors that could cause actual results to differ from

those discussed in forward-looking statements. Other than as required under the securities laws, the Company does not assume a

duty to update these forward-looking statements.

About China Jo-Jo Drugstores, Inc.

China

Jo-Jo Drugstores, Inc., through its own retail drugstores, wholesale distributor and online pharmacy, is a leading retailer and

wholesale distributor of pharmaceutical and healthcare products in China. As of December 31, 2015, the Company had 59 retail pharmacies

in Zhejiang Province, China. The Company's wholesale subsidiary not only supplies its retail stores, but also distributes drug

and other healthcare products to other drugstores and drug vendors. The Company routinely posts important information on its corporate

websites at www.jiuzhou-drugstore.com (Chinese) and www.chinajojodrugstores.com (English).

Investor

Relations Contact:

Christopher

Chu, Taylor Rafferty

Tel:

(908) 251-9869

Email:

christopher.chu@taylor-rafferty.com

Frank

Zhao

Chief

Financial Officer

frank.zhao@jojodrugstores.com

Phone:

(561) 372-5555

86-13968118759

9

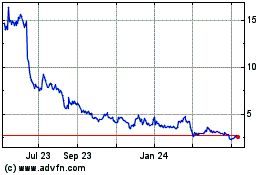

China Jo Jo Drugstores (NASDAQ:CJJD)

Historical Stock Chart

From Mar 2024 to Apr 2024

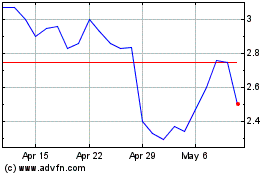

China Jo Jo Drugstores (NASDAQ:CJJD)

Historical Stock Chart

From Apr 2023 to Apr 2024