AIG Reaches Agreement With Icahn for Board Representation

February 11 2016 - 5:03PM

Dow Jones News

By Leslie Scism

American International Group Inc. is adding two new board seats

as it averts a proxy fight by billionaire activist Carl Icahn, the

company said Thursday.

Mr. Icahn had been pushing for a three-way breakup of the

company, in a move opposed by AIG management as not in

shareholders' best interest. AIG said it is expanding its board to

16 seats from 14, adding a position for a managing director of

Icahn Capital LP as well as John Paulson, the billionaire

hedge-fund investor who also last year became an AIG shareholder

and has advocated a breakup.

The announcement came as AIG released fourth-quarter results.

The global insurer posted a $1.84 billion fourth-quarter loss on a

previously announced strengthening of claims reserves while

increasing its common-stock dividend and buyback program.

AIG Chief Executive Peter Hancock committed on Jan. 26 to a

wide-ranging set of initiatives to improve financial results,

including returning at least $25 billion of capital to shareholders

over the next two years, as an alternative to the dramatic split

envisioned by the billionaire investor.

AIG said Thursday that its board approved a 14% increase in the

quarterly dividend to 32 cents a share. That brings the annual

payout to about $1.53 billion, based on the company's share count

as of Dec. 31.

In addition, the board approved new share repurchases of $5

billion, on top of $800 million in an allocation that remains from

last year.

From Jan. 1 through Feb. 11, AIG had bought back $2.5 billion of

shares, so with the higher dividend and full use of the buyback

allocations, the company is on track to return nearly $10 billion

this year with the measures in place. The company said it returned

$11.7 billion in capital in 2015, between buybacks and

dividends.

In the wake of AIG's strategy update last month, the importance

of the fourth-quarter earnings has receded. At that time, Mr.

Hancock surprised investors with the announcement of a plan to

strengthen reserves by $3.6 billion before taxes, or about 6% of

AIG's total net loss reserves. The increase applies to a wide range

of policies sold over many years, from more than a decade ago

through 2014.

Mr. Hancock also promised improvement in profit metrics over the

next two years, through more-aggressive cost cutting and exiting

some business-insurance segments.The fourth-quarter results include

$222 million, before tax, of restructuring charges.

The reserve strengthening and restructuring charge created a

fourth-quarter loss of $1.84 billion, or $1.50 a share, compared

with net income of $655 million, or 46 cents a share, in the

year-earlier quarter.

Results also were hurt by lower net investment income, as low

interest rates have persisted on the high-quality bonds AIG favors,

and the slice of the investment portfolio allocated to hedge funds

also produced lower returns, the company said.

The company posted a fourth-quarter operating loss of $1.3

billion, or $1.10 a share, compared with operating income of $1.4

billion, or 97 cents a share, in the year-earlier quarter.

In the insurance industry, analysts focus on operating results

because they exclude realized gains and losses on insurers' big

investment portfolios. Analysts were expecting AIG to post an

operating loss of 93 cents a share. Some of the gap stemmed from

worse-than-expected results in the company's business of selling

car and home insurance.

Mr. Icahn hasadvocated breaking apart AIG's three main insurance

businesses--life, property-cans-casualty and mortgage--a move he

said would help AIG escape new federal regulations and boost

shareholder returns. Mr. Hancock has maintained the benefits of

being a conglomerate far outweigh the regulatory burdens, though he

wants to narrow AIG's focus through selected divestitures.

Last month, the company announced a planned initial public

offering of up to 20% of its mortgage-insurance unit and the sale

of a financial-advisory business. In the fourth-quarter earnings

release, it said it sold $2.1 billion of assets during the period,

including some shares of a Chinese insurer.

AIG was the recipient of one of the biggest U.S.- government

bailouts during the financial crisis. To repay the nearly $185

billion rescue package, it sold dozens of businesses and shrank by

about half, to just over $500 billion in assets. As the government

exited the scenes, the spotlight turned to AIG's high costs and

below-average profit margins.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

February 11, 2016 16:48 ET (21:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

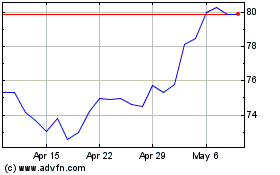

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

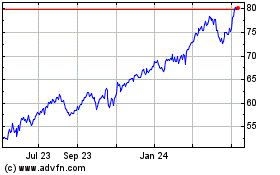

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024